Outlook

Although it is often, incorrectly, associated with coal mining for energy generation purposes, JSW Group's core business is aligned with the steelmaking value chain. The Group extracts and processes mainly coking (metallurgical) coal, which is used to make steel. In 2017, the European Commission confirmed the critical raw material status for coking coal by placing it on its list of 27 raw materials that carry the risk of supply shortages and the effects of which for the economy would be greater than in the case of other raw materials.

The main challenges that the mining industry is facing is a reduction of production costs alongside an increase in operational efficiency, expanding the resource base and incorporating challenges related to safety, environmental protection and corporate social responsibility in all aspects of the business.

JSW Group is closely monitoring the situation in industries and rapidly responding to changes on the coal, coke and steel markets. Its strategy has been updated in order to adapt it to the on-going changes. JSW S.A.'s strategy incorporating JSW Group subsidiaries for 2020-2030 constitutes a response to the challenges emerging in a dynamically changing market environment and economic situation, changes in the Group's capital structure, as well as challenges related to stable, long-term growth, meeting the expectations of stakeholders in the long term.

Global market conditions for the Group's main products are shaped by the largest customers and suppliers for these raw materials, i.e. China, Australia and the U.S., and especially the supply-demand relations between them. Aside from the supply-demand equation, particularly between Asia and Australia, one-off events play a role, including logistics problems resulting from sharp and unforeseen changes in weather or geological conditions as well as crisis situations, such as the coronavirus pandemic, which in China alone in the first quarter of 2020 caused a decline in production capacities of 40-60% on average, depending on the sector. JSW Group is exposed to demand and supply swings on the global market and to changes on the domestic mining and steel sectors. Changes in China's production capacities have a negative impact on businesses throughout the world because the Chinese industry is present in a majority of global supply chains and is involved in building the value of international corporates. Supply disruptions out of China have an impact on the financial results of a majority of companies from numerous industries and sectors that operate on a global scale. Because it is not possible to predict when the epidemic will end, the negative impacts of COVID-19 and the ensuing economic crisis may have long-term influence over the global economy.

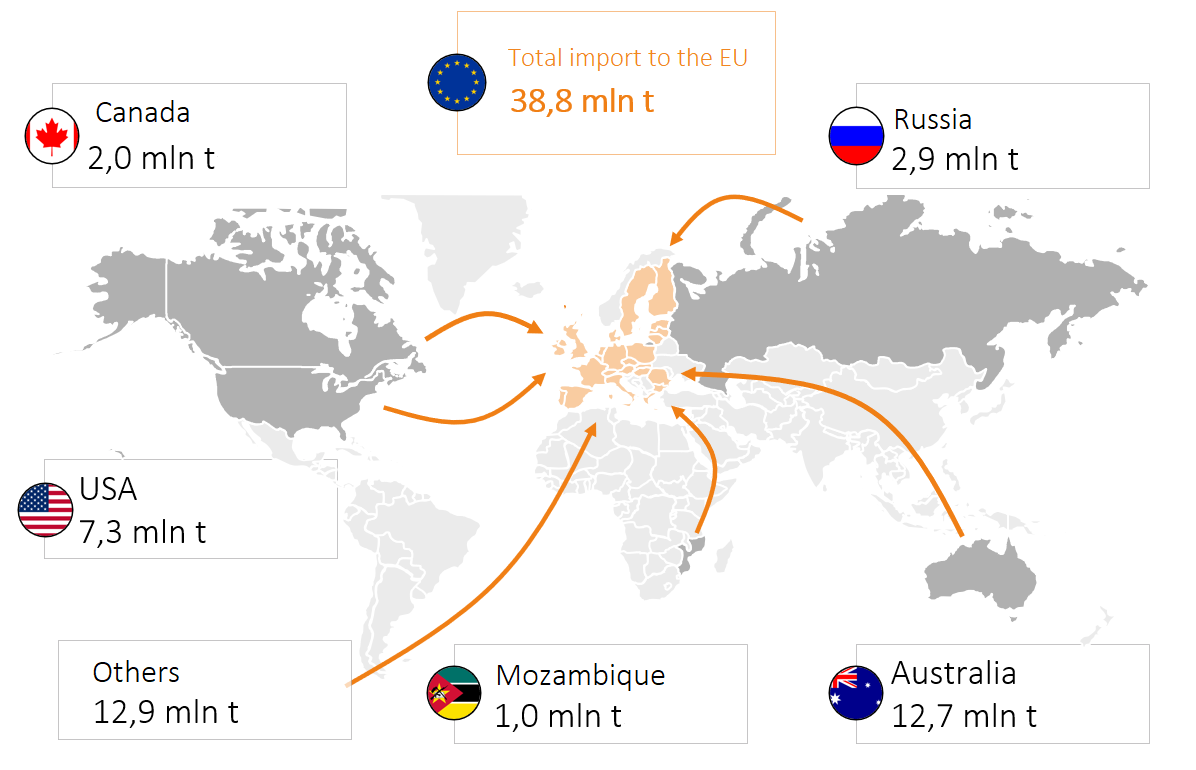

Existing forecasts for global steel production see average growth of 1.6% annually until 2024, including an average of 0.7% for the European Union. Long-term forecasting is difficult due to the specific nature of the market and potential impact events. The import of coking coal into the European Union in 2019 reached 38.8 Mt, with EU itself producing approx. 14-15 Mt, including 10-11 Mt produced by JSW.

Blast-furnace technology is the dominant steelmaking process in Europe and in the world, accounting for more than 70% of the global steel output. Electric furnace production accounts for approx. 25%. Many European steelworks use the PCI (Pulverized Coal Injection) technology. Projects are also in progress to partially or completely decarbonise steelmaking, although they are at research or pilot stages. The European Commission has announced its support for clean steel production technologies until 2030. Despite this, many experts claim that it will not be possible to completely replace coke in blast-furnace iron pig smelting within the next 25 years.

Global forecasts for coke production are stable, at around 680-690 Mt annually. Coke output in China is expected to fall from 443 Mt in 2019 to 407 Mt in 2024, while production in India is expected to increase by more than 10 Mt to 58 Mt in 2024. In the EU, after the declines in 2018-2019, demand is expected to pick up, reaching 34.5 Mt by 2024. However, these forecasts may change due to the epidemic.

The largest sources of coking coal imports to the EU in 2019

Compliance with legal regulations related to environmental protection and the use of natural resources - reducing greehouse gas emissions and the EU Strategic Plan on methane - are a major challenge for JSW Group in the mid- and long-term. As the industrial revolution progresses, JSW Group plans to actively use scientific and technical advancements, committing its intellectual capital and implementing the latest technological solutions for the mining sector.

To reduce adverse environmental impact, JSW Group is engaging in a number of initiatives to increase the economic use of methane and coke oven gas to generate electric and thermal energy and become energy-independent, also when it comes to the use of coal derivatives and the separation of hydrogen from coke oven gas, which constitutes one of the key objectives in its strategy.

In the long term, if the project to produce hydrogen as fuel for the future gets the green light, JSW will be able to efficiently produce this energy source at JSW Group's coking plants. A properly constructed installation would make it possible to use hydrogen in the future for zero-emission urban transport.

| Key issues impacting JSW Group | ||||

|---|---|---|---|---|

| Area | Perspectives | short-term (2020-2021) |

mid-term (2025) |

long-term (2030 r.) |

| financial | restricted financing options for investments in mining industry by financial industry | x | x | x |

| revenue diversification | x | x | ||

| effectively managing the Group's financial risk | x | x | ||

| securing a stable financing structure | x | x | x | |

| optimising the Group's operating costs | x | x | x | |

| national regulations, including in particular the Capital Market Development Strategy | x | x | ||

| securing EU funding for projects | x | x | ||

| production | access to coking coal resources with high and stable quality parameters | x | x | x |

| expanding the product and service portfolio (including repairs, excavation development, laboratory services) | x | x | ||

| greater synergies between the mining and coking areas | x | x | ||

| extending the value chain toward the use of coal derivative volumes | x | x | ||

| optimisation activities in the mining and coking areas | x | x | x | |

| operational capability to perform planned production and deliveries | x | x | ||

| expanding the resource base for coking coal | x | x | x | |

| regulatory | higher mandatory share of renewables and increase in energy efficiency | x | x | |

| variability of law | x | x | x | |

| further CO2 emission reductions, resulting in higher prices of emission allowances | x | x | ||

| adapting generation units to BAT conclusions and the EU ETS trading scheme | x | x | ||

| strategic documents adopted at EU level, in particular the EU's climate policy to 2050 | x | x | ||

| national plan for energy and climate 2021-2030 | x | x | x | |

| European Green Deal | x | x | x | |

| technological | new steelmaking technologies that reduce the use of coke (PCI, hydrogen) | x | x | |

| innovative technologies in support of production and use of by-products (e.g. methane, coke oven gas or stone) | x | x | ||

| digitalisation of production-support processes | x | x | ||

| market | limited import of Chinese coke to Europe due to production costs in China and strong internal demand | x | x | |

| escalation in the U.S.-China trade war, resulting in further restrictions of trade, including steel | x | x | ||

| long delivery deadlines for overseas coking coal to Europe (approx. 2-3 months) in comparison to deliveries of coking coal from JSW | x | x | x | |

| stable commercial relations based on trust in product quality | x | x | x | |

| limited competition from other coking coal producers on the domestic and European market | x | x | x | |

| retention of customer base, development of product offering, market expansion | x | x | ||

| higher coking coal output in Australia and Russia, and their export capacities | x | x | ||

| forecasts for higher demand in India for coking coal, alongside an increase in steel output | x | x | ||

| environmental | pressure on CO2 emission reductions from EU's climate and energy policy | x | x | |

| effective use of coal derivatives and striving for energy self-sufficiency | x | x | ||

| economic | mergers and acquisitions in European steelmaking | x | x | |

| rdevelopment of the European and global economy | x | x | ||

| social | maintaining a licence to operate by building good relations with local communities, becoming involved in their lives | x | x | x |

| limiting the negative impact of mining activities on the surrounding areas and life (mining damages) | x | x | x | |

| zensuring a high level of workplace safety | x | x | x | |

| countering the generational gap | x | x | ||