Results and perspectives by segments

Segments

The Group is organised and managed on a segment basis, taking into account the type of goods and the type of production activity. JSW's Management Board has identified operating segments based on the financial reporting of Group companies. Following an analysis of aggregation criteria and quantitative thresholds, the following operating segments are reported in the Group's consolidated financial statements:

coal segment

mining and selling hard coal14.8 Mt

of coal producedPLN 2,050.7

million in investment expenditurescoke segment

producing and selling coke and coal derivatives3.2 Mt

of coke producedPLN 115.0

million in investment expendituresother segments

other activities of Group subsidiariesPLN 355.7

million in revenue from salesPLN 234.0

million in investment expendituresWe realise that achieving a range of smaller, partial objectives is essential in reaching an optimal value-creation model. These objectives are related to both securing coal resources and guarantee quality and improved efficiency. These targets are related to implementing innovative technical and technological solutions, optimising energy-intensity, caring for people and their safety and concern for the natural environment.

In 2019, the Group focused on development and growth in productivity across all of its segments.

Table. Financial results by segment

| ITEM | COAL SEGMENT | COKE SEGMENT | OTHER SEGMENTS | |||

|---|---|---|---|---|---|---|

| 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | |

| Revenue from sale to external customers | 4,771.1 | 5,084.6 | 3,545.0 | 4,451.5 | 355.7 | 273.4 |

| Operating profit/(loss) | 478,1 | 1,753.1 | 259.5 | 416.4 | 93.2 | 84.9 |

| Depreciation | 878.6 | 612.1 | 103.4 | 100.2 | 108.9 | 64.4 |

| EBITDA | 1,356.7 | 2,365.2 | 362.9 | 516.6 | 202.1 | 149.3 |

Revenue from the sale of coal to external customers in 2019 reached PLN 4 771.1 million, denoting a 6.2% decline in comparison to 2018. During the reporting period, revenue from the sale of coke reached PLN 3 545.0 million, down by 20.4% compared to 2018. The decline in revenue from sales is mainly caused by lower sales volumes (coal by 6.7% and coke by 17.1%).

During the reporting period, revenue from the five largest external customers in the coal segment accounted for 73.8% of this segment's total revenue (2018: 72.9%). The other customers, none of which exceeded 10.0% of revenue, collectively accounted for 26.2% of coal-segment revenue. Revenue from the five largest external customers in the coke segment accounted for 69.6% of this segment's total revenue (from 1 January to 31 December 2018: 59.0%). The other customers, none of which exceeded 10.0% of revenue, collectively accounted for 30.4% of coke-segment revenue.

Coal segment

The Group's mining activities are spread out over five mines.

- KWK Borynia-Zofiówka,

- KWK Jastrzębie - Bzie,

- KWK Budryk,

- KWK Knurów-Szczygłowice,

- KWK Pniówek.

All of the mines operate within the geographic boundaries of their respective concession areas, with specified concession validity dates, surface areas and depths. The mines operate in the south-western part of the Upper Silesian Coal Basin, within and in the vicinity of the following cities and towns: Jastrzębie-Zdrój, Żory, Knurów, Mikołów, Gliwice, Pszczyna, Świerklany, Suszec, Pawłowice, Mszana, Zebrzydowice, Orzesze, Ornontowice, Gierałtowice as well as Czerwionka-Leszczyny and Pilchowice, covering a total area of 209.4km2.

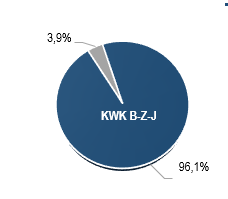

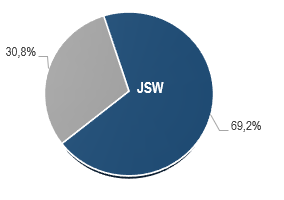

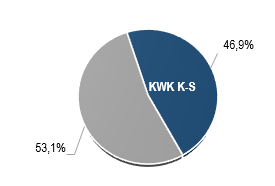

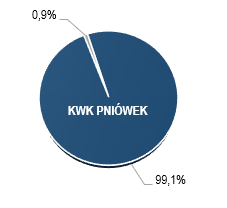

JSW Group's coal production structure in 2019

The Group's coal output structure results from the present geological conditions at the mines, dynamically changing market needs and the supply and demand situation on the domestic and foreign markets.

The share of coking coal and coal for energy-generation purposes in total net output in 2019 was 69.2% and 30.8%, respectively.

In 2019, the Group's mines produced and sold type-35 coals and type-34 coals with solid physical, chemical and coking parameters. The Borynia-Zofiówka-Jastrzębie (Ruch Borynia and Zofiówka) and Pniówek mines produced high-quality type-35 coal, mainly for the production of blast-furnace coke. The Budryk and Knurów-Szczygłowice mines produced high-quality type-34 coals used in the production of blast-furnace coke and heating coke.

Quality surveys of in-seam and commercial coal at the Budryk and Szczygłowice mines confirm the expected change in its properties towards type-35 coals, i.e. a lower content of volatile materials, high level of dilatation and high swelling index. The Budryk and Knurów-Szczygłowice mines also produce coal for energy-generation purposes, which is used by power plants and heat-and-power plants to generate electric and thermal energy.

Table. Key quality parameters for coal produced by the Group in 2019 (average values))

| CATEGORY | KWK BORYNIA - ZOFIÓWKA - JASTRZĘBIE | KWK PNIÓWEK | KWK KNURÓW-SZCZYGŁOWICE | KWK BUDRYK | |||||

|---|---|---|---|---|---|---|---|---|---|

| Ruch Borynia | Ruch Zofiówka | Ruch Knurów | Ruch Szczygłowice | ||||||

| COKING COAL | |||||||||

| Ash content Ad (%) | 6.6 | 6.8 | 6.8 | 7.6 | 7.3 | 7.1 | |||

| Moisture content Wtr (%) | 11.3 | 10.2 | 9.1 | 7.0 | 7.3 | 6.8 | |||

| Sulphur content Std (%) | 0.62 | 0.47 | 0.62 | 0.66 | 0.52 | 0.62 | |||

| Volatile materials content (Vdaf %) | 24.3 | 21.2 | 26.3 | 32.8 | 30.5 | 30.8 | |||

| Coke Strength after Reaction (CSR %) | 78 | 71 | 81 | 76 | 76 | 82 | |||

| Coke Reactivity Index (CRI %) | 61.4 | 52.5 | 62.6 | 41.0 | 42.1 | 45.9 | |||

| Reakcyjność koksu wobec CO2 (CRI %) | 27.2 | 37.5 | 24.3 | 40.4 | 39.8 | 37.7 | |||

| COAL FOR ENERGY-GENERATION PURPOSES | |||||||||

| Ash content Ar (%) | - | 28.0 | 13.7 | 24.7 | 23.8 | 27.1 | |||

| Moisture content Wtr (%) | - | 14.7 | 3.2 | 9.4 | 9.3 | 9.1 | |||

| Sulphur content Str (%) | - | 0.37 | 0.67 | 0.68 | 0.52 | 0.60 | |||

| Calorific value (Qir MJ/kg) | - | 18.8 | 28.7 | 21.8 | 22.2 | 21.2 | |||

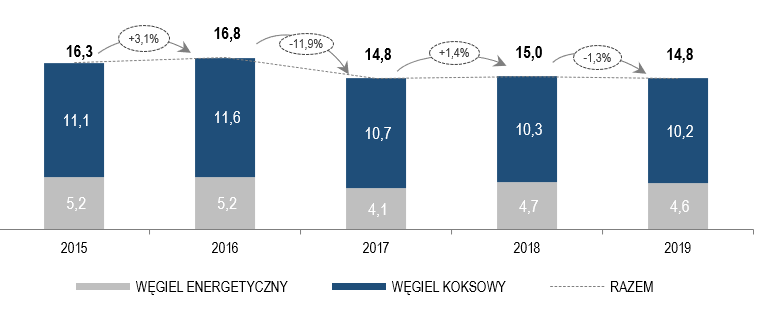

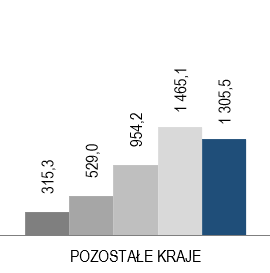

Chart. Coal production at the Group in 2015-2019 (Mt)

A total of 13.8 Mt of coal produced at the Group's mines was sold, including intra-group and external supplies, i.e. 1.0 Mt less than in 2018. The decline consisted of a 0.5 Mt decrease in coking coal sales and a 0.5 Mt decrease in coal for energy purposes, which is directly related to the difficult situation on the coke and steel markets and in the energy-generation industry. By intended use of coal - coking coal sales accounted for 71.8% of the Group's total supplies, while the remaining 28.2% was coal for energy purposes with calorific values in line with customer requirements.

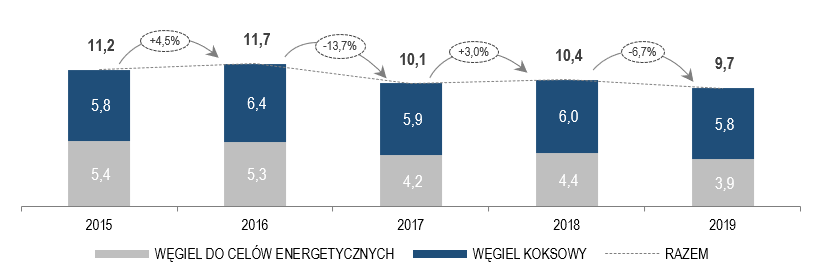

Chart. Sale of coal to external customers in 2015-2019 (Mt)

The declines were caused by a difficult situation on the coke and steel markets, leading to reduced demand from counterparties for coking coal supplies. During the reporting period, the sale of coal for energy-generation purposes to external customers also fell by 0.5 Mt in comparison to the preceding year, which was due to limited energy coal purchases by domestic power plants because of lower-than-planned electricity production.

Table. Coal production and sales, including intra-group sales

| ITEM | 2019 | 2018 | 2017 | 2016 | 2015 | CHANGE 2018=100 |

|---|---|---|---|---|---|---|

| Production (Mt) | 14.8 | 15.0 | 14.8 | 16.8 | 16.3 | 98.7 |

| - Coking coal (Mt) | 10.2 | 10.3 | 10.7 | 11.6 | 11.1 | 99.0 |

| - Coal for energy-generation purposes (Mt) | 4.6 | 4.7 | 4.1 | 5.2 | 5.2 | 97.9 |

| JSW's total sales (Mt)1 | 13.8 | 14.8 | 14.6 | 17.2 | 16.6 | 93.2 |

| - Coking coal (Mt) | 9.9 | 10.4 | 10.4 | 11.8 | 11.1 | 95.2 |

| - Coal for energy-generation purposes (Mt) | 3.9 | 4.4 | 4.2 | 5.4 | 5.5 | 88.6 |

| Intra-group sales (Mt)1 | 4.1 | 4.4 | 4.5 | 5.5 | 5.4 | 93.2 |

| - Coking coal (Mt) | 4.1 | 4.4 | 4.5 | 5.4 | 5.3 | 93.2 |

| - Coal for energy-generation purposes (Mt) | - 2 | - 2 | - | 0.1 | 0.1 | - |

| Sales to external customers (Mt)1 | 9.7 | 10.4 | 10.1 | 11.7 | 11.2 | 93.3 |

| - Coking coal (Mt) | 5.8 | 6.0 | 5.9 | 6.4 | 5.8 | 96.7 |

| - Coal for energy-generation purposes (Mt) | 3.9 | 4.4 | 4.2 | 5.3 | 5.4 | 88.6 |

| Revenue from sale of coal (in PLNm)3 | 7 688.0 | 8 296.6 | 7 929.2 | 5 846.2 | 5 724.3 | 92.7 |

| Revenue from sale of coal between segments (in PLNm) | 2 916.9 | 3 212.0 | 3 003.3 | 2 294.6 | 2 274.9 | 90.8 |

| Revenue from sale of coal to external customers (in PLNm) | 4 771.1 | 5 084.6 | 4 925.9 | 3 551.6 | 3 449.4 | 93.8 |

(2) no impact on values in Mt due to low volume,

(3) this value takes into account the Group's additional revenue in 2019, 2018, 2017, 2016 and 2015, as follows: PLN 315.9 million, PLN 225.2 million, PLN 245.0 million, PLN 99.0 million and PLN 302.9 million for the sale of coal produced outside of the Group.

For external sales, coal supplies to domestic customers accounted for 78.7% (volume) and 71.7% (revenue), while foreign markets accounted for 21.3% and 28.3%, respectively. For comparison's sake, in 2018 these figures were respectively: domestic customers 78.7% (volume) and 71.2% (revenue); foreign customers 21.3% (volume) and 28.8% (revenue).

In 2019, revenue from sales to external customers in the coal segment reached PLN 4 771.1 million, down by PLN 313.5 million (6.2%) from 2018, due to an unfavourable market situation.

Coke segment.

An unfavourable market situation led to down-trends on the coke market as well. In comparison with 2018, coke production decreased by 11.1%, while sales were down by 17.1%.

Table. Production and sale of coke, including revenue from sale of coke and coal derivatives

| ITEM | 2019 | 2018 | 2017 | 2016 | 2015 | CHANGE 2018=100 |

|---|---|---|---|---|---|---|

| Production (Mt)(1) | 3.2 | 3.6 | 3.5 | 4.1 | 4.2 | 88.9 |

| Sale of coke (Mt) | 2.9 | 3.5 | 3.5 | 4.1 | 4.0 | 82.9 |

| Revenue from sales (in PLNm)(2) | 3,545.0 | 4,451.5 | 3,688.1 | 2,822.7 | 3,051.8 | 79.6 |

(2) revenue from sale of coke and coal derivatives.

Other segments

The Group's other activity includes various types of support activities, including in the areas of innovations, IT, logistics, repair and maintenance services, laboratory and insurance services.

The Group includes:

Centralne Laboratorium Pomiarowo-Badawcze Sp. z o.o. - provides research services concerning coal, ash from coal, coke, slag, solid by-products from combustion of solid fuels, mining rock aggregate and mining waste, as well as services related to monitoring CO2 emission volumes and measuring oxidation rates. The company also provides inspection services concerning solid fuels, training activities and expert analyses consisting of comparing coal and ash from coal research between laboratories. The company has a leading role in consolidating the Group's laboratory activities.

JSW IT SYSTEMS Sp. z o.o. - provides services in the area of IT, production and assembly of electronic equipment, development and sale of software. The company is currently a supplier of modern and innovative solutions for the Group (on an outsourcing basis) and is implementing tasks related to the development and maintenance of a coherent IT system for the entire Group.

JSW Innowacje S.A. - the Group's research and development arm. The company's activities encompass all phases of the Group's R&D work, including feasibility studies and supervision of projects and deployments. JSW Innowacje’s strategy seeks to develop R&D activities, including the development of technologies and systems that increase the potential and capabilities of the Polish mining industry.

Jastrzębskie Zakłady Remontowe Sp. z o.o. - provides services concerning machinery and equipment repairs, maintenance and servicing for JSW's mines.

Jastrzębska Spółka Kolejowa Sp. z o.o. - provides railway lines, maintains railway infrastructure and equipment, builds and repairs rail systems and rail facilities, provides design services and expert opinions, forwarding services, road transport services, removal of mining damages as well as training, promotional and innovation activities.

JSW Logistics Sp. z o.o. - provides comprehensive service for a rail siding owned by Koksownia Przyjaźń S.A. and efficient flow of goods between the siding and the Dąbrowa Górnicza Towarowa railway station. It also provides technical maintenance services for the siding as well as domestic and international rail-based forwarding services based on own agreements with carriers and through sub-contractors.

Przedsiębiorstwo Gospodarki Wodnej i Rekultywacji S.A. - its activities include water abstraction, treatment and supply, collection and treatment of waste water, collection, processing, removal and utilisation of waste, services related to the management of green areas.

Jastrzębska Spółka Ubezpieczeniowa Sp. z o.o. - provides services consisting of insurance agency for the Group's employees as regards life insurance, personal claim settlement services for accident insurance, as well as tourism, hotel, food and cultural services. The company is a member of the Polish Chamber of Tourism and is an authorised host of tourist events.

JSW Szkolenie i Górnictwo Sp. .z o.o., - provides support services for mining, services for changing rooms at JSW's mines.

![]()

JSW Shipping Sp. z o.o. - its main activity is comprehensive service for port forwarding in Polish sea ports in Gdańsk, Gdynia, Świnoujście, Szczecin. It provides port forwarding services mainly for JSW Group and for others.

Sales prices

Coal market

JSW Group sets coal prices based on price indexes, taking into account quality differences between the Group's coals and index coals as well as its geographical advantage. No unpredictable one-off events were recorded in 2019, such as those having major impact on the prices of coking coal in previous years.

| ITEM | 2019 | 2018 | 2017 | 2016 | 2015 | CHANGE 2018=100 |

|---|---|---|---|---|---|---|

| AVERAGE SALES PRICES FOR COAL PRODUCED AT JSW | ||||||

| Coking coal (PLN/t) | 634.84 | 658.67 | 656.70 | 397.35 | 377.29 | 96.4 |

| Coal for energy-generation purposes (PLN/t) | 275.79 | 249.40 | 206.71 | 187.44 | 213.26 | 110.6 |

| Total (PLN/t)(1) | 490.99 | 486.32 | 471.10 | 302.07 | 298.35 | 101.0 |

| AVERAGE SALES PRICES FOR COKE | ||||||

| Coke (PLN/t)(2) | 1,072.79 | 1,095.37 | 936.01 | 583.53 | 648.49 | 97.9 |

(2)price based on FCA..

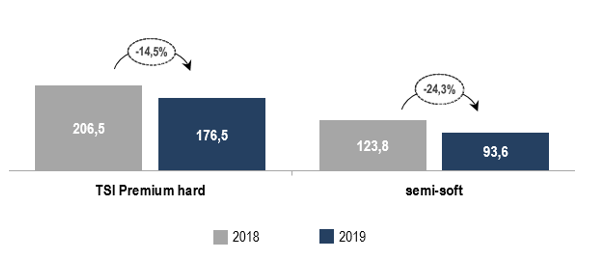

The TSI Premium HCC index remained stable in the first half of 2019, averaging 206.6 USD/t in Q1 2019 and 202.6 USD/t in Q2. In the second half of the year, the price of coking coal systematically fell, with TSI Premium HCC averaging in Q3 2019 160.1 USD/t and just 139.4 USD/t in Q4 2019. The average annual price in 2019 was 24.3% lower than a year earlier. The average of daily prices for the TSI Premium HCC index in full-year 2019 was 176.5 USD/t and was 14.5% lower than in 2018. Semi-soft coals recorded stronger declines than hard premium coals.

Chart. Spot prices of coking coals 2019 vs. 2018 [USD / t]

The declines in coking coal prices in H2 2019 resulted from lower demand for coal in maritime trade, given a lack of supply restrictions. The decline in demand in H2 2019 was driven by: restrictions in coking coal purchases by China, lower than expected demand from India and reduced steel production in Europe.

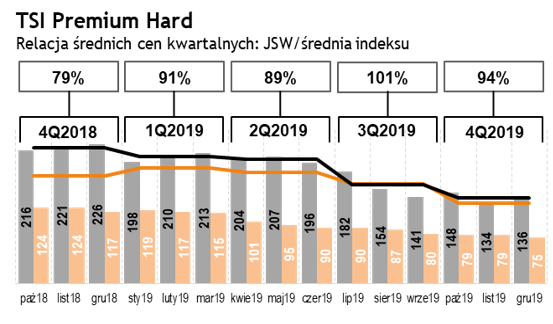

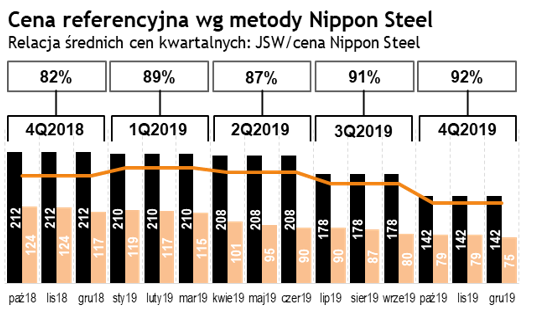

The average prices for coking coal sold by JSW Group to external customers, converted into USD using the average exchange rate published by the National Bank of Poland for a given quarter, in relation to the TSI index and a benchmark price calculated using Nippon Steel's methodology are shown in the following diagrams.

Chart. TSI Premium Hard

Relationship of average quarterly prices: JSW/index average

Chart. Reference price according to the Nippon Steel method

Relationship of average quarterly prices: JSW /Nippon Steel

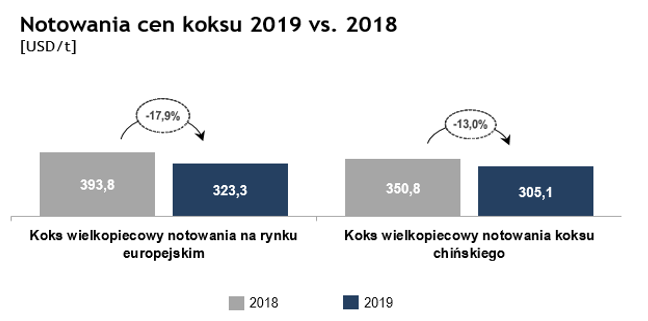

Coke market

Poland is a leading supplier of coke in the EU. Because the coke market is global, coke from Poland competes with suppliers not just from Europe but from all over the world, including from China, Russia and Colombia. Prices for blast-furnace coke on the European market averaged 323 USD/mt CIF ARA in 2019, denoting an 18% decline in comparison to 394 USD/mt CIF ARA in 2018. In 2019, the relation between the price of blast-furnace coke on the European market and contract prices for hard premium coking coal remained in a range considered as essential conditions for the efficient operation of coking plants.

Coke production in China reached 471 Mt in 2019, which constitutes approx. 70% of global coke production, with China recording an 8% increase over last year's output. It is estimated that global coke trade in 2019 reached 23.3 Mt, a 15% decline from the preceding year. Coke exports from China in 2019 reached 6.5 Mt, down by 33% from the previous year. The decline in coke exports from China is due to its loss of pricing competitiveness in comparison with other sources of this commodity.

Chart. Coke prices quotes 2019 vs. 2018 [USD / t]

The relations between average quarterly prices for coke based on FCA, converted into USD using the average exchange rate published by the National Bank of Poland for each quarter, and prices for blast-furnace coke on the European market and Chinese coke are shown on the following diagrams.

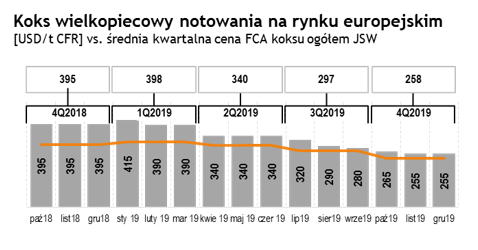

Chart. Blast furnace coke on the European market

[USD / t CFR] vs. JSW average quarterly FCA coke total price

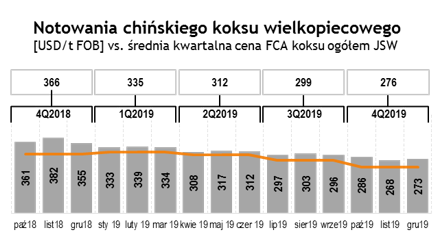

Chart. NChinese blast furnace coke

[USD / t FOB] vs. average quarterly FCA total price of coke JSWchart-13

Energy coal market

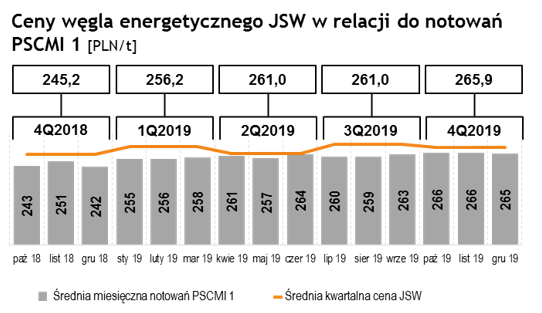

According to data from the Energy Market Agency, the use of hard coal by utility power plants in 2019 reached just under 36.1 Mt, down by 7% from the preceding year. Due to the above, mines producing coal for energy-generation purposes recorded inventory increases during the year. In 2019, the PSCMI1 index, depicting the price for coal for energy-generation purposes in sales to domestic utility and industrial power plants, increased by more than 9% from 2018. In contrast to domestic increases in prices, the average annual price for pulverised coal imported by sea to Western and Northern European countries through ARA ports (Amsterdam, Rotterdam, Antwerp) declined by more than 34% in 2019 to 60.2 USD/t.

Chart. JSW steam coal price in relation to PSCM 1 quotations [PLN / t]

Revenue

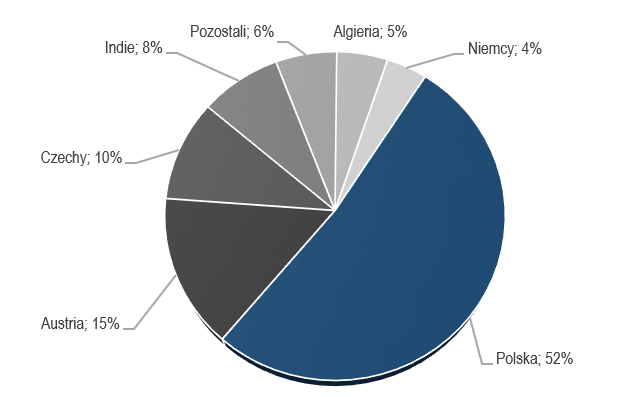

Poland is the main sales market for the coal produced by the Group. Europe is the main sales market for the coke produced by the Group. Due to market conditions and market diversification, overseas markets are also a major destination for coke sales, particularly India. The coke offered from Poland in overseas markets is successfully competing against coke from China, Russia, Ukraine or Colombia. Coal derivatives have long-term customers on the European market. Coke oven gas surpluses are sold to customers directly by the coking plants.

Revenue from the sale of coal, coke and coal derivatives by geographic region, according to end customers

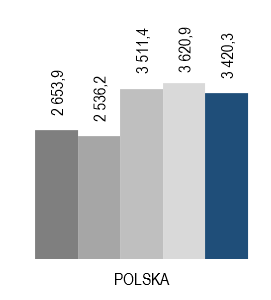

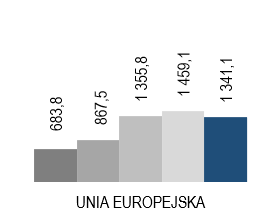

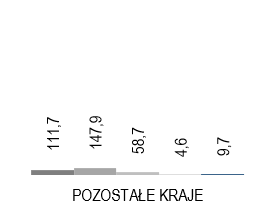

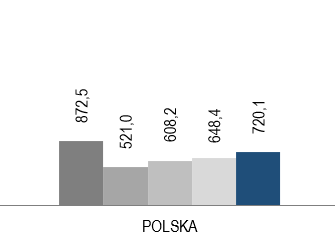

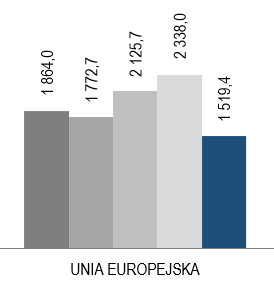

Chart. Revenue from coal sales (PLN million)

Chart. Revenues from the sale of coconut and coal derivatives (PLN million)

Chart. Revenue structure by destination countries as at 31 December 2019

Suppliers

The Group is required to apply the provisions of the Act of 29 January 2004 - Public Procurement Law. At the balance sheet date, the Group was required to organise public tenders for contracts exceeding EUR 443 thousand for goods and services, as provided for by the law.

Open tenders are the most frequently used method. Proposals can be submitted by all suppliers meeting the contracting entity's requirements. Prices set in the tender are in effect for the term of the contract. In the case of contracts below the threshold requiring the application of the Public Procurement Law, the Group selects suppliers based on internal regulations, most frequently in the form of an electronic auction or a request for proposal in the OFERTY system. On-going supplies of materials for mines are performed by the Production Support Entity.

Suppliers in the coal segment

The following companies were the largest suppliers in the coal segment in 2019:

Suppliers in the coke segment

The following companies were the largest suppliers to the Group's coking activities:

According to the Management Board, relations with supplies do not result in the Group's dependence on any one supplier in a way that could have an adverse impact on the Group's operations.

Investments

Equity investments

Equity investments in 2019 are described in point 2.4 of this report and in note 1.2. of JSW Group's consolidated financial statements for the financial year ended 31 December 2019.

Information on segments for reporting purposes

| Coal | Coke | Other segments * | Cibsikudation adjustments ** | Total | |

|---|---|---|---|---|---|

| FOR THE PERIOD ENDED 31 DECEMBER 2019 | |||||

| Total segment revenue from sale | 7,688.0 | 3,545.0 | 1,294.0 | (3,855.2) | 8,671.8 |

| - Revenue from sale between segments | 2,916.9 | - | 938.3 | (3,855.2) | - |

| - Revenue from sale to external customers | 4,771.1 | 3,545.0 | 355.7 | - | 8,671.8 |

| Segment gross profit on sales | 1,177.2 | 285.4 | 172.6 | (31.6) | 1,603.6 |

| Segment operating profit/(loss) | 478.1 | 259.5 | 93.2 | 74.8 | 905.6 |

| Depreciation | (878.6) | (103.4) | (108.9) | 57.0 | (1,033.9) |

| OTHER MATERIAL NON-CASH ITEMS: | |||||

| - Release of impairment losses on non-financial non-current assets | 5.6 | 189.8 | - | - | 195.4 |

| TOTAL SEGMENT ASSETS, INCLUDING: | 8,280.7 | 2,343.9 | 1,955.9 | (744.5) | 11,836.0 |

| Increases in non-current assets (other than financial instruments and deferred tax assets) | 2,424.1 | 107.5 | 528.7 | (318.1) | 2,742.2 |

**Column: "Consolidation adjustments" eliminate the effects of transactions between the Group's segments.

| Coal | Coke | Other segments* | Consolidation adjustments** | Total | |

|---|---|---|---|---|---|

| FOR THE PERIOD ENDED 31 DECEMBER 2018 | |||||

| Total segment revenue from sale | 8,296.6 | 4,451.5 | 1,003.3 | (3,941.9) | 9,809.5 |

| - Revenue from sale between segments | 3,212.0 | - | 729.9 | (3,941.9) | - |

| - Revenue from sale to external customers | 5,084.6 | 4,451.5 | 273.4 | - | 9,809.5 |

| Segment gross profit on sales | 2,146.1 | 677.3 | 143.4 | -95.7 | 2,871.1 |

| Segment operating profit/(loss) | 1,753.1 | 416.4 | 84.9 | -0.3 | 2,254.1 |

| Depreciation | -612.1 | -100.2 | -64.4 | 10.7 | -766 |

| OTHER MATERIAL NON-CASH ITEMS: | |||||

| - Recognition of impairment losses on tangible assets and intangible assets | (1,214.0) | - | - | - | (1,214.0) |

| - Release of impairment losses on tangible assets and intangible assets | 719.3 | - | - | - | 719.3 |

| - Release of impairment loss on KWK Krupiński tangible assets transferred from Suszec region to other facilities | 15.5 | - | - | - | 15.5 |

| - Release of provision for potential court disputes regarding free coal for pensioners | 653.5 | - | - | - | 653.5 |

| TOTAL SEGMENT ASSETS, INCLUDING: | 7,947.2 | 2,288.7 | 1,516.3 | -843.3 | 10,908.9 |

| Increases in non-current assets (other than financial instruments and deferred tax assets) | 1,471.9 | 50.1 | 241.3 | -48.8 | 1,714.5 |

**Column: "Consolidation adjustments" eliminate the effects of transactions between the Group's segments

Presented below is a reconciliation of segment results (operating profit) and profit before tax:

| 2019 | 2018 | |

|---|---|---|

| OPERATING PROFIT | 905.6 | 2,254.1 |

| Finance income | 26.5 | 40.1 |

| Finance costs | (104.4) | (101.8) |

| Share in profit/(loss) of associates | 0.3 | 0.1 |

| PROFIT BEFORE TAX | 828.0 | 2,192.5 |

Segment assets

Total asset amounts are measured in a way that is consistent with the method applied in the consolidated statement of financial position. These assets are allocated in line with the segment's business line and by the physical location of a given asset.

The Group's assets are located in Poland.

Presented below is a reconciliation of segment assets with the Group's total assets:

| 31.12.2019 | 31.12.2018 | |

|---|---|---|

| SEGMENT ASSETS | 11,836,0 | 10,908.9 |

| Investments in associates | 1.2 | 1.1 |

| Deferred income tax assets | 525.0 | 669.5 |

| Long-term investments in FIZ asset portfolio | 1,174.0 | 1,826.1 |

| Other non-current assets | 376.1 | 349.1 |

| Overpaid income tax | 162.8 | 0.7 |

| Financial derivative instruments | 60.5 | 7.2 |

| Short-term investments in FIZ asset portfolio | 700.0 | - |

| Other current financial assets | 90.8 | - |

| TOTAL ASSETS AS PER CONSOLIDATED STATEMENT OF FINANCIAL POSITION | 14,926.4 | 13,762.6 |

Material investments

| ITEM | 2019* | 2018 | 2017 | 2016 | 2015 | CHARGE 2018=100 |

|---|---|---|---|---|---|---|

| COAL SEGMENT | ||||||

| Expenditures on tangible assets (without operational headings), investment expenditures and intangible assets | 1,235.7 | 864.4 | 394.9 | 311.0 | 412.1 | 143.0 |

| Expenditures on operational headings | 531.8 | 541.4 | 459.1 | 380.2 | 385.0 | 98.2 |

| Expenditures on right-of-use assets | 283.2 | nd | nd | nd | nd | - |

| TOTAL | 2,050.7 | 1 405,8 | 854.0 | 691.2 | 797.1 | 145.9 |

| COKE SEGMENT | ||||||

| Expenditures on tangible assets and intangible assets | 115.0 | 50.1 | 45.3 | 71.4 | 49.8 | 229.5 |

| Expenditures on right-of-use assets | - | nd | nd | nd | nd | - |

| TOTAL | 115.0 | 50.1 | 45.3 | 71.4 | 49.8 | 229.5 |

| OTHER SEGMENTS | ||||||

| Expenditures on tangible assets and intangible assets | 150.5 | 212.7 | 123.4 | 250.6 | 209.6 | 70.8 |

| Expenditures on right-of-use assets | 83.5 | nd | nd | nd | nd | - |

| TOTAL | 234.0 | 212.7 | 123.4 | 250.6 | 209.6 | 110.1 |

| TOTAL SEGMENTS | ||||||

| Expenditures on tangible assets (without operational headings), investment expenditures and intangible assets | 1,501.2 | 1 127.2 | 563.6 | 633.0 | 671.5 | 133.2 |

| Expenditures on operational headings | 531.8 | 541.4 | 459.1 | 380.2 | 385.0 | 98.2 |

| Expenditures on right-of-use assets | 366.7 | nd | nd | nd | nd | - |

| TOTAL** | 2,399.7 | 1,668.6 | 1,022.7 | 1,013.2 | 1,056.5 | 143.8 |

| TOTAL (AFTER CONSOLIDATION ADJUSTMENTS) | 2,329.0 | 1,639.1 | 1,013.7 | 911.3 | 1,056.6 | 142.1 |

** Amount of expenditures prior to consolidation adjustments (in 2019: PLN -70.7 million, in 2018: PLN -29.5 million, in 2017: PLN -9 million, in 2016: PLN -101.9 million, in 2015: PLN 0.1 million).

Total expenditures in 2019, amounting to PLN 2 399.7 million include PLN 2 021.6 million on tangible assets, PLN 366.7 million on leases under IFRS 16 and PLN 11.4 million on intangible assets. No expenditures on investment properties were recorded.

Expenditures os asset inwestments at JSW

In 2019, the Parent incurred PLN 2 050.7 million in expenditures on asset investments, up by 45.9% from 2018. Investment expenditures in the analysed period included PLN 1 764.8 million on tangible assets, PLN 2.7 million on intangible assets and PLN 283.2 million on right-of-use assets (IFRS 16). The Parent's own funds as well as external financing were used to finance its investment expenditures in 2019.

The Parent's investment expenditures on tangible assets in 2019 concerned key tasks (vertical and horizontal expansion of mines) and other tasks, including the on-going maintenance of production capacities.

| ITEM | INVESTMENTS CARRIED OUT BY JSW IN 2019 |

|---|---|

| CONSTRUCTION OF LEVEL 1120 AT KWK BORYNIA-ZOFIÓWKA-JASTRZĘBIE RUCH BORYNIA | Works related to the construction of level 1120 at the mine KWK Borynia-Zofiówka-Jastrzębie Ruch Borynia were continued. Extractable resources expected to be accessed from level 1120m are estimated at approx. 40 Mt. These deposits mainly feature type-35 (hard) coking coal. The project is being implemented in two stages: stage I until 2023, consisting of accessing decks 502/1 and 504/1, together with a depth extension for shaft II; stage II in 2024-2030, consisting of accessing sections B and C from level 1120. Works related to drilling mining excavations were performed in 2019. The exploitation of resources through the extended shaft II is expected to begin in 2025. During the reporting period, expenditures on this investment amounted to PLN 15.7 million. |

| KWK BZIE-DĘBINA UNDER CONSTRUCTION | In 2019, the Parent continued works commenced in 2005 related to accessing and managing new deposits: "Bzie-Dębina 2-Zachód" and "Bzie-Dębina 1-Zachód" from level 1110m. Extractable resources are estimated at 174 Mt, down to 1300m. These deposits mainly feature type-35 (hard) coking coal. In 2019, expenditures on this investment amounted to PLN 71.1 million. In 2019, works related to the drilling of mining excavations and adapting shaft 1 Bzie for human transport were performed. Exploitation in section A of deposit "Bzie-Dębina 2-Zachód" is expected to begin in 2022. |

| EXPANSION OF MINE BORYNIA-ZOFIÓWKA-JASTRZĘBIE RUCH ZOFIÓWKA | In 2019, JSW continued its investment consisting of the construction of level 1080 at the mine Ruch Zofiówka in order to access and manage resources at the "Zofiówka" deposit below level 900. Extractable resources at the 900-1080 level are estimated at 43.2 Mt. In 2019, works related to a depth extension of shaft IIz to level 1080 and drilling of mining excavations were continued. During the reporting period, PLN 49.3 million was spent on the investment. |

| CONSTRUCTION OF NEW LEVEL AT MINE BUDRYK TOGETHER WITH MODERNISATION OF MECHANICAL COAL PROCESSING FACILITIES | JSW continued the construction of level 1290m, which had begun in 2007. Total extractable resources at level 1290m are estimated at 168.2 Mt, down to the depth of 1400m. In 2019, expenditures on this investment included the purchase of equipment for the Cz-2 face at deck 405/1. During the reporting period, expenditures on this investment amounted to PLN 165.3 million. The construction of a new level 1290, along with the modernisation of mechanical coal processing facilities, will make it possible to begin producing type-35 (hard) coal in 2020, increase coking coal production to approx. 65% in the mine's production structure and generate higher coal output overall. Some of the investment tasks, i.e. those pertaining to the modernisation of mechanical coal processing facilities in 2016-2020, are being implemented by JZR, with external financing from the Enterprise Development Fund. In 2019, expenditures on this investment amounted to PLN 31.1 million. Approx. 92.6% of the budget specified in Business Plan 1 for the investment related to modernising mechanical coal processing facilities at KWK Budryk was completed by the end of 2019. |

|

CONSTRUCTION OF LEVEL 1050 AT MINE KNURÓW-SZCZYGŁOWICE - RUCH KNURÓW |

JSW conducted works related to the management of resources at the 850-1050 level at mine Ruch Knurów. The project is intended to access high-quality type-34 coking coal resources. The total volume of documented extractable resources at the 850-1050 level of Ruch Knurów is 86.5 Mt. Works related to drilling mine excavations at level 1050 were performed in 2019. In 2019, expenditures on this investment amounted to PLN 16.0 million |

| CONSTRUCTION OF LEVEL 1050 AT MINE KNURÓW-SZCZYGŁOWICE - RUCH SZCZYGŁOWICE | The Parent conducted works related to the management of resources at the 850-1050 level at mine Ruch Szczygłowice. The project is intended to access high-quality type-35 coking coal resources. The total volume of documented extractable resources at the 850-1050 level of Ruch Szczygłowice is approx. 64.7 Mt. In 2019, expenditures on the purchase and installation of conveyor belts necessary to extend shaft I were incurred. During this period, PLN 1.4 million was spent on the investment. |

| EXTENSION OF SHAFT II AND EXTENSION OF SHAFT HOIST AT MINE KWK KNURÓW-SZCZYGŁOWICE RUCH SZCZYGŁOWICE | The Parent began work on preparing shaft II for a depth extension. The project is intended to ensure effective production of type-35 coal at mine Ruch Szczygłowice after 2025 by enhancing capacity for vertical transport of coal and optimisation of ventilation network and prevention of natural hazards. In 2019, expenditures on this investment amounted to PLN 0.1 million. |

|

EXPANSION OF MINE PNIÓWEK |

The Parent continued an investment project at the Pniówek mine, which had commenced in 2017, consisting of the expansion of mine level 1000 and a depth extension for shafts IV and III. Works related to the drilling of mine excavations, deepening of shaft IV and drilling of mine excavations at level 1000 were performed as part of this investment in 2019. The project is intended to ensure the safe exploitation and access to type-35 coal resources in the south-western section of the Pniówek deposit, expected to be exploited after 2022. Total extractable resources at level 1000 in KWK Pniówek are estimated at approx. 56.6 Mt. In 2019, expenditures on this investment amounted to PLN 62.7 million. |

Table. Expenditures on JSW's key investments

| ITEM | 2019 | 2018 | 2017 | 2016 | 2015 | CHARGE 2018=100 |

|---|---|---|---|---|---|---|

| KWK Borynia-Zofiówka-Jastrzębie Ruch Borynia Construction of level 1120m | 15.7 | 8.9 | 0.3 | - | - | 176.4 |

| KWK Bzie-Dębina under construction* | 71.1 | 16.3 | 4.2 | 23.0 | 61.0 | 436.2 |

| KWK Borynia-Zofiówka-Jastrzębie Ruch Zofiówka Construction of level 1080m | 49.3 | 23.7 | 12.6 | 1.8 | 8.2 | 208.0 |

| KWK Budryk Construction of level 1290m | 165.3 | 63.5 | 26.8 | 17.2 | 23.8 | 260.3 |

| KWK Knurów-Szczygłowice Ruch Knurów Construction of level 1050m | 16.0 | 8.5 | 2.0 | 1.5 | 2.5 | 188.2 |

| KWK Knurów-Szczygłowice Ruch Szczygłowice Construction of level 1050m | 1.4 | 15.7 | - | - | 1.3 | 8.9 |

| KWK Knurów-Szczygłowice Ruch Szczygłowice Depth extension of shaft II and extension of vertical mine hoist | 0.1 | 6.4 | 0.1 | - | - | 1.6 |

| KWK Pniówek Rozbudowa Expansion of level 1000m and deepening of shafts IV and III | 62.7 | 56.0 | 34.6 | 6.9 | - | 112.0 |

| TOTAL | 381.6 | 199.0 | 80.6 | 50.4 | 96.8 | 191.8 |

Modernisation of mechanical coal processing facilities to increase coking coal output and begin producing type-35 coking coal as well as other investment tasks intended to increase net coal output at mine Knurów-Szczygłowice

The Group is implementing an investment consisting of modernising processing facilities and other investment tasks in order to begin producing type-35 (hard) coal, increase the share of coking coal and increase net coal output. The investment will make it possible to eventually increase the share of coking coal (type 34 and 35) to 80% of the mine's total output, as well as to begin producing type 35 (hard) coking coal from 2019 and increase total output. Some of the investment tasks, i.e. modernising mechanical coal processing facilities in 2016-2020 and other tasks intended to increase net coal output, are being conducted by JZR. In 2019, PLN 35.2 million was spent on the investment. Approx. 93.5% of the budget outlined in Business Plan 1 for the investment being implemented at KWK Knurów-Szczygłowice is completed.

Financial support agreement - JZR

On 30 September 2016, an agreement was executed between the State Treasury and JZR to provide support other than public aid, in three tranches, in total amounting to PLN 290.0 million, in the form of a cash contribution in exchange for shares in JZR's increased share capital, acquired by the State Treasury. These funds were used for the modernisation of processing facilities at KWK Budryk and KWK Knurów-Szczygłowice. To perform the provisions of this agreement, on 30 September 2016 JZR's Extraordinary General Meeting adopted a resolution increasing JZR's share capital to PLN 400.5 million through a PLN 150.0 million cash contribution (tranche 1) and the issue of 300 000 new shares with nominal and issue value of PLN 500.00 each.

On 13 February 2018, JZR's Extraordinary General Meeting decided to increase share capital to PLN 645.0 million, i.e. by PLN 244.5 million, through the acquisition of 249 000 shares by JSW and 240 000 shares by the State Treasury, with nominal value of PLN 500 each (JSW acquired 249 000 shares in exchange for a cash contribution of PLN 124.5 million made on 21 February 2018, the State Treasury acquired 240 000 new shares (Tranche 2) in exchange for a PLN 120.0 million cash contribution).

In 2018, JZR began preliminary talks with the Ministry of Entrepreneurship and Technology and the Industrial Development Agency (ARP) regarding early repayment of funds other than public aid to the State Treasury. Analytical work on the State Treasury's further equity investment in JZR continued in 2019. On 2 April 2019, a decision was made to stop this work. Due to the above, on 10 April 2019, JZR notified the Ministry of Energy and the Ministry of Entrepreneurship and Technology that it had stopped working on the repayment of this support funding. Following arrangements, in December 2019 JZR filed an application with the ARP to execute Annex 2 to the support agreement, which included an updated Business Plan for the Investment, with an updated investment budget and schedule (extension of investment completion deadline from 2019 to 2020). Until this report was prepared, JZR had not received a response.

JSW Group's other investment expenditures

Investment expenditures at the Group's other companies in 2019 reached PLN 349.0 million (including lease-related expenditures under IFRS 16: PLN 83.5 million). Expenditures on tangible assets, investment properties and intangible assets amounted to PLN 265.5 million and were 1.0% higher than in 2018. Investment expenditures in the coking segment and other segments in 2019 accounted for 14.5% of the Group's total expenditures. The companies' investment expenditures on tangible assets concerned the key investments and activities intended to maintain the companies' on-going operations.

| ITEM | KEY INVESTMENT PROJECTS AT OTHER JSW GROUP COMPANIES IN 2019 |

|---|---|

|

MODERNISATION OF COKE OVEN BATTERIES AT KOKSOWNIA PRZYJAŹŃ |

Koksownia Przyjaźń (JSW KOKS) is implementing an investment programme as part of which in 2011 it put a modernised battery 1 into service, with additional coke oven batteries still awaiting modernisation. On 15 September 2011, an agreement was signed with BP Koksoprojekt Sp. z o.o., based in Zabrze, which was selected in a tender procedure, to perform formal and legal activities as well as design work for the modernisation of coke oven batteries 3 and 4 and detailed designs for the modernisation of coke oven battery 4. Development of detailed designs for the modernisation of battery 4 was completed in 2014. On 14 March 2018, JSW's Management Board, through a resolution, adopted and approved Detailed Documentation, thus giving the green light for the investment "Modernisation of coke oven batter 4 at Koksownia Przyjaźń" to be implemented in 2018-2021. In 2019, PLN 7.1 million was spent on the investment. |

| CONSTRUCTION OF POWER-GENERATION UNIT AT KOKSOWNIA RADLIN | This investment is being implemented by JSW KOKS in order to use coke oven gas to generate electricity and heat for internal use and for sale. The investment is expected to consist of the construction of a power unit fuelled with internally sourced coke oven gas, with a thermal capacity of 104 MWt and a bleed-steam condensing turbine with capacity of 28 MWe and a heating unit with 37 MWt, which will provide electricity, steam and heat supplies to the coking plant Radlin, heat supplies to the near-by mine KWK ROW Ruch Marcel and for the residents of Radlin. On 14 March 2018, JSW's Management Board, through a resolution, adopted and approved Detailed Documentation, thus giving the green light for the investment "Construction of power-generation unit at Koksownia Radlin" to be implemented in 2018-2020. On 12 June 2019, an agreement was signed with RAFAKO S.A. with a delivery date of 12 November 2021. In 2019, PLN 27.7 million was spent on the investment. |

Information on geographic areas

Geographical breakdown of revenue from sales by location of headquarters of buyer-counterparty:

| Note | 2019 | 2018 | |

|---|---|---|---|

| Sales in Poland, including: | |||

| Coal | 3,509.2 | 3,712.3 | |

| Coke | 720.0 | 648.3 | |

| Other segments | 354.7 | 271.8 | |

| TOTAL SALES IN POLAND | 4,583.9 | 4,632.4 | |

| Sales outside of Poland, including: | |||

| EU member states, including: | 3,486.9 | 4,809.5 | |

| Coal | 1,261.9 | 1.372.3 | |

| Coke | 2,224.5 | 3,436.0 | |

| Other segments | 0,5 | 1.2 | |

| Non-EU European countries, including | 601.0 | 367.6 | |

| Coke | 600.5 | 367.2 | |

| Other segments | 0,5 | 0,4 | |

| TOTAL SALES OUTSIDE OF POLAND, including: | 4,087.9 | 5,177.1 | |

| Coal | 1,261.9 | 1,372.3 | |

| Coek | 2,825.0 | 3,803.2 | |

| Other segments | 1,0 | 1.6 | |

| TOTAL REVENUE FROM SALE | 4.1 | 8,671.8 | 9,809.5 |

Revenue from sales - geographical breakdown by location of headquarters of buyer-counterparty:

| 2019 | 2018 | |

|---|---|---|

| Poland | 4,583.9 | 4,632.4 |

| Austria | 1,308.6 | 1,098.3 |

| Germany | 1,006.6 | 1,997.0 |

| Czech Republic | 769.1 | 940.1 |

| Switzerland | 471.1 | 216.6 |

| Norway | 129.9 | 126.8 |

| Slovakia | 118.1 | 283.5 |

| Belgium | 98.8 | 145.9 |

| Spain | 74.3 | 152.0 |

| Luxembourg | 60.2 | 120.8 |

| France | 21.1 | - |

| Romania | 18.9 | - |

| Sweden | 9.7 | 49.1 |

| Other countries | 1.5 | 47.0 |

| TOTAL REVENUE FROM SALE | 8,671.8 | 9,809.5 |

Information on key customers

In the period from 1 January to 31 December 2019, revenue from sales to two customers each exceeded 10% of the Group's revenue from sales. Revenue from sales to one of them reached PLN 2 502.6 million, and PLN 1 288.1 million to the other. Revenue from sales to these customers is recognised in the Coal segment and in the Coke segment.

In the period from 1 January to 31 December 2018, revenue from sales to two customers each exceeded 10% of the Group's revenue from sales. Revenue from sales to one of them reached PLN 2 589.8 million, and PLN 979.9 million to the other. Revenue from sales to these customers is recognised in the Coal segment and in the Coke segment.