Market and competitive environment

JSW Group is the European Union's largest producer of high-quality coking coal and a major producer of coke. The type and range of the Group's activities and products are largely sensitive to changes on the intertwined steel, coking coal and coke markets.

European Green Deal begins at JSW

Source: World Steel Association

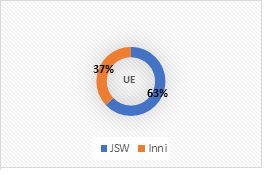

Steel is regarded as a strategic material in all sectors of the economy related to the low-carbon transition. Approx. 780 kg of coking coal is needed to produce 1 tonne of steel. tutaj

Steel demand, output and prices determine the market conditions for coking coal producers, setting demand for coking coal and realisable prices for this raw material.

The transition to a zero-carbon economy and the massive technological transformation will drive elevated demand for steel, which will play a supporting role in all technologies requiring additional

Approx. 70% of steel is produced in the blast furnace process using coke, while the remainder is produced in electric furnaces using scrap metal.infrastructure.

Blast-furnace process

Coke, and thus also coking coal, are, aside from iron ore, the main raw materials in steelmaking.

In the blast-furnace process, blast-furnace coke is mainly used to reduce iron ore into pig iron. Coke performs the following functions in this process:

- fuel that generates the heat necessary to heat up and smelt raw material and for chemical reactions

- reducing agent supplying the right amount of CO for reduction

- component ensuring appropriate gas permeability of raw material in each zone of the blast furnace

- carburising agent for pig iron

The CO2 reductions announced by steelmakers in alignment with the European Green Deal will necessitate technological changes. Two main paths for technological change are currently being considered in the production of primary steel (from iron ore): replacing coke with hydrogen and improving the existing blast furnace process (using coke) with CO2 capture technologies. This means that coke will not be completely eliminated from steel production, and JSW Group will be a key local supplier to the European steel industry.

- global:

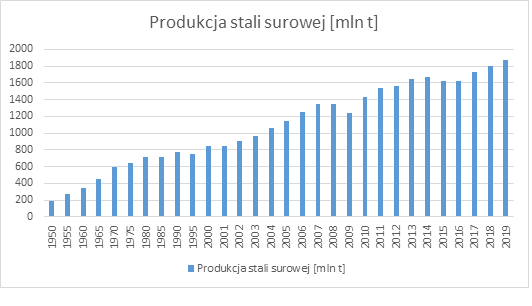

The production of steel is systematically growing. Steel production has increased tenfold since 1950 and doubled since 2000.

Chart. Crude steel production [mln t]

Source: World Steel Association

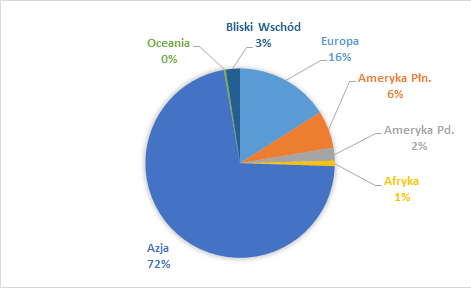

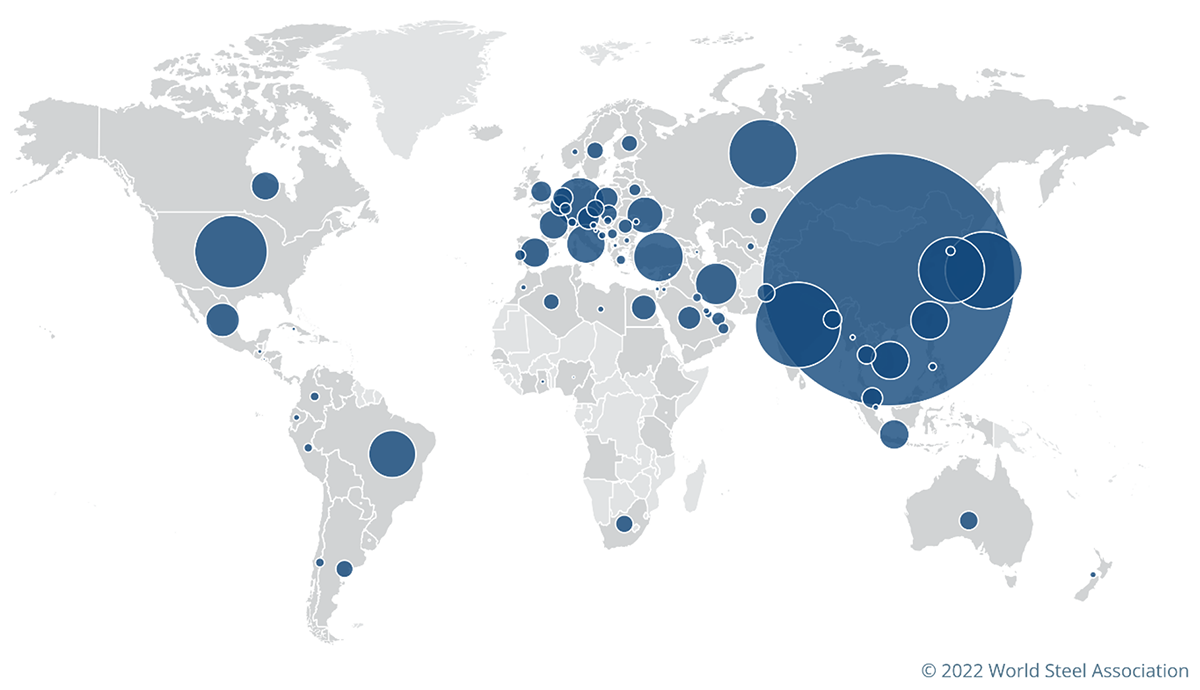

The steel market is dominated by global steel-makers and steel production is largely concentrated in Asian countries. China remains the largest producer of steel.

Chart. Steel production by geographic region in 2021 [mt,%]

Source: World Steel Association

Globally, steel production is still dominated by oxygen-blown converter technology using coke. It accounts for over 70% of the global steel production structure. Steel production in electric arc furnaces accounts for approx. 28% of crude steel output, while production in open hearth furnaces has a small and declining share.

The leading producer - with an annual steel output of more than 1 billion tonnes - is China, which produced 3% less steel in 2021 than in 2020 (1.03 billion tonnes). On a global scale, the declines in output in China were more than offset by higher production in other regions, as a result of which global steel production reached 1.95 billion tonnes in 2021, up by 3.7% from 2020.

Table.Largest producers of steel in 2021, by country

| [mln t] | Change in production vs. 2020 [%] | |

|---|---|---|

| China | 1 032.8 | -3% |

| India | 118,1 | +17.8% |

| Japan | 96,3 | +15.8% |

| USA | 86.0 | +18.3 |

| Russia | 76.0 | +6.1 |

Source: worldsteel.org

The steel market recovery following the pandemic shock in many regions in 2021 proved stronger than expected despite continuing supply chain problems and successive waves of COVID-19. In China, steel demand slowed in 2021 mainly due to constraints in the construction industry. In advanced economies, despite sporadic waves of COVID-19 and supply chain constraints in manufacturing, steel demand has improved significantly, particularly in the EU and US. In developing markets (excluding China), after a 7.7% decline in 2020, demand for steel grew by 10.7% in 2021.

Global construction activity reached a record 3.4% growth in 2021 despite a decline in China. The recovery was driven by infrastructure development as part of recovery programs across numerous countries, and investments related to the energy transition are likely to drive growth in the construction sector in the coming years.

The global automotive industry's recovery in 2021 was disappointing as supply chain bottlenecks stalled the pace of recovery in the second half of the year. The war in Ukraine is likely to delay the return to normalcy following supply chain problems, especially in Europe.

Table.Top 10 steel-consuming countries in 2021

| [rok] | |

|---|---|

| China | 952 |

| India | 106,1 |

| USA | 97,1 |

| Japan | 57,5 |

| South Korea | 55,6 |

| Russia | 43,9 |

| Germany | 35,2 |

| Turkey | 33,4 |

| Brazil | 26,4 |

| Italy | 25,9 |

Source: wordsteel.org

- european:

The blast furnace process dominates in the European Union (59%) but steel production in electric arc furnaces has a larger share (41%) than the global average.

Approx. 350 kg of blast-furnace coke is used to produce 1 tonne of iron pig in the European Union.

EU steelworks consume approx. 40 mt of coke in blast-furnace processes, for which approx. 53 mt of coking coal is consumed annually (without PCI). Coke consumption per one tonne of produced pig iron depends on the characteristics of the blast furnace and the input blend, which is why parameters in various steelworks differ. The overall level of coke and coking coal consumption largely depends on the level of steel production in the blast furnace process.

The EU steelmaking industry (EU 27) produced 152 mt of crude steel in 2020, which is 15.4% more than in 2020. The largest crude steel producer in the EU, Germany, ramped up its crude steel output by 12.3%.

Despite on-going research on direct reduction and the use of hydrogen in steel production processes, the level of coke and coal consumption in the EU will remain stable in the coming years. The prospects for a wide use of new technologies in European steelmaking are far away and limited.

Demand for steel in the EU is driven by investments: in construction (approx. 35% of steel consumption), automotive (18% and machinery (approx. 14%). The pipeline industry plays an important role in the steel consumption structure (with a 13% share), along with the metal product sector (14% of global steel consumption).

Guaranteed stable deliveries of key raw materials at competitive prices are important to the European steel industry. A lack of sufficient own sources of supply means that the European Union is highly dependent on the import of both iron ore and coking coal.

The war in Ukraine will have a strong impact on the global and EU steel market. The combined output of Russia and Ukraine in 2021 accounted for 5% of global steel production (97 mt). Russia was the second-largest exporter of steel globally, with the main export markets being: EU (22%) and Asia (23%).

Both Russia and Ukraine are among the world's largest exporters of pig iron. Approx. 28% of the EU's and 35% of the US' imports of pig iron in 2021 came from Russia. Without these supplies, the capacity utilisation at European steel mills might increase, which would translate into increased demand for coke and coking coal in Europe. Ukraine is also a major supplier of iron ore to the Central European market.

- domestic:

According to World Steel Association data, Poland produced 8.5 mt of crude steel in 2021, i.e. over 7% more than in 2020 (7.9 mt). The sole producer of crude steel in the blast furnace process, i.e. using coke and thus also coking coal, is ArcelorMittal Poland in its steel plant in Dąbrowa Górnicza.

In 2021, the Polish economy consumed approx. 15 mt of steel products, i.e. 16% more than in the previous year. The vast majority of steel consumed is imported; just 21% of the industry's needs are met by domestic production.

Coal market:

Coking coal market

- global:

The coking coal market is global. Demand for coking coal largely depends on the condition of the steel industry, which uses these commodities in blast furnaces to produce pig iron. Despite many years of research and implementation work on other methods of steel production, e.g. direct reduction of iron ore (DRI) or other technologies limiting the share of coke (e.g. gas, hydrogen), the blast furnace (BOF) process with coke still dominates in the world.

Coking coal and iron ore are the main raw materials in steelmaking. Coking coal is processed into coke at the steel companies' own coking plants. Coke, along with iron ore, is the main input in the blast furnace process. In the Pulverized Coal Injection (PCI) technology, coal dust of suitable parameters is blown into the blast furnace, which reduces coke consumption and production costs and improves blast furnace efficiency. Coking and PCI coals are collectively referred to as metallurgical coals in many studies.

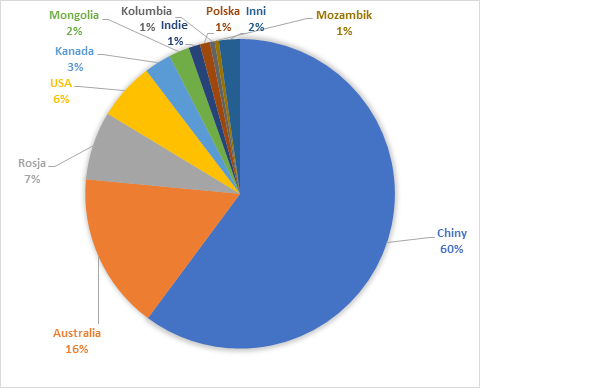

Global coking coal production (993 mt in 2021) is highly concentrated in several countries. The largest producers of coking coal remain China (637 mt in 2021) and Australia (138 mt in 2021), which together have a market share of more than 75%.

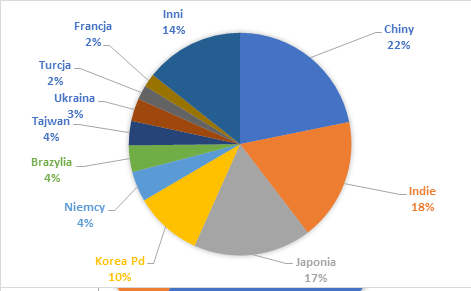

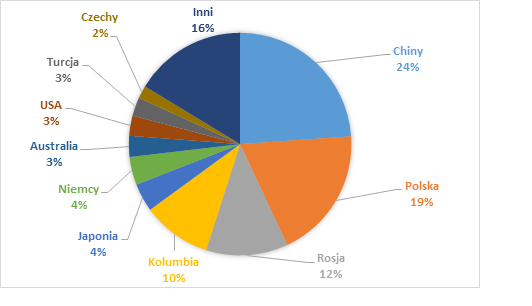

Chart. Largest producers of coking coal in 2021 [mt, estimated values]

Source: CRU, polskirynekwegla.pl.

Global demand for coking coal is mainly driven by China (67% of global coking coal consumption), while global export supply is driven by the main supplier - Australia (over 53% share of coking coal exports) which together with other major exporters - US, Canada and Russia - account for approx. 90% of coal supplies to the global market. The total volume of trade in coking coal reached approx. 256 mt in 2021 (according to CRU) and 323 mt for metallurgical coal.

Chart. Largest exporters of coking coal (HCC and SSCC) in 2021 [mt, % estimated values]

Source: CRU

In 2021, the Chinese coking coal import policy (import ban since November 2020) has had a significant impact on the coking coal market:

- has altered natural and historical trade flows,

- has raised domestic prices for end users in China,

- has created two separate trade markets:

- CFR China market - served only by non-Australian producers (mainly US and Canada),

- FOB Australia for regions other than China - potentially served by all overseas producers, but the only market for Australian products.

In addition to political decisions, the volatile market conditions have had a major impact on the market. Rising steel production - in the process of economic recovery after slowdowns caused by pandemic restrictions - generated strong demand for coking coal in 2021. At the same time, the supply of this raw material was limited by production difficulties (e.g. methane ignitions, safety inspections), transport problems (railways and ports), as well as weather difficulties and disasters (downpours, floods, fires) at the main suppliers to the maritime market.

Chart. Largest importers of coking coal (HCC and SSCC) in 2021 [mt, % estimated values]

Source: CRU

- european:

Guaranteed stable deliveries of key raw materials at competitive prices are important to the European steel industry. A lack of sufficient own sources of supply means that the European Union is almost entirely dependent on the import of both iron ore and coking coal. On 3 September 2020, the European Commission published the EU's list of Critical Raw Materials, i.e. raw materials that are of strategic significance to the functioning and economic development of the European Union. Their shortages may have grave economic effects for the entire economy. The economic significance and risk associated with supply security are taken into account in evaluating the risk of shortages. The EC reviews the Critical Raw Materials List every three years.

Currently in the EU coking coal is generally produced only in Poland and Czechia. In 2020, a final decision was taken in Czechia to shut down two of OKD's four mines by the end of the first quarter of 2021 and the remaining two mines by the end of 2022. Due to the war in Ukraine and the sanctions imposed on Russia, CSM mine operations will be extended until at least mid-2023. Analyses are being carried out as to whether and under what conditions further mining is possible. The planned extension of the operational life of the existing Czech mines, due to the severely limited production capacity, will have no impact on JSW's position as a key coking coal producer in the European Union. The deficit of coking coal on the EU market is mainly made up by imports from Australia, USA, Canada, Russia and in recent years Mozambique and Columbia. The sanctions being imposed on Russia as a result of its aggression against Ukraine may result in a further reorganisation of the global metallurgical coal market and the need to increase overseas imports into the EU. Before the war in Ukraine, Russia's share of metallurgical coal imports to the EU was: approx. 10% for coking coal and approx. 30% for PCI coal. Jastrzębska Spółka Węglowa SA is the largest producer of coking coal in the country. It is the only producer of hard coking coal, while semi-soft coal is also extracted from PGG SA's mines, but in relatively small quantities.

In 2021, a total of about 14 mt of coking coal was mined in the European Union, including approx. 11 mt mined by JSW. Aside from JSW, coking coal is also mined by PGG SA and OKD (Czechia).

As leading producer of coking coal in the European Union, JSW benefits from a geographic premium but is still subject to general trends on the global market. Market volatility and the impact of global price mechanisms mean that transactions on the coking coal market are currently conducted on the basis of coal indexes published for coals from Australia and USA.

- domestic:

JSW is the only domestic producer of hard coking coal and a major producer of semi-soft coking coal. The other domestic producers mainly produce thermal coal, while semi-soft coking coal is mined only by PGG in small quantities (1.6 mt in 2021).

Domestic consumption of coking coal is around 13-14 mt and depends on the level of coke production in domestic coking plants.

Thermal coal market

- domestic:

Because of market conditions, the domestic market is crucial for local producers of thermal coal. Coal companies in Poland usually produce coal for electricity and heating generation purposes. The largest domestic coal companies, aside from Jastrzębska Spółka Węglowa S.A., are: Polska Grupa Górnicza S.A. and Lubelski Węgiel „Bogdanka” S.A.

According to its strategy, JSW aims to increase coking coal production and reduce thermal coal production. JSW, not being a major domestic producer of thermal coal, is seen by customers in the domestic energy generation segment as a supplementary supplier.

The price of thermal coal in Poland is largely driven by the situation on the domestic market and competition between domestic producers. The thermal coal market in Poland is largely dependent on the domestic economic situation, weather conditions, energy policy (prices of electricity, use of biomass, lignite-based electricity generation, share of subsidised renewable energy). Thermal coal prices to a limited extent follow the global trends in price indexes for spot transactions. While indexes set trends, the situation on the domestic market and competition between domestic producers are of key significance. Market prices for thermal coal are determined by the Polish Steam Coal Market Index (PSCMI). This is a group of price indicators for benchmark thermal coal produced by domestic producers and sold on the domestic energy market (PSCMI 1 index) or the domestic heating market (PSCMI 2 index). These indicators are based on monthly ex-post data and reflect the sales price for hard coal (ex-works), with quality parameters optimised to customer needs.

The level of production of electricity from hard coal is essential for the domestic demand for thermal coal. In 2021, electricity production from hard coal increased by 30% in comparison with 2020.

Structure of electricity generation in domestic power stations, volumes of electricity exchange with foreign countries and domestic energy consumption - gross volumes.

|

No. |

Item |

|||

|---|---|---|---|---|

|

2020 |

2021 |

Change |

||

|

[d] |

[e] |

[f] |

||

|

1. |

Total production (1.1+1.2+1.3+1.4) |

152 308 |

173 583 |

13,97 |

|

1.1 |

Utility power plants |

126 137 |

154 599 |

22,56 |

|

1.1.1 |

Utility hydropower plants |

2 698 |

2 830 |

4,88 |

|

1.1.2 |

Utility thermal power plants |

123 439 |

151 769 |

22,95 |

|

1.1.2.1 |

hard coal-fired |

71 546 |

93 037 |

30,04 |

|

1.1.2.2 |

lignite-fired |

37 969 |

45 367 |

19,48 |

|

1.1.2.3 |

gas-fired |

13 924 |

13 366 |

-4,01 |

|

1.2 |

Other renewable power plants |

2 198 |

4 749 |

116,09 |

|

1.3 |

Wind farms |

14 174 |

14 234 |

0,42 |

|

1.4 |

On-site industrial power plants |

9 799 |

- |

- |

|

2. |

Balance of cross-border exchange |

13 224 |

820 |

-93,8 |

|

3. |

National consumption of electricity |

165 532 |

174 402 |

5,36 |

Source: Polskie Sieci Elektroenergetyczne S.A

Coke market:

- global:

The iron and steel industry is the largest and crucial customer for coke, where it is mainly used to produce pig iron in a blast-furnace process while finer types are used to produce agglomerates from iron ore that are then used in the production of ferro-alloys. Foundries that use high-quality foundry coke are also in this customer group.

The other types of coke are used for smelting non-ferrous metals (zinc, lead and copper), in the lime industry, chemicals industry (mainly to produce carbide), soda industry (production of glass), food sector (sugar refineries, dryers) and in the communal sector (heating coke).

Just as in the case of coking coal, the coke market is global. Coke production is increasing and demand for coke mainly depends on the level of steel production in blast-furnace processes and changes in the technological processes for steel production. Coke production is mainly concentrated in Asian countries, which account for over 80% of global coke output.

2021 saw a return to typical flows in the global coke market. China returned to being a net exporter, with China's coke exports estimated at 6.3 mt in 2021, significantly higher than the 3.5 mt in 2020. Coke imports to China reached 1.3 Mt in 2021, a 57% decline in comparison with 2020.

Global coke production in 2021 went up 2% year-on-year to 702 mt. China produced approx. 465 mt, which is about 66% of the global coke production.

Global coke trade in 2021 was 31 mt, up 32% from 2020 as the market replenished stocks following the COVID-19 pandemic. This came after two years of restricting the coke trade.

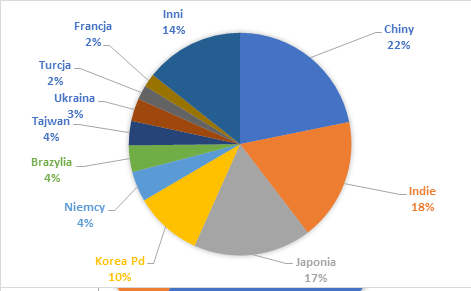

Chart. Global coke production [mt]

Source: CRU

In the near term, the coke market will be affected by sanctions imposed on Russia following the invasion of Ukraine. Russia is a major exporter of coke, having exported approx. 3.3 mt in 2021, mainly to Kazakhstan (approx. 35%), Ukraine (16%) and Turkey (9%). With the outbreak of war, coke exports to Ukraine were suspended, and by April the war's impact on cooperation with Kazakhstan and Turkey was reduced. Ukraine is not an exporter of coke, and its production of approx. 11 mt per year is used internally.

The war in Ukraine and sanctions imposed on Russia may affect the coke market. In addition to restrictions on its market availability, there may be factors associated with a reduced supply of certain types of coal. The lack of availability of PCI coals, of which Russia is one of the main exporters, may lead to an increase in coke consumption in the blast furnace process. Reduced availability of coking coals may increase interest in external purchases of coke.

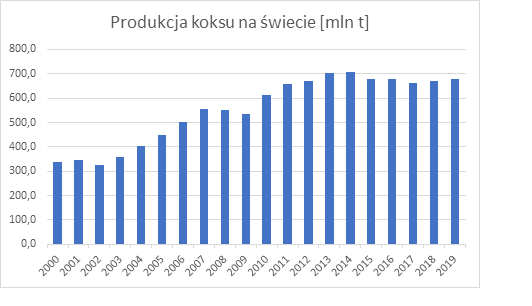

Chart. Largest producers of coke in 2021 [mt, %]

Source: own data (production in Poland) and CRU

Chart. Largest exporters of coke in 2021 [mt, %]

Source: own data, CRU.

- european:

European Union members account for merely 5-7% of global coke consumption, however the EU's share in the consumption of imported coke is approx. 9-11 mt, which represents around 1/3 of the global consumption of this raw material.

The recovery of steel production in 2021 led to a return in demand for coke in EU27, traditionally the largest importer. In 2021, coke consumption in EU27 grew by 14% compared to the previous year and amounted to approx. 36 mt, while the production of coke in that period also increased by 12% to approx. 35.8 mt.

The European Union predominantly features coking plants integrated with steel works, which meets their needs using internally produced coke in the first place. At JSW Group, coking plants are independent, meaning that the entire coke output is for sale. Several independent coking plants are also located in Hungary, Czech Republic and Bosnia. JSW Group's advantage over other coke producers lies in the availability of the raw material - JSW's coking plants use coking coal from JSW's own mines. Despite the fact that most of the European steelworks have their own integrated coking plants, they still require imports to a certain degree. On average, European steelworks meet 95% of their demand through their integrated coking plants. When reducing steel production, external supplies are cut first, which is why when steel output at integrated steelworks is weakened, it affects predominately independent coking plants supplying coke to these steelworks.

Coke consumption structure globally and in the EU is similar: approx. 80% of coke is used for producing pig iron in large-furnace processes and the other 20% outside of large furnaces. A vast majority of coke is producing in coking plants owned by steel-makers. This production is for the internal purposes of steel works owned by these steel-makers. Only a small volume (slightly over 4% of total production volume) is internationally traded.

- domestic:

Domestic coke production reached 9.0 mt in 2021 (a 15% increase from 2020), of which 3.7 mt was produced at JSW's coking plants. JSW thus accounts for 41% of the overall domestic output. The other coke producers in Poland are: ArcelorMittal Poland, Koksownia Częstochowa Nowa Sp. z o.o, WZK Victoria S.A., with JSW and ArcelorMittal Poland being the dominant producers of blast-furnace coke in Poland.

Exports of Polish coke reached 7 mt in 2021, up by 17%.

Market for carbon-related products

Coke production is accompanied by the production of coke oven gas. Its purification process produces coke tar, benzol and ammonium sulphate or sulphur depending on the technology used. The market share in the production of these products usually corresponds to the market share in the production of coke. Coke tar and benzol are valuable raw materials for the chemical industry, and ammonium sulphate is a fertiliser. Coke oven gas is used to fire the coke oven batteries, with any surplus used to generate electricity or sold to local consumers.

JSW GROUP ON THE COKING COAL MARKET

| 2019 | 2020 | 2021 | ||

|---|---|---|---|---|

| Global production | mt | 992 | 960 | 993 |

| Global trade | mt | 288 | 261 | 256 |

| Import of coking coal (HCC + SSCC) | ||||

| China | mt | 75 | 76 | 85 |

| India | mt | 58 | 55 | 56 |

| Japan | mt | 47 | 42 | 44 |

| European Union | mt | 41 | 35 | 39 |

| Export of coking coal (HCC + SSCC) | ||||

| Australia | mt | 149 | 141 | 136 |

| USA | mt | 43 | 36 | 37 |

| Canada | mt | 32 | 24 | 23 |

| Russia | mt | 25 | 29 | 32 |

| JSW - Sale of metallurgical coal | ||||

| Total | mt | 9,9 | 10,8 | 12,4 |

| External sale | mt | 5,8 | 6,3 | 7,6 |

Source: Own data, CRU, Australian Government - Department of Industry, Science, Energy and Resources, ARP, Ministerstvo průmyslu a obchodu ČR

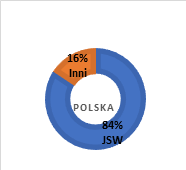

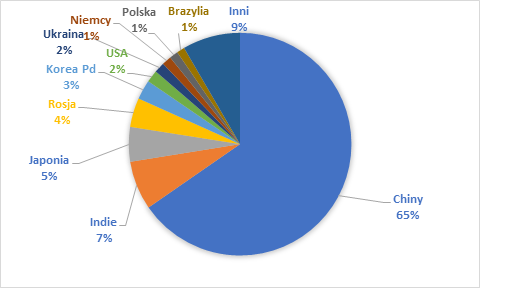

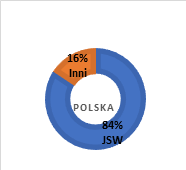

Chart. JSW's share in coking coal production in Poland, EU and globally in 2021 [mt, %]

JSW GROUP ON THE COKE MARKET:

|

2019 |

2020 |

2021 |

||

|---|---|---|---|---|

|

BOF steel production |

||||

|

World |

mt |

1 334 | 1 363 | 1 388 |

|

China |

mt |

881 | 946 | 920 |

|

Europe (EU + UK) |

mt |

93 | 80 | 91 |

|

Total coke consumption |

||||

|

World |

mt |

701 | 688 | 705 |

|

China |

mt |

466 | 471 | 460 |

|

Europe (EU + UK) |

mt |

39 | 34 | 38 |

|

Coke trade |

||||

|

World |

mt |

25,9 | 23,9 | 31,5 |

|

China - export |

mt |

6,4 | 3,5 | 6,3 |

|

Poland - export |

mt |

5,8 | 6,0 | 7,2 |

| Europe (EU + UK) - import | mt | 10,4 | 9,4 | 11,9 |

|

JSW KOKS - sale of coke |

||||

|

JSW KOKS |

mt |

3,0 |

3,6 |

3,6 |

Source: Dane własne, CRU, CMS.

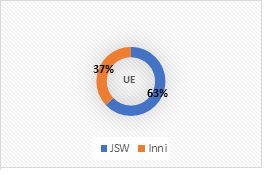

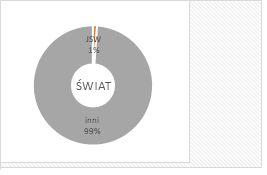

Chart. JSW's share in coke production in Poland, EU and globally in 2021 [mt, %]