COMPLIANCE OF SUSTAINABLE OPERATIONS WITH THE TAXONOMY

EU TAXONOMY

The Group is disclosing in this Statement information regarding the so-called EU Taxonomy which sets out the criteria for recognizing an activity as environmentally sustainable. This obligation follows from Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment (“Regulation 2020/852”), which requires disclosure of whether and to what extent an undertaking's economic activities comply with the assumptions of the EU Taxonomy.

An activity that is eligible for the EU Taxonomy is one that is included in the catalog of economic activities for which technical criteria for being considered environmentally sustainable are specified in the delegated regulations to Regulation 2020/852. In turn, an environmentally sustainable activity is an activity that eligible for the EU Taxonomy, which:

- contributes substantially to one or more of the environmental objectives,

- complies with technical screening criteria,

- does not significantly harm any of the environmental objectives, and

- complies with the minimum safeguards.

The EU Taxonomy creates a common tool for investors and undertakings to classify sustainable economic activities. Its purpose is to assist investors in making investment decisions and to define activities that can be considered environmentally sustainable.

According to Commission Delegated Regulation (EU) 2021/2178[1], as of 1 January 2023, non-financial companies are required to disclose key performance indicators and related contextual (i.e. explanatory) information as indicated in Annexes I, II and XII to the Regulation. Key performance indicators are to be disclosed in tabular form, according to the formulas indicated in Annexes II and XII to the Regulation. These key performance indicators relate to:

- percentage of EU Taxonomy eligible and non-eligible activities in total: turnover (revenue), capital expenditures ("CapEx"), operating expenses ("OpEx"), and to

- percentage of environmentally sustainable activities (i.e. aligned with the EU Taxonomy) in total: turnover (revenue), capital expenditures ("CapEx"), operating expenses ("OpEx").

In addition, Commission Delegated Regulation (EU) 2021/2178 clarifies the reporting obligations indicated in Article 8 of the EU Taxonomy - defining the content, methodology and providing reporting templates for financial and non-financial companies.

For the 2022 disclosures, JSW's Management Board - as for the 2021 disclosures - analyzed its activities for eligibility to the EU Taxonomy, and - for the first time - assessed the alignment of the activities eligible for the EU Taxonomy with its technical criteria and minimum social safeguards. Eligibility and alignment were assessed against the first two environmental objectives, for which lists of eligible activities and corresponding technical eligibility criteria were published:

- OBJECTIVE I - Climate change mitigation - as per Annex I of Commission Delegated Regulation (EU) 2021/2139[1] and

- OBJECTIVE I - Climate change adaptation - as per Annex I of Commission Delegated Regulation (EU) 2021/2139.

The Group's core business activities are largely outside the scope of the activities currently defined for the first two environmental objectives. However, Regulation 2020/852 will evolve and the list of activities covered will expand.

As of 2022 and as of the date of publication of this report, the EU Commission's delegated regulations on the list of eligible activities and corresponding technical criteria for the four remaining environmental objectives identified in the EU Taxonomy have not yet been published:

- Sustainable use and protection of water and marine resources,

- Transition to a circular economy,

- Pollution prevention and control,

- Protection and restoration of biodiversity and ecosystems.

Accordingly, eligibility and alignment with the four environmental objectives indicated above will be reported by the Group after the publication of the EU Commission's binding delegated regulations on the subject, i.e. in later reporting periods.

The Group hereby presents key performance indicators relating to the proportion of turnover (revenue), capital expenditures ("CapEx") and operating expenses ("OpEx") associated with activities that are eligible for the EU Taxonomy and those that are aligned with the EU Taxonomy (i.e. environmentally sustainable).

The key performance indicators were prepared both on a consolidated level in relation to the JSW Group and on a separate level in relation to the Parent Company.

[1]Commission Delegated Regulation (EU) 2021/2139 of 4 June 2021 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by establishing the technical screening criteria for determining the conditions under which an economic activity qualifies as contributing substantially to climate change mitigation or climate change adaptation and for determining whether that economic activity causes no significant harm to any of the other environmental objectives ("Delegated Act establishing technical eligibility criteria") – taking into account the amendments introduced by European Commission Delegated Regulation (EU) 2022/1214 of 9 March 2022 amending delegated regulation (EU) 2021/2139 as regards economic activities in certain energy sectors and delegated regulation (EU) 2021/2178 as regards specific public disclosures for those economic activities.

ANALYSIS OF ELIGIBLE ACTIVITIES

In the process of preparing the 2022 disclosures, a detailed analysis of the activities was carried out at all Group companies. As a condition for an activity to be considered eligible, the actual activity was assumed to be consistent with the activity description in Annexes I or II of the Delegated Act establishing the technical eligibility criteria. Financial data for eligible activities includes both revenues (turnover) from conducted eligible economic activities, related capital expenditures (“CapEx”) and/or operating expenses (“OpEx”), and purchases made in 2022 and associated with eligible activities. The definitions in Annex I of the Commission Delegated Regulation (EU) 2021/2178 were used to calculate the indicators, taking into account relevant consolidation eliminations.

ANALYSIS OF ENVIRONMENTALLY SUSTAINABLE (ALIGNED) ACTIVITIES

Analysis of alignment with technical criteria

For the activities identified as eligible for the EU Taxonomy, a detailed analysis was carried out for alignment with the technical criteria indicated in Annexes I or II of Commission Delegated Regulation (EU) 2021/2139.

Each activity has been reviewed to check if it:

- makes a significant contribution to a specific environmental objective and

- does no significant harm (“DNSH”) for the other environmental objectives identified in the EU Taxonomy.

The detailed analysis of the fulfillment of the technical criteria was based on the knowledge of experienced managers and industry specialists from individual business areas who know the technological and environmental processes in the JSW Group, the knowledge and experience of external experts, as well as relevant source documentation (concerning, among other things: technical parameters of operations, or the environmental impact of operations).

Analysis of alignment with minimum social safeguards

The analysis of the JSW Group's alignment with minimum social safeguards was carried out based on the practical guidance provided in the “Final Report on Minimum Safeguards” document published in October 2022 by the Sustainable Finance Platform and including detailed suggestions for process solutions for verifying alignment with Article 18 of the EU Taxonomy.

The analysis focused on the Group's approach to managing issues of human rights, labor law, corruption and bribery, taxation and fair competition. The verification of alignment with minimum social safeguards for 2022 involved two main pillars: 1) analysis of the Group's litigation cases in the areas of human rights and labor law; and 2) analysis of the Group's implementation of due diligence processes in the areas of human rights, labor law, corruption and bribery, taxation, and fair competition. The analyses carried out relied on the knowledge of the Group's experienced managers and specialists in legal, compliance management, risk management, ESG and human resources management, the knowledge and experience of external experts, as well as relevant source documentation.

KEY PERFORMANCE INDICATORS FOR THE EU TAXONOMY AND THE PRINCIPLES OF THEIR CALCULATION

The disclosures have been prepared taking into account the principle of avoiding double counting, i.e. the different activities have been allocated to only one eligible or aligned activity and each part of revenue, CapEx and OpEx has been included only once. If a particular revenue-generating activity in 2022 was assigned to any of the eligible or aligned activities, then the capital expenditures (CapEx) and operating expenses (OpEx) associated with that activity were also assigned to that activity, no longer subject to evaluation for eligibility or alignment with any of other activities specified in the EU Taxonomy.

In contrast, the remaining CapEx and OpEx that could not be considered to be related to eligible revenue-generating activities were analyzed for their possible classification as purchases pertaining to assets of processes associated with eligible or aligned activities, subject to the principle that they could only be attributed to one, best matching activity.

The JSW Management Board adopted the rules for calculation of the indicators described in the annexes to the Delegated Act on Article 8 of the EU Taxonomy regarding the disclosures for calculating the eligible and environmentally sustainable (aligned) portion of turnover (revenues), capital expenditures and operating expenses.

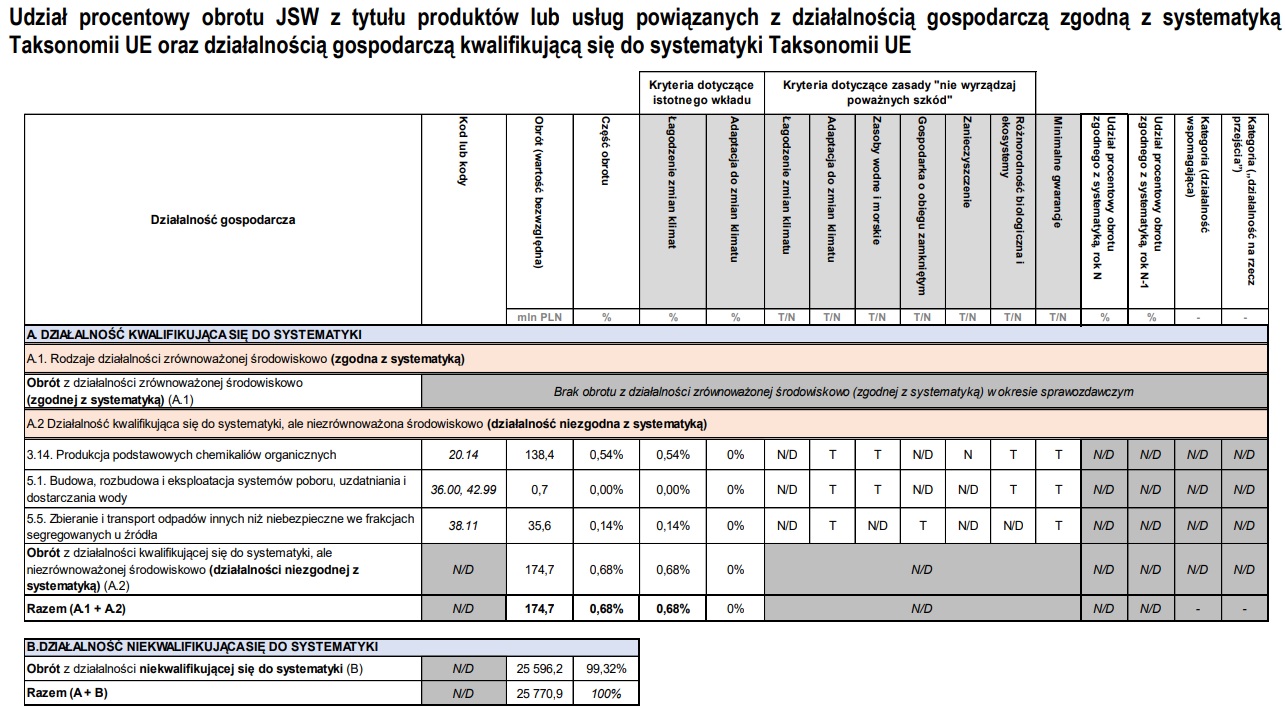

TAXONOMY INDICATORS FOR THE PARENT COMPANY

The Parent Company discloses the percentage of turnover (revenue), capital expenditures, and operating expenses that are EU Taxonomy-eligible or aligned.

SUMMARY OF KEY PERFORMANCE INDICATORS

| 2022 |

TOTAL |

ELIGIBLE AND ALIGNED WITH THE TAXONOMY |

ELIGIBLE AND NOT ALIGNED WITH THE TAXONOMY |

TAXONOMY-NON-ELIGIBLE |

|||

|---|---|---|---|---|---|---|---|

| % | PLN m | % | PLN m | % | PLN m | ||

| Turnover (Revenue)* | 25 770,9 | - | - | 0,68% | 174,7 | 99,32% | 25 596,2 |

| CapEx* | 2 020,2 | 0,92% | 18,5 | 0,36% | 7,4 | 98,72% | 1 994,3 |

| OpEx* | 587,7 | 1,14% | 6,7 | 4,01% | 23,6 | 94,85% | 557,4 |

* The total includes Objective I Climate change mitigation.

KEY PERFORMANCE INDICATORS FOR TURNOVER (REVENUE)

JSW's operations are concentrated in the area of the mining industry and mainly involve the mining and sale of coking coal, which is a raw material that is essential for steel production and, consequently, crucial to the processes associated with the transition to a low-carbon economy. However, the catalog of activities listed in the annexes to Commission Delegated Regulation (EU) 2021/2139 does not include coking coal mining activities. As a result, the Company currently has a very limited ability to make its core business activities Taxonomy-eligible despite the fact that coking coal is a raw material important for the development of environmentally sustainable technologies.

Consequently, the key performance indicators for turnover (revenue) for 2022 include mainly activities related to the sale of organic chemicals (BTX) produced in the JSW Group and selective collection and transportation of waste, which are Taxonomy-eligible according to Annex I to Delegated Regulation 2021/2139.

In 2022, JSW has not identified revenue-generating activities that are environmentally sustainable according to the EU Taxonomy.

The ratio of the Company's percentage of turnover (revenue) from products or services related to business activities eligible for the EU Taxonomy was calculated as the quotient of the following values:

- the numerator expressed as revenue from eligible activities indicated in the following table in Section A.2 - all turnover attributable to eligible activities relates to revenue from contracts with customers,

- the denominator expressed as JSW sales revenue in 2022, as disclosed in the Financial Statements of Jastrzębska Spółka Węglowa S.A. for the financial year ended 31 December 2022, in Note 3.1

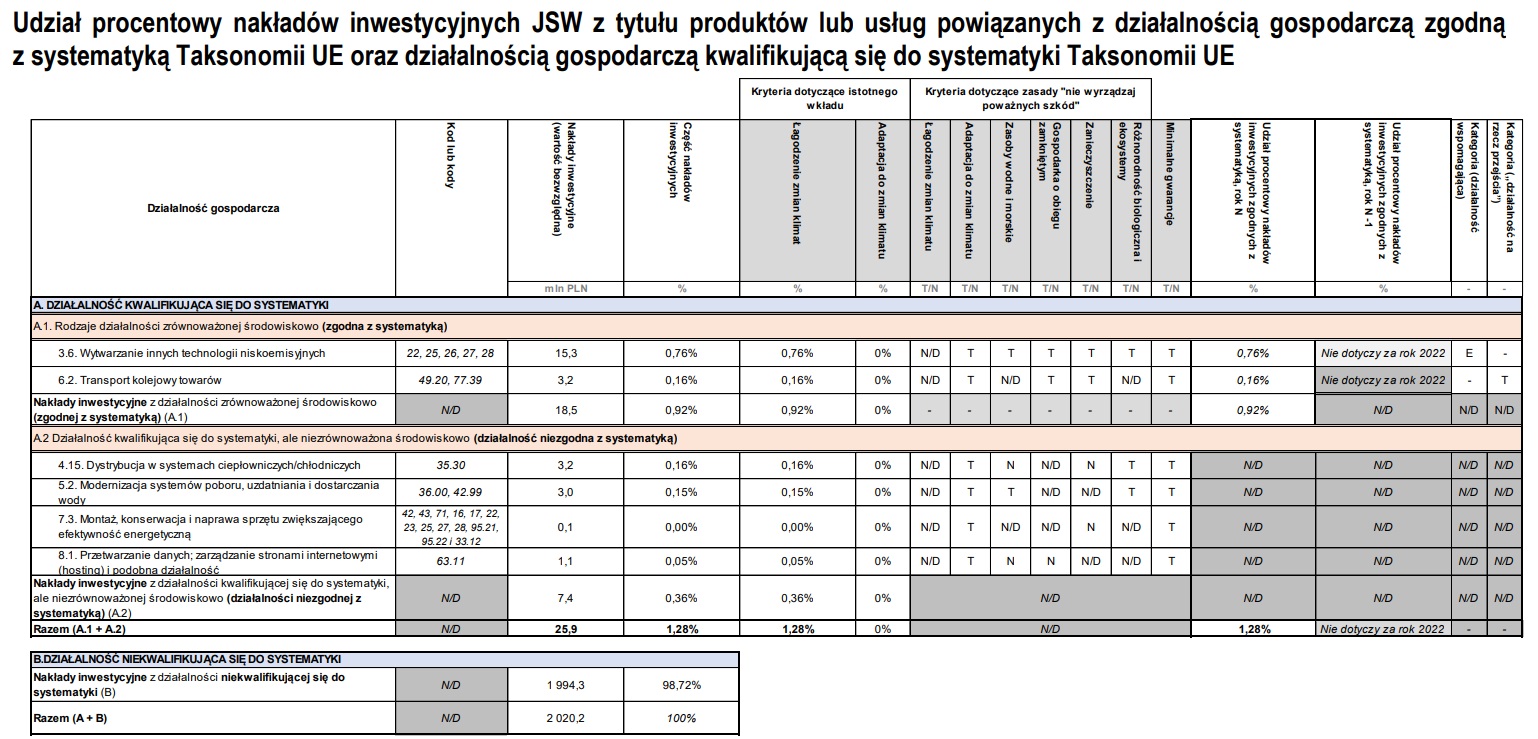

KEY PERFORMANCE INDICATORS FOR CAPITAL EXPENDITURES

The values included in CapEx relate only to direct expenditures on property, plant and equipment, intangible assets, investment property and right-of-use assets.

The reported capital expenditures associated with environmentally sustainable operations relate to the expansion of cogeneration systems based on methane fuel captured from mines (which is aimed at significantly reducing greenhouse gas emissions in the economy by seeking to maximize the use of methane fuel captured from mines in order to reduce the Company's demand for electricity/heat supplied by third-party producers and generated mainly from fossil fuels) and new assets from the right to use zero-emission suspended railways used to transport equipment supporting the Company's production processes.

The capital expenditures shown for eligible activities relate in particular to the construction and modernization of heat or cool air distribution grids at production facilities, the modernization of water intake, treatment and supply systems, the purchase of reactive power compensation system hardware and software, as well as work to increase the energy efficiency of buildings managed by the Company. The environmental strategy is an important element of the JSW Strategy including JSW Group Subsidiaries for 2022-2030 - JSW has been for years taking measures to protect the environment and climate, including reduction of greenhouse gases, and the current strategy and the goals contained in it are a continuation and development of the direction adopted so far. The Company is currently implementing methodologies and processes that will ensure that new investments can be evaluated on an ongoing basis according to the technical criteria of the EU Taxonomy and will support the Company in reflecting the achievement of its environmental strategic goals on the level of the EU Taxonomy key performance indicators for capital expenditures in subsequent reporting periods.

The ratio of the percentage of the Company's capital expenditures for products or services related to environmentally sustainable business activities (aligned with the EU Taxonomy) was calculated as the quotient of the following values:

- numerator expressed as capital expenditures related to the environmentally sustainable activities shown in the table below in Section A.1;

- denominator expressed as total capital expenditures recognized in the Financial Statements of Jastrzębska Spółka Węglowa S.A. for the financial year ended 31 December 2022, respectively:

- property, plant and equipment – Note 6.1.

- intangible assets – Note 6.2.

- related to right-of-use assets – Note 6.3.

- investment property – Note 6.5.

The ratio of the percentage of the Company's capital expenditures for products or services related to business activities that are eligible for the EU Taxonomy (not aligned with the EU Taxonomy) was calculated as the quotient of the following values:

- numerator expressed as capital expenditures related to EU Taxonomy-eligible activities shown in the table below in Section A.2;

- denominator expressed in the same way as for the index of capital expenditures related to environmentally sustainable economic activities described above.

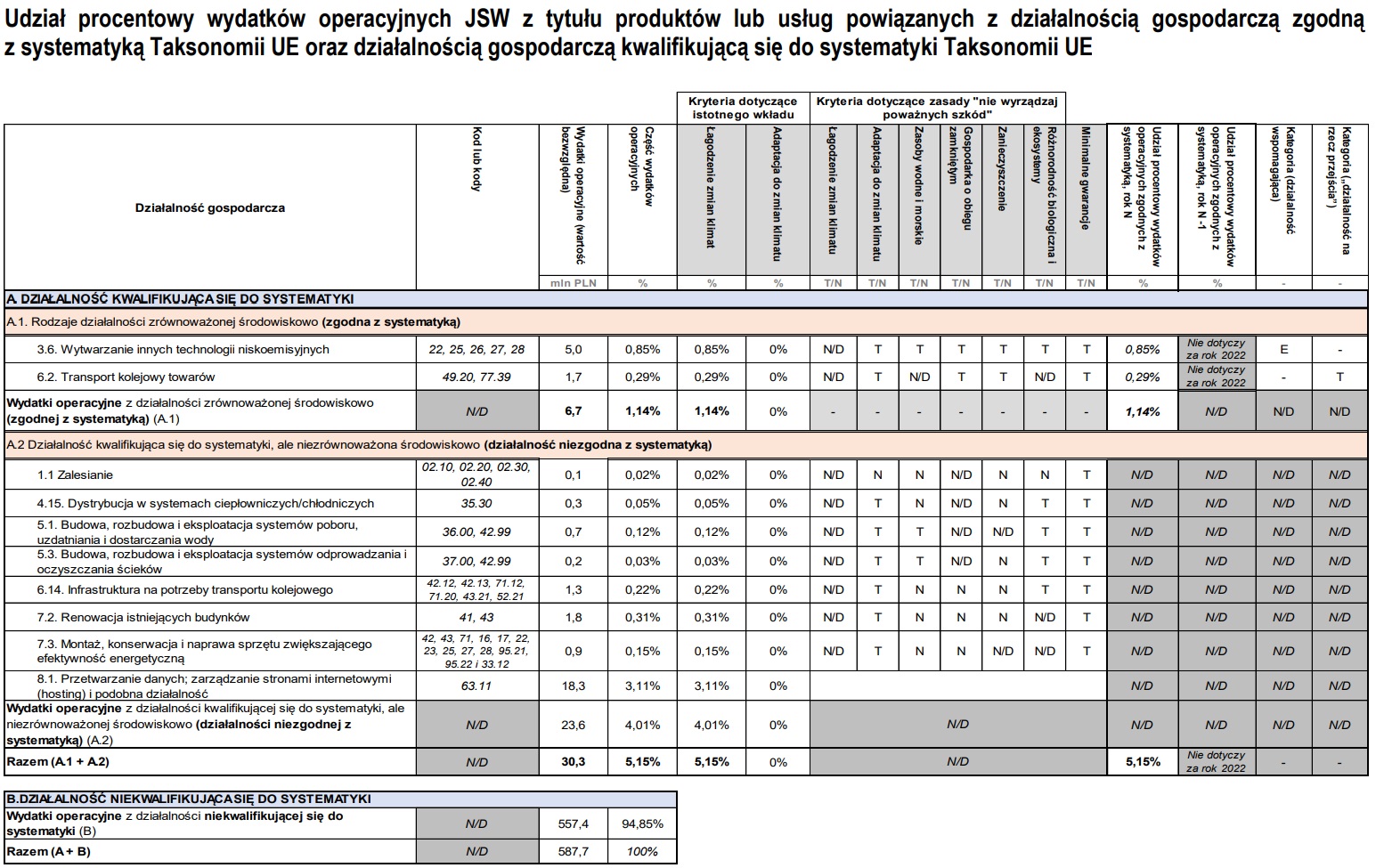

KEY PERFORMANCE INDICATORS FOR OPERATING EXPENSES

As defined in Annex I of Commission Delegated Regulation (EU) 2021/2178, operating expenses included in the calculation of the indicator in both the numerator and denominator include direct, non-capitalized costs related to research and development, building renovation activities, short-term leases, maintenance and repairs, and any other direct expenses related to the day-to-day operation of property, plant and equipment by the Company or third parties to whom activities necessary to ensure the continuous and efficient operation of those assets have been outsourced.

In accordance with the guidance provided in the Commission Notice on the interpretation of certain legal provisions of the Disclosures Delegated Act under Article 8 of EU Taxonomy Regulation on the reporting of eligible economic activities and assets (2022/C 385/01), the Company in particular:

- included in the calculation of operating expenses the costs related to maintenance and repair of property, plant and equipment, i.e. among other things: the cost of materials used in connection with the repair / maintenance / renovation of equipment, facilities or buildings, as well as the costs of third parties performing the work indicated above;

- did not include in the calculation of operating expenses the costs associated with the operation of property, plant and equipment, i.e. among others: the cost of electricity or operating fluids, as well as the cost of employees operating machinery and equipment.

The reported operating expenses associated with environmentally sustainable activities relate to maintenance/repairs of cogeneration systems based on methane fuel captured from mines (a technology aimed at significantly reducing greenhouse gas emissions in the economy) and maintenance/repairs of zero-emission suspended railways used to transport equipment supporting the Company's production processes.

The reported operating expenses related to eligible activities pertain, in particular, to maintenance work on tangible components of information systems (hardware) supporting the Company's production processes and the security of these processes, work on the maintenance and repair of heat and cool air distribution systems at production facilities, renovation of buildings managed by the Company (including work on the installation or repair of equipment to increase building energy efficiency), work on the repair and maintenance of railroad infrastructure, and work on the maintenance and upkeep of systems for the intake, treatment and supply of potable water.

The ratio of the percentage of the Company's operating expenses for products or services related to environmentally sustainable business activities (aligned with the EU Taxonomy) was calculated as the quotient of the following values:

- numerator expressed as operating expenses related to the environmentally sustainable activities shown in the table below in Section A.1;

- the denominator expressed as the Company's total non-capitalized operating expenses related to repairs, maintenance, servicing and repairs (of buildings, machinery and other property, plant and equipment) and the materials used for this work, as well as the attestation, testing and legalization of machinery / equipment (to the extent necessary to ensure the continuous and efficient operation of property, plant and equipment).

The ratio of the percentage of the Company's operating expenses for products or services related to business activities that are eligible for the EU Taxonomy (not aligned with the EU Taxonomy) was calculated as the quotient of the following values:

- numerator expressed as operating expenses related to EU Taxonomy-eligible activities shown in the table below in Section A.2;

- denominator expressed in the same way as for the index of operating expenses related to environmentally sustainable economic activities described above.

KEY PERFORMANCE INDICATORS FOR NUCLEAR AND FOSSIL GAS RELATED ACTIVITIES

In the table below, the Company discloses information on the extent to which the Company's nuclear and fossil gas related activities.

| Row | Nuclear energy related activities | |

|---|---|---|

| 1 | The undertaking carries out, funds or has exposures to research, development, demonstration and deployment of innovative electricity generation facilities that produce energy from nuclear processes with minimal waste from the fuel cycle. | NO |

| 2 | The undertaking carries out, funds or has exposures to construction and safe operation of new nuclear installations to produce electricity or process heat, including for the purposes of district heating or industrial processes such as hydrogen production, as well as their safety upgrades, using best available technologies. | NO |

| 3 | The undertaking carries out, funds or has exposures to safe operation of existing nuclear installations that produce electricity or process heat, including for the purposes of district heating or industrial processes such as hydrogen production from nuclear energy, as well as their safety upgrades. | NO |

| Row | Fossil gas related activities | |

| 4 | The undertaking carries out, funds or has exposures to construction or operation of electricity generation facilities that produce electricity using fossil gaseous fuels. | NO |

| 5 | The undertaking carries out, funds or has exposures to construction, refurbishment, and operation of combined heat/cool and power generation facilities using fossil gaseous fuels. | NO |

| 6 | The undertaking carries out, funds or has exposures to construction, refurbishment and operation of heat generation facilities that produce heat/cool using fossil gaseous fuels. | NO |

The Company does not disclose separate tables according to Templates 2 and 3 of Annex XII of the Commission Delegated Regulation (EU) 2021/2178, as nuclear and fossil gas related activities do not apply to the Company. This means that the values presented in the aforementioned tables according to Templates 2 and 3 can only take values equal to zero - in this context, the presentation of separate tables would, in the Company's opinion, negatively affect the transparency of this document.

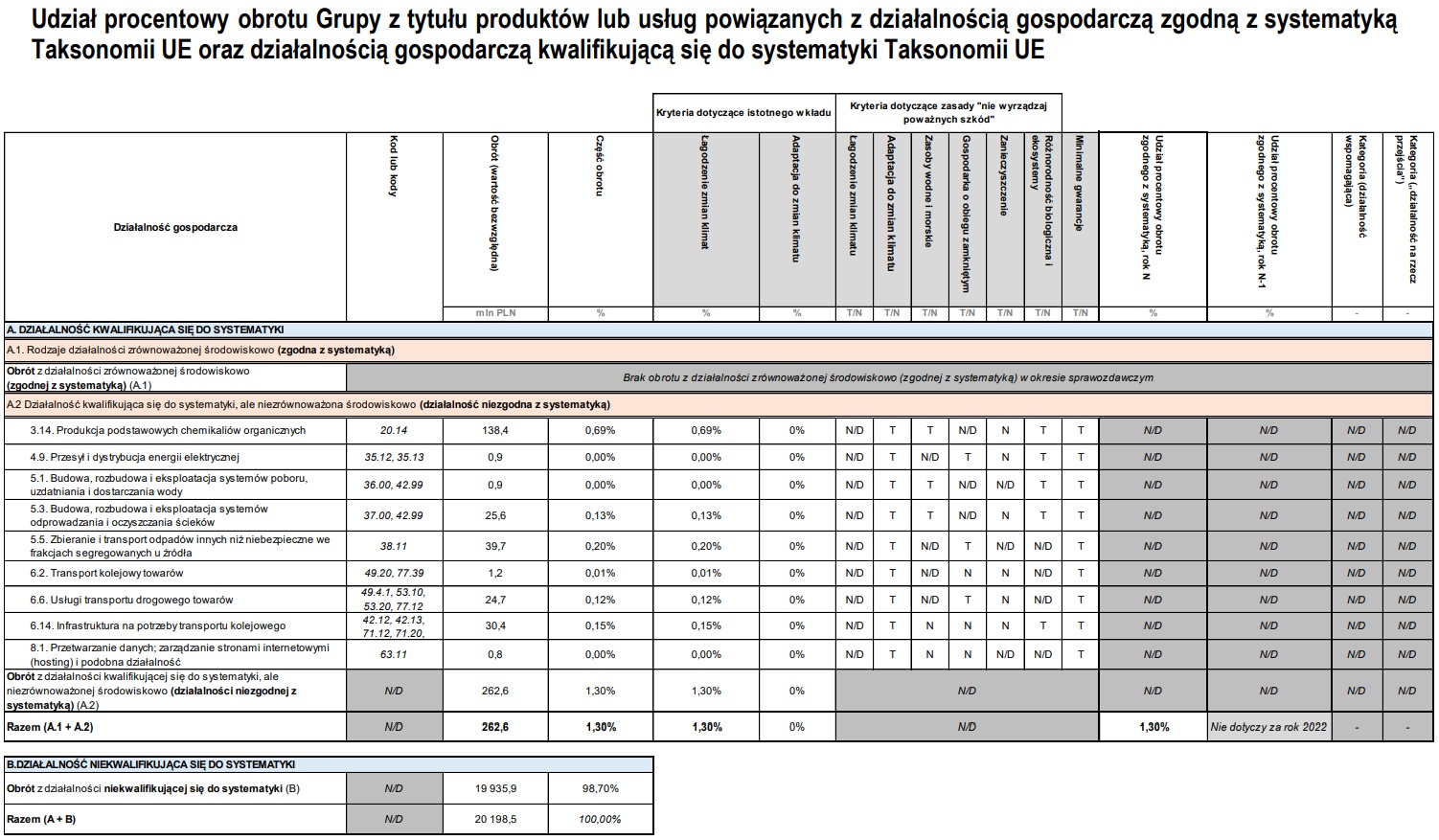

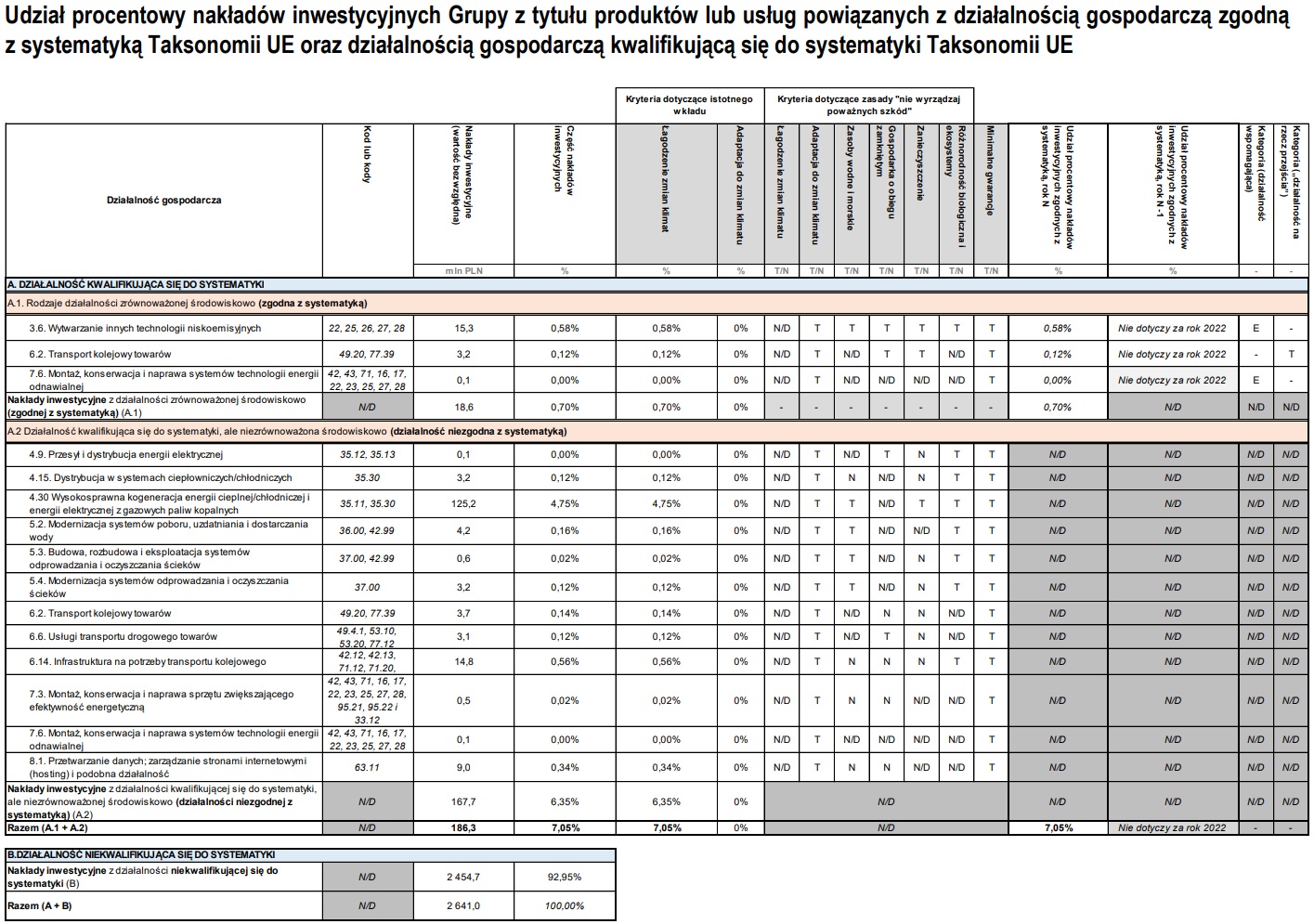

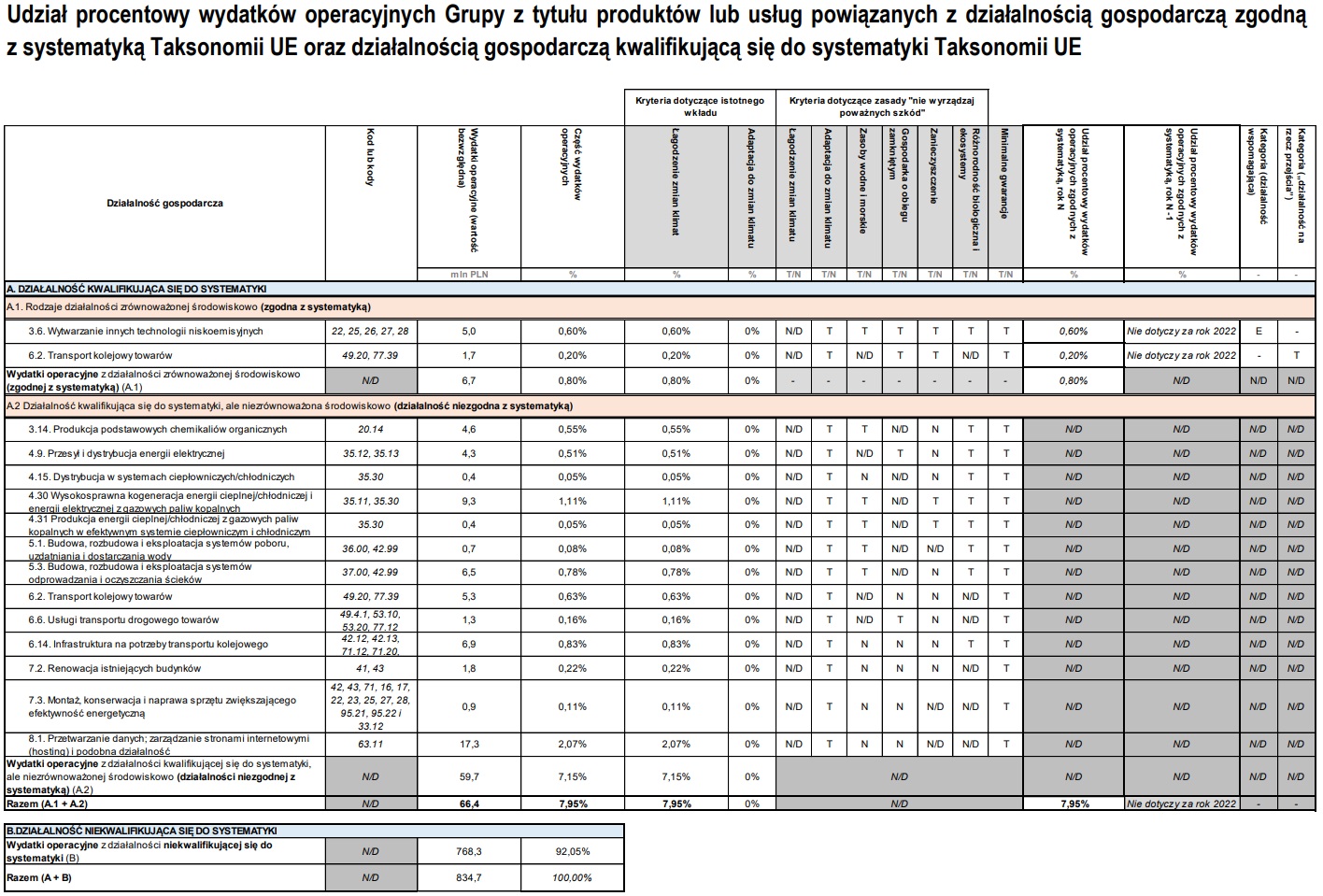

TAXONOMY INDICATORS FOR THE GROUP

The Group discloses the percentage of turnover (revenue), capital expenditures, and operating expenses that are EU Taxonomy-eligible or aligned.

SUMMARY OF KEY PERFORMANCE INDICATORS

| 2022 |

TOTAL PLN m |

TAXONOMY ELIGIBLE AND ALIGNED |

ELIGIBLE AND NOT ALIGNED WITH THE TAXONOMY |

TAXONOMY-NON-ELIGIBLE |

|||

|---|---|---|---|---|---|---|---|

| % | PLN m | % | PLN m | % | PLN m | ||

| Turnover (Revenue)* | 20 198,5 | - | - | 1,30% | 262,6 | 98,70% | 19 935,9 |

| CapEx* | 2 641,0 | 0,70% | 18,6 | 6,35% | 167,7 | 92,95% | 2 454,7 |

| OpEx* | 834,7 | 0,80% | 6,7 | 7,15% | 59,7 | 92,05% | 768,3 |

* The total includes Objective I Climate change mitigation.

KEY PERFORMANCE INDICATORS FOR TURNOVER (REVENUE)

The Group's activities are concentrated in the area of the mining industry and mainly involve the mining and sale of coking coal and the production and sale of coke. Coking coal and coke are key raw materials for steelmaking and, consequently, essential for the processes involved in the transition to a low-carbon economy. However, the catalog of activities listed in the annexes to Commission Delegated Regulation (EU) 2021/2139 does not include coking coal mining and coke production activities. As a result, the Group currently has a very limited ability to make its core business activities Taxonomy-eligible despite the fact that coking coal and coke are raw materials important for the development of environmentally sustainable technologies.

Consequently, the key performance indicators for turnover (revenue) for 2022 include mainly activities related to the sale of organic chemicals produced in the Group, transport of goods and railroad infrastructure, as well as selective collection and transportation of waste, which are Taxonomy-eligible according to Annex I to Delegated Regulation 2021/2139.

The reported revenues related to eligible activities relate in particular to the sale of BTX produced by JSW KOKS, the treatment of municipal and industrial wastewater, road and rail transportation of goods, the maintenance and modernization of rail infrastructure, as well as the treatment and distribution of drinking water.

The ratio of the percentage of the Group’s revenue from products or services related to business activities that are eligible for the EU Taxonomy (not aligned with the EU Taxonomy) was calculated as the quotient of the following values:

- numerator expressed as revenue related to EU Taxonomy-eligible activities shown in the table below in Section A.2;

- denominator expressed in the same way as for the index of revenue related to environmentally sustainable economic activities described above

KEY PERFORMANCE INDICATORS FOR CAPITAL EXPENDITURES

The values included in CapEx relate only to direct expenditures on property, plant and equipment, intangible assets, investment property and right-of-use assets.

The reported capital expenditures associated with environmentally sustainable operations relate to the expansion of cogeneration systems based on methane fuel captured from mines (which is aimed at significantly reducing greenhouse gas emissions in the economy by seeking to maximize the use of methane fuel captured from mines in order to reduce the Group’s demand for electricity/heat supplied by third-party producers and generated mainly from fossil fuels), new assets from the right to use zero-emission suspended railways used to transport equipment supporting the Group’s production processes and installation of photovoltaic panels on one of the office buildings.

The capital expenditures shown for eligible activities relate, in particular, to the construction of a power unit for the high-efficiency cogeneration of heat and electricity from gaseous fossil fuels (from coke oven gas), the construction and modernization of heat or cool air distribution networks at production facilities, the installation of heat pumps at one of the companies, the modernization of water intake, treatment and supply systems and wastewater treatment systems, the expansion/modernization of rail infrastructure, the purchase of freight transport vehicles, as well as work to increase the energy efficiency of buildings managed by the Group.

The JSW Group has been for years taking measures to protect the environment and climate, including reduction of greenhouse gases, and the current strategy and the goals contained in it are a continuation and development of the direction adopted so far. The Group is currently implementing methodologies and processes that will ensure that new investments can be evaluated on an ongoing basis according to the technical criteria of the EU Taxonomy and will support the Group in reflecting the achievement of its environmental strategic goals on the level of the EU Taxonomy key performance indicators for capital expenditures in subsequent reporting periods.

The ratio of the percentage of the Group’s capital expenditures for products or services related to environmentally sustainable business activities (aligned with the EU Taxonomy) was calculated as the quotient of the following values:

- numerator expressed as capital expenditures related to the environmentally sustainable activities shown in the table below in Section A.1;

- denominator expressed as total capital expenditures described in the Consolidated Financial Statements of the JSW S.A. Group for the financial year ended 31 December 2022, respectively:

- property, plant and equipment – Note 7.1.

- intangible assets – Note 7.3.

- right-of-use assets – Note 7.4.

- investment property – Note 7.6.

The ratio of the percentage of the Group’s capital expenditures for products or services related to business activities that are eligible for the EU Taxonomy (not aligned with the EU Taxonomy) was calculated as the quotient of the following values:

- numerator expressed as capital expenditures related to EU Taxonomy-eligible activities shown in the table below in Section A.2;

- denominator expressed in the same way as for the index of capital expenditures related to environmentally sustainable economic activities described above.

KEY PERFORMANCE INDICATORS FOR OPERATING EXPENSES

The reported operating expenses[3] associated with environmentally sustainable activities relate to maintenance/repairs of cogeneration systems based on methane fuel captured from mines (a technology aimed at significantly reducing greenhouse gas emissions in the economy), maintenance/repairs of zero-emission suspended railways used to transport equipment supporting the company's production processes and maintenance/repair of the heat distribution network at one of the production facilities, which distributes heat produced more than half from waste heat.

The reported operating expenses associated with eligible activities pertain, in particular, to work related to the maintenance and repair of heat and power cogeneration systems from gaseous fossil fuels (from coke oven gas), work on the maintenance and repair of heat and cool air distribution systems at production facilities, renovation of buildings managed by the Group (including work related to the installation or repair of equipment to increase the energy efficiency of the building), work related to the repair and maintenance of railroad infrastructure and rolling stock, and work related to the maintenance and upkeep of systems for the intake, treatment and supply of drinking water and wastewater treatment systems.

The ratio of the percentage of the Group’s operating expenses for products or services related to environmentally sustainable business activities (aligned with the EU Taxonomy) was calculated as the quotient of the following values:

- numerator expressed as operating expenses related to the environmentally sustainable activities shown in the table below in Section A.1;

- the denominator expressed as the Group’s total non-capitalized operating expenses related to repairs, maintenance, servicing and repairs (of buildings, machinery and other property, plant and equipment) and the materials used for this work, as well as the attestation, testing and legalization of machinery / equipment (to the extent necessary to ensure the continuous and efficient operation of property, plant and equipment).

The ratio of the percentage of the Group’s operating expenses for products or services related to business activities that are eligible for the EU Taxonomy (not aligned with the EU Taxonomy) was calculated as the quotient of the following values:

- numerator expressed as operating expenses related to EU Taxonomy-eligible activities shown in the table below in Section A.2;

- denominator expressed in the same way as for the index of operating expenses related to environmentally sustainable economic activities described above.

[3]The Group has identified cost items that qualify as operating expenses as defined in Annex I of Commission Delegated Regulation (EU) 2021/2178. The Group's approach to identifying cost items that are eligible for key performance indicators for operating expenses is the same as that described for the parent company on page 160.

KEY PERFORMANCE INDICATORS FOR NUCLEAR AND FOSSIL GAS RELATED ACTIVITIES

In the table below, the Group discloses information on the extent to which the Group’s nuclear and fossil gas related activities.

| Row | Nuclear energy related activities | |

|---|---|---|

| 1 | The undertaking carries out, funds or has exposures to research, development, demonstration and deployment of innovative electricity generation facilities that produce energy from nuclear processes with minimal waste from the fuel cycle. | NO |

| 2 | The undertaking carries out, funds or has exposures to construction and safe operation of new nuclear installations to produce electricity or process heat, including for the purposes of district heating or industrial processes such as hydrogen production, as well as their safety upgrades, using best available technologies. | NO |

| 3 | The undertaking carries out, funds or has exposures to safe operation of existing nuclear installations that produce electricity or process heat, including for the purposes of district heating or industrial processes such as hydrogen production from nuclear energy, as well as their safety upgrades. | NO |

| Row | Fossil gas related activities | |

| 4 | The undertaking carries out, funds or has exposures to construction or operation of electricity generation facilities that produce electricity using fossil gaseous fuels. | NO |

| 5 | The undertaking carries out, funds or has exposures to construction, refurbishment, and operation of combined heat/cool and power generation facilities using fossil gaseous fuels. | YES |

| 6 | The undertaking carries out, funds or has exposures to construction, refurbishment and operation of heat generation facilities that produce heat/cool using fossil gaseous fuels. | YES |

The Group does not disclose separate tables according to Templates 2 and 3 of Annex XII of the Commission Delegated Regulation (EU) 2021/2178, because:

- nuclear energy related activities do not apply to the Group - this means that the values presented in the aforementioned tables according to Templates 2 and 3 can only take values equal to zero - in this context, the presentation of separate tables would, in the Group’s opinion, negatively affect the transparency of this document;

- the values resulting from the Group's fossil gas related activities are disclosed (for activities “4.30 High-efficiency cogeneration of heat/cooling energy and electricity from gaseous fossil fuels” and “4.31 Production of heat/cooling energy from gaseous fossil fuels in an efficient heating and cooling system”) in the table “Percentage of the Group's capital expenditures for products or services related to business activities aligned with the EU Taxonomy and business activities eligible for the EU Taxonomy” and in the table “Percentage of the Group's operating expenses for products or services related to business activities aligned with the EU Taxonomy and business activities eligible for the EU Taxonomy”; the disclosures in the indicated tables fully address the scope of the disclosures required by Templates 2 and 3 of Annex XII of Commission Delegated Regulation (EU) 2021/2178 - in this context, the presentation of separate tables containing the same information for a second time would, in the Group's opinion, negatively affect the transparency of this document.