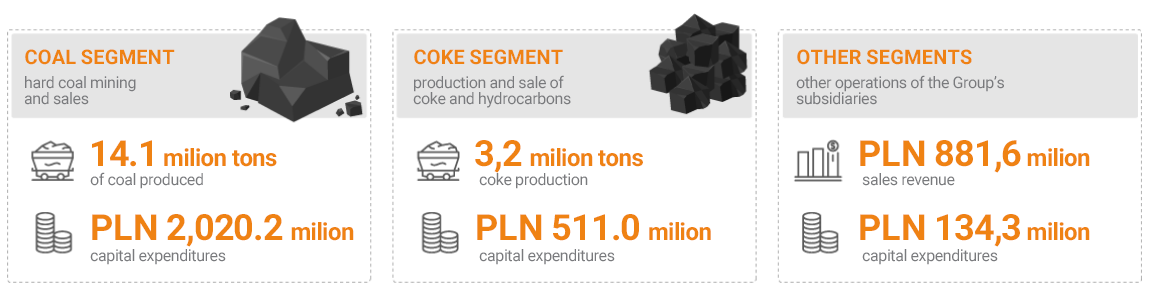

Results and perspectives by segments

Segments

The Group is an active participant of the metallurgical coal – coke – steel supply chain. It focuses on extraction and processing of coal as well as sale of the JSW Group’s products, such as coal, coke and other hydrocarbons. It is therefore the key element of the recommended Group operation model.

The Group is organized and managed in segments by type of products offered and type of production activity. The Management Board of the JSW has identified operating segments based on the financial reporting of the companies comprising the Group. The Group's operations are conducted by the following operating segments:

Financial results of the segments

| ITEM | COAL SEGMENT | COKE SEGMENT | OTHER SEGMENTS | |||

|---|---|---|---|---|---|---|

| 2022 | 2021 | 2022 | 2021 |

2022 | 2021 | |

| Sales revenues from external customers* | 11 406,9 | 5 079,8 | 7 945,8 | 5 064,7 | 881,6 | 487,7 |

| Operating profit/(loss) | 8 674,5 | 411,9 | 584,3 | 1 234,4 | 11,9 | 86,7 |

| Depreciation and amortization | 1 045,5 | 1 039,4 | 102,6 | 113,7 | 142,3 | 145,6 |

| EBITDA** | 9 720,0 | 1 451,3 | 686,9 | 1 348,1 | 154,2 | 232,3 |

* Sales revenues without taking into account an adjustment of revenues due to execution of a hedging transaction related to the coke segment, totaling PLN (35.8) million in 2022 and PLN (3.1) million in 2021.

** EBITDA = operating profit/(loss)/ plus depreciation. According to the ESMA Guidelines on Alternative Performance Measures (APM), EBITDA is an Alternative Performance Measure. EBITDA, as a measure not defined by IFRS, is not a standardized measure and the manner of its calculation may differ between companies. EBITDA used by the Group may not be comparable to similar ratios presented by other companies. This ratio should be treated as supplementary information extending the presentation of the results and other data of the Group.

SEGMENT-SPECIFIC INFORMATION FOR REPORTING PURPOSE

The Group presents information on operating segments in accordance with IFRS 8 "Operating Segments". The Group is organized and managed in segments by type of products offered and type of production activity.

| Coal | Coke | Other segments * | Consolidation adjustments ** | Total | |

|---|---|---|---|---|---|

| FOR THE PERIOD ENDED 31 DECEMBER 2022 | |||||

| Total segment sales revenues | 17 949,9 | 7 910,0 | 2 361,6 | (8 023,0) | 20 198,5 |

| - Revenues on inter-segment sales | 6 543,0 | - | 1 480,0 | (8 023,0) | - |

| - Sales revenues from external customers | 11 406,9 | 7 945,8 | 881,6 | - | 20 234,3 |

| - Adjustment of sales revenues on account of realization of hedging transactions | - | (35,8) | - | - | (35,8) |

| Segment’s gross profit/(loss) on sales | 9 659,3 | 843,2 | 178,1 | (34,6) | 10 646,0 |

| Operating profit of the segment | 8 674,5 | 584,3 | 11,9 | 65,7 | 9 336,4 |

| Depreciation and amortization | (1 045,5) | (102,6) | (142,3) | 62,7 | (1 227,7) |

| OTHER SIGNIFICANT NON-CASH ITEMS: | |||||

| - Recognition of impairment losses for non-financial non-current assets | (267,9) | (30,5) | (66,4) | - | (364,8) |

| - Reversal of impairment losses for non-financial non-current assets | 7,5 | - | 7,5 | - | 15,0 |

| TOTAL SEGMENT ASSETS, INCLUDING: | 13 855,4 | 4 366,9 | 2 379,6 | (1 779,8) | 18 822,1 |

| Increases in non-current assets (other than financial instruments and deferred income tax assets) | 2 117,8 | 510,9 | 134,9 | (16,9) | 2 746,7 |

* No operations classified in “Other segments” meet the aggregation criteria and quantitative thresholds defined by IFRS 8 Operating Segments, to be accounted for as a separate operating segment.

** The "Consolidation adjustments" column eliminates the effects of intra-segment transactions within the Group.

| Coal | Coke | Other segments * | Consolidation adjustments ** | Total | |

|---|---|---|---|---|---|

| FOR THE PERIOD ENDED 31 DECEMBER 2021 | |||||

| Total segment sales revenues | 8 495,1 | 5 061,6 | 1 771,1 | (4 698,7) | 10 629,1 |

| - Revenues on inter-segment sales | 3 415,3 | - | 1 283,4 | (4 698,7) | - |

| - Sales revenues from external customers | 5 079,8 | 5 064,7 | 487,7 | - | 10 632,2 |

| - Adjustment of sales revenues on account of realization of hedging transactions | - | (3,1) | - | - | (3,1) |

| Segment’s gross profit/(loss) on sales | 1 409,1 | 1 571,0 | 160,2 | (545,1) | 2 595,2 |

| Segment's operating profit/(loss) | 411,9 | 1 234,4 | 86,7 | (470,6) | 1 262,4 |

| Depreciation and amortization | (1 039,4) | (113,7) | (145,6) | 78,6 | (1 220,1) |

| OTHER SIGNIFICANT NON-CASH ITEMS: | |||||

| - Recognition of impairment losses for non-financial non-current assets following impairment tests | (348,4) | (420,6) | - | 0,4 | (768,6) |

| - Reversal of impairment losses for non-financial non-current assets following impairment tests | 75,0 | 260,5 | - | - | 335,5 |

| TOTAL SEGMENT ASSETS, INCLUDING: | 9 559,3 | 4 349,0 | 2 168,8 | (2 241,0) | 13 836,1 |

| Increases in non-current assets (other than financial instruments and deferred income tax assets) | 1 653,0 | 102,8 | 145,0 | (34,4) | 1 866,4 |

* No operations classified in “Other segments” meet the aggregation criteria and quantitative thresholds defined by IFRS 8 Operating Segments, to be accounted for as a separate operating segment.

** The "Consolidation adjustments" column eliminates the effects of intra-segment transactions within the Group.

The reconciliation of segment assets with the Group's total assets is presented below:

| 2022 | 2021 | |

|---|---|---|

| OPERATING PROFIT | 9 336,4 | 1 262,4 |

| Financial income | 194,3 | 8,2 |

| Financial costs | (141,4) | (104,0) |

| Share in profits of associated entities | 0,1 | 0,1 |

| PROFIT BEFORE TAX | 9 389,4 | 1 166,7 |

SEGMENT ASSETS

The amounts of total assets are measured in a manner consistent with the method applied in the consolidated statement of financial position. These assets are allocated by segment's business and by physical location of the asset component.

Group assets are located in Poland.

The reconciliation of segment assets with the Group's total assets is presented below:

| 31 December 2022 | 31 December 2021 | |

|---|---|---|

| SEGMENT ASSETS | 18 822,1 | 13 836,1 |

| Investments in associates | 1,2 | 1,2 |

| Deferred tax assets | 495,5 | 849,9 |

| Investments in the FIZ asset portfolio | 7 131,2 | 767,5 |

| Other non-current assets | 436,3 | 390,6 |

| Income tax overpaid | 29,9 | 69,2 |

| Financial derivatives | 43,8 | 10,7 |

| Other current financial assets | 3,1 | 9,6 |

| Assets held for sale | - | 27,0 |

| TOTAL ASSETS ACCORDING TO THE CONSOLIDATED STATEMENT OF FINANCIAL POSITION | 26 936,1 | 15 961,8 |

INFORMATION RELATING TO GEOGRAPHICAL AREAS

The geographic breakdown of revenues on sales is depicted by the buyer's country of origin:

| Nota | 2022 | 2021 | |

|---|---|---|---|

| Sales in Poland, of which: | |||

| Coal | 7 132,9 | 3 389,3 | |

| Coke | 1 091,8 | 792,3 | |

| Other segments | 864,6 | 472,6 | |

| TOTAL SALES IN POLAND | 9 089,3 | 4 654,2 | |

| Sales abroad, including: | |||

| EU member states, of which: | 10 589,6 | 5 583,6 | |

| Coal | 4 274,0 | 1 690,5 | |

| Coke | 6 298,7 | 3 878,5 | |

| Other segments | 16,9 | 14,6 | |

| Non-EU Europe, of which: | 555,4 | 350,8 | |

| Coke | 555,3 | 350,7 | |

| Other segments | 0,1 | 0,1 | |

| Other states, of which: | - | 43,6 | |

| Coke | - | 43,2 | |

| Other segments | - | 0,4 | |

| TOTAL SALES ABROAD, including: | 11 145,0 | 5 978,0 | |

| Coal | 4 274,0 | 1 690,5 | |

| Coke | 6 854,0 | 4 272,4 | |

| Other segments | 17,0 | 15,1 | |

| Adjustment of sales revenues on account of realization of hedging transactions | (35,8) | (3,1) | |

| TOTAL SALES REVENUES | 4.1 | 20 198,5 |

10 629,1 |

Revenues on sales – geographic breakdown by the country of origin of the counterparty making the purchase:

| 2022 | 2021 | |

|---|---|---|

| Poland | 9 089,3 | 4 654,2 |

| Austria | 3 330,0 | 1 579,0 |

| Czech Republic | 2 721,1 | 1 187,4 |

| Germany | 2 496,6 | 1 536,0 |

| Romania | 582,2 | 485,8 |

| Belgium | 449,9 | 498,7 |

| Slovakia | 436,4 | 161,4 |

| Norway | 279,3 | 144,0 |

| Switzerland | 276,1 | 206,7 |

| Spain | 241,2 | 100,7 |

| Italy | 222,4 | - |

| Luxembourg | 58,4 | 1,4 |

| Holland | 26,8 | 9,2 |

| France | 24,5 | 23,6 |

| Singapore | - | 43,6 |

| Ireland | - | 0,3 |

| Other countries | 0,1 | 0,2 |

| Adjustment of sales revenues on account of realization of hedging transactions | (35,8) | (3,1) |

| TOTAL SALES REVENUES | 20 198,5 | 10 629,1 |

INFORMATION ON KEY CUSTOMERS

For the period from 1 January to 31 December 2022, revenues on sales to two clients, to each one of them individually, exceeded 10% of the Group's revenues on sales. Revenues on sales to one of them were PLN 4,869.3 million and to the other PLN 3,245.2 million. Revenues on sales to those clients were included in the Coal segment and in the Coke segment.

For the period from 1 January to 31 December 2021, revenues on sales to two clients, to each one of them individually, exceeded 10% of the Group's revenues on sales. Revenues on sales to one of them were PLN 2,387.1 million and to the other PLN 1,534.9 million. Revenues on sales to those clients were included in the Coal segment and in the Coke segment.

Coal segment

The Group’s mining activity is performed by five hard coal mines. All these mines do their business within the geographical boundaries of their concession areas for which the concession expiry date, the surface area and the depth are specified. The Group’s mines exploit hard coal deposits in the mining areas defined in the concessions, located in townships of Jastrzębie-Zdrój and Żory, rural townships (gmina) of Świerklany, Mszana, Pawłowice, Gierałtowice, Ornontowice, Pilchowice, as well as the towns of Mikołów, Czerwionka-Leszczyny, Gliwice, Knurów, and Pszczyna.

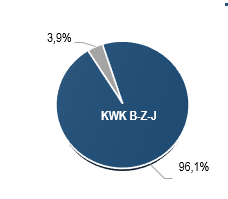

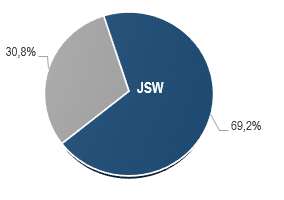

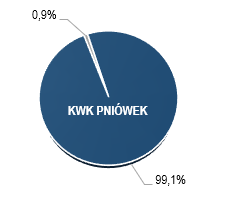

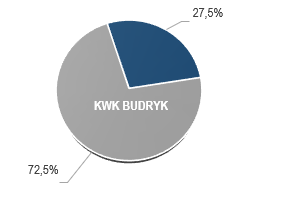

Structure of coal production and sales

The structure of the Group’s coal production is the result of the current geological conditions in mines and rapidly changing market needs, taking into account supply and demand in the domestic and foreign markets. The share of coking coal and steam coal in total net production in 2022 was 78.1% and 21.9%, respectively.

In 2022, a total of 14.4 million tons of coal was sold, of which, on account of the intended use of coal, the share of coking coal sales in the Group’s total deliveries was 75.3% with the remaining 24.7% was steam coal.

The coal production volume achieved by the Group’s mines in 2022 was 14.1 million tons, i.e. 0.3 million tons more than in 2021. In the period under analysis, the Group’s mines produced and sold mainly hard coking coals, and lesser volumes of coking gas coal. KWK Borynia-Zofiówka and KWK Pniówek mines produced good quality hard coking coal, with a very good average level of CRI 24–30% and CSR 60–64, mainly for the production of blast-furnace coke. KWK Budryk and KWK Knurów-Szczygłowice, Szczygłowice Section also produce hard coking coal with good quality parameters, i.e. low volatile matter content below 31% and a good average CRI of 30–35% and CSR of 47–50%. The quality of coal originating from KWK Budryk relative to 2021 improved significantly, and the long-term production plans supported by the deposit exploration level indicate that this situation should maintain in the long-term perspective. In turn, the Knurów Section produced coking gas coal of stable quality parameters with a CRI of 42% and CSR of 39%.

KWK Budryk and KWK Knurów-Szczygłowice also produce steam coal. In addition, KWK Knurów-Szczygłowice launched production of granulates from coal slurry with the use of two installations in H2 2022. This made it possible to sell slurry granulates both in the form of individual products and to place them in power mixes. KWK Budryk, in turn, launched the production and sale of coal to individual customers, enabling local customers to obtain fuel coal.

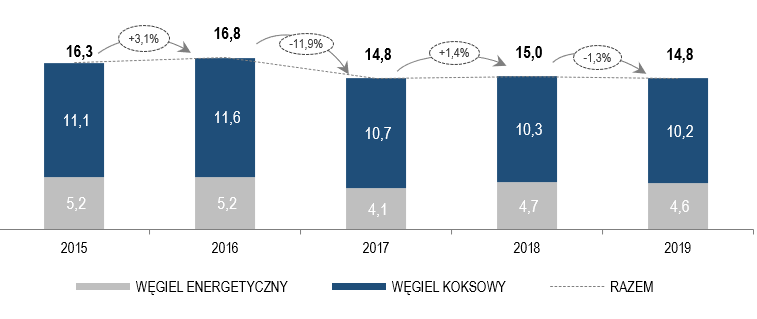

Coal production in the Group in 2018-2022 (million tons)

The total sales of coal produced by the Group’s mines, comprising intra-group and external deliveries, were realized at 14.4 million tons, i.e. 0.5 million tons less than in 2021, including coking coal sales drop of 0.8 million tons and steam coal sales growth of 0.3 million tons.

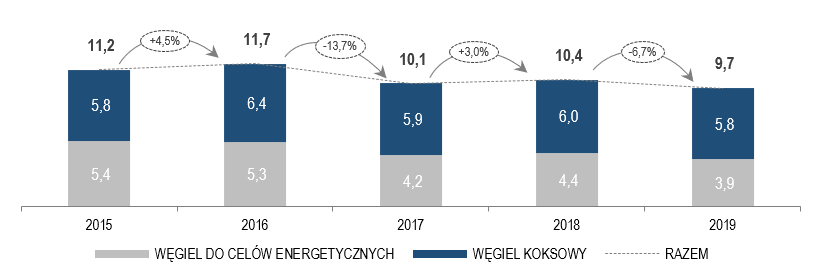

Coal sales to external offtakers in 2018-2022 (million tons)

In external sales, the share of coal supplies to domestic customers accounted for 67.8% (volume) and 56.8% (revenue), while sales to the international market represented 32.2% and 43.2%, respectively. For comparison, in 2021 these percentages were as follows: domestic buyers 68.4% (volume) and 60.5% (revenue); foreign buyers 31.6% (volume) and 39.5% (revenue).

Average quality parameters of coal produced by the Group in 2022

| CATEGORY | KWK BORYNIA - ZOFIÓWKA | KWK PNIÓWEK | KWK KNURÓW-SZCZYGŁOWICE | KWK BUDRYK | |||||

|---|---|---|---|---|---|---|---|---|---|

| Section Borynia |

Section Zofiówka |

Section Knurów |

Section Szczygłowice |

||||||

| COKING COAL | |||||||||

| Ash content Ad (%) | 6,6 | 7,4 | 6,7 | 7,9 | 8,4 | 7,8 | |||

| Moisture content Wtr (%) | 11,5 | 10,4 | 9,2 | 6,6 | 8,0 | 8,3 | |||

| Sulfur content Std (%) | 0,55 | 0,53 | 0,63 | 0,65 | 0,61 | 0,53 | |||

| Volatile matter content Vdaf (%) | 23,6 | 23,0 | 26,3 | 32,0 | 30,6 | 30,4 | |||

| Sinterability (RI) | 78 | 76 | 80 | 72 | 78 | 81 | |||

| Coke strength after reaction CSR (%) | 60 | 63 | 64 | 39 | 47 | 50 | |||

| CO2 coke reactivity index (CRI %) | 30 | 29 | 24 | 42 | 33 | 35 | |||

| STEAM COAL | |||||||||

| Ash content Ar (%) | - | 21,81 | 25,2 | 22,7 | 25,9 | 27,4 | |||

| Moisture content Wtr (%) | - | 9,8 | 6,0 | 9,2 | 10,2 | 9,2 | |||

| Sulfur content Str (%) | - | 0,45 | 0,73 | 0,7 | 0,55 | 0,53 | |||

| Calorific value (Qir MJ/kg) | - | 23,1 | 23,0 | 22,3 | 21,0 | 20,9 | |||

Achieved production and sales of coal, including intra-Group sales

| ITEM | 2022 | 2021 | 2020 | 2019 | 2018 | GROWTH RATE 2021=100 |

|---|---|---|---|---|---|---|

| Production (million tons) | 14,1 | 13,8 | 14,4 | 14,8 | 15,0 | 102,2 |

| - Coking coal | 11,0 | 11,0 | 11,1 | 10,2 | 10,3 | 100,0 |

| - Steam coal | 3,1 | 2,8 | 3,3 | 4,6 | 4,7 | 110,7 |

| Total volume of JSW’s sales (million tons)(1) | 14,4 | 14,9 | 14,0 | 13,8 | 14,8 | 96,6 |

| - Coking coal | 10,8 | 11,6 | 10,8 | 9,9 | 10,4 | 93,1 |

| - Steam coal | 3,6 | 3,3 | 3,2 | 3,9 | 4,4 | 109,1 |

| Intra-group sales (million tons)(1) | 4,4 | 4,7 | 4,5 | 4,1 | 4,4 | 93,6 |

| - Coking coal | 4,4 | 4,7 | 4,5 | 4,1 | 4,4 | 93,6 |

| - Steam coal | - | - | - | - (2) | - (2) | - |

| External sales volume (million tons)(1) | 10,0 | 10,2 | 9,5 | 9,7 | 10,4 | 98,0 |

| - Coking coal | 6,4 | 6,9 | 6,3 | 5,8 | 6,0 | 92,8 |

| - Steam coal | 3,6 | 3,3 | 3,2 | 3,9 | 4,4 | 109,1 |

| Revenues from coal sales (PLN million)(3) | 17 949,9 | 8 495,1 | 5 577,2 | 7 688,0 | 8 296,6 | 211,3 |

| Revenues from inter-segment coal sales (PLN million) | 6 543,0 | 3 415,3 | 2 022,6 | 2 916,9 | 3 212,0 | 191,6 |

| Revenues from coal sales to external customers (PLN million) | 11 406,9 | 5 079,8 | 3 554,6 | 4 771,1 | 5 084,6 | 224,6 |

(1) sales volume of coal produced by the Group,

(2) because of the low volume, there is no impact on the figures expressed in million tons,

(3) this value takes into account the Group’s additional revenues in 2022, 2021, 2020, 2019 and 2018, respectively: PLN 342.8 million, PLN 274.5 million, PLN 85.3 million, PLN 315.9 million and PLN 225.2 million from the sale of coal produced outside the Group.

Coke segment

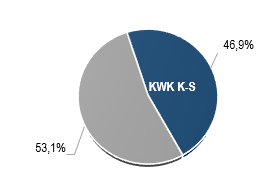

Coke production and sales

The production of coke by the Group in 2022 decreased by 0.5 million tons, i.e. by 13.5%, while the sales were lower by 0.4 million tons, i.e. by 11.1% as compared to 2021. Sales revenues in the Coke segment including coke and hydrocarbons (without taking into account the adjustment of sales revenues on account of execution of hedging transactions) in the analyzed period were PLN 7,945.8 million and were PLN 2,881.1 million (56.9%) higher than in 2021. The increase in the sales revenues from coke and hydrocarbons was attributable to the higher product sales prices obtained.

Poland is one of the main suppliers of coke in the EU market. Since the coke market is globalized, coke from Poland competes with supplies of this commodity not only from Europe but also from all other parts of the world, including China, Russia and Colombia.

Prices of blast furnace coke increased following the outbreak of war in Ukraine, but the appreciation was less pronounced than for Australian coking coal. The prices of Chinese CSR 64/62 coke increased from below 500 USD/t in February 2022 to 680 USD/t in the second half of March 2022. On the European market, in March 2022, CSR 64/62 blast furnace coke prices increased by nearly 100 USD/t (compared to February 2022) to 700 USD/t. As in the case of coal, there was a gradual decline in coke prices in individual months.

The average price of Chinese coke (64/62 CSR) FOB China in Q1 2022 was 563.8 USD/t, in Q2 2022 it increased by 5.2% to 593.2 USD/t relative to Q1 2022, in Q3 2022 there was a decrease in the prices by 28.5% to 424.0 USD/t compared to Q2 2022, and Q4 saw a further decrease by 6.0% to 398.4 USD/t compared to Q3 2022.The Chinese coke prices in 2022 reached 493.5 USD/t on average, which means an increase by 2.7% relative to 480.6 USD/t in 2021.

In the European market, blast-furnace coke (64/62 CSR) CFR was priced at 636.7 USD/t in Q1 2022, with a 4.2% price increase to 663.3 USD/t in Q2 2022. In Q3 2022, the average coke price on the European market was 460.0 USD/t, down 30.7% from Q2 2022, and in Q4 2022 it fell 10.9% to 410.0 USD/t compared to Q3 2022. The prices of blast-furnace coke in the European market stood on average in 2022 at USD 542.5 per ton on a CFR Northern Europe Port basis, representing an increase of 17.9% compared to USD 460.0 per ton on CFR Northern Europe Port basis in 2021.

The negative impact of the war in Ukraine was felt increasingly more strongly in the European market in H2 2022. The consequence of Europe's deep energy commodity deficit, following the introduction of sanctions on Russia, has been an unprecedented increase in electricity and gas prices and concerns about their availability during the winter. This influenced the steel market in the European Union. Faced with the threat of an energy crisis, rising costs, and uncertainty in demand for steel products, many steel companies have introduced production restrictions and temporary shutdowns of blast furnaces. Following a relatively stable steel production level in the EU in H1 2022, it plunged by 14.8% in H2 2022 relative to H1 2022.

Coke production at integrated coking plants has been curtailed to a lesser extent than would result from blast furnace shutdowns. Coke gas production has become a priority. This has led to a periodic oversupply of coke on the market and a drop in prices. The increase in imports of raw materials, mainly steam coal from overseas, has led to greater strain on domestic seaports and rail routes, making the logistics of delivery to customers, in particular overseas shipments, more difficult.

The Coke Market Report estimates that the global coke trade volume plummeted to 5.4-5.5 million tons in Q4 2022 from approx. 7.0 million tons recorded in both Q2 and Q3 2022. The coke trade volume in Q4 2022 means the lowest quarterly result recorded since 2020. A clear drop in imported coke demand was visible in all world regions but the coke trade in Europe was exceptionally low.

Realized coke production and sales together with revenues from sale of coke and hydrocarbons

| ITEM | 2022 | 2021 | 2020 | 2019 | 2018 | GROWTH RATE 2021=100 |

|---|---|---|---|---|---|---|

| Production (million tons)(1) | 3,2 | 3,7 | 3,3 | 3,2 | 3,6 | 86,5 |

| Coke sales volume (million tons) | 3,2 | 3,6 | 3,6 | 2,9 | 3,5 | 88,9 |

| Sales revenues (PLN million)(2) | 7 945,8 | 5 064,7 | 3 047,0 | 3 545,0 | 4 451,5 | 156,9 |

| Adjustment of sales revenues on account of execution of hedging transactions (PLN million)(3) | (35,8) | (3,1) | (53,4) | - | - | 1 154,8 |

(1) coke production from the Group's coking plants,

(2) revenues from the sales of coke and hydrocarbons,

(3) the item results from a change in the presentation rules applied by the Group as of 1 January 2021 pertaining to reclassification of the effective result in connection with execution of the hedged position from other comprehensive income to profit or loss.

Other segments

The Group is also engaged in limited auxiliary activities that are immaterial from the standpoint of the Group’s operations and financial standing. In 2022 sales revenues in other segments were PLN 881.6 million, or 4.4% of the Group’s sales revenues, and were up 80.8% above the amounts generated in 2021.

The Group's other activity includes various types of support activities, including in the areas of innovations, IT, logistics, repair and maintenance services, laboratory and insurance services.

The Group includes:

Centralne Laboratorium Pomiarowo-Badawcze Sp. z o.o. – Technical research services, chemical and physiochemical analyses of minerals, and solid, liquid and gaseous materials and products.

JSW IT SYSTEMS Sp. z o.o. Computer hardware consulting, programming and data processing services.

JSW Innowacje S.A. - The Group’s research and development activity, feasibility studies and oversight over execution of projects and implementations.

Jastrzębskie Zakłady Remontowe Sp. z o.o. - Service activity pertaining to renovation, maintenance and upkeep of machinery and equipment Production of machinery for mining, quarrying and construction as well as generation, transmission, distribution of, and trading in, electricity.

![]()

Przedsiębiorstwo Budowy Szybów S.A. - Specialized mining services: designing and execution of vertical and horizontal mine workings and tunnels, construction services, architectural and engineering services, lease of machinery and equipment as well as assembly, repairs and upkeep of machinery for the mining, quarrying and construction industries.

Jastrzębska Spółka Kolejowa Sp. z o.o. - Provision of railway lines, maintenance of railway infrastructure structures and equipment, construction and repair of railway tracks and facilities.

JSW Logistics Sp. z o.o. - Rendering services concerning rail siding services, coal and coke transportation, organizing the carriage of cargo and technical maintenance and repair of rail cars.

Przedsiębiorstwo Gospodarki Wodnej i Rekultywacji S.A. - Provision of water and sewage-related services and discharge of salt water, supply of industrial water, reclamation activity and production of salt.

Jastrzębska Spółka Ubezpieczeniowa Sp. z o.o. - Insurance intermediation and insurance administration pertaining to insurance claims handling, tourist and hotel activity.

JSW Szkolenie i Górnictwo Sp. .z o.o. - Mining support activity and operating the shower rooms in JSW’s mines.

Sales prices

Coal market

The Group sets coal prices based on published price indexes, taking into account differences in quality between the Group’s coal grades compared to index coal grades and the bonus it derives from its geographical location.

Coal sales prices (PLN/ton)

| ITEM | 2022 | 2021 | 2020 | 2019 | 2018 | GROWTH RATE 2021=100 |

|---|---|---|---|---|---|---|

| Coal sales prices (PLN/ton) | ||||||

| Coking coal | 1 510,49 | 619,68 | 436,76 | 634,84 | 658,67 | 243,8 |

| Steam coal | 443,62 | 224,85 | 249,36 | 275,79 | 249,40 | 197,3 |

| TOTAL(1) | 1 130,26 | 491,59 | 373,78 | 490,99 | 486,32 | 229,9 |

(1) the prices pertain to external deliveries of coal produced in the Group and include transportation costs, which in JSW were on average: PLN/t 8.10 in 2022, PLN/t 6.15 in 2021, PLN/t 6.32 in 2020, PLN/t 7.28 in 2019 and PLN/t 6.23 in 2018.

Coke market

Average coke sales prices

| ITEM | 2022 | 2021 | 2020 | 2019 | 2018 | GROWTH RATE 2021=100 |

|---|---|---|---|---|---|---|

| Coke (PLN/t)(1) | 2 179,89 | 1 266,47 | 777,75 | 1 112,88 | 1 139,90 | 172,1 |

(1) the prices pertain to external deliveries of coke and include transportation costs, which were on average: PLN/t 47.86 in 2022, PLN/t 35.09 in 2021, PLN/t 37.32 in 2020, PLN/t 40.09 in 2019 and PLN/t 44.53 in 2018.

For more information see here

Investments

Of the total expenditures incurred in 2022 of PLN 2,665.5 million, PLN 2,430.8 million was spent on property, plant and equipment, PLN 207.5 million on right-of-use assets, and PLN 27.2 million on intangible assets.

| ITEM | 2022 | 2021 | 2020 | 2019* | 2018 | GROWTH RATE 2021=100 |

|---|---|---|---|---|---|---|

| COAL SEGMENT | ||||||

| Expenditures for property, plant and equipment (without expensable mining pits), intangible assets and investment property | 1 027,3 | 619,0 | 753,1 | 1 235,7 | 864,4 | 166,0 |

| Expenditures on expensable mining pits | 817,5 | 651,1 | 604,1 | 531,8 | 541,4 | 125,6 |

| Expenditures re. the right-of-use assets | 175,4 | 87,6 | 195,1 | 283,2 | nd | 200,2 |

| TOTAL | 2 020,2 | 1 357,7 | 1 552,3 | 2 050,7 | 1 405,8 | 148,8 |

| COKE SEGMENT | ||||||

| Expenditures on property, plant and equipment and intangible assets | 504,9 | 226,7 | 127,2 | 115,0 | 50,1 | 222,7 |

| Expenditures re. the right-of-use assets | 6,1 | 0,6 | 0,4 | - | nd | 1 016,7 |

| TOTAL | 511,0 | 227,3 | 127,6 | 115,0 | 50,1 | 224,8 |

| OTHER SEGMENTS | ||||||

| Expenditures on property, plant and equipment and intangible assets | 108,3 | 100,3 | 163,8 | 150,5 | 212,7 | 108,0 |

| Expenditures re. the right-of-use assets | 26,0 | 21,9 | 52,3 | 83,5 | nd | 118,7 |

| TOTAL | 134,3 | 122,2 | 216,1 | 234,0 | 212,7 | 109,9 |

| TOTAL SEGMENTS | ||||||

| Expenditures for property, plant and equipment (without expensable mining pits), intangible assets and investment property | 1 640,5 | 946,0 | 1 044,1 | 1 501,2 | 1 127,2 | 173,4 |

| Expenditures on expensable mining pits | 817,5 | 651,1 | 604,1 | 531,8 | 541,4 | 125,6 |

| Expenditures re. the right-of-use assets | 207,5 | 110,1 | 247,8 | 366,7 | nd | 188,5 |

| TOTAL ** | 2 665,5 | 1 707,2 | 1 896,0 | 2 399,7 | 1 668,6 | 156,1 |

| TOTAL (AFTER CONSOLIDATION ADJUSTMENTS) | 2 641,0 | 1 668,4 | 1 832,0 | 2 329,0 | 1 639,1 | 158,3 |

* From 1 January 2019, in connection with entry into force of the new accounting standard, IFRS 16 “Leases”, the Group presents expenditures under leases in a separate line item (Expenditures re. the right-of-use asset).

** Value of capital expenditures before consolidation adjustments (in 2022: PLN (-)24.5 million, in 2021: PLN (-)38.8 million, in 2020: PLN (-)64.0 million, in 2019: PLN (-)70.7 million, in 2018: PLN (-)29.5 million).

INVESTMENTS IN PROPERTY, PLANT AND EQUIPMENT IN THE PARENT COMPANY

In 2022, the Parent Company incurred capital expenditures on property, plant and equipment of PLN 2,020.2 million. They were 48.8% higher compared to the same period of 2021. Of the total capital expenditures in the period under analysis: PLN 1,843.7 million was spent on property, plant and equipment, PLN 175.4 million was spent on right-of-use assets, and PLN 1.1 million was spend on intangible assets. In 2022, capital expenditures were financed from own funds. Moreover, the Parent Company acquired external financing.

The capital expenditures incurred by the Parent Company for property, plant and equipment in 2022 were earmarked for the performance of key tasks (vertical and horizontal development of the mines) and other tasks, including upkeep of the current production capacity.

| ITEM |

CAPITAL EXPENDITURES in 2022 |

MAIN STRATEGIC INVESTMENT PROJECTS EXECUTED IN JSW |

|---|---|---|

|

CONSTRUCTION OF LEVEL 1120 IN KWK BORYNIA-ZOFIÓWKA, BORYNIA SECTION |

31,7 | Works to build level 1120 in the Borynia Section of KWK Borynia-Zofiówka mine were continued. Recoverable reserves planned to be opened from level 1120 m are estimated at 40 million tons. The deposits contain mainly type 35 (hard) coking coal. As planned, the project will be executed in two stages: Stage 1 until 2024, assuming the opening of seams 502/1 and 504/1 and the deepening of shaft II; and Stage 2 in 2022-2029, assuming the opening of areas B and C at level 1120. Exploitation of resources based on the deepened shaft II should commence in 2025. |

|

OPENING AND INDUSTRIAL UTILIZATION OF RESOURCES WITHIN THE AREA OF THE BZIE-DĘBINA 2-ZACHÓD AND BZIE-DĘBINA 1-ZACHÓD DEPOSITS IN KWK JASTRZĘBIE-BZIE (since 1 January 2023: KWK BORYNIA-ZOFIÓWKA-BZIE, BZIE SECTION) |

56,6 | The Parent Company continued the opening and utilization of new deposits started in 2005: “Bzie-Dębina 2-Zachód” and “Bzie-Dębina 1-Zachód” from level 1110 m. Recoverable reserves planned to be opened up to the depth of 1300 m are estimated at 181 million tons. The deposits contain mainly type 35 (hard) coking coal. In 2022 expenditures were continued in connection with the tunneling and equipping of underground mining pits. |

|

CONSTRUCTION OF LEVEL 1080 IN KWK BORYNIA-ZOFIÓWKA, ZOFIÓWKA SECTION |

76,3 | The parent company continued the execution of the investment project to build level 1080 in the Zofiówka Section to provide access to and exploit resources of the “Zofiówka” deposit below the 900 level. The estimated amount of recoverable reserves between levels 900-1080 is 42 million tons. In 2022 works were continued on the tunneling process of underground mining pits. |

|

MODERNIZATION OF COAL PREPARATION PLANT KWK BUDRYK |

11,6 | The execution of some investment tasks, i.e. the modernization of the coal preparation plant in 2016-2022 is handled by JZR with the participation of external financing using FRP funds. As at the end of 2022, approx. 91.3% of the total budget specified in the update of Business Plan 1 for the investment project associated with the modernization of the Coal Preparation Plant at KWK Budryk was completed. |

|

ECONOMIC UTILIZATION OF METHANE AT KWK BUDRYK AND KWK KNURÓW-SZCZYGŁOWICE |

33,4 |

The Parent Company is implementing investments involving the extension of infrastructure enabling JSW to generate electricity and heat by using methane obtained in mines in the methane drainage process. The implementation of this project will facilitate utilization of methane from the KWK Budryk Mine and the KWK Knurów-Szczygłowice Mine, as well as enable generation of energy, to be used primarily by the mines. The surplus energy will be used by JSW’s other units, and may be traded seasonally. The investment project envisages the building of gas engines and construction of the technical, i.e. gas and energy, infrastructure in KWK Budryk and KWK Knurów-Szczygłowice. In 2022, capital expenditures were incurred in the amount of PLN 29.5 million (KWK Budryk) and PLN 3.9 million (KWK Knurów-Szczygłowice). |

|

CONSTRUCTION OF LEVEL 1050 IN KWK KNURÓW-SZCZYGŁOWICE, KNURÓW SECTION |

28,4 | The Parent Company conducted works aimed at tapping into the resources available on level 850-1050 in the Knurów Section. The project is executed with a view to gaining access to deposits of high quality type 34 coking coal. The total quantum of documented recoverable coal reserves available on level 850-1050 in the Knurów Section is 75 million tons. In 2022, works were conducted in connection with the tunneling process of mining pits on level 1050. |

|

CONSTRUCTION OF LEVEL 1050 IN KWK KNURÓW-SZCZYGŁOWICE, SZCZYGŁOWICE SECTION |

9,5 | The Parent Company conducted works aimed at tapping into the resources available on level 850-1050 in the Szczygłowice Section. The project is executed with a view to gaining access to deposits of type 35 coking coal. The total quantum of documented recoverable coal reserves available on level 850-1050 in the Szczygłowice deposit is estimated to be 82 million tons. In 2022, work continued in connection with the tunneling process of underground mining pits. |

|

EXPANSION OF LEVEL 1000 AND DEEPENING OF SHAFTS III AND IV IN KWK PNIÓWEK |

88,6 | The Parent Company continued the investment project launched in 2017 in KWK Pniówek related to expansion of the mining level 1000 together with deepening shafts III and IV. The project is performed to secure effective exploitation and an access to reserves of type 35 coal in the south-west part of the “Pniówek” deposit, which are planned to be exploited after 2022. The total quantum of recoverable reserves available from the level 1000 in the KWK Pniówek mine is estimated to be approximately 56 million tons. |

| TOTAL | 336,1 |

FINANCIAL SUPPORT CONTRACT - JZR

On 30 September 2016, an agreement was concluded between the State Treasury and JZR to provide non-state aid support (“Support Agreement”), effected in three tranches, in the total amount of up to PLN 290.0 million, in the form of a cash contribution in exchange for shares in JZR’s increased share capital, subscribed for by the State Treasury. Proceeds from the support were designated for the modernization of the coal preparation plants of KWK Budryk and KWK Knurów-Szczygłowice.

OTHER CAPITAL EXPENDITURES OF THE GROUP

Capital expenditures in other Group companies in 2022 totaled PLN 645.3 million (including expenditures associated with right-of-use assets of PLN 32.1 million). The expenditures on property, plant and equipment, investment property and intangible assets amounted to PLN 613.2 million and were 87.5% higher than in the corresponding period of 2021. The capital expenditures in the coke segment and other segments in 2022 accounted for 24.2% of the Group’s total expenditures. Investments in property, plant and equipment incurred by the companies were allocated for execution of key investment projects and tasks securing their on-going operating activities.

| ITEM |

CAPITAL EXPENDITURES in 2022 |

KEY INVESTMENT PROJECTS CARRIED OUT BY OTHER GROUP COMPANIES |

|---|---|---|

|

MODERNIZATION OF COKE OVEN BATTERIES IN PRZYJAŹŃ COKING PLANT (JSW KOKS) |

246,4 |

JSW KOKS – Przyjaźń Coking Plant pursues an investment program, which included the commissioning in 2011 of the modernized oven battery no. 1, and a plan to modernize more coke oven batteries in the future. On 14 March 2018, the JSW Management Board adopted a resolution to approve Execution Documents to implement an investment project entitled “Modernization of Coke Oven Battery no. 4 at the Przyjaźń Coking Plant”. In accordance with the adopted method of implementation of the investment project (the so-called in-house approach), the whole project was divided into stages. The selection of contractors for the execution of each stage was based on applicable tender procedures. On 30 July 2021, an agreement was signed with ZARMEN Sp. z o.o. as the contractor for the main task, with the completion date falling on 19 February 2024. On 13 December 2021 an agreement to co-fund the investment was executed with the Voivodeship Fund For Environmental Protection and Water Management (“WFOŚiGW”) in Katowice. Support was provided in the form of a preferential loan of PLN 70.0 million disbursed under the regional program for co-funding investments to protect the atmosphere. In 2022, works related to the performance of the primary objective and in the field of electrical systems, dust removal from the coke side of the battery, furnace machinery, a chimney and a station for renovation of stamping units were continued as part of the project execution. Moreover, ceramic materials were purchased. Following the date ending the reporting period, i.e. on 1 March 2023, an agreement was signed with the National Fund for Environmental Protection and Water Management in Warsaw (“NFOŚiGW”) regarding financial support for the modernization of battery no. 4 in the amount of PLN 100.0 million. The support was granted in the form of a preferential loan as part of the priority program “Energy Plus”. |

|

CONSTRUCTION OF A POWER UNIT IN RADLIN COKING PLANT (JSW KOKS) |

125,3 |

This project, executed by JSW KOKS, is designed to use coke oven gas to generate electricity and heat for own needs and for sale. A part of the project is the construction of a power unit fired with own coke oven gas, of a thermal capacity of 104 MW, with an extraction condensing turbine of a capacity of 28 MWe and a heat-generating segment of a capacity of 37 MWt, which will supply electricity, steam and heat to the Radlin coking plant, as well as heat to the nearby KWK ROW, Marcel Section and the town of Radlin inhabitants. On 14 March 2018, the JSW Management Board adopted a resolution approving the Execution Documents which plan the execution of an investment project entitled “Construction of a power unit at the Radlin Coking Plant.” On 12 June 2019, an agreement was signed with RAFAKO S.A. On 31 March 2022, Annex 4 to the Contract was executed, which adopted a new Contract Schedule with a Statement of Settlement Milestones and a List of Checkpoints. In addition, Annex 4 defines the scope of necessary additional works to be performed under the “Complete Facility” with a completion date of 30 June 2023, and the scope of additional tasks with completion dates specified in the material and financial schedule attached to the Annex. At the same time, following the assignment of works and additional tasks, the Contract value was increased by PLN 150.6 million to the net value of PLN 447.4 million. On 29 November 2022, JSW KOKS and RAFAKO S.A. concluded Annex 5 to the Contract, whose primary provision is the change in the amount of the price discount (rebate) from 8% to 12% per annum. For the project execution, JSW KOKS obtained financial support in 2020 in the form of a preferential loan agreement in the amount of PLN 34.0 million from WFOŚiGW in Katowice, which was granted as part of horizontal aid for environmental protection. After the end of the reporting period, i.e. on 14 March 2023, the Parties signed Annex 6 to the Agreement, which implements bridging solutions to bring about the completion, commissioning and hand-over of the complete facility (power unit) as soon as possible, taking into account the additional intensification of work carried out on the contractor's side (RAFAKO S.A.). At the same time, on 14 March 2023, the Parties signed a Mediation Agreement in which they agreed to continue talks in mediation proceedings before the Arbitration Court at the General Counsel to the Republic of Poland. |

| TOTAL | 371,7 |

Revenue

The Group’s product mix referring to the production of hard and semi-soft coking coal grads, steam coal and coke is aligned to dynamically evolving market needs reflecting the supply and demand on local and foreign markets. The Polish market is the main market for the coal produced by the Group.

The European market is the main market for the sale of coke produced by the Group. Having regard for market conditions and market diversification, the overseas markets, especially the Indian market were significant sales markets. Coke finds customers in overseas markets with the use of the supply and demand situation in a given market and of the achievable selling prices. Due to the strong dynamics of changes in the coke market, JSW responds on an ongoing basis to the import needs of the individual markets in order to allocate coke in an optimal manner. Hydrocarbons have regular buyers on the European market. Surplus coke oven gas is sold to consumers directly by coke plants.

Revenues from sales of coal, coke and hydrocarbons, by geographical area and type of end customers

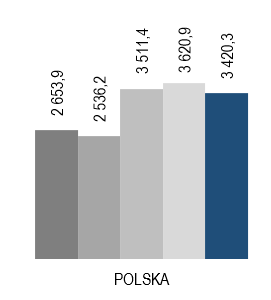

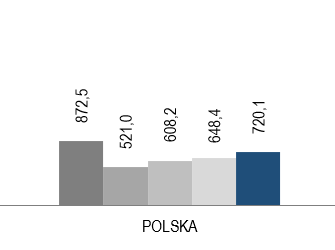

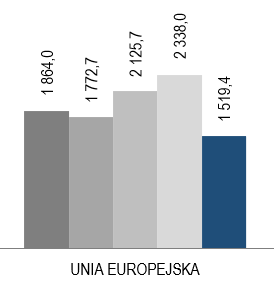

COAL SALES REVENUES (PLN million)

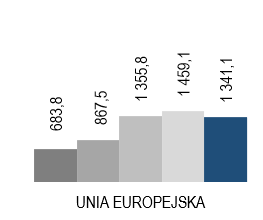

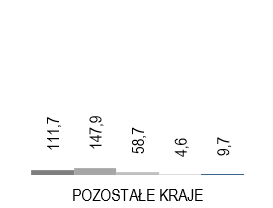

SALES REVENUES FROM COKE AND HYDROCARBONS (PLN million)

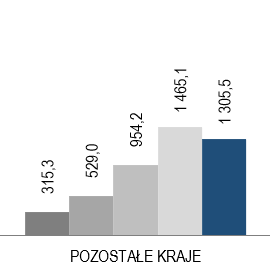

Revenue mix by country of destination as of 31 December 2022

Suppliers

The Group is obligated to comply with provisions of the Act of 11 September 2019 - Public Procurement Law. As at the final day of the reporting period, the Group was obligated to hold public proceedings in accordance with the procedures specified in the laws for procurements for goods and services valued in excess of EUR 431 thousand and for procurements for construction works valued in excess of EUR 5,382 thousand.

The most commonly applied procedure is an open tender procedure. Bids may be submitted by all potential suppliers satisfying the awarding party’s requirements specified in the tender procedure. For procurements with a value of less than the threshold for application of the Public Procurement Law, the Group selects suppliers based on sub-threshold tender procedures or requests for quotations.

GROUP’S LARGEST SUPPLIERS IN THE COAL AND COKE SEGMENT IN 2022

SUPPLIERS IN THE COAL SEGMENT:

SUPPLIERS IN THE COKE SEGMENT:

In the Management Board’s opinion, its relations with suppliers do not make the Group dependent on any one supplier in a way that could have an adverse impact on the Group’s activity.