Market and competitive environment

The JSW Group is the largest producer of high quality hard coking coal and a significant producer of coke in the European Union. The type and scope of the Group’s operations are highly sensitive to changes in the interconnected coal, coke and steel markets.

The European Green Deal begins at JSW

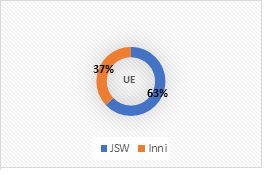

Steel is one of the most widely used materials in the world. Economic development is not possible without the consumption of steel, which is used in all sectors of the economy. Steel is one of the few materials that is almost 100% recyclable.

Source: World Steel Association

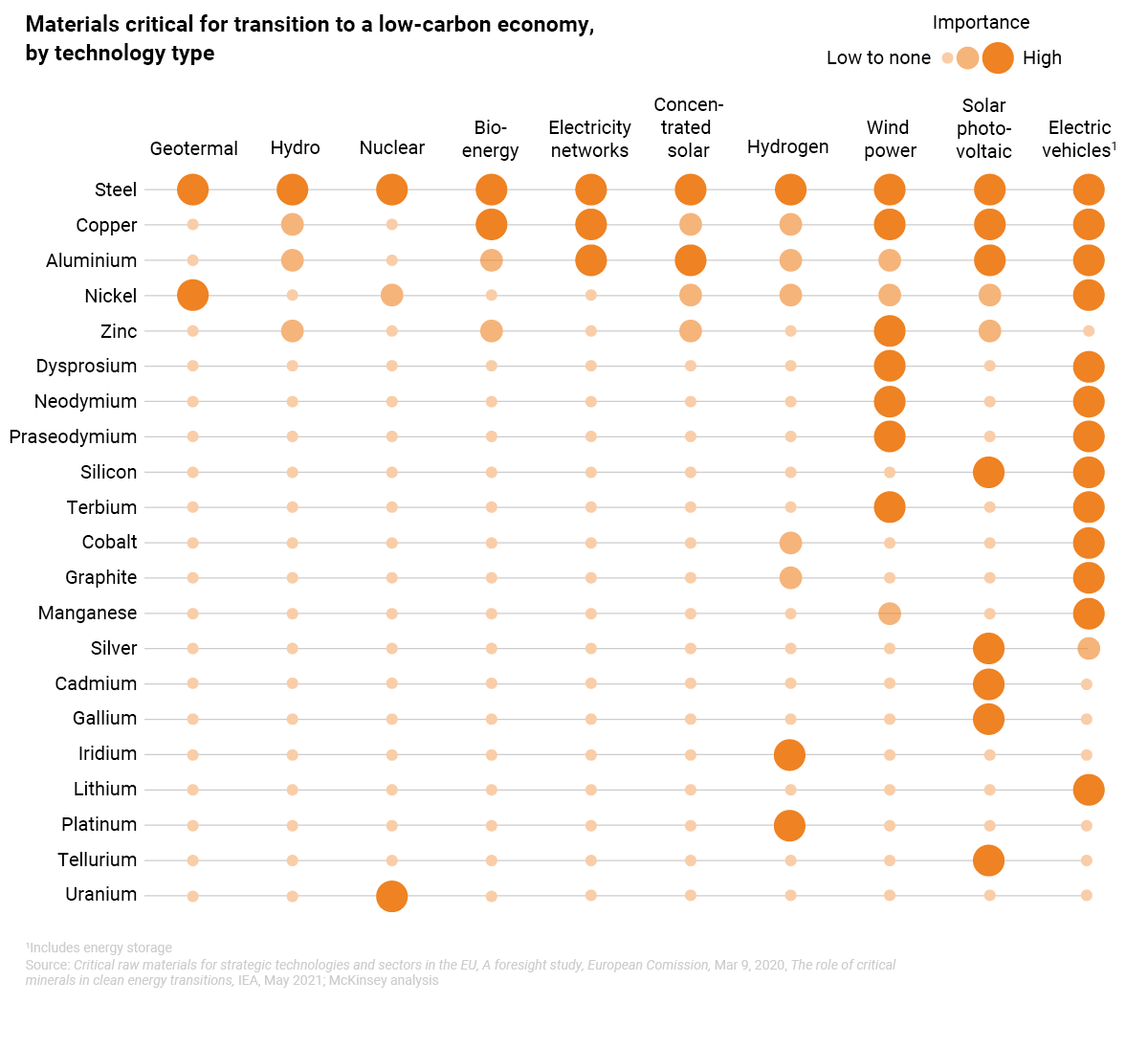

Steel is a strategic material in all sectors of the economy related to the low-carbon transition. Approximately 780 kg of coking coal are needed to produce 1 ton of steel.

The demand for steel and the level of its production, as well as the prices obtained by its producers, determine the market conditions for coking coal producers. They also determine the level of demand for coking coal and the prices that can be obtained for this raw material.

The transition to a zero-carbon economy and the massive technological transformation will lead to increased demand for steel, which will play a supporting role in all technologies that require additional infrastructure.

Approximately 70% of steel is produced in blast furnaces using coke, while the remainder is produced in electric furnaces using scrap.

Blast furnace process

Next to iron ore, coke, and therefore also coking coal, is the key raw material for the steel industry.

In the blast furnace process, blast-furnace coke is used mainly in the reaction of reducing iron ore to pig iron. Coke has the following functions in this process:

- the fuel that generates the heat needed to heat and melt the feedstock and produce the chemical reactions

- the reducer providing sufficient CO for reduction

- the component that ensures adequate gas permeability of the feedstock column in each zone of the blast furnace.

- the pig iron carburizer

The restrictions on CO₂ emissions announced by steel companies under the “Green Deal Policy” will force changes in technology. Currently, two main paths of technological change are being considered in the production of primary steel (from iron ore): replacing coke with hydrogen and improving the current blast furnace process (using coke) with technologies that capture CO₂ emissions. This means that coke will not be completely eliminated from steel production and the JSW Group will be a key local supplier to the European steel industry.

- global steel market:

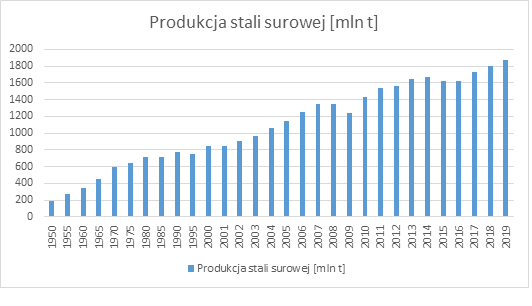

Global steel production continues to rise. Since 1950, it has risen tenfold, and doubled since 2000.

Chart. Crude steel production [million tons]

Source: World Steel Association

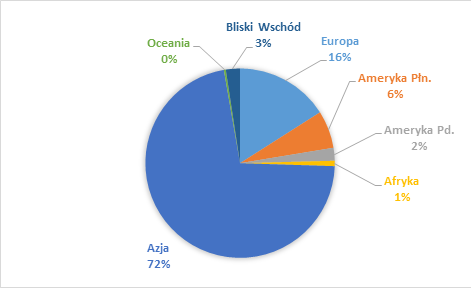

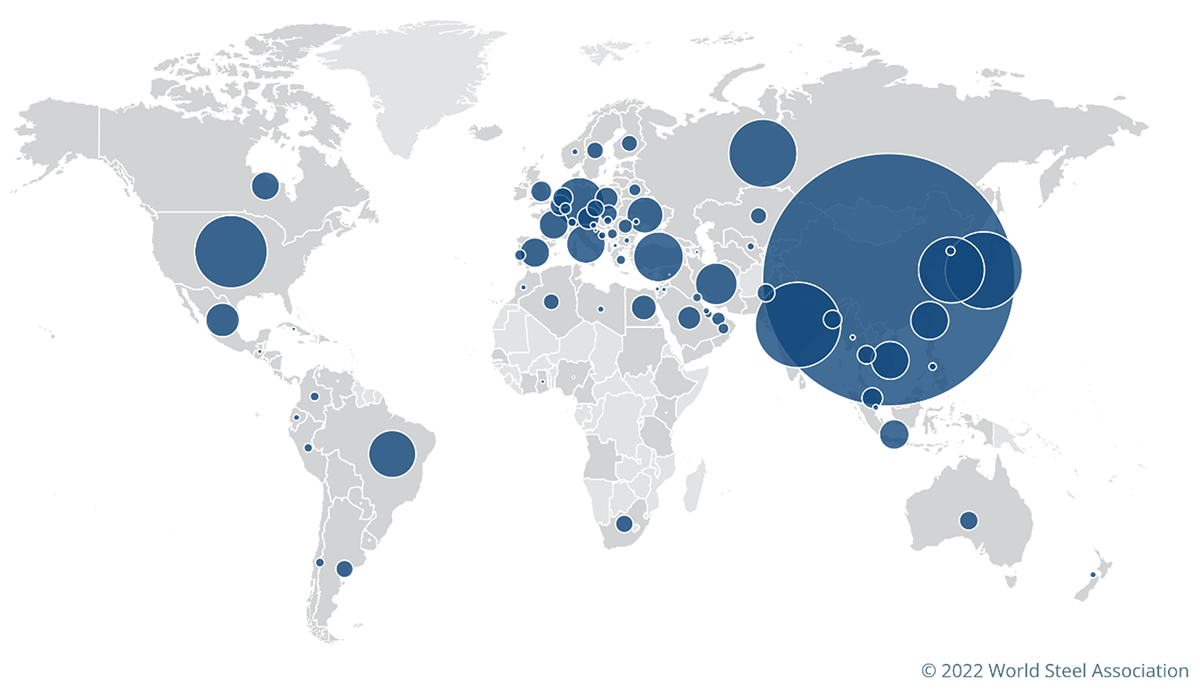

The steel market has been dominated by global metallurgical concerns and steel production is increasingly concentrated in Asian countries. For several years now, China has been the largest producer of steel.

Chart. Steel production in 2022, by regions of the world [m tons, %]

Source: World Steel Association

Total production of crude steel (thousand tonnes)

Global steel production remains dominated by the oxygen-blown converter technology using coke. It represents more than 70% in the global structure of steel production. Steel production in electric furnaces represents about 28% of crude steel production; production in open hearth furnaces is low and declining.

China is the leading producer, which produces more than 1 billion tons of steel per year, and which in 2022 produced 2.1% less steel than in 2021 (1.03 billion tons). As steel production fell also in other regions, global steel production reached 1.83 billion tons in 2022, down 4.3% from 2021.

Table. Largest steel producers in 2022, by country

| Country | [m tons] | Production change vs. 2020 [%] |

|---|---|---|

| China | 1 013,00 | -2,1% |

| India | 124,7 | 5,5% |

| Japan | 89,2 | -7,4% |

| USA | 80,7 | -5,9% |

| Russia | 71,5 | -7,2% |

Source: wordsteel.org

The World Steel Association estimates that the demand for steel in the global economy decreased by 3.2% to 1.8 billion tons in 2022 relative to 2021.

The outbreak of the COVID-19 pandemic in China and continued weakness in the country's real estate sector have caused a decline in steel production at the world's largest producer. The aftermath of the Russian invasion of Ukraine has also had a negative impact on steel production in many countries/regions outside of China in 2022, with raw material shortages and high energy prices contributing to weakened industrial production and forcing production cuts among large producers such as the EU, US and Japan, as well as a significant loss of capacity in Ukraine. India was one of the few large producers to increase steel production in 2022.

According to the European Automobile Manufacturers' Association (ACEA), new car registrations reached 66.2 million units globally in 2022, the same as in 2021, helped by a reduction in semiconductor shipments and a recovery in sales in the last quarter of 2022. Still, global vehicle demand was still well below pre-pandemic levels, i.e. compared to 2019 volumes (74.9 million units).

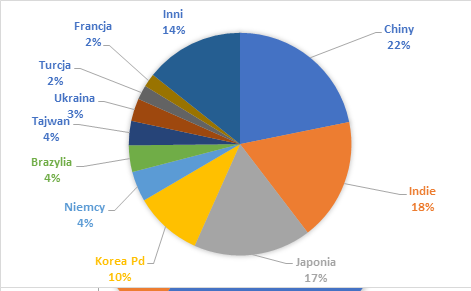

10 countries with top steel consumption in 2022

| Country | [m tons] |

|---|---|

| China | 914 |

| India | 112,7 |

| USA | 99,2 |

| Japan | 57,5 |

| South Korea | 54,6 |

| Russia | 41,3 |

| Germany | 33,6 |

| Turkey | 32,0 |

| Italy | 25,7 |

| Brazil | 24,1 |

Source: wordsteel.org

- european steel market:

In the European Union, oxygen converter process dominates steel production (59%) but the percentage of steel produced in the electric process is higher than the global average (41%).

On average, 350 kg of blast furnace coke is used to produce 1 ton of pig iron in the EU

Steel mills in the EU consume approximately 40 mt of coke in the blast furnace process, whose production consumes roughly 53 mt of coking coal per annum (net of PCI) Coke consumption levels per ton of pig iron produced depends on the unique characteristics of the blast furnace and the feedstock blend used; this is why the parameters differ for individual steel mills. The overall coke and coking coal consumption level depends largely on the steel production level.

In 2022, the European (EU 27) steel industry produced 136.7 million tons of crude steel, which was 10.5% less than in 2021. Germany, which is the largest crude steel producer in the EU, reduced its crude steel output by 8.4%.

The positive trend in steel consumption observed in the EU over the entire 2021 ended in Q2 2022 as a consequence of the drastic increase in gas and electricity prices. This affected the steel market in the European Union, where many steel companies introduced production restrictions and temporary shutdowns of blast furnaces in the second half of 2022 in the conditions of an energy crisis, rising costs and weak demand for steel products.

The steel production reduction was caused by several factors: the economic slowdown in Europe, the high steel stocks, and the increase in gas and electricity prices. Furthermore, the CO₂ emission allowances as part of the ETS system, which do not apply to steel producers from outside the European Union, reached a record-breaking level in 2022, which made steel production in Europe uncompetitive.

The World Steel Association estimates that the demand for steel in the EU member states (including the United Kingdom) dropped by 3.5% to 158.9 million tons in 2022 relative to 2021.

The demand for steel in the EU is generated mainly by industrial activity: in the construction industry (about 37% of steel consumption), the automotive industry (16% of steel consumption) and the engineering sector (about 15% of steel consumption). The piping (12% of steel consumption) and the metal products (14% of global steel consumption) industries play an important role in the structure of steel consumption.

According to the European Automobile Manufacturers' Association’s (“ACEA”) data, the quantity of new passenger cars registered in the EU decreased by 4.6% to 9.3 million in 2022 relative to 2021, mainly due to the shortage of components in H1 2022. Despite the improved market situation in the second half of the year, the quantity of cars registered in entire 2022 was lower only in 1993, when 9.2 million new vehicles were registered. Among the four largest EU markets, the quantity of new passenger car registrations increased only in Germany in 2022, by 1.1% relative to 2021. The main factor affecting the region’s performance was, once again, the shortage in semiconductors. The war in Ukraine also continued to slow down the Eastern European market, with significant declines in the countries directly involved in the conflict: Ukraine (-64.7%) and Russia (-62.7%).

Despite research into direct reduction or the use of hydrogen in the steelmaking process, the level of coke and coal consumption in the EU will remain stable in the coming years. The outlook for the extensive application of new technologies in the European steel milling industry is remote and limited.

For the European steel industry, it is important to have a stable supply of its key raw materials at competitive conditions. The EU is very dependent on imports for both iron ore and coking coal, as there are not sufficient sources of supply within the EU.

The war in Ukraine has significantly affected the global and the European steel market. The combined output of Russia and Ukraine in 2022 accounted for 4% of global steel production (77.80 million tons according to the World Steel Association). By 2022, Ukrainian iron ore mining companies were operating at an average of 20% of capacity, while steel producers were operating at about 15%. In May 2022, two of Ukraine’s largest steel plants in Mariupol – Azovstal and Illich Steel – were destroyed. In the entire year 2022, Ukraine produced 6.3 million tons of steel (down 71% from 2021), 6.4 million tons of pig iron (down 70% from 2021) and approx. 5.4 million tons of rolled steel (down 72% from 2021). Russia’s 2022 steel production is down 7.2% vs. 2021 to 71.5 million tons. Both Russia and Ukraine are among the world's largest exporters of pig iron. The lack of these supplies may increase the utilization of the capacity of European raw material mills, which will translate into increased demand for coke and coking coal in Europe. Ukraine is also a major supplier of iron ore to the Central European market.

- domestic steel market:

According to the World Steel Association, Poland produced 7.7 million tons of crude steel in 2022, i.e. 8.6% less than in 2021 (8.5 million tons). ArcelorMittal Poland is the only producer of crude steel in Poland that uses the blast furnace process with coke and therefore also with coking coal at the steel plant in Dąbrowa Górnicza. ArcelorMittal owns 50% of the domestic production capacity.

In 2021, the Polish economy consumed approx. 15 million tons of steel products, which was 16% more than in the previous year. Most of the steel used is imported, with domestic production satisfying only 21% of the needs of the industry. Current production is reaching the same level as in the middle of the first decade of this century, while steel consumption has increased by about 80 percent over the same period.

Coal market:

Coking coal market

- global:

The market for metallurgical (coking) coal is global. Demand for metallurgical (coking) coal is primarily driven by the state of the steel industry, which consumes these commodities in blast furnaces in the pig iron production process. Despite years of research and implementation work on other methods of steelmaking, such as direct reduction of iron ore (DRI) or other technologies that reduce the proportion of coke (technologies based on gas, hydrogen), the blast furnace (BOF) process using coke remains dominant worldwide.

The main raw materials for the steel industry are coking coal and iron ore. Steel companies use their captive coke plants to convert coking coal into coke, which, along with iron ore, is the main component of blast furnace feedstock. In the PCI (Pulverized Coal Injection) technology, coal dust with appropriate parameters is blown into the blast furnace, which reduces consumption of coke and production costs and improves blast furnace efficiency. In many papers, different coking coals and PCI are referred to as metallurgical coal.

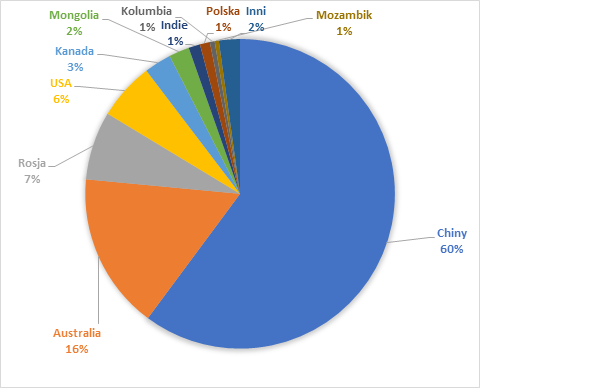

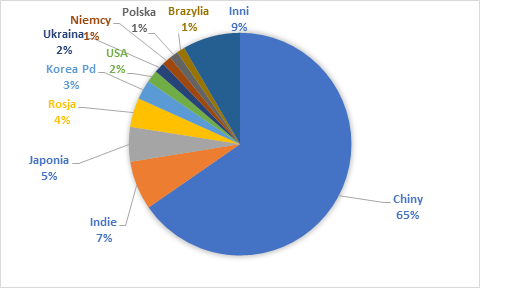

World production of metallurgical coals (1,096 million tons in 2022) is heavily concentrated in a few countries. China (676 million tons in 2022) and Australia (169 million tons in 2022) remain the largest producers of coking coal, with a combined market share of more than 77%.

Largest coking coal producers in 2022 [m tons,% estimates]

Source: International Energy Agency, ARP.

Largest coking coal producers in 2022

| BHP Group | Teck Resources | Anglo American | JSW Group | |

|---|---|---|---|---|

|

Coking coal production |

58 mt | 21,5 mt | 15 mt | 11,0 mt |

| EBITDA |

USD 40,6 billion |

USD 9.6 billion |

USD 14.5 billion |

PLN 10.6 billion |

| headcount | ~80 000 | ~11 000 | ~ 64 000 | ~31 000 |

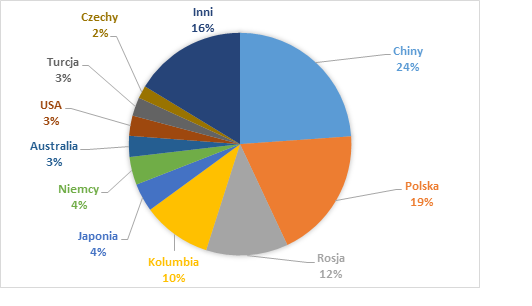

China is the main country affecting the global level of demand for coking coal (since it represents 59% of global coking coal consumption), while global export supply is dependent on the main supplier, Australia (approx. 54% share of coking coal exports), which, together with the other major exporters - the US, Canada and Russia, together account for about 90% of coal supply to the global market. The total volume of metallurgical coal trade was about 299 million tons in 2022 (according to the Australian Government - Department of Industry, Science, Energy and Resources).

Chart. Largest exporters of coking coal (HCC, SSCC, PCI) in 2022 [m tons,% estimates]

Source: Australian Government – Department of Industry, Science, Energy and Resources

In 2022, the coking coal market was significantly affected by China’s coking coal import policy (import ban from November 2020), which:

- changed natural and historical trade flows,

- raised domestic prices for end users in China,

- created two separate trade markets:

- CFR China market – served only by producers from outside Australia (mainly the US and Canada,

- FOB Australia market for regions outside of China – potentially served by all overseas producers, but the only market for Australian products.

By the end of 2022, there were signs of a relaxation of China's restrictive policy banning imports of Australian coal into China, influenced by the shortage of domestic supply and high prices. In addition to policy decisions, the market was significantly impacted by volatile market and geopolitical conditions. They included the COVID-19 pandemic (the “Zero-Covid” policy in China) and the Russian invasion of Ukraine, which caused serious disruptions in the raw materials market.

Chart. Largest importers of coking coal (HCC, SSCC, PCI) in 2022 [m tons,% estimates]

Source: Australian Government – Department of Industry, Science, Energy and Resources

- european:

For the European steel industry, it is important to have a stable supply of its key raw materials at competitive conditions. Since there are no sufficient sources of supply within the European Union, the EU is virtually fully dependent on the imports of both iron ore and coking coal. Coking coal has been reinstated on the list of critical raw materials, which is updated at least every three years to reflect market and technological developments. The high risk of coking coal shortage or lack of supply is due to a limited number of its sources. The European Commission has been publishing the List of Critical Raw Materials (CRM) since 2011.

In the EU, only Poland and the Czech Republic produce coking coal. In 2020, decisions were made to close two of OKD’s four Czech mines by the end of Q1 2021 and the remaining two mines by the end of 2022. The change in the market situation after the embargo against Russia extended the period of their operation until the end of 2025.

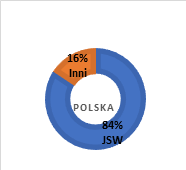

JSW is the main producer of coking coal in the EU market and will become the only one by the end of 2025. Jastrzębska Spółka Węglowa SA is the only coal company in Poland to produce hard coking coal, whereas semi-soft coal is also extracted by PGG SA mines, albeit in relatively small quantities.

Structural deficit of coking coal on the EU market was addressed by imports chiefly from Australia, the US, Canada and Russia and, in recent years, from Mozambique and Colombia. Coal imports from Russia have been suspended since August 2022 as a result of the embargo imposed on Russia following its military invasion on Ukraine, which increases demand for overseas coal.

Before the war in Ukraine, Russia’s share of metallurgical coal imports to the EU was: approx. 10% for coking coal and approx. 30% for PCI coal.

In 2022, a total of about 14 million tons of coking coal was mined in the European Union, of which JSW mined about 11 million tons. In addition to JSW, coking coal is mined in PGG SA and OKD (Czech Republic).

Being a leading producer of coking coal in the European Union, JSW enjoys the so-called geographic rent, but is also subject to overall global market trends. Due to market volatility and the influence of global pricing mechanisms, transactions in the coking coal market are currently based on published coal indices for Australian and US coals.

- domestic:

JSW is the only domestic producer of “hard” coking coal and a major producer of “semi-soft” coking coal. Other domestic producers are mainly thermal coal producers, and semi-soft coking coal is mined only in PGG in small quantities (about 1.4 million tons in 2022).

Domestic consumption of coking coal is about 13-14 million tons and depends on the level of coke production at domestic coke plants.

Steam coal market

- domestic:

Due to the market conditions, the domestic market is essential for domestic steam coal producers. Polish coal companies mainly produce coal for the generation of electricity and heat. The largest domestic coal companies, apart from Jastrzębska Spółka Węglowa S.A., are Polska Grupa Górnicza S.A. and Lubelski Węgiel "Bogdanka" S.A.

In accordance with its strategy, JSW aims to increase the production of coking coal and reduce the production of steam coal. Since JSW is not the leading steam coal producer in Poland, customers in the domestic commercial power generation segment perceive it as a complementary supplier.

The situation on the domestic market and the competition among domestic producers are vitally important for steam coal prices in Poland. The steam coal market in Poland depends mainly on the business conditions in the country, weather conditions, energy policy (electricity prices, biomass consumption, power generation from lignite, and the share of subsidized renewable energy). Coal prices for the domestic power industry follow, to a limited extent, the global trends of price indices set for spot transactions. The indices influence the general trend, while the main impact is exerted by the situation on the domestic market and competition between Polish producers. The prices for steam coal sold on the market are determined by the Polish Steam Coal Market Index (PSCMI). It is group of benchmark price indices of steam coal mined by domestic producers and sold on the domestic electricity market (PSCMI 1) and the domestic heat market (PSCMI 2) These indices are based on monthly ex-post data and express the selling price of hard coal (ex-mine) under quality conditions optimized for the needs of consumers.

The level of electricity production from coal is crucial for the domestic demand for steam coal. In 2022, the production of electricity from coal decreased by 6% compared to 2021 and accounted for about 50% of domestic electricity production (by individual groups of power plants by fuel type).

Structure of electricity production in domestic power plants, volumes of cross-border electricity exchange and domestic energy consumption - gross volumes

| No. | Item | 2020 |

2021 |

Growth rate [(b-a)/a*100] [%] |

2022 [GWh] |

Growth rate [(d-b)/b*100] [%] |

|---|---|---|---|---|---|---|

| [a] | [b] | [c] | [d] | [e] | ||

| 1. |

Total production (1.1+1.2+1.3+1.4) |

152 308 | 173 583 | 13,97 | 175 157 | 0,91 |

| 1.1 |

Commercial power plants |

126 137 | 154 599 | 22,56 | 147 555 | -4,56 |

| 1.1.1 |

Commercial hydro power plants |

2 698 | 2 830 | 4,88 | 2 815 | -0,53 |

| 1.1.2 |

Commercial CHP plants |

123 439 | 151 769 | 22,95 | 144 740 | -4,63 |

| 1.1.2.1 |

hard coal-fired |

71 546 | 93 037 | 30,04 | 87 761 | -5,67 |

| 1.1.2.2 |

lignite-fired |

37 969 | 45 367 | 19,48 | 46 978 | 3,55 |

| 1.1.2.3 |

gas-fired |

13 924 | 13 366 | -4,01 | 10 002 | -25,17 |

| 1.2 |

Wind power plants and other renewable |

2 198 | 4 749 | 116,09 | 27 602 | 45,4 |

| 1.3 |

Industrial power plants |

9 799 | - | - | - | - |

| 2. |

Balance of cross-border exchange |

13 224 | 820 | -93,8 | -1 679 | - |

| 3. |

Domestic electricity consumption |

165 532 | 174 402 | 5,36 | 173 479 | -0,53 |

Source: Polskie Sieci Elektroenergetyczne S.A. (Polish Power Grid Company)

Coke market:

- global:

Iron and steel metallurgy is the main and key buyers of coke, which is used mainly for the production of pig iron in the blast furnace process, while smaller grades are used for producing agglomerates from iron ore and ferro-alloys. This group of clients also includes foundries, which purchase high quality foundry coke.

Other types of coke are used in the smelting of non-ferrous metals (zinc, lead and copper), in the lime industry, chemical industry (mainly in the production of carbide), sodium industry (in the production of glass), food sector (sugar factories, drying plants) and in the municipal sector (heating coke).

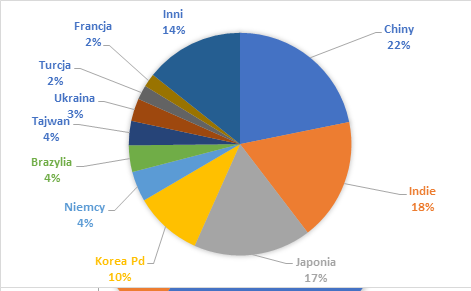

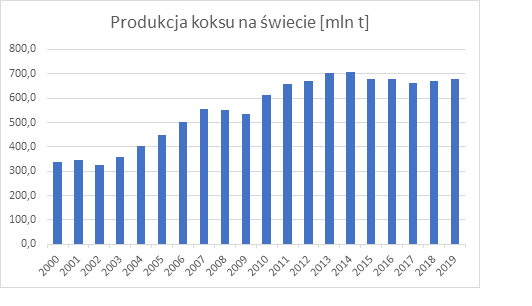

The coke market, similarly to the coking coal market, is a global market. Coke production is increasing and the demand for coke depends mainly on the level of steel production in the blast furnace process and technological changes in the steelmaking industry. Coke production is mainly concentrated in Asian countries, which account for more than 80% of global coke production.

In 2022 standard coke flows were revisited on the global market. China consolidated its role as a net exporter. In 2022, total Chinese coke exports increased by 50% year-on-year to nearly 9 million tons, which was the highest level since 2018. The replenishment of inventories after Covid-19, followed by concerns about shortages after Russia’s invasion of Ukraine, were the main factors driving the growth of China’s coke exports in 2022.

Global coke production in 2022 versus the previous year moved down 1.9% to 685.5 million tons. In China it was approximately 473.4 million tons, which accounted for approx. 69% of global coke production,

Global coke consumption was 684.5 million tons in 2022 (over 17 million tons less than in 2021), with global imported coke consumption at just under 29 million tons in 2022, nearly 6 million tons less than in 2021, driven by lower production of steel and lower demand for coke.

Chart. Global coke production [m tons]

Source: CRU

In the coming months, the coke market will be impacted by the sanctions imposed on Russia after its invasion of Ukraine. Russia is a major exporter of coke. In 2022, it exported about 1.9 million tons, or 41% less than in 2021 (3.3 million tons), due to lower demand from Ukraine, which was suffering from the consequences of the war.

Chart. Largest coke producers globally in 2022 [%]

Source: proprietary data (production in Poland), CRU, customs data from China and Ukraine.

Chart. Largest coke exporters globally in 2022 [%]

Source: CRU.

- european:

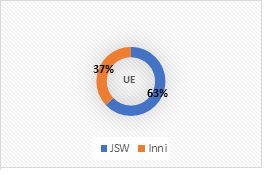

Only 5-7% of the world's coke consumption takes place in the countries of the European Union, but the EU's share in the consumption of imported coke is about 9-11 million tons, which represents about 1/3 of the world's consumption of the imported raw material.

The decline in steel production in 2022 resulted in lower coke demand in EU27 countries, which were traditionally its largest importer. Coke consumption in EU27 fell 10% in 2022 versus the previous year to approximately 34 million tons. Coke production in this period also moved down 9% to approximately 32.5 million tons.

In the European Union, the majority of coke plants are integrated with steel mills, which satisfy their needs with their own coke production. JSW Group's coke plants are independent, which means that all coke produced is sold. There are several independent coke plants in other countries: Hungary, the Czech Republic and Bosnia. The advantage of the JSW Group over other coke producers is based on the availability of the raw material: JSW’s coke plants rely on coking coal supplies from the Group’s own mines. Although most European steel mills have their own integrated coke plants, they still require some imports. On average, European steel mills satisfy 95% of their demand for coke with the raw material produced in their own integrated coke plants. When a producer reduces the volume of its steel production, it cuts off deliveries from external providers first, so when steel production at integrated mills weakens, independent coke plants that are suppliers of coke to these mills are most affected.

The structure of coke consumption globally and in the EU is similar: 80% of coke is used in blast furnaces to produce pig iron, while the remaining 20% is used outside of blast furnaces. The vast majority of coke is produced in coke plants owned by steelmakers. Production is for the internal needs of the steel mills that are part of these concerns. Only a small volume (slightly more than 4% of total production volume) is traded internationally.

- domestic:

In 2022, coke production in Poland was 8.2 million tons, down by 0.8 million tons, i.e. 8.9% compared to 2021 (9.0 million tons). With 3.2 million tons of production volume, the JSW Group accounted for 39% of domestic coke production in this period. Other coke producers in Poland include: ArcelorMittal Poland, Koksownia Częstochowa Nowa Sp. z o.o, WZK Victoria S.A. Out of those JSW and ArcelorMittal Poland are the main producers of blast-furnace coke in Poland.

In 2022, exports of coke from Poland was 6.4 million tons, down 10% compared to 2021.

Hydrocarbons market

Coke oven gas is a by-product of the coke production process. When purified, it produces coke tar, BTX, and ammonium sulfate or sulfur, depending on the technology used. The market share of the production of these products is usually the same as the market share of coke production. Coke tar and BTX are valuable raw materials for the chemical industry, while ammonium sulfate is a fertilizer. Coke oven gas is used to fuel coke oven batteries, while the surplus is used to generate electricity or sold to local consumers.

JSW GROUP ON THE COKING COAL MARKET

| 2019 | 2020 | 2021 | 2022 | ||

|---|---|---|---|---|---|

|

Global production |

m tons | 992 | 1104 | 1111 | 1096s |

| World trade | m tons | 288 | 309 | 296 | 299s |

| Coking coal imports (HCC+SSCC) | |||||

| China | m tons | 75 | 73 | 55 | 52s |

| India | m tons | 58 | 63 | 61 | 60s |

| Japan | m tons | 47 | 42 | 44 | 43s |

| European Union | m tons | 41 | 34 | 36 | 36s |

| Coking coal exports (HCC+SSCC) | |||||

| Australia | m tons | 149 | 172 | 167 | 161s |

| USA | m tons | 43 | 38 | 41 | 43s |

| Canada | m tons | 32 | 33 | 26 | 29s |

| Russia | m tons | 25 | 30 | 30 | 29s |

| JSW – sales of metallurgical coal | |||||

| Total | m tons | 9,9 | 10,8 | 11,6 | 10,8 |

| External sales | m tons | 5,8 | 6,3 | 6,9 | 6,4 |

Source: proprietary data, International Energy Agency, Australian Government – Department of Industry, Science, Energy and Resources (s estimated figures).

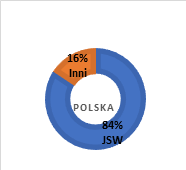

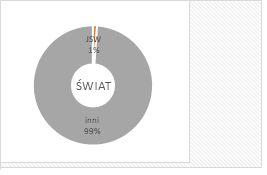

Chart. JSW's share in coking coal production in Poland, the EU and globally in 2022 [%].

JSW GROUP ON THE COKE MARKET

|

2019 |

2020 |

2021 |

2022 | ||

|---|---|---|---|---|---|

|

Steel BOF production |

|||||

|

World |

mln ton |

1 334 | 1 357 | 1 386 | 1 340 |

|

China |

mln ton |

881 | 946 | 922 | 909 |

|

Europe (EU + UK) |

mln ton |

93 | 79 | 93 | 86 |

|

Total coke consumption |

|||||

|

World |

m tons |

701 | 689 | 702 | 685 |

|

China |

m tons |

466 | 471 | 461 | 462 |

|

Europe (UE + UK) |

m tons |

39 | 33 | 38 | 34 |

|

Coke trade |

|||||

|

World |

m tons |

25,9 | 24 | 32 | 30 |

|

China - exports |

m tons |

6,4 | 3,5 | 6,5 | 9,0 |

|

Poland - exports |

m tons |

5,8 | 6,0 | 7,1 | 6,4 |

| Europe (UE + UK) - imports | m tons | 10,4 | 9 | 12 | 10 |

|

JSW KOKS – coke sales |

|||||

|

JSW KOKS |

m tons |

3,0 |

3,6 |

3,6 |

3,2 |

Source: proprietary data, CRU, CMS.

Chart. JSW's share in coke production in Poland, the EU and globally in 2022 [m tons,%].