Key financial and operating data

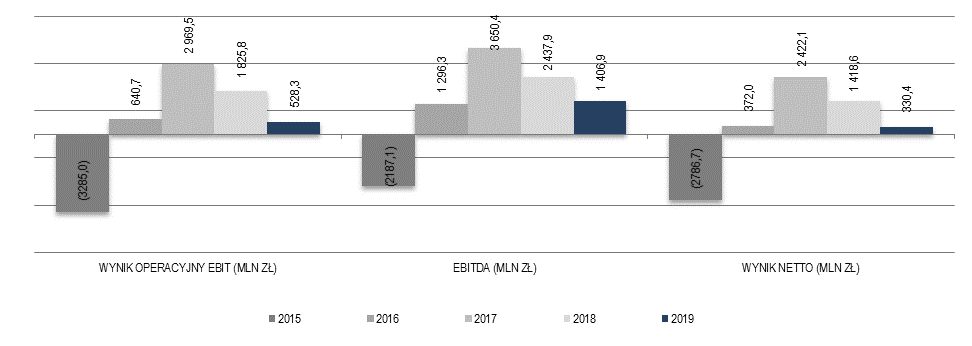

Despite the economic slowdown that the entire commodity industry is struggling with, the Group's financial results remained stable. In 2019, the Group reported a positive financial result of PLN 649.6 million, EBITDA of PLN 1 939.5 million and revenue from sales of PLN 8 671.8 million.

JSW Group is a key participant in the coking coal - coke - steel supply chain, having produced 14.8 million tonnes of coal, 3.2 million tonnes of coke and built 75.1km of walkways in 2019. The Group is also one of the largest employers in Poland, employing 30 629 people in total, including 22 433 at Jastrzębska Spółka Węglowa.

Table. Economic and financial highlights for the JSW Group

| ITEM | UNIT | 2019 | 2018 | 2017 | 2016 | 2015 | GROWTH RATE 2018=100 |

|---|---|---|---|---|---|---|---|

| CONSOLIDATED STATEMENT OF FINANCIAL POSITION | |||||||

| Balance sheet total | PLN million | 14,926.4 | 13,762.6 | 12,090.2 | 11,519.6 | 11,812.2 | 108.5 |

| Non-current assets | PLN million | 11,565.1 | 10,300.7 | 8,118.2 | 9,097.3 | 10,324.7 | 112.3 |

| Current assets | PLN million | 3,361.3 | 3,461.9 | 3,972.0 | 2,422.3 | 1,487.5 | 97.1 |

| Equity | PLN million | 8,851.5 | 8,445.4 | 6,621.5 | 4,069.6 | 3,934.2 | 104.8 |

| Liabilities | PLN million | 6,074.9 | 5,317.2 | 5,468.7 | 7,450.0 | 7,878.0 | 114.2 |

| CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME | |||||||

| Sales revenues | PLN million | 8,671.8 | 9,809.5 | 8,877.2 | 6,731.3 | 6,934.9 | 88.4 |

| Gross profit (loss) on sales | PLN million | 1,603.6 | 2,871.1 | 3,238.9 | 1,229.7 | (50.2) | 55.9 |

| Operating profit/(loss) | PLN million | 905.6 | 2,254.1 | 3,116.5 | 226.6 | (3,896.0) | 40.2 |

| EBITDA | PLN million | 1,939.5 | 3,020.1 | 3,941.2 | 1,065.4 | (2,533.1) | 64.2 |

| EBITDA margin | % | 22.4 | 30.8 | 44.4 | 15.8 | (36.5) | 72.7 |

| Profit/(loss) before tax | PLN million | 828.0 | 2,192.5 | 3,123.6 | 19.6 | (4,045.3) | 37.8 |

| Net profit/(loss) | PLN million | 649.6 | 1,760.8 | 2,543.3 | 4.4 | (3,285.2) | 36.9 |

| Total comprehensive income | PLN million | 636.7 | 1,718.4 | 2,552.0 | 16.2 | (3,301.1) | 37.1 |

| CONSOLIDATED STATEMENT OF CASH FLOWS | |||||||

| Net cash flow on operating activity | PLN million | 1,140.3 | 2,818.4 | 2,870.7 | 896.5 | 725.1 | 40.5 |

| Net cash flow on investing activity | PLN million | (2,260.5) | (1,581.7) | (2,170.3) | (354.4) | (1,015.3) | 142.9 |

| Net cash flow on financing activity | PLN million | (180.3) | (755.8) | (699.8) | 277.7 | (80.0) | 23.9 |

| Net movement in cash and cash equivalents | PLN million | (1,300.5) | 480.9 | 0.6 | 819.8 | (370.2) | - |

| FINANCIAL RATIOS | |||||||

| Dividend per share | PLN/share | 1.71 | - | - | - | - | - |

| Current liquidity | 1.05 | 1.03 | 1.67 | 1.14 | 0.39 | 101.9 | |

| Quick liquidity | 0.70 | 0.84 | 1.46 | 0.98 | 0.26 | 83.3 | |

| Net return on sales | % | 7.5 | 17.9 | 28.6 | 0.1 | (47.4) | 41.9 |

| Return on Assets (ROA) | % | 4.4 | 12.8 | 21.0 | 0.0 | (27.8) | 34.4 |

| Return on Equity (ROE) | % | 7.3 | 20.8 | 38.4 | 0.1 | (83.5) | 35.1 |

| Total debt ratio | 0.41 | 0.39 | 0.45 | 0.65 | 0.67 | 105.1 | |

| Debt to equity ratio | 0.69 | 0.63 | 0.83 | 1.83 | 2.00 | 109.5 | |

| Fixed capital to non-current assets ratio | 0.91 | 0.91 | 1.0 | 0.70 | 0.49 | 100.0 | |

| PRODUCTION DATA | |||||||

| Coal production | million tons | 14.8 | 15.0 | 14.8 | 16.8 | 16.3 | 98.7 |

| Coking coal production | million tons | 10.2 | 10.3 | 10.7 | 11.6 | 11.1 | 99.0 |

| Steam coal production | million tons | 4.6 | 4.7 | 4.1 | 5.2 | 5.2 | 97.9 |

| Coke production | million tons | 3.2 | 3.6 | 3.5 | 4.1 | 4.2 | 88.9 |

| Mining cash cost | PLN/ton | 426.00 | 396.46 | 312.54 | 251.38 | 307.10 | 107.5 |

| Cash conversion cost | PLN/ton | 191.78 | 161.68 | 149.82 | 133.52 | 144.66 | 118.6 |

| OTHER DATA | |||||||

| Stock price at the end of the period | PLN/share | 21.38 | 67.26 | 96.27 | 66.90 | 10.65 | 31.8 |

| Headcount at the end of the period | persons | 30,629 | 28,268 | 26,465 | 27,366 | 32,168 | 108.4 |

| Average headcount during the year | persons | 29,440 | 27,207 | 26,563 | 30,765 | 33,116 | 108.2 |

| Investments in property, plant and equipment | PLN million | 2,329.0 | 1,639.1 | 1,013.7 | 911.3 | 1,056.6 | 142.1 |

| Depreciation and amortization | PLN million | 1,033.9 | 766.0 | 824.7 | 838.8 | 1,362.9 | 135.0 |

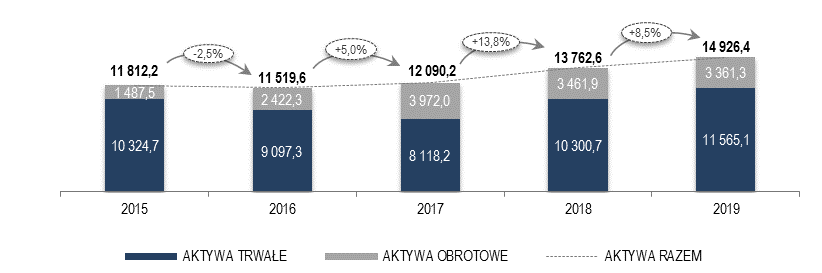

Asset situation

Factors driving changes in non-current assets (growth by PLN 1 264.4 million)

The growth in non-current assets in 2019 was driven by the introduction, from 1 January 2019, of the new standard IFRS 16 Leases, in accordance with which the Group recognised right-of-use assets. Based on an analysis, the implementation of IFRS 16 from 1 January 2019 resulted in a PLN 304.7 million increase in assets (this amount includes an impairment loss of PLN 37.0 million). Financial leases were also reclassified from property, plant and equipment and intangible assets (mainly right to perpetual usufruct of land) to right-of-use assets, totalling PLN 126.9 million. At the end of the reporting period, JSW recognised PLN 618.3 million in right-of-use assets in accordance with IFRS 16 (as at 1 January 2019: PLN 423.0 million).

The acquisition of a 95.01% stake in PBSz also increased the Group's non-current assets in 2019. The overall impact of non-current assets measured at fair value as at 31 December 2019 was PLN 153.1 million. Details on the purchase price allocation are presented in Note 10.3 of JSW Group's consolidated financial statements for the financial year ended 31 December 2019.

At the same time, the line Investments in FIZ asset portfolio within non-current assets decreased during the reporting period by PLN 652.1 million, i.e. by 35.7%. In connection with a decision by JSW's Management Board to partially redeem investment certificates, a PLN 700.0 million portion of Investments in FIZ asset portfolio was reclassified to Other current financial assets. Deferred income tax assets also decreased, by PLN 144.5 million, i.e. 21.6%.

Factors driving changes in current assets (decrease by PLN 100.6 million)

Comparing to 31 December 2018, current assets declined by a total of PLN 100.6 million as of the end of the reporting period, mainly as a result of a decrease in cash and equivalents by PLN 1 300.5 million, i.e. by 78.8%, and trade and other receivables by PLN 280.6 million, i.e. by 24.5% (including trade receivables by PLN 348.3 million, i.e. 35.7%), caused mainly by a decline in revenue from sales by PLN 1 137.7 million, i.e. 11.6%.

At the same time, in 2019 the Group reported in current assets PLN 700.0 million in Investments in FIZ asset portfolio and inventory PLN 474.3 million higher than in 2018, caused by an increase in finished product inventory by PLN 531.3 million (including an increase in coal product inventory by 997.8 thousand tonnes and an increase in coke inventory by 260.5 thousand tonnes).

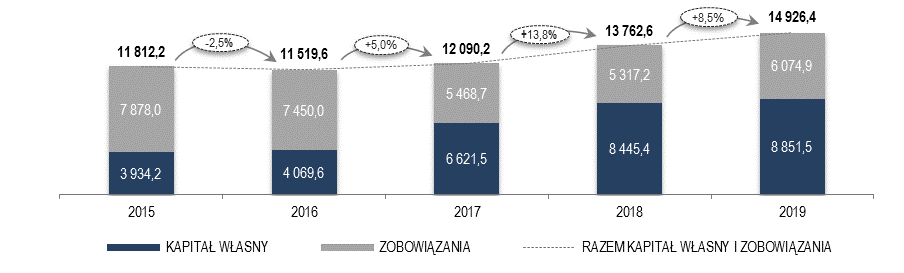

Asset coverage sources

Factors driving changes in equity (increase by PLN 406.1 million)

An increase in total equity by 4.8 as at 31 December 2019 is associated primarily with an increase in retained earnings by PLN 350.3 million, 5.9% as compared to 31 December 2018, which resulted directly from the net profit attributable to shareholders of the Parent Company in the amount PLN 628.9 million, despite of the dividends for 2018 paid to shareholders of PLN 200.8 million, other total revenues on actuarial losses in the amount of PLN 43.7 million as well as implementation of IFRS 16 (write off on the account of total loss in value at the day of the implementation of the standard) in the amount of PLN 37.0 million.

Moreover, as at 31 December 2019, the Group recognised in its consolidated statement of financial position a reserve for the measurement of financial instruments, amounting to PLN -20.6 million, constituting a part of gains and losses resulting from changes in the fair value of hedging instruments (increase by PLN 31.5 million), as described further in Note 7.13.2 of JSW Group’s consolidated financial statements for the financial year ended 31 December 2019.

Factors driving changes in liabilities (increase by PLN 757.7 million)

Non-current liabilities grew by PLN 889.1 million, i.e. 52.6%, in 2019, compared to 31 December 2018, mainly as a result of the recognition of additional lease liabilities due to the implementation of IFRS 16 Leases, which at 31 December 2019 amounted to PLN 406.7 million. Non-current credit and loan liabilities also increased in comparison with 31 December 2018, by PLN 296.8 million, i.e. 813.2%, due to a term loan, term credit facility and a revolving credit facility being received, as described in Note 6.1. of JSW Group's consolidated financial statements for the financial year ended 31 December 2019.

At 31 December 2019, non-current employee benefit liabilities also increased in comparison with 31 December 2018, by PLN 100.8 million, i.e. 13.8%. Liabilities related to provisions also grew in comparison with 31 December 2018, to PLN 78.9 million, i.e. by 10.0%.

Current liabilities declined in 2019 by PLN 131.4 million, i.e. 3.6%, comparing to 31 December 2018, mainly including current income tax liabilities (by PLN 197.3 million, i.e. 96.9%). Furthermore, liabilities related to debt securities decreased in 2019 by PLN 121.0 million, in line with a decision by JSW's Management Board made on 16 January 2019 concerning a complete buy-back of bonds, worth in total PLN 121.0 million in nominal terms (including PLN 71.5 million and USD 13.2 million). At the same time, in 2019 the Group reported current lease liabilities as a separate line in the statement of comprehensive income, in accordance with IFRS 16. These amounted to PLN 206.4 million as at 31 December 2019.

Revenue from sales in 2019 reached PLN 8 671.8 million, i.e. PLN 1 137.7 million, or 11.6%, lower than in 2018. The lower revenue was mainly the result of lower sales of coke by PLN 773.9 million, i.e. 19.2%, coal by PLN 313.5 million, i.e. 6.2%, and coal derivatives by PLN 132.6 million, i.e. 31.7%. The lower revenue from coke sales result from both a 17.1% decline in sales volume and 2.1% lower average sales price, while the lower revenue from coal sales are caused by a 6.7% decline in sales volume and 3.6% decline in sales prices for coking coal. The lower revenue from the sale of coal derivatives resulted from a lower average sales price for tar (by approx. 32.0%) and BTX (by approx. 20.0%). Revenue from other activities increased in 2019, as compared to 2018, by PLN 82.3 million, i.e. 30.1%, mainly due to the recognition of the acquired PBSz's revenue for the period from 1 July to 31 December 2019.

The Group's profit before tax for 2019 reached PLN 828.0 million. After tax (amounting to PLN 178.4 million), net result was PLN 649.6 million, down by PLN 1 111.2 million, i.e. 63.1%, from 2018. Having included the measurement of hedging instruments amounting to PLN 38.9 million, along with income tax of PLN -7.4 million and actuarial losses of PLN -54.8 million, along with income tax of PLN 10.4 million in other comprehensive income, total comprehensive income reached PLN 636.7 million.

Cash from operating activities

The positive net cash flows from operating activities generated by the Group in 2019 of PLN 1 140.3 million (mainly due to pre-tax profit of PLN 828.0 million and depreciation amounting to PLN 1 033.9 million) were not fully sufficient to cover investment expenditures, especially on the purchase of property, plant and equipment (PLN 2 040.5 million), and financial expenditures (payment of a dividend of PLN 200.8 million to shareholders, buy-back of debt securities of PLN 121.0 million). Other factors having impact on cash flows from operating activities are presented in Note 8.1. of JSW Group's consolidated financial statements for the financial year ended 31 December 2019.

Cash from investing activities

Cash used in investing activities in 2019 reached PLN -2 260.5 million, comparing to an increase of PLN 678.8 million in 2018. The main investment expenditure in 2019 constitutes the purchase of property, plant and equipment, amounting to PLN 2 040.5 million. Moreover, the Group purchased PBSz for PLN 199.0 million, while recognising the impact of PBSz's cash and equivalents of PLN 28.1 million (the total impact of the transaction was PLN 170.9 million).

Cash from financing activities

Net cash flows from financing activities at the end of 2019 reached PLN -180.3 million, compared to PLN -755.8 million in 2018. In the analysed period, this amount includes a dividend payment to shareholders of PLN 200.8 million, payments related to leases of PLN 121.4 million, buy-back of debt securities of PLN 121.0 million and credit and loans received, amounting to PLN 337.1 million.

As a result of the aforementioned events, cash and equivalents at 31 December 2019 amounted to PLN 350.3 million. The change in net cash and equivalents was PLN -1 300.5 million.

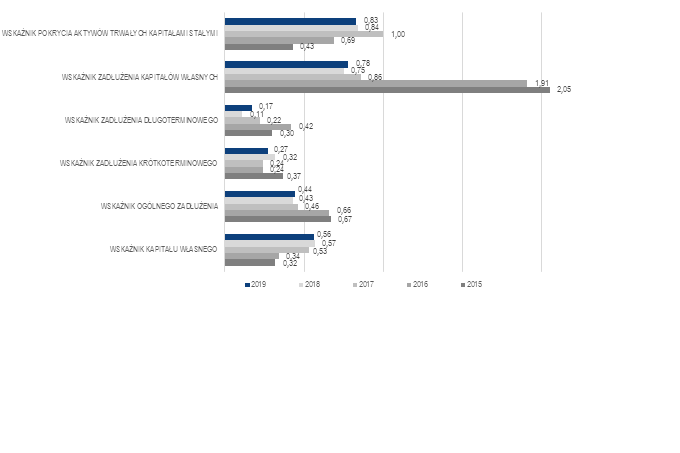

Selected financial ratios in JSW

JSW's debt and financing structure

As at 31 December 2019, the share of liabilities in JSW's financing, measured using the debt ratio, was 0.44, compared to 0.43 at the end of 2018. At the end of 2019, JSW had lease-related debt worth PLN 685.3 million and credit and loans worth PLN 299.0 million. Long-term debt ratio increased by 54.5% as a result of an increase in non-current liabilities by PLN 902.7 million, i.e. 62.6%, including mainly leases by PLN 458.4 million and credit and loans by PLN 277.3 million. Short-term debt ratio from 0.32 at the end of 2018 to 0.27 at the end of 2019, mainly as a result of a decrease in current liabilities by PLN 599.8 million, including trade payables by PLN 542.9 million and lower liabilities related to suppliers, works and services by PLN 434.7 million.

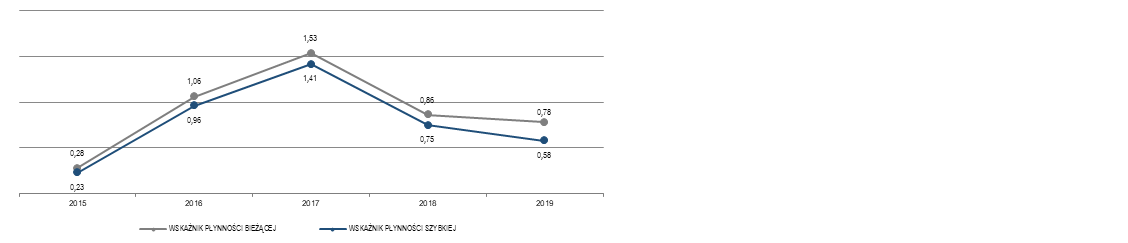

Liquidity

The current ratio for 2019 reached 0.78, declining by 9.3% from 2018, while the quick ratio decreased by 22.7%, from 0.75 at the end of 2018 to 0.58 at the end of 2019. The lower liquidity ratios are due to a decrease in current assets by PLN 848.6 million, i.e. by 23.6%, including cash and equivalents by PLN 1 332.4 million and trade and other receivables by 659.1 million, alongside growth in current financial assets by 700.0 million (in connection with the transfer of some investment certificates from non-current assets) and an increase in inventory by PLN 243.7 million. At the same time, current liabilities (without current provisions) declined by 618.4 million, i.e. 14.8%, mainly due to a decrease in trade payables and other liabilities by PLN 542.9 million, including supplies, works and services by PLN 434.7 million.

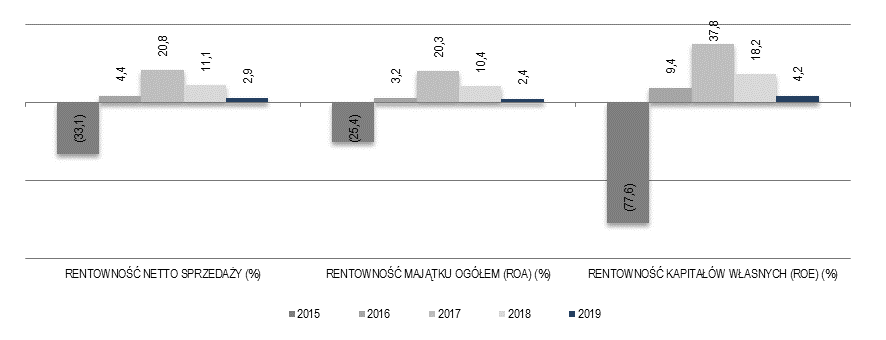

Profitability

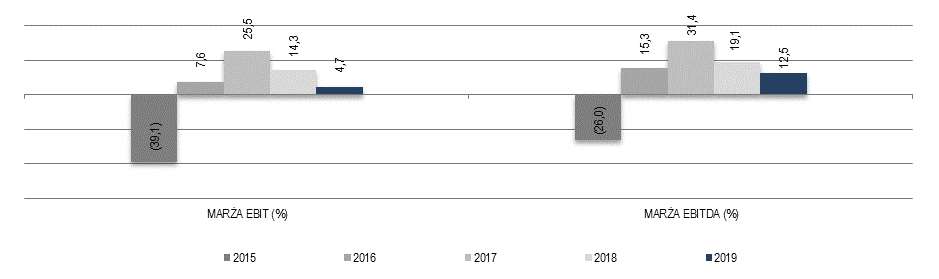

An analysis of profitability ratios shows that despite a PLN 320.9 million increase in cost of coal sold and lower revenue from the sale of coal produced by JSW by PLN 699.3 million, caused by a decline in the average sales price for coal and the quantity of coal sold, JSW is operating effectively. EBITDA for 2019 reached PLN 1 406.9 million, compared to PLN 2 437.9 million in 2018, denoting a decrease by PLN 1 031.0 million.

EBITDA margin decreased by 6.6 percentage points, from 19.1% in 2018 to 12.5% in 2019. EBIT margin reached 4.7%, meaning that within JSW's core business every one million zlotys in revenue from sales generated approx. 47 thousand zlotys in operating profit. In comparison with 2018, EBIT margin was lower by 9.6 percentage points.

Net sales margin reached 2.9%, i.e. 8.2 percentage points lower than in 2018. Return on assets and return on equity show that JSW's assets and equity were being used effectively in 2019.

Production of coal and coke

An unfavourable market situation led to down-trends on the coal and coke markets. In comparison with 2018, coal production decreased by 1.3% (coking coal production decreased by 1.0%, while coal for energy purposes declined by 2.1%), while coke production declined by 11.1%.

Mining cash cost

In 2019, mining cash cost reached 426.00 PLN/t, i.e. 29.54 PLN/t (7.5%) higher than in 2018, reached led to a 5.6% increase in expenditures on coal production and coal output lower by 0.2 Mt.

Cash conversion cost

In 2019 cash conversion cost reached PLN 191.78 PLN/t and was PLN 30.10 PLN/t, i.e. 18.6%, higher than in 2018, driven by expenditures on coke production up by 32.7%, i.e. 5.7%, and lower volume of coke produced for sale by 0.4 Mt, i.e. 11.1%.

Employment

As of 31 December 2019, the Group had 30 629 employees, compared to 28 268 at 31 December 2018. The growth in headcount at JSW results from implementing the expected production tasks and was also intended to limit the negative impact of weak potential offered by external providers of services to JSW's mines. In addition, in 2019 the Group absorbed PBSz, which employs 1 231 people. Average employment at the Group was 29 440. Comparing to the same period of last year, the headcount was higher by 2 233 persons.

Selected non-financial information regarding the business are presented in the section concerning sustainable development at JSW.