Key financial and operating data in the JSW Group

Despite the difficult, volatile market environment we faced in 2022, the Jastrzębska Spółka Węglowa Group earned a net profit of nearly PLN 7.6 billion, almost PLN 6.6 billion higher than the net profit earned in 2021. This is the best result in the company's history.

Consolidated EBITDA stood at PLN 10.6 billion. In 2021 EBIDTA amounted to PLN 2.5 billion.

BASIC ECONOMIC AND FINANCIAL FIGURES OF JSW

| ITEM | UNIT | 2022 | 2021 | 2020* | 2019 | 2018 | GROWTH RATE 2021=100 |

|---|---|---|---|---|---|---|---|

| CONSOLIDATED STATEMENT OF FINANCIAL POSITION | |||||||

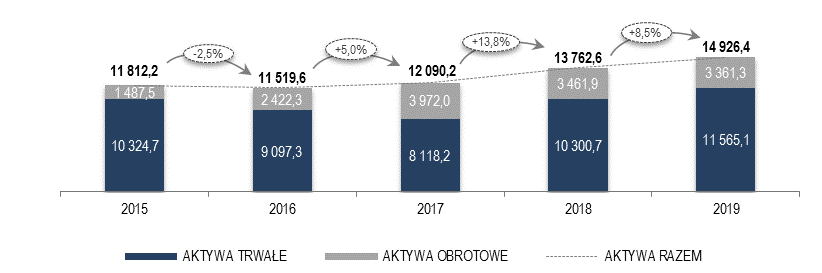

| Balance sheet total | PLN million | 26 963,1 | 15 961,8 | 15 030,9 | 14 926,4 | 13 762,6 | 168,9 |

| Non-current assets | PLN million | 19 110,8 | 12 070,2 | 11 638,5 | 11 565,1 | 10 300,7 | 158,3 |

| Current assets | PLN million | 7 852,3 | 3 891,6 | 3 392,4 | 3 361,3 | 3 461,9 | 201,8 |

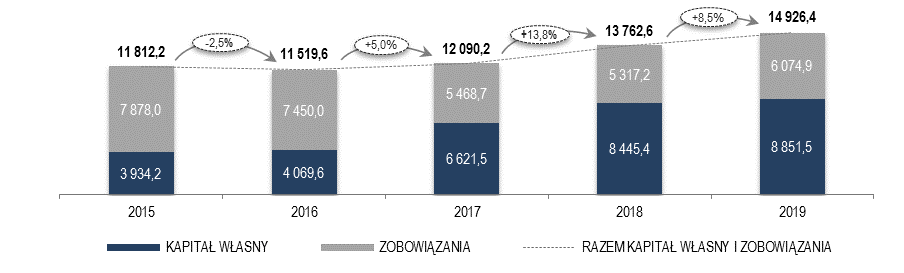

| Equity | PLN million | 15 937,5 | 8 297,8 | 7 317,1 | 8 851,5 | 8 445,4 | 192,1 |

| Liabilities | PLN million | 11 025,6 | 7 664,0 | 7 713,8 | 6 074,9 | 5 317,2 | 143,9 |

| CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME | |||||||

| Sales revenues | PLN million | 20 198,5 | 10 629,1 | 6 936,0 | 8 671,8 | 9 809,5 | 190,0 |

| Gross profit/(loss) on sales | PLN million | 10 646,0 | 2 595,2 | (401,3) | 1 603,6 | 2 871,1 | 410,2 |

| Operating profit / (loss) | PLN million | 9 336,4 | 1 262,4 | (1 780,6) | 905,6 | 2 254,1 | 739,6 |

| EBITDA | PLN million | 10 564,1 | 2 482,5 | (675,7) | 1 939,5 | 3 020,1 | 425,5 |

| EBITDA margin | % | 52,3 | 23,4 | (9,7) | 22,4 | 30,8 | 223,5 |

| Profit/(loss) before tax | PLN million | 9 389,4 | 1 166,7 | (1 867,6) | 828,0 | 2 192,5 | 804,8 |

| Net profit/(loss) | PLN million | 7 593,8 | 952,6 | (1 537,4) | 649,6 | 1 760,8 | 797,2 |

| Total comprehensive income | PLN million | 7 619,9 | 980,8 | (1 534,3) | 636,7 | 1 718,4 | 776,9 |

| CONSOLIDATED STATEMENT OF CASH FLOWS | |||||||

| Net cash flow on operating activity | PLN million | 10 689,8 | 1 661,2 | 354,7 | 1 140,3 | 2 818,4 | 643,5 |

| Net cash flow on investing activity | PLN million | (6 333,1) | (1 620,2) | (549,3) | (2 260,5) | (1 581,7) | 390,9 |

| Net cash flow on financing activity | PLN million | (818,7) | (338,1) | 1 441,2 | (180,3) | (755,8) | 242,1 |

| Net movement in cash and cash equivalents | PLN million | 3 538,0 | (297,1) | 1 246,6 | (1 300,5) | 480,9 | - |

| FINANCIAL RATIOS | |||||||

| Dividend per share | (PLN/share) | - | - | - | 1,71 | - | - |

| Current liquidity | 1,05 | 1,08 | 1,03 | 1,05 | 1,03 | 97,2 | |

| Current liquidity | 0,91 | 0,90 | 0,76 | 0,70 | 0,84 | 101,1 | |

| Net return on sales | % | 37,6 | 9,0 | (22,2) | 7,5 | 17,9 | 417,8 |

| Return on Assets (ROA) | % | 28,2 | 6,0 | (10,2) | 4,4 | 12,8 | 470,0 |

| Return on Equity (ROE) | % | 47,6 | 11,5 | (21,0) | 7,3 | 20,8 | 413,9 |

| Total debt ratio | 0,41 | 0,48 | 0,51 | 0,41 | 0,39 | 85,4 | |

| Debt to equity ratio | 0,69 | 0,92 | 1,05 | 0,69 | 0,63 | 75,0 | |

| Fixed capital to non-current assets ratio | 0,94 | 0,90 | 0,90 | 0,91 | 0,91 | 104,4 | |

| PRODUCTION DATA | |||||||

| Coal production | million tons | 14,1 | 13,8 | 14,4 | 14,8 | 15,0 | 102,2 |

| Coking coal production | million tons | 11,0 | 11,0 | 11,1 | 10,2 | 10,3 | 100,0 |

| Steam coal production | million tons | 3,1 | 2,8 | 3,3 | 4,6 | 4,7 | 110,7 |

| Coke production | million tons | 3,2 | 3,7 | 3,3 | 3,2 | 3,6 | 86,5 |

| Mining cash cost | PLN/ton | 543,81 | 447,12 | 407,37 | 426,00 | 396,46 | 121,6 |

| Cash conversion cost | PLN/ton | 252,32 | 173,10 | 178,37 | 191,78 | 161,68 | 145,8 |

| OTHER DATA | |||||||

| Stock price at the end of the period | (PLN/share) | 58,16 | 34,87 | 25,95 | 21,38 | 67,26 | 166,8 |

| Headcount at the end of the period | persons | 30 739 | 31 916 | 30 593 | 30 629 | 28 268 | 96,3 |

| Average headcount during the year | persons | 29 981 | 30 560 | 30 674 | 29 440 | 247 207 | 98,1 |

| Investments in property, plant and equipment | PLN million | 2 641,0 | 1 668,4 | 1 832,0 | 2 329,0 | 1 639,1 | 158,3 |

| Depreciation and amortization | PLN million | 1 227,7 | 1 220,1 | 1 104,9 | 1 033,9 | 766,0 | 100,6 |

* The 2020 data were restated in connection with the change in the rules of presentation applied by the Group as of 1 January 2021; this concerns reclassification of the effective result after a hedged item has been realized, from other comprehensive income to profit or loss.

IMPACT OF THE COVID-19 PANDEMIC ON BUSINESS

In 2022 the Group did not record any material impact of the COVID-19 pandemic on its coal production volume, production of coke and hydrocarbons and the sales revenue achieved. The Group continued the required preventive measures and measures strengthening the safety of employees aimed at preventing the spread of the SARS-CoV-2 coronavirus. The total costs incurred for combating the pandemic in the Group in 2022 were PLN 8.8 million (in 2021, the total costs associated with the COVID-19 pandemic in the Group were PLN 28.2 million).

ECONOMIC POSITION

The biggest assets line item as at 31 December 2022 were non-current assets (70.9%). Their value in 2022 increased by PLN 7,040.6 million, i.e. by 58.3%, mainly due to the following factors:

| NON-CURRENT ASSETS change (PLN million) |

EXPLANATION |

|---|---|

|

INVESTMENTS IN THE FIZ ASSET PORTFOLIO (+) 6 363,7 |

The 829.1% increase is due mainly to the investment made in April 2022 in a portfolio of financial assets through the JSW Stabilization FIZ with the total value of PLN 4,200.0 million. As at 31 December 2022, the net value of the Fund’s assets amounted to PLN 4,893.6 million, which means an increase by PLN 4,385.9 million as compared to 31 December 2021. |

|

PROPERTY, PLANT AND EQUIPMENT (+) 990,9 |

In 2022, the Group incurred expenditures for property, plant and equipment of PLN 2,430.8 million, with depreciation and amortization of PLN 1,044.9 million (in 2021, expenditures for property, plant and equipment amounted to PLN 1,588.6 million, with depreciation and amortization of PLN 1,023.0 million). In 2022, the Group recognized in non-current assets an impairment loss on the non-financial non-current assets in the total amount of PLN 364.8 million, of which PLN 290.7 million relates to property, plant and equipment. |

|

OTHER NON-CURRENT FINANCIAL ASSETS (+) 45,7 |

An increase of 11.7% mainly as a result of an increase of PLN 43.3 million, or 11.9%, in cash held in the Parent Company's Mine Closure Fund, compared to 31 December 2021. |

|

DEFERRED TAX ASSETS (-) 354,4 |

The decrease by 41.7%, including in the Parent Company by PLN 327.4 million, or 51.7%, resulting mainly from a decrease in assets on account of settlement of tax loss by PLN 183.2 million, reduction of assets on account of temporary differences on property, plant and equipment by PLN 67.8 million, an increase in the provision for deferred tax on investments in the FIZ asset portfolio by PLN 35.3 million, an increase of PLN 41.2 million in the provision for deferred tax on expenditures on development (expensable mining pits |

|

GOODWILL (-) 57,0 |

The decrease is due to the recognition of a goodwill impairment loss of PLN 57.0 million as of 31 December 2022, as a result of impairment testing. |

Current assets increased by PLN 3,960.7 million, or by 101.8%. The change in this group of assets was influenced by:

| NON-CURRENT ASSETS change (PLN million) |

EXPLANATION |

|---|---|

|

CASH AND CASH EQUIVALENTS (+) 3 538,1 |

The 272.2% increase resulted mainly from higher revenues from coal and coke sales, achieved as a consequence of higher sales prices for these products. |

|

INVENTORIES (+) 337,6 |

The 51.7% increase is mainly due to a PLN 228.8 million, or 135.4%, increase in material inventories, caused mainly by a higher level of coal inventories from outside the Group (as a result of price increases) and a higher level of material inventories (increased purchases of materials securing the implementation of investments and overhauls and higher prices for steel materials), as well as a PLN 109.3 million, or 23.5%, increase in finished goods inventories, caused mainly by higher prices for coal and coke. |

|

TRADE AND OTHER RECEIVABLES (+) 124,7 |

Growth by 6.8%, which results from the level of trade receivables higher by PLN 119.9 million, i.e. 7.5%, and prepaid expenses by PLN 10.5 million or 49.3%. |

|

FINANCIAL DERIVATIVES (+) 33,1 |

An increase of 309.3%, which follows mainly from a positive measurement of transactions hedging FX risk at JSW as at 31 December 2022. |

|

INCOME TAX OVERPAID (-) 39,3 |

A drop by PLN 39.3 million, or 56.8%, stems from a lower value of overpaid income tax in JSW KOKS as at 31 December 2022. |

|

NON-CURRENT ASSETS HELD FOR SALE (-) 27,0 |

A decrease by PLN 27.0 million results from the transfer of a designated part of the "Jastrzębie III" mining area, which is a part of the Jastrzębie-Bzie mine, to SRK, effective as of 1 January 2022. |

ASSET FINANCING SOURCES

The increase in equity by 92.1% as at 31 December 2022 has its roots in an increase in retained earnings by PLN 7,569.9 million, or 132.5%, as compared to 31 December 2021, resulting from the generated net profit attributable to the shareholders of the Parent Company in the amount of PLN 7,561.4 million.

As at 31 December 2022, total liabilities increased by PLN 3,361.6 million, or 43.9%, as compared to 31 December 2021; the change results mainly from:

| LIABILITIES change (PLN million) |

EXPLANATION |

|---|---|

|

NON-CURRENT LIABILITIES (-) 522,9 |

A lower level of loans and borrowings by PLN 602.0 million, or 44.4%, caused primarily by repayment by JSW of PLN 360.0 million of the revolving B loan under the financing agreement with the Consortium and repayment of the loans obtained from PFR in the amount of PLN 265.5 million. An increase in employee benefit liabilities by PLN 27.7 million, or 3.7% (including by PLN 32.9 million, or 5.9% at the Parent Company, mainly as a result of application of a higher discount rate of 6.73% as at 31 December 2022 (31 December 2021: 3.64%) to measure employee benefits, as stated in the actuarial report). |

|

CURRENT LIABILITIES (+) 3 884,5 |

An increase in FIZ liabilities by PLN 1,977.8 million, i.e. 761.3%, including mainly liabilities from transactions with the Fund's buy-back commitment (Sell Buy Back transactions) – an increase of PLN 1,841.3 million, the Fund’s liabilities on account of purchased assets – an increase by PLN 74.7 million, and other Fund liabilities – an increase of PLN 60.5 million. An increase in current income tax liabilities by PLN 1,339.8 million, including PLN 1,333.5 million in the Parent Company (as at 31 December 2022, JSW recognized a tax liability in connection with generated tax income, which amounted to PLN 1,333.5 million after settlement of tax advance payments made). An increase in trade and other liabilities by PLN 602.6 million, or 25.9% (including trade liabilities by PLN 459.0 million and investment liabilities by PLN 104.5 million). The balance of liabilities associated with assets held for sale lower by PLN 65.8 million in connection with the transfer, as of 1 January 2022, to SRK, of a designated part of the "Jastrzębie III" mining area, which forms part of the Jastrzębie-Bzie mine. |

Sales revenues

In 2022, sales revenues sales rose by 90.2% compared to 2021 and amounted to PLN 25,770.9 million. The rise was impacted by:

- sales revenues from the coal produced by JSW higher by PLN 9,386.4 million, i.e. 114.2%, mainly as a result of the average coal sales price achieved by JSW higher by a total of PLN 670.3 million PLN per ton (growth by 121.9%),

- sales revenues on coke higher by PLN 2,460.7 million, i.e. 53.8% (without taking into account the adjustment of sales revenues on account of executing hedging transactions), mainly due to the average sales price of coke commanded by JSW being higher by PLN 913.46 per ton, or an increase of 72.1%,

- sales revenues of hydrocarbons higher by PLN 242.7 million, i.e. by 67.6%, mainly due to the increase in the prices of coke-oven tar by 61.0% and of BTX by 29.8%.

Cost of products, materials and goods sold

In 2022, cost of products, materials and goods sold increased by PLN 3,909.6 million, or 32.8%, compared to 2021, to PLN 15,819.5 million, mainly as a result of an increase in costs by nature by PLN 4,538.3 million, i.e. by 34.1% (mainly the cost of materials and goods sold by PLN 2,665.2 million and employee benefits by PLN 859.6 million).

Gross sales profit

In 2022, the Company achieved a gross profit on sales in the amount of PLN 9,951.4 million, compared to PLN 1,640.5 million in 2021.

Selling and distribution expenses

In 2022, selling and distribution expenses amounted to PLN 419.4 million (growth by PLN 78.8 million), which results for the most part from an increase in costs of transport services and port operators (in spite of decreasing the volume of coal sold by 517.0 thousand tons and coke by 383.9 thousand tons).

Administrative expenses

Administrative expenses for 2022 were PLN 660.4 million compared to PLN 555.5 million in the previous year(an increase by PLN 104.9 million, or 18.9%, resulting mainly from an increase in the costs of employee benefits by PLN 81.9 million).

Other revenues

In 2022, other revenues amounted to PLN 231.7 million, compared to PLN 305.3 million last year (a decline of PLN 73.6 million, or 24.1%). The higher level of other revenues in 2021 resulted mainly from the recognition of forgiveness of part of the preferential loan from the Polish Development Fund (PFR) in the amount of PLN 89.2 million, income under preferential interest on the PFR loan in the amount of PLN 38.7 million and reversal of impairment loss on non-current assets in the amount of PLN 75.0 million. In contrast, in 2022, other revenues include revenues associated with free-of-charge transfer of a designated part of the "Jastrzębie III" mining area to SRK in the amount of PLN 65.8 million as well as damages received in connection with the 2020 fires in the Zofiówka Section in the amount of PLN 61.7 million and in KWK Budryk in the amount of PLN 7.8 million.

Other costs

Other costs in 2022 amounted to PLN 398.2 million, compared to PLN 444.3 million in 2021 (a decline of PLN 46.1 million). The lower level other costs results the recognition in 2022 of impairment loss on non-financial non-current assets in the total amount of PLN 267.9 million against PLN 352.2 million of impairment loss recognized in 2021 and the recognition of the impairment loss on the value of PBSz shares in the amount of PLN 27.7 million.

Other net gains/(losses)

Other net gains in 2022 amounted to PLN 112.3 million, compared to PLN (77.7) million of other net losses in 2021 (an increase of PLN 190.0 million). The change is caused by the profit from the measurement of investment certificates higher by PLN 168.9 million, profit from F/X differences on operating activities higher by PLN 43.3 million, loss on selling property, plant and equipment lower by PLN 16.1 million and loss on financial derivatives lower by PLN 38.9 million mainly as a result of negative settlement of a commodity swap securing coal prices (continuing high coking coal prices in 2022, favorable to the Company, negatively affected the derivative transactions concluded earlier, generating a negative settlement result).

Operating profit

For 2022, JSW recorded an operating profit in the amount of PLN 8,817.4 million, compared to a profit of PLN 527.7 million recorded in 2021.

Financial income and costs

Financial income for 2022 totaled PLN 140.4 million and was higher by PLN 132.7 million than financial income achieved in 2021, which results mainly from interest income on cash and cash equivalents higher by PLN 130.3 million.

Financial costs for 2022 amounted to PLN 150.3 million - an increase by PLN 17.7 million, i.e. 13.3%, results from interest associated with settlement of the discount on account of long-term provisions higher by PLN 15.5 million and the costs of interest and commissions on loans and borrowings higher by PLN 8.6 million.

Profit before tax

Profit before tax for 2022 was PLN 8,807.5 million compared to PLN 402.8 million in 2021 (up by PLN 8,404.7 million).

Net profit

The Company’s net profit for 2022 was PLN 7,115.8 million and was higher by PLN 6,785.9 million than the net profit generated in 2021. Basic and diluted earnings per share was PLN 60.61 (2021: earnings per share was PLN 2.81).

Cash flow on operating activity

In 2022, positive net cash flow on operating activity in the amount of PLN 10,863.9 million was generated thanks to positive cash flows from operating activities in the amount of PLN 10,878.3 million, which was mainly attributable to profit before tax in the amount of PLN 8,807.5 million and depreciation and amortization in the amount of PLN 1,045.5 million. Other factors affecting the cash flow on operating activity are presented in Note 7.1. of the financial statements of Jastrzębska Spółka Węglowa S.A. for the financial year ended 31 December 2022.

Cash flow on investing activity

Cash used in investing activities in 2022 was PLN 5,629.3 million and was PLN 4,304.2 million higher compared to 2021. The main capital expenditure item is the payment for the purchase of investment certificates in the amount of PLN 4,200.0 million and the acquisition of property, plant and equipment for PLN 1,527.9 million.

Cash flow on financing activity

In 2022, net cash flow on financing activity was PLN (991.0) million compared to PLN (377.0) million of cash flow in 2021. Their level in 2022 includes: repayment of loans and borrowings of PLN 715.3 million (chiefly repayment by JSW of the revolving B loan under the financing agreement with the Consortium in the amount of PLN 360.0 million, and repayment of the loans obtained from PFR in the amount of PLN 265.5 million), lease payments of PLN 215.3 million and interest and commissions paid in financing activity in the amount of PLN 63.4 million.

The balance of cash and cash equivalents in the statement of cash flows for 2022 was PLN 3,608.4 million (the balance sheet amount of cash was PLN 3,734.3 million and includes the amount of PLN 125.9 million for the cash provided by the Group companies as part of the PCP service).

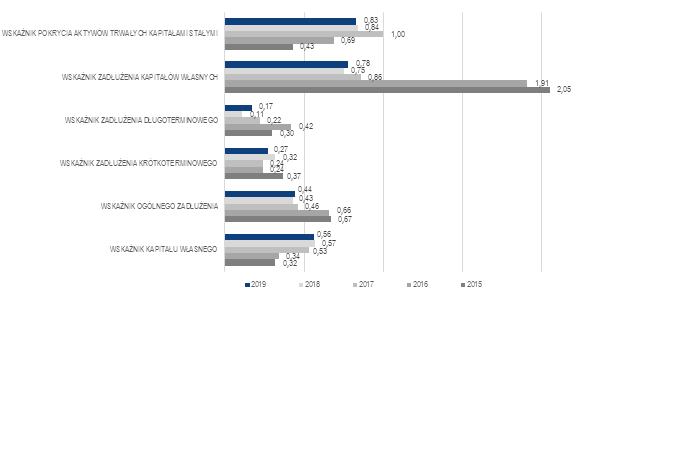

SELECTED FINANCIAL RATIOS JSW’S DEBT AND FUNDING STRUCTURE

JSW’S DEBT AND FUNDING STRUCTURE

As at the end of the reporting period, the share of liabilities in financing JSW’s activity, measured by the total debt ratio, was 0.39 compared to 0.56 as at the end of 2021, which resulted from an increase in equity in JSW’s financing structure. Short-term debt ratio decreased to 0.27 compared to 0.33 at the end of 2021, as a result of the increase in the current liabilities by PLN 1,064.7 million, or 21.6%, including mainly current income tax liabilities by PLN 1,333.5 million and liabilities on account of loans and borrowings by PLN 92.8 million, or 21.1%, with a simultaneous increase in total liabilities and equity by PLN 7,441.4 million, or 49.3%. Long-term debt ratio decreased from 0.23 as at the end of 2021 against 0.12 as at the end of 2022, mainly as a result of the increase in non-current liabilities by PLN 761.8 million, i.e. 22.0% (including mainly loans and borrowings by PLN 754.7 million). The fixed capital to assets ratio as at the end of 2022 was 0.95 against 0.78 as at the end of 2021 (an increase of 21.8%) in view of the growth in fixed capital by PLN 6,386.3 million, i.e. by 71.9% and the simultaneous increase in the level of non-current assets by PLN 4,718.2 million, i.e. by 41.5% (including mainly by virtue of the acquisition of FIZ investment certificates by PLN 4,385.9 million). The debt to equity ratio decreased to 0.63 as compared to 1.26 as at the end of 2021, primarily due to an increase in equity by PLN 7,138.5 million, or 106.7%, including for the most part retained earnings by PLN 7,123.4 million and despite an increase in liabilities by PLN 302.9 million.

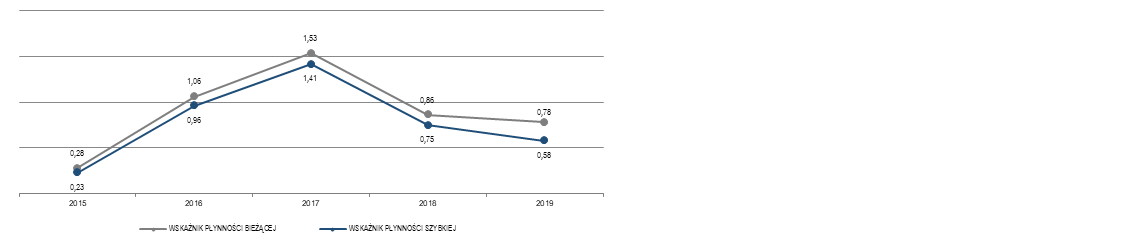

LIQUIDITY

As at 31 December 2022, the current and quick liquidity ratios improved significantly to 1.10 (up 41.0% from 0.78 as at 31 December 2021) and 1.02 (up 59.4% from 0.64 as at 31 December 2021), respectively. The above results from an increase in current assets by PLN 2,723.2 million, i.e. by 73.1%, including mainly cash and cash equivalents by PLN 3,442.7 million, i.e. by 1,180.6 % (in view of a high level of sales revenues in 2022), and in spite of a decrease in trade and other receivables by PLN 519.0 million, i.e. by 19.2% and a drop in inventories by PLN 204.4 million, i.e. 30.1%.

PROFITABILITY

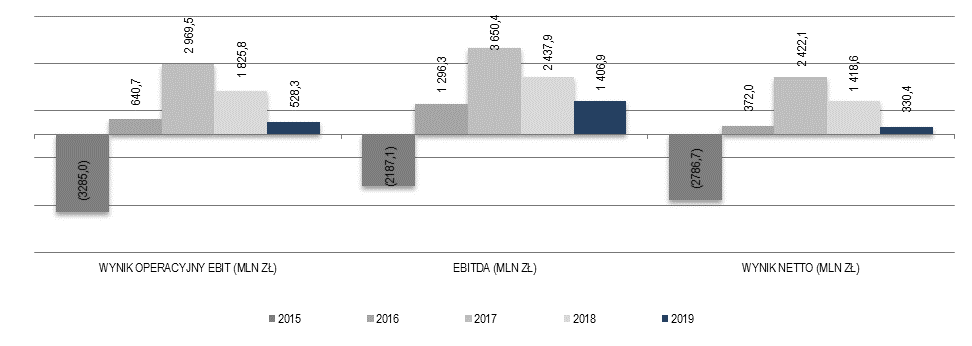

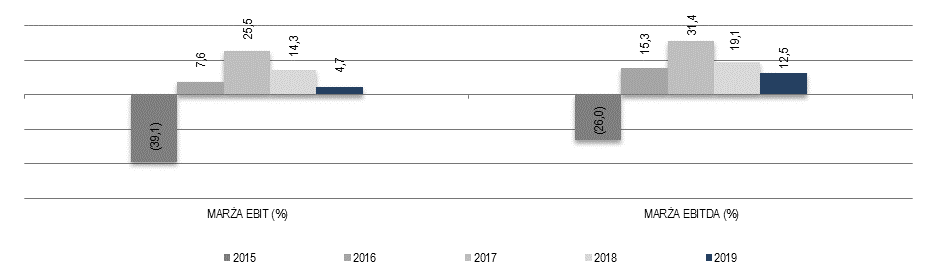

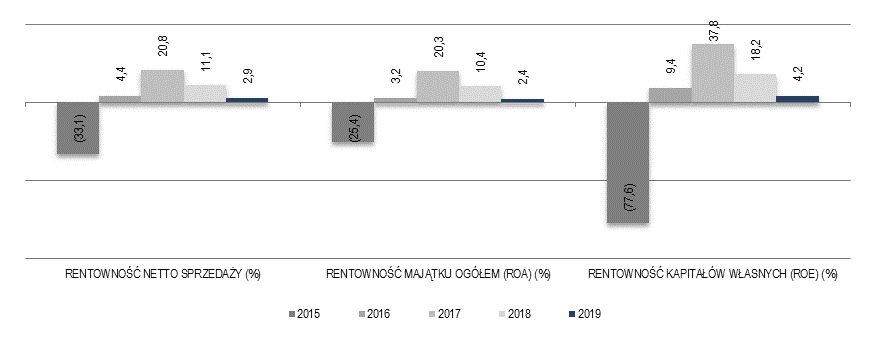

Analysis of a group of profitability ratios points to a considerable improvement of profitability compared to 2021. In 2022, JSW posted higher EBIT, EBITDA and net result by PLN 8,289.7 million, by PLN 8,295.8 million and by PLN 6,785.9 million, respectively. The higher ratio levels are the result of sales revenues being up PLN 12,220.5 million.

The EBITDA margin was up by 26.7 p.p., whereas the EBIT margin was up by 30.3 p.p. compared to 2021. Net profitability of sales was 27.6%, i.e. 25.2 p.p. higher than in 2021. The return on assets (ROA) and return on equity (ROE) ratios increased as compared to 2021, being 31.6 and 51.4, respectively, which is the outcome of the net profit of PLN 7,115.8 million generated in 2022, combined with an increase in total assets by PLN 7,441.4 million and an increase in equity by PLN 7,138.5 million.

MINING CASH COST

Mining cash cost (“MCC”) is a ratio used by the Group for management purposes. The methodology of calculation and presentation of coal mining cash cost reflects the cost from the point of view of cash consumption regardless of the period in which it was incurred. The Parent Company calculates the mining cash cost by subtracting costs not directly associated with the production of coal and costs not permanently affecting the financial flows from all costs incurred in the period.

The mining cash cost for 2022 was PLN 7,652.4 million, which is PLN 1,502.6 million (24.4%) higher than in 2021. The increase in mining cash cost was caused primarily by the following factors:

- higher costs of employee benefits by PLN 681.6 million (21.0%) resulting primarily from the 3.4% increase in base salary as of 1 July 2021 and the implementation, as of 1 September 2021, of new base salary rates which were 1.6% higher than the existing ones. In addition, higher costs of employee benefits result primarily from an increase in base salary rates by 10%, which was implemented in JSW as of 1 January 2022, as well as an increase in the price for a supportive meal from PLN 21 to PLN 30 per day, and payment of a cash bonus for employees in 2022,

- higher costs of consumption of materials and energy by PLN 545.0 million (43.0%), of which the consumption of materials increased by PLN 387.6 million and energy consumption was higher by PLN 157.4 million. An increase in the costs of consumption of materials resulted chiefly from higher prices of materials used in underground transport processes, with service, maintenance, assembly and dismantling of coal haulage outside the coal-face, longwall outfitting and decommissioning, combating natural threats, repair and refurbishment of tools in underground workshops, technological processes in coal preparation plants, mining work, prevention of caving hazard, reconstruction of pits and removal of effects of mining accidents. On the other hand, the increase in energy consumption costs was connected with an increase in the unit price of electricity and a higher volume of purchased energy,

- higher costs of external services by PLN 270.9 million (19.0%), mainly in the area of: repair services by PLN 119.5 million, due to an increase in the scope of services related to repairs and maintenance of mining machinery and equipment and an increase in the cost of materials used in the process of maintenance of mining machinery and equipment. There was also an increase in the costs of other services regarding production of coal by PLN 77.2 million, in connection with higher costs of desalination and discharge of salt water, recognition of a provision for environmental protection and for the costs of works securing landslide areas, as well as a growth in the costs of mining works. In addition, the costs of mining damage removal services grew by PLN 52.6 million in connection with revaluation of provisions for removal of mining damage.

On a per-unit basis the mining cash cost in 2022 was PLN 543.81 per ton, i.e. PLN 96.69 per ton (21.6%) more than in the corresponding period of 2021, influenced by the 24.4% increase of expenditures for coal production with a 0.3 mt increase in net coal production.

The cash conversion cost of coke (cash conversion cost )

In 2022, the cash conversion cost of coke was PLN 811.6 million, i.e. increased by PLN 178.3 million or 28.2% as compared to 2021. This change was driven mainly by:

- an increase in employee benefits by PLN 60.9 million, or 25.5%, primarily as a result of a 10% increase in base salary rates as of 1 February 2022 based on the Salary Agreement entered into between the JSW KOKS Management Board and the trade union organizations. The increase was also influenced by the payment of additional cash awards totaling PLN 30.0 million, as well as increase in the discretionary bonus for each employee from PLN 100.00 to PLN 200.00, effective January 2022.Changes in payroll policy also contributed increasing the cost of social security and other benefits by PLN 12.2 million,

- the costs of external services without the coal feedstock transport costs up PLN 43.0 million, or 21.8%, driven mainly by the cost of renovation services being up PLN 33.6 million, costs of transportation services being up PLN 6.5 million (higher costs of coke storage and unloading and operation of rail sidings), and other services by PLN 2.9 million,

- the costs of consumption of materials net of coal feedstock up by PLN 42.9 million, or 65.1%, driven primarily by higher consumption of sodium hydroxide by PLN 27.7 million, materials for overhauls by PLN 7.5 million, stripping oil by PLN 3.1 million and other materials,

- the costs of energy consumption up by PLN 24.8 million, or 54.5%, resulting primarily from higher costs of electricity consumption by PLN 19.5 million (an increase in the purchase volume by 11,183 MWh and the purchase price by PLN 583.49/MWh) and steam consumption by PLN 5.6 million,

- administrative expenses less depreciation and amortization up PLN 17.8 million, or 24.6%, mainly due to higher employee benefit costs by PLN 17.2 million (implementation of the Salary Agreements between the JSW KOKS Management Board and Trade Union Organizations),

- selling and distribution expenses minus depreciation and amortization attributable to selling and distribution expenses up PLN 7.0 million, or 29.7%, mainly due to higher costs of transportation services by PLN 5.3 million,

- costs of taxes and charges down PLN 4.3 million, or 12.1%, due to a PLN 3.7 million lower excise tax on energy, with a PLN 2.5 million lower costs of certificates of origin for cogeneration, with the simultaneous increase in concession, license and tariff fees by PLN 0.7 million, a higher real estate tax by PLN 0.5 million and higher land tax and perpetual usufruct tax by PLN 0.4 million.

As a result of the above events, on a per-unit basis, Cash Conversion Cost for 2022 reached PLN 252.32 per ton and was PLN 79.22 per ton, 45.8% higher relative to 2021, which was also affected by a 0.5 mt decrease in coke produced for sale.

HEADCOUNT

As at 31 December 2022, the Group had 30,739 employees while as at 31 December 2021 the headcount was 31,916. At the end of 2022, the Parent Company had 21,239 employees versus 23,119 employees in 2021. The average headcount in the Group in 2022 was 29,981 persons. It was 579 persons lower than in the previous year. The average headcount in the Parent Company in 2022 was 21,132, which was 971 persons lower than in the previous year.

In 2021 the JSW Management Board decided to transfer free of charge a portion of JSW’s enterprise in the form of the “Jastrzębie III” Mining Area in KWK “Jastrzębie-Bzie” to Spółka Restrukturyzacji Kopalń S.A. As a result of the signed agreement, the Parent Company transferred 2,148 employees (including 1,234 employees of PGG) to SRK as of 1 January 2022. On the transfer date, these people were employees of KWK Jastrzębie–Bzie.