JSW's shares have been listed on the Warsaw Stock Exchange since 6 July 2011. The securities are traded in PLN.

In 2019, JSW S.A.'s shares were part of the following indexes:

- price-type: WIG, WIG20, WIG30, RESPECT Index, WIG-ESG (from 3 September 2019),

- income-type: WIG-Poland index, WIG-Górnictwo index.

JSW was also a constituent of MSCI Poland until 26 November 2019.

The lowest closing price for JSW S.A. shares in 2019 was PLN 18.80, recorded on 4 December 2019, while the highest closing price was PLN 70.38, recorded on 5 February 2019. At the end of the reporting period, the share price was PLN 21.38. The average daily trading volume in 2019 was 521 585 shares.

| SHARE DATA |

2019 |

2018 |

2017 |

2016 |

2015 |

| Number of shares at the end of the year |

117,411,596 |

117,411,596 |

117,411,596 |

117,411,596 |

117,411,596 |

| Minimum closing price (PLN) |

18.80 |

63.00 |

60.21 |

8.77 |

10.00 |

| Maximum closing price (PLN) |

70.38 |

108.15 |

106.95 |

87.50 |

25.96 |

| Closing price on last quotation date (PLN) |

21.38 |

67.26 |

96.27 |

66.90 |

10.65 |

| Capitalisation at year-end (PLNm) |

2,510.3 |

7,897.1 |

11,303.2 |

7,854.8 |

1,250.4 |

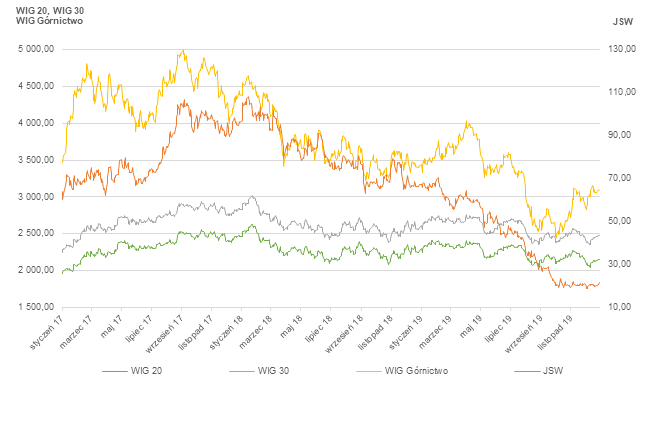

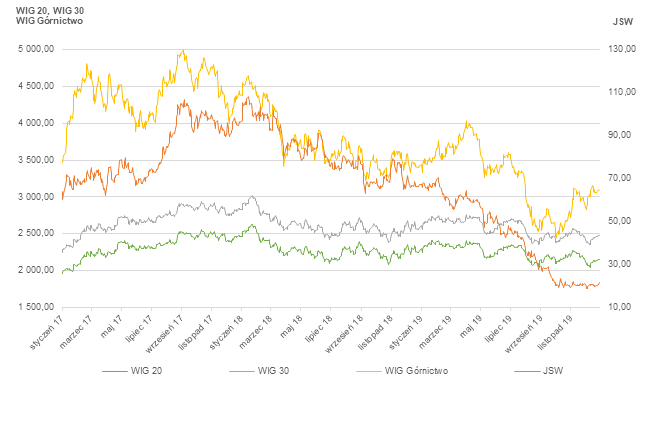

In the analysed period, the average closing price for JSW's shares was PLN 42.91, and the difference between the price at the beginning and the end of the reporting period was a negative 68.14%. For comparison, during the same period indexes fell as follows: WIG20 by 6.58%, WIG30 by 5.37%, WIG-Górnictwo by 10.04%.

The following chart contains JSW S.A.'s share price along with the WIG20, WIG30 and WIG-Górnictwo indexes in 2017-2019:

Chart. JSW S.A. share price vs selected Polish mining-sector companies

Chart. JSW S.A. share price vs international markets (selected companies)

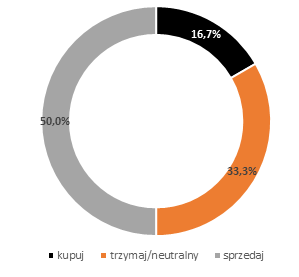

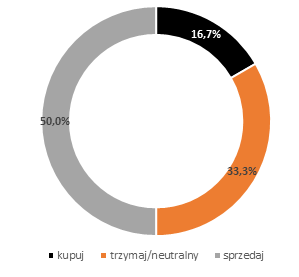

Recommendations for JSW shares

36 recommendations from brokerage firms were issued for JSW in 2019. Six recommendations from four brokerages were a buy, 12 recommendations from eight brokerages were a neutral (hold), while 18 recommendations from eight brokerages were a sell.

The following chart presents a percentage structure for these recommendations:

Proper reporting based on good practices, regular Management Board meetings with analysts, investors, reporters and employee representatives as well as convenient and on-going contact with people in charge of investor relations constitute a pillar of our information policy and the key communications rules in place at our company.

All of the aforementioned activities contribute to the Company's credibility in the widely-understood market surrounding. Credibility results from caring about contacts with the market, which remains a priority for us.

Communication with the capital market

In order to uphold a desired image amongst JSW's stakeholders as well as positive standards for communicating with capital market participants, JSW continues its efforts to provide reliable information in line with the highest standards for this area. Communication with the market in 2019 was done through the following:

- publishing current and periodic reports,

- organising meetings and conferences,

- giving interviews,

- correspondence,

- participating in investor conferences.

Each time JSW published a periodic report, it organised an earnings conference for investors, analysts and reporters on the WSE, during which management board members discussed financial results. The conferences were broadcast live online in both Polish and English.

JSW was also an active participant in over a dozen meetings and conferences with investors in Poland and abroad, the most important of which include:

- 7th edition of CEE Capital Markets Conference - London 2019 (18-19 March 2019), organised by PKO Bank Polski, with representatives of companies from CEE and institutional investors.

- Investor's Day (23 May 2019) - meetings at JSW's Warsaw office with institutional investors.

- Parkiet Challenge (13 May - 18 June 2019) - the company participated in a competition for retail investors organised by Gazeta Giełdy Parkiet. Materials promoting the company were published in the newspaper during that time and two interviews were shown on Parkiet TV.

- Conference for Individual Investors WallStreet 23 (31 May - 2 June 2019) - with approx. 1000 participants: active individual investors from around the country, management board representatives from WSE, KDPW and other capital-market institutions. Our CEO gave an interview for the conference newspaper - WallStreet Voice.

- 16th Annual Emerging Europe Investment Conference (9-10 September 2019) organised by PEKAO IB, with the participation of representatives of companies from CEE and institutional investors.

- 9th edition of the conference "Investor's day: Energy, mining and fuels" (25-26 September 2019), organised by DM PKO PB, with the participation of representatives of companies from CEE and institutional investors.

- ESG conference initiated by WSE and NN TFI (25 November 2019).

- 5th edition of the conference Energy, Commodity and Fuel Sector Companies (26 November 2019), hosted by Santander DM.

- 8th edition of WOOD's Winter Wonderland EME Conference (5-6 December 2019), organised by Wood & Co.

The investor relations section of the website was also being regularly updated, with a range of financial and operating data available in editable formats making it possible to compare them with historic data. The website also featured video recordings of all of the Company's earnings conferences and general meetings.

Given the dynamic nature of the capital market, investor interest and the needs of various stakeholder groups, the investor relations team was continuously available, quickly responding to any interest in the Company shown by market participants.

A diligent approach to compliance with legally-mandated information obligations as well as activities intended to maintain high standards for communications and business transparency allowed the Company to remain part of the RESPECT Index and now the WIG-ESG index. In 2019, JSW published its first online integrated annual report for 2018.

Capital-market participants and entities can contact the Stock Market Relations Office, which is headed by Director Krzysztof Solus - e-mail: [email protected], and are invited to follow JSW's Investor Relations, available here: https://www.jsw.pl/relacje-inwestorskie/

Reporting schedule for 2020

19 march 2020

ANNUAL REPORT for 2019

21 may 2020

QUARTERLY REPORT for Q1 2020

20 august 2020

SEMI-ANNUAL REPORT za H1 2020

19 november 2020

QUARTERLY REPORT za Q3 2020

JSW's share capital in 2019 amounted to PLN 587 057 980.00 and was divided into 117 411 596 ordinary shares with a nominal value of PLN 5.00 each, including: 99 524 020 series A shares, 9 325 580 series B shares, 2 157 886 series C shares and 6 404 110 series D shares. The total number of votes at JSW's General Meeting arising from all outstanding JSW shares is 117 411 596.

In accordance with the most recent statutory notice from 2012, received from a shareholder directly or indirectly through subsidiaries holding at least 5% of total votes at JSW's General Meeting (current report 40/2012 of 30 November 2012), JSW's ownership structure is as follows:

| Shareholder* |

Number of shares |

Number of General Meeting votes |

% stake in share capital |

% share of total number of General Meeting votes |

| State Treasury |

64,775,542 |

64,775,542 |

55.16% |

55.16% |

| Other shareholders |

52,636,054 |

52,636,054 |

44.84% |

44.84% |

| TOTAL |

117,411,596 |

117,411,596 |

100.00% |

100.00% |

*In accordance with current report 45/2019 of 3 July 2019, the State Treasury was a shareholder with at least 5% of votes at the last General Meeting on 26 June 2019 and resumed after a break on 3 July 2019, with 64 388 780 votes, which constituted 54.84% of total votes.

Rights from JSW's shares held by the State Treasury are exercised by the minister competent for state asset affairs.

The Company has not issued any securities that would carry special control authorisations.

Restrictions concerning the exercise of voting rights are described in detail in § 9 of the Articles of Association, available at the Company's website www.jsw.pl.

These restrictions are as follows:

- The voting rights of shareholders with over 10% of the Company's voting rights are limited in that no such shareholder may exercise more than 10% of voting rights at the Company's General Meeting.

- The voting right restriction referred to in sec. 1 does not apply to the State Treasury and its subsidiaries during the period in which the State Treasury and subsidiaries hold shares in the Company entitling to at least 34% plus one votes.

- Votes belonging to shareholders linked by a relationship of control or subordination in the meaning of § 9 of the Articles of Association (Shareholder Group) are accumulated; if the accumulated number of votes exceeds 10% of the Company's total votes, it is reduced. Rules for accumulating and reducing votes are specified in sec. 6 and 7 below.

- A shareholder in the meaning of § 9 point 4 of JSW S.A.'s Articles of Association is any person, including its parent company and subsidiary, who is directly or indirectly entitled to a voting right at the General Meeting based on any legal title; this also applies to persons who do not hold the Company's shares, especially users, pledgers, persons authorised under depositary receipts in the meaning of the Act of 29 July 2005 on trade in financial instruments, as well as persons authorised to participate in the General Meeting despite having sold their shares after the General Meeting record date.

- For the purposes of § 9 sec. 5, parent and subsidiary are understood as a person:

- entities remaining in a relationship of control or subordination within the meaning of the Polish Commercial Companies Code,

- entities having the status of a parent company, subsidiary or simultaneously parent and subsidiary, within the meaning of the Act on Competition and Consumer Protection of 16 February 2007; or

- entities having the status of a parent, higher-level parent, subsidiary, lower-level subsidiary, co-subsidiary, and at the same time having the status of parent (including higher-level parent) and subsidiary (including lower-level subsidiary and co-subsidiary) within the meaning of the Accounting Act of 29 September 1994; or

- entity that exerts (parent) or is subject to (subsidiary) decisive influence within the meaning of the Act of 22 September 2006 on transparency of financial relations between public authorities and public enterprises and financial transparency of certain enterprises; or

- entities the votes of which result directly or indirectly from the Company's shares, are accumulated with the votes of another entity or other entities on the principles set forth in the Act of 29 July 2005 on public offerings and the terms for introducing financial instruments to an organised trading system and on public companies, in connection with holding, selling or acquiring significant stakes in the Company.

- Vote accumulation involves adding up the number of votes held by individual shareholders in a Shareholder Group.

- Vote reduction involves reducing the total number of votes in the Company at the General Meeting vested in the shareholders from a Shareholder Group, to the level of 10% of total votes in the Company. Vote reduction is effected according to the following principles:

- the number of votes of a shareholder holding the largest number of the Company's votes from among all shareholders in the Shareholder Group is reduced by the number of votes equal to the surplus above 10% of all the votes in the Company vested jointly in all shareholders in that Shareholder Group,

- if despite the reduction referred to in point 1) above the total number of votes at the General Meeting vested in shareholders from a Shareholder Group exceeds 10% of the Company's total votes, votes held by the other shareholders in the Shareholder Group are reduced. The votes of individual shareholders are reduced in the order determined on the basis of the number of votes held by individual shareholders from the Shareholder Group (from the largest to the smallest). Further reduction is carried out until the total number of votes held by shareholders in the Shareholder Group does not exceed 10% of the Company's total votes,

- in each case a shareholder whose voting rights are reduced retains the right to exercise at least one vote,

- vote reduction also applies to shareholders who are not present at the General Meeting.

- Each shareholder intending to participate in a General Meeting, either directly or through an attorney, is required, without the separate notice referred to in sec. 9 below, to notify the Management Board or the General Meeting Chairperson if it holds directly or indirectly more than 10% of the Company's votes.

- Irrespective of sec. 8 above, in order to determine the basis for vote accumulation and reduction, the Company's shareholders, Management Board, Supervisory Board and specific members of these organs may demand that a shareholder provides information on whether it is an entity having the status of parent or subsidiary in respect of another shareholder in the meaning of § 9 of the Articles of Association. The authorisation referred to in the preceding sentence also covers the right to demand disclosure of votes a shareholder holds independently or together with other shareholders.

- A person who fails to comply, or incorrectly complies, with the information obligation referred to in sec. 8 and 9 above, may exercise voting rights attached to one share only, until the information obligation is complied with; the exercise of voting rights by this person in respect of other shares is invalid.

Restrictions with regard to transferring the ownership of securities result from the provisions of law, including the Act on rules for managing state assets.

In accordance with the existing provisions of § 8 in the Company's Articles of Association, shares belonging to the State Treasury may not be sold and may not be donated to local government units or an association of local government units.