JSW Group

About us

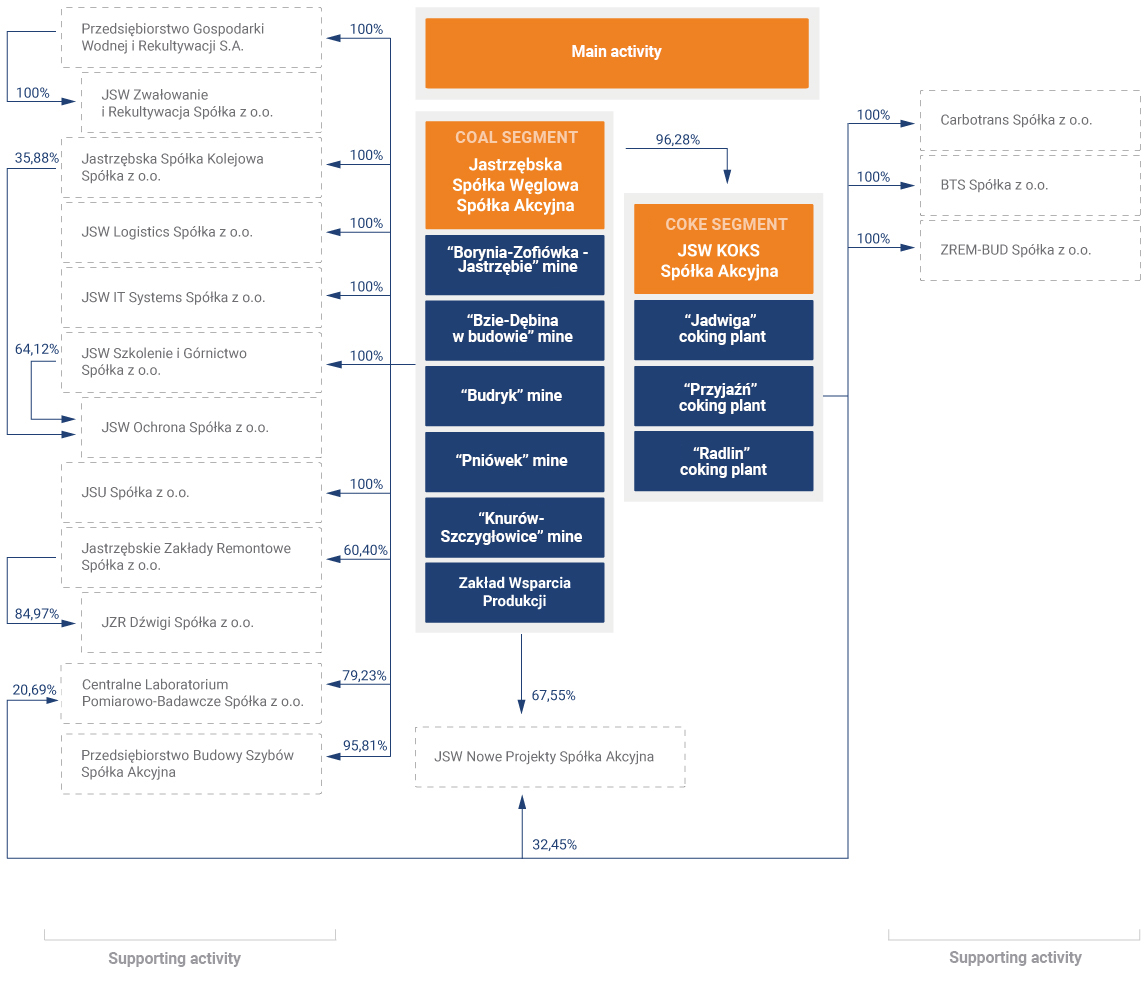

JSW Group is the largest producer of high-quality coking coal in the European Union and one of the major producers of coke for steelmaking. The Group's core business encompasses the production and sale of coking coal as well as the production and sale of coke and coal derivatives. The Group's parent is the WSE-listed Jastrzębska Spółka Węglowa S.A., based in Jastrzębie-Zdrój. JSW S.A. operates in the Upper Silesia region of Poland. Aside from coking coal and coke, JSW Group is an important producer of coal derivatives that are generated in the coking process.

(30-50 years)

coal resources

* After the closing date of the reporting period, i.e. 1 January 2023, KWK Jastrzębie-Bzie was incorporated, as the Bzie Section, into the structure of the KWK Borynia-Zofiówka coal mine. Consequently, KWK Borynia-Zofiówka became a three-section mine under the name KWK Borynia-Zofiówka-Bzie.

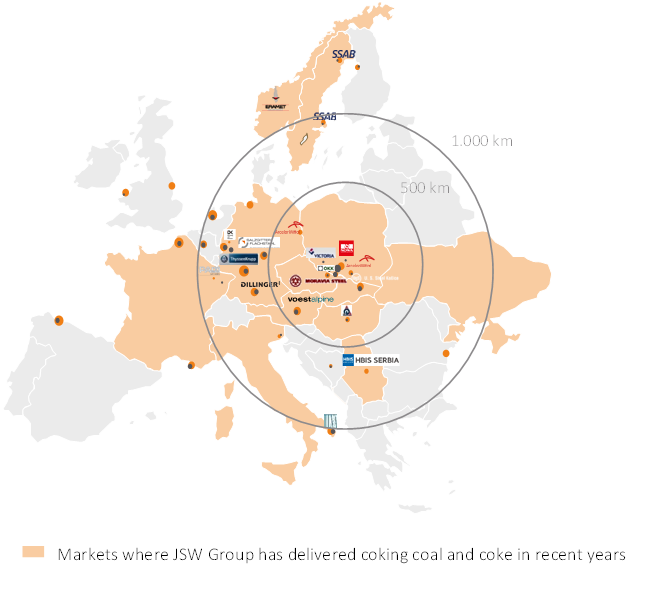

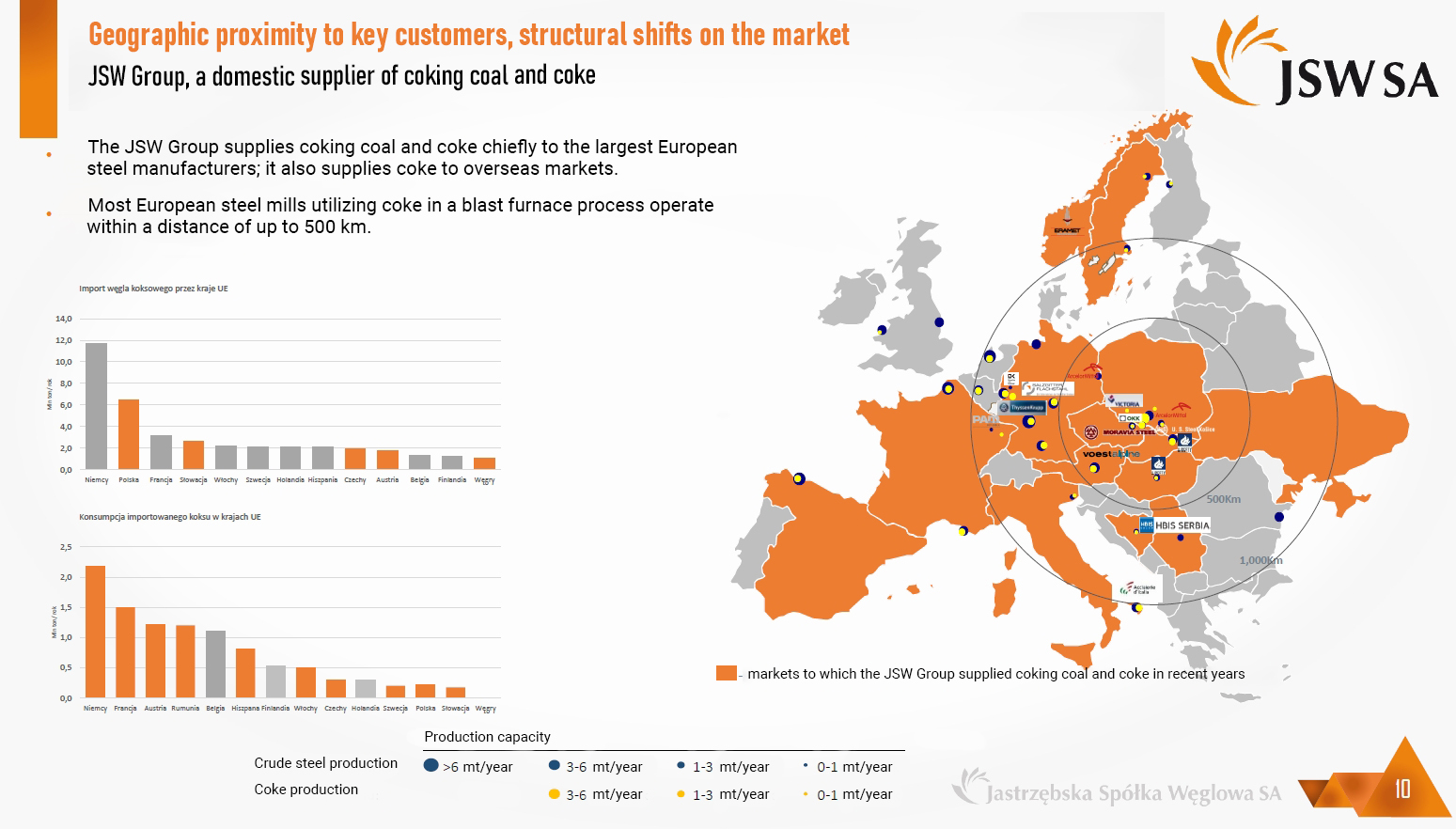

JSW Group is one of the largest employers in Poland. At the end of 2022, it had over 30 000 employees, including more than 21 000 at Jastrzębska Spółka Węglowa. JSW Group delivers coking coal and coke mainly to some of the largest European steelmakers and into more distanced markets in the case of coke. The majority of European steelmakers operating the basic oxygen furnace process using coke are located within 500km.

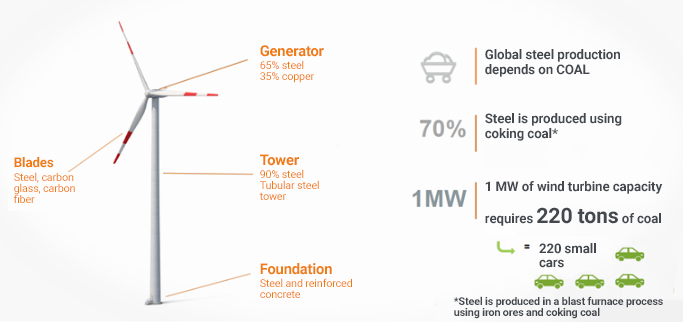

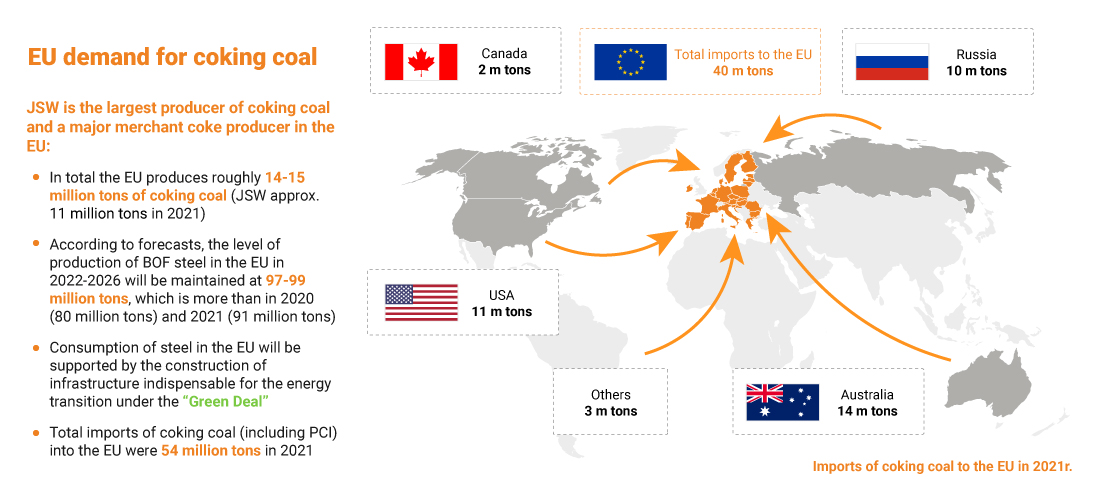

For the European steel industry, it is important to ensure a stable supply of its key raw materials on competitive terms. The lack of own sufficient sources of supply means that the European Union is practically dependent on imports of iron ore and coking coal.

On 16 March 2023, the EC published a draft Regulation on establishing a framework for ensuring a secure and sustainable supply of critical raw materials. Attached to the document is an updated proposal for the List of Critical Raw Materials, which includes coking coal for the fourth time, thus maintaining its status as a critical raw material for the European economy.

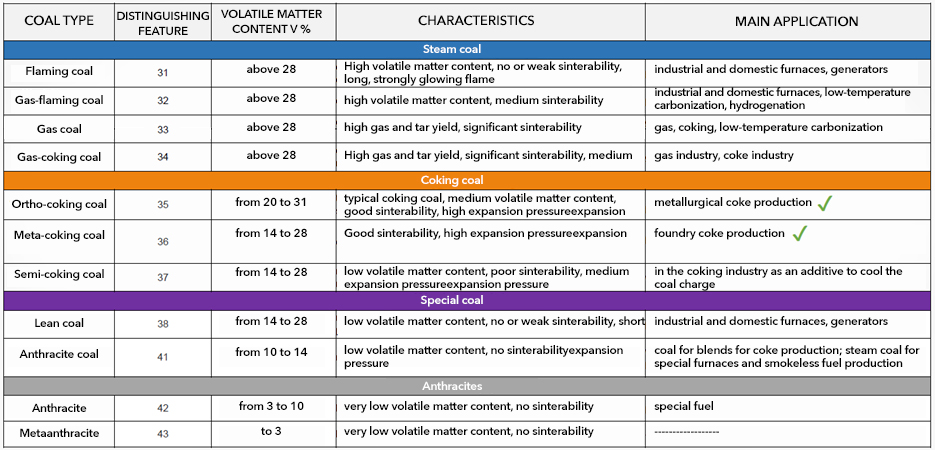

Coal types

Not all coal is steam coal

List of CRM-Critical Raw Materials - since 2011, the European Commission has been publishing the EU Critical Raw Materials (CRM), i.e. a list of raw materials of strategic economic importance at risk of supply disruption due to the high concentration of their production outside the European Union. Coking coal has been on the list since 2014 and maintains its status as a critical raw material for European industry.

Critical raw materials 2020:

- Antimony

- Baryte

- Beryllium

- Bismuth

- Borate

- Cobalt

- Coking coal

- Fluorspar

- Gallium

- Germanium

- Hafnium

- Heavy metals of rare earths

- Light rare earth metals

- Indium

- Magnesium

- Natural graphite

- Natural rubber

- Niobium

- Platinum group metals

- Phosphate rock

- Phosphorus

- Scandium

- Silicon metal

- Tantalum

- Tungsten

- Vanadium

- Bauxite

- Lithium

- Titanium

- Strontium

Position of the Capital Group

The Group is an important supplier of high quality coking coal to the domestic and European market. Being the owner of its coking plants, the Group can tap the synergy effects, by delivering coking coal and coke. The Group’s strong position ensues from the resources it holds and its advantageous location in the vicinity of key European steel manufacturers, which are the main offtakers of the Group’s products. After the scaling back of production in Czech mines, JSW became the strategic supplier of coal to the Central European market, and the efforts taken focus on continuing to strengthen the Group’s position as a key stable supplier regardless of market conditions.

On a global scale, the Group’s share in hard coal production is insignificant, representing approx. 0.2% of global coal output. The global annual production of coal is approx. 8.3 billion tons, of which approx. 1.1 billion tons is coking coal for the needs of cokemaking and the steel industry, which include coking coal and PCI. The remaining coal production is made up of coals used primarily for energy generation purposes. The Group’s market share in the global production of coking coal is approx. 1%, while in the EU the Group is the largest producer of coking coal (approx. 78% of total coking coal output in the EU), and also the leading producer of hard coking coal grades.

GROUP STRUCTURE AS AT 31 DECEMBER 2022

After the end of the reporting period, 1 January 2023, in accordance with the Management Board decision, the organizational structure of two mines was changed. KWK Jastrzębie-Bzie was incorporated into the structure of KWK Borynia-Zofiówka as the Bzie Section and, consequently, KWK Borynia-Zofiówka became a three-section mine under the name KWK Borynia-Zofiówka-Bzie.

Our assets

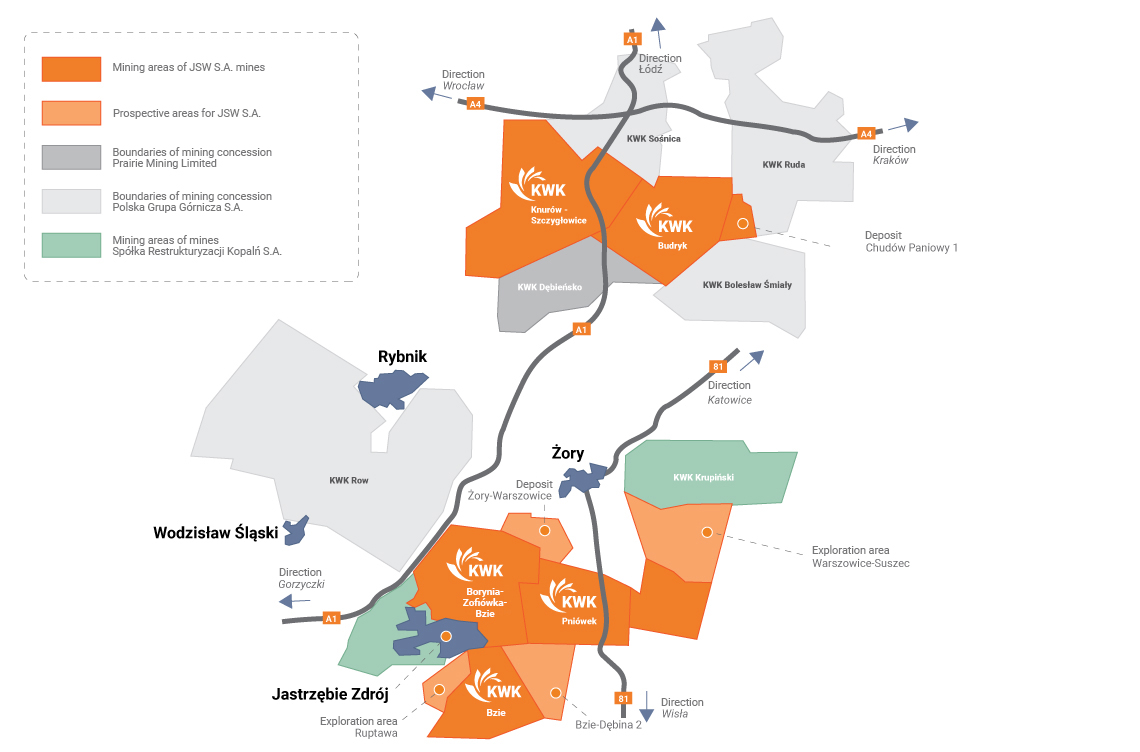

The Group's mines mine hard coal deposits in mining areas established in the licenses in the cities of: Jastrzębie-Zdrój, Mikołów, CzerwionkaLeszczyny, Knurów, Gliwice and Pszczyna, and Świerklany, Mszana, Pawłowice, Gierałtowice, Ornontowice and Pilchowice municipalities.

The mining area is located in the Upper Silesian Coal Basin. The mines have a total of approx. 6,980.2 mt of resources of coal, including approx 1,205.3 mt of recoverable coal reserves (based on mine resource appraisal reports as at 31 December 2022).

GROUP’S MINING AREAS

COAL RESOURCES BY THE GROUP’S MINES

The Group’s mining activity is performed by five hard coal mines. All these mines do their business within the geographical boundaries of their concession areas for which the concession expiry date, the surface area and the depth are specified.

|

GROUP’S MINES |

RESOURCES (m tons) | RECOVERABLE RESERVES (m tons) | FORECAST OF THE MINES’ LIFE OF MINE |

|---|---|---|---|

| BUDRYK | 1 354,4 | 244,6 | 2077 r. |

| PNIÓWEK | 1 525,2 | 297,8 | 2081 r. |

| BORYNA - ZOFIÓWKA | 1 585,8 | 174,2 | Ruch Borynia-2051 r. Ruch Zofiówka-2051 r. |

| KNURÓW - SZCZYGŁOWICE | 1 674,1 | 303,6 | Ruch Szczygłowice-2078 r. Ruch Knurów-2072 r. |

| JASTRZĘBIE-BZIE* | 840,7 | 185,1 | 2084 r. |

| TOTAL | 6980,2 | 1 205,3 | - |

*After the closing date of the reporting period, i.e. 1 January 2023, KWK Jastrzębie-Bzie was incorporated, as the Bzie Section, into the structure of the KWK Borynia-Zofiówka coal mine. Consequently, KWK Borynia-Zofiówka became a three-section mine under the name KWK Borynia-Zofiówka-Bzie.

If, due to market conditions, it will not be financially plausible to carry out the investments needed to develop the documented resources fully, the life of mine in the various mines may be truncated.

Concessions

The Group’s mines conduct their operations pursuant to pertinent concessions. JSW holds the following concessions:

|

DEPOSIT SUBJECT TO CONCESSION |

CONCESSION NO. | DATE OF GRANTING THE CONCESSION | DATE OF EXPIRY OF THE CONCESSION | |

|---|---|---|---|---|

| KWK BORYNIA-ZOFIÓWKA | Borynia Deposit, Szeroka I Mining Area | 7/2009 | 27.10.2009 | 31.12.2025 |

| Zofiówka Deposit, Jastrzębie Górne I Mining Area | 5/2010 | 14.05.2010 | 31.12.2042 | |

| KWK JSTRZĘBIE - BZIE* | Bzie - Dębina 2 - Zachód Deposit, Bzie - Dębina 2 - Zachód Mining Area | 15/2008 | 01.12.2008 | 31.12.2042 |

| Bzie - Dębina 1 - Zachód Deposit, Bzie - Dębina 1 - Zachód Mining Area | 2/2019 | 23.05.2019 | 31.12.2051 | |

| Jas-Mos 1 Deposit, Jastrzębie IV Mining Area | 1/2019 | 05.02.2019 | 31.12.2025 | |

| KWK BUDRYK | Budryk Deposit, Ornontowice I Mining Area | 13/94 | 21.03.1994 | 31.12.2043 |

| Chudów - Paniowy 1 Deposit, Ornontowice II Mining Area | 3/2005 | 18.04.2005 | 31.12.2044 | |

| KWK KNURÓW-SZCZYGŁOWICE | Szczygłowice Deposit, Szczygłowice Mining Area | 4/2019 | 30.08.2019 (obowiązuje od 01.01.2020) | 31.12.2040 |

| Szczygłowice Deposit, Szczygłowice Mining Area | 60/94 | 21.04.1994 | 15.04.2044 | |

| KWK PNIÓWEK | Pniówek Deposit, Krzyżowice III Mining Area | 5/2019 | 08.11.2019 (obwiązuje od 01.01.2020) | 31.12.2051 |

| Pawłowice 1 Deposit, Pawłowice 1 Mining Area | 3/2012 | 21.06.2012 | 31.12.2051 | |

|

AREA COVERED BY THE CONCESSION (exploration concessions) |

CONCESSION NO. | DATE OF GRANTING THE CONCESSION | DATE OF EXPIRY OF THE CONCESSION |

|---|---|---|---|

| Knurów Exploration Area | 5/2022/p | 03.11.2022 | 03.11.2027 |

| Bzie-Dębina 2-Zachód Exploration Area | 2/2022/p | 06.09.2022 | 06.09.2023 |

| Ruptawa Exploration Area (Upper Silesian Coal Basin)(1) | 2/2019/p | 06.02.2019 | 06.02.2022 |

| Warszowice-Suszec Exploration Area (Upper Silesian Coal Basin)(2) | 1/2018/p | 15.01.2018 | 15.01.2023 |

*After the closing date of the reporting period, i.e. 1 January 2023, KWK Jastrzębie-Bzie was incorporated, as the Bzie Section, into the structure of the KWK Borynia-Zofiówka coal mine. Consequently, KWK Borynia-Zofiówka became a three-section mine under the name KWK Borynia-Zofiówka-Bzie.

(1) On 6 February 2022, exploration concession 2/2019/p expired.

(2) On 11 January 2022, JSW waived exploration concession 1/2018/p.

Significant events in 2022

IMPACT OF THE COVID-19 PANDEMIC ON BUSINESS

In 2022 the Group did not record any material impact of the COVID-19 pandemic on its coal production volume, production of coke and hydrocarbons and the sales revenue achieved. The Group continued the required preventive measures and measures strengthening the safety of employees aimed at preventing the spread of the SARS-CoV-2 coronavirus. The total costs incurred for combating the pandemic in the Group in 2022 were PLN 8.8 million (in 2021, the total costs associated with the COVID-19 pandemic in the Group were PLN 28.2 million).

THE IMPACT OF THE ARMED CONFLICT IN UKRAINE ON THE GROUP'S ACTIVITIES

In 2022, the armed conflict in Ukraine and the sanctions imposed on Russia strongly affected the macroeconomic situation in Europe and the world, in particular the energy and energy commodity markets.

The outbreak of the war in Ukraine has caused great uncertainty for steelmakers regarding security of supply of raw materials, providing the impetus for a record increase in coking coal prices, exceeding historical highs by 200 USD/t. The prices of hard coals exceeded 670 USD/t in the peak period (as of 14 March 2022). In the following months, the prices steadily declined, reaching pre-war levels in June 2022. The average TSI Premium HCC index in Q1 2022 was 487.80 USD/t and fell 8.7% down to 445.52 USD/t in Q2 2022. In Q3 2022, it went further down by 43.9% vs. Q2 2022 down to 249.75 USD/t. In Q4 2022, the average TSI Premium HCC price increased by 11.4% to 278.13 USD/t compared to Q3 2022.

Prices of blast furnace coke increased following the outbreak of war in Ukraine, but the appreciation was less pronounced than for Australian

coking coal. The prices of Chinese CSR 64/62 coke increased from below 500 USD/t in February 2022 to 680 USD/t in the second half of March 2022. On the European market, in March 2022, CSR 64/62 blast furnace coke prices increased by nearly 100 USD/t (compared to February 2022) to 700 USD/t. As in the case of coal, there was a decline in coke prices in individual months.

The average price of Chinese coke (64/62 CSR) FOB China in Q1 2022 was 563.8 USD/t, in Q2 it increased by 5.2% to 593.2 USD/t, in Q3 2022 there was a decrease in the prices by 28.5% to 424.0 USD/t compared to Q2 2022, and Q4 saw a further decrease compared to Q3 2022 by 6.0% to 398.4 USD/t.

In the European market, blast furnace coke (64/62 CSR) CFR was priced at 636.7 USD/t in Q1 2022, with a 4.2% price increase to 663.3 USD/t in Q2 2022. In Q3 2022, the average coke price on the European market was 460.0 USD/t, down 30.7% from Q2 2022, and in Q4 2022 it fell 10.9% to 410.0 USD/t compared to Q3 2022.

The sanctions imposed on Russia regarding the ban on the import of energy commodities, the restriction of the supply of steam coal, and gas and oil from Russia to the EU have led to the need to rapidly import steam coal from overseas markets contributing to an increase in the prices on world markets.

The average price for steam coal at ARA ports in Q1 2022 was 229.6 USD/t, with a 47.8% increase in Q2 to 339.2 USD/t, in Q3 2022 prices were 364.2 USD/t up 7.4% from Q2 2022, and in Q4 2022 there was a 34.6% decrease in the prices from Q3 2022 to 238.2 USD/t.

The change in the market situation has also affected domestic steam coal prices. The Polish Steam Coal Market Index prices in sales to commercial and industrial energy sector (PSCMI 1) in Q1 2022 stood at PLN 291.59 per ton and increased by 11.7% to PLN 325.58 per ton in Q2 2022.In Q3, domestic mining companies undertook renegotiations with customers, as a result of which PSCMI1 prices increased by 64.8% t PLN 536.42 per ton compared to the previous quarter. In Q4 2022, the prices stood at PLN 543.89 per ton, up 1.4% compared to Q3 2022.

The consequence of Europe's deep energy commodity deficit, following the introduction of sanctions on Russia, has been an unprecedented increase in electricity and gas prices and concerns about their availability during the winter. This has affected the steel market in the European Union. Faced with the threat of an energy crisis, rising costs, and uncertainty in demand for steel products, many steel companies have introduced production restrictions and temporary shutdowns of blast furnaces. Coke production at integrated coking plants has been curtailed to a lesser extent than would result from blast furnace shutdowns. Coke gas production has become a priority. This has led to a periodic oversupply of coke on the market and a drop in prices.

The increase in imports of raw materials, mainly steam coal from overseas, has led to greater strain on domestic seaports and rail routes, making the logistics of delivery to customers more difficult.

The development of the market situation is exposed to significant risk and it is difficult to estimate the long-term impact of the war in Ukraine on the European and global markets. Globally, the war in the territory of Ukraine has resulted in a less stable economic situation, higher inflation and rising interest rates.

The war in Ukraine may continue to affect markets important to the Group, including:

- steel market- the combined output of Russia and Ukraine in 2021 accounted for 5% of global steel production (97 million tons). Russia was the second largest steel exporter in the world, the main export markets being the EU (22%) and Asia (23%). Approx. 28% of the EU's and 35% of the U.S.' imported pig iron in 2021 came from Russia. Ukraine was also a major supplier of iron ore to the Central European market. By 2022, Ukrainian iron ore mining companies were operating at an average of 20% of capacity, while steel producers were operating at about 15%. The largest loss of steel assets occurred in May 2022, when two of Ukraine's largest steel plants in Mariupol - Azovstal and Illich Steel - were destroyed. In 2022, Ukraine produced 6.3 million tons of steel (down 71% from 2021), 6.4 million tons of pig iron (down 70% from 2021) and approx. 5.4 million tons of rolled steel (down 72% from 2021). Russia's 2022 steel production is down 7.2% to 71.5 million tons from the previous year. Once the war is over, Ukraine's steel exports will not resume, as the country will need huge amounts of steel for reconstruction. After the war, Ukraine's estimated steel demand will increase to 15-20 million tons per annum, up from 2 million tons in 2022 and 5 million tons in 2021;

- coking coal market-the sanctions imposed on Russia as a result of its aggression on Ukraine cause another reorganization of the global market. Before the war in Ukraine, Russia’s share of coking coal imports to the EU was: approx. 10% for coking coal and approx. 30% for PCI coal. After the introduction of the sanctions, Russian coal was diverted to the Asian market, mainly to India and China. In EU countries the demand for overseas imports has increased. The coking coal market is affected by the situation in the steam coal market. At the peak of the steam coal buying rush, its prices exceeded coking coal prices, causing the diversion of lower-quality semi-soft and PCI coal to the energy market. Some mining companies with coking and steam coal mines in their assets increased steam coal mining at the expense of coking coal, which affected the supply of coking coal and its price;

- coke market– high energy and gas costs in the EU may lead to restrictions on steel production and a decline in demand for coke. Factors related to the lower supply of certain types of coal may be at play when steel production increases. Lack of availability of PCI coal, of which Russia is one of the major exporters, may lead to increased coke consumption in the blast furnace process;

- energy market – record increased in energy prices, fears for its availability affect decisions of steel concerns regarding periodic restriction of steel production, which may translate into lower demand for coke and coking coal;

- freight forwarding market– increased imports of offshore steam coal, increased strain on sea ports and rail routes may hinder coal and coke supplies to business partners.

The armed conflict in Ukraine has pushed up commodity prices in the market. This situation resulted in requests from some material suppliers (mainly steel-based) to renegotiate their contracts. In justified cases, the Group signed annexes to the contracts with suppliers. There has also been an increase in the prices offered by business partners for materials in ongoing tenders.

In addition to threats, the war in Ukraine also creates market opportunities for the Group's operations. The Group's market position as a local, stable and predictable supplier of raw materials to the steel industry is growing, as evidenced by the long-term contracts concluded with key customers over the past year.

Possible disruptions to the Group's operations and investment activities if the conflict escalates include:

- severed or disrupted supply chains that may lead to limitations in the availability of raw materials from Ukraine and Russia that steel companies and coke plants need,

- disruptions in production continuity or higher production costs,

- disruptions in electricity supply, deterioration of the country's energy security, and further increases in energy costs,

- increase in the prices of raw materials, as well as materials and services,

- disruptions to logistics in ports due to higher overseas imports of raw materials, i.a. iron ore,

- impact on the supply of metallurgical goods on the European market,

- cyberattacks against IT resources leading to a data leak and disinformation,

- hazards arising from the availability of employees.

As at the date of this report, due to the dynamic situation, it is difficult to predict the long-term economic effects of the war in Ukraine and its effect on the overall macroeconomic situation, which may indirectly affect the Group’s financial performance. The Group analyzes on an ongoing basis the possible impact of the armed conflict in Ukraine on its current and future financial position, its operations and future financial results.

EVENTS IN THE PNIÓWEK MINE AND BORYNIA-ZOFIÓWKA MINE, ZOFIÓWKA SECTION

On 20 and 23 April 2022, incidents took place in JSW’s mines:

- KWK Pniówek – on 20 April 2022 there was an explosion and ignition of methane and secondary explosions, which took place in longwall N-6, seam 404/4+405/1 on level 1000. The mining in this longwall was scheduled to end in June 2022. The longwall where the explosion occurred is one of six longwalls operated in KWK Pniówek.

As a result of the incident, 9 people died, 7 people were reported missing. Due to the high risk of further methane explosions and the safety of the rescue teams, a decision was made to isolate the threatened area from the rest of the mine by building isolation stoppings. On 2 May 2022, the rescue operation was terminated after blocking the N-6 longwall area.

After the closing day of the reporting period, i.e. on 4 February 2023, rescue operations resumed to reach the 7 missing miners. As a first step, the rescuers focused on narrowing the size of the sealed off area by building new stoppings, which will allow them to assess the situation in the N-6 longwall area and decide on the implementation of the second stage of the search operation, i.e. the construction of a new 350-meter pit that will allow rescuers to safely reach the missing miners. On 5 February 2023, the first stage of the search operation involving 90 rescue teams was completed. Further work related to the implementation of the second stage of the search operation will be carried out on a prevention work basis. This phase of the operation may take 4 to 6 months.

- KWK Borynia-Zofiówka, Zofiówka Section – on 23 April 2022 a high energy shock wave combined with an intensive outflow of methane took place. The incident occurred in an area where no mining was performed, in the D-4a working face roadway, seam 412, on level 900, during excavation and drilling of long blast holes. There were 52 workers in the area of the accident, 42 of whom got out on their own. Contact with ten persons was lost. After four days of the rescue operation, on 27 April 2022 the search ended. The shock wave killed 10 miners, 3 of whom were employees of an outside company.

As a result of the aforementioned incidents at KWK Pniówek and KWK Borynia-Zofiówka, Zofiówka Section, in 2022, JSW incurred costs related mainly to rescue operations, removal of the consequences of the incidents and costs of impairment of KWK Pniówek's assets in the total amount of PLN 54.6 million.

On 29 April 2022 the JSW Management Board adopted a resolution on the occurrence of force majeure in JSW and the notification of the Company’s business partners of its occurrence and the ensuing consequences for the obligations affected by the operation of force majeure. As a result of the analyses conducted, the impact exerted by these events in terms of reduced coal production until the end of 2022 has been estimated to be roughly 400 thous. tons. The exact impact of the events on the level of output/production in subsequent years is difficult to estimate, which results from both the ongoing work of the State Mining Authority’s Commission in the case of KWK Pniówek and the manner in which the findings are implemented and mining works are carried out at the Zofiówka Section.

Changes to the Company’s governance rules in 2022

To streamline the Company’s governance, in 2022 the Management Board adopted a number of resolutions pertaining to changes in the organizational structure of the Company’s Management Board Office and its mines. These changes intended to enhance the effectiveness of governance and adapt to the evolving market environment.

The key changes in the Company’s governance in 2022 pertained to the following:

- changing the organizational structure of the Management Board Office, concerning, among other things, strengthening the supervision over the operation of subsidiaries, optimizing the organizational structure in the areas of communication and promotion, compliance, shipping, strategy, fundraising, innovation and diversification of operations, as well as adjusting the organizational structure to the implementation of tasks envisaged in the JSW Group's environmental strategy and challenges arising from the energy market,

- updating the Mines’ Framework Organizational Charts to improve management efficiency and adapt to evolving market and legal conditions,

- changing the organizational structure of the two mines involving the subordination, as of 1 January 2023, of KWK Jastrzębie-Bzie as the Bzie Section to KWK Borynia-Zofiówka and changing the name of KWK Borynia-Zofiówka to KWK Borynia-Zofiówka-Bzie.

MATERIAL AGREEMENTS AND TRANSACTIONS

EXECUTION OF A COAL SUPPLY AGREEMENT WITH MORAVIA STEEL

On 17 January 2022, JSW signed a master coal supply agreement with Moravia Steel a.s. with its registered office in Trzyniec, Czech Republic. This agreement was executed for a term of 7 years starting from January 2022 to December 2028. Under the agreement, coal, mainly coking coal, will be supplied to secure the production needs of TŘINECKÉ ŽELEZÁRNY a.s. The estimated value of the agreement is PLN 2.6 billion.

EXECUTION OF AN ANNEX TO THE AGREEMENT ON THE FREE-OF-CHARGE TRANSFER OF A DESIGNATED PART OF THE JASTRZĘBIE III MINING AREA TO SPÓŁKA RESTRUKTURYZACJI KOPALŃ S.A.

On 31 March 2022, with the dispositive effect as of 1 April 2022, JSW and SRK signed an annex to the agreement of 31 December 2021, taking into account the transfer to SRK of the remaining assets of the designated part of the Jastrzębie III mining area, in the form of a system discharge of saline water to the Olza Collector and a system for industrial water supply and a rail siding.

EXECUTION OF A COAL SUPPLY AGREEMENT WITH METALIMEX

On 21 April 2022, a long-term agreement for coal supplies was signed between JSW and Metalimex a.s. with its registered office in Prague, Czechia. This agreement was executed for a term from April 2022 to December 2028. Under the agreement, coal will be supplied to secure the production needs of OKK Koksovny a.s. The estimated value of the agreement is PLN 2.12 billion.

EXECUTION OF AN ANNEX TO THE MULTI-YEAR AGREEMENT WITH ARCELORMITTAL POLAND S.A.

On 28 October 2022, JSW and ArcelorMittal Poland S.A. concluded an Annex to the multi-year agreement, in which they agreed on the terms of cooperation in the supply of coking coal in 2023-2025. The signed document assumes that the Parties will continue to cooperate with one another and the estimated value of the agreement in 2023-2025 may surpass PLN 7.0 billion. Following this period the agreement will be subject to extension for subsequent years up to the end of 2029 at the maximum. Based on this multi-year agreement annual contracts will still be executed to agree on the specific terms of business.