Key financial and operating data in the JSW Group

In 2021 the Jastrzębska Spółka Węglowa Group generated a net profit of PLN 953 million. Its consistent and effective trading policy supported by higher coking coal and coke prices, output stabilization and efficiency gains enabled the Company to generate very robust financial results.

The JSW Group’s 2021 EBITDA (net of non-recurring events) was PLN 2.9 billion. In turn, sales revenues surpassed PLN 10.6 billion and were up 53.2% compared to 2020. It should be emphasized that the average price for the sale of coke in 2021 was PLN 1,266 per ton, meaning that it was up 62.8% above the price commanded in 2020. The average price of coking coal in the period under discussion was favorable and stood at PLN 620 per ton, up 41.9% from the previous year.

In 2021 the JSW Group’s mines produced 13.8 mt of coal and 3.7 mt of coke. The split of coking coal and steam coal production was 80% and 20%, respectively.

The Group’s revenues on the sales of hydrocarbons to external customers shot up 42.9% versus last year to more than PLN 5 billion, and the revenues on the sales of coke and hydrocarbons to external customers were also up 69.1% and also surpassed PLN 5 billion.

Table. BASIC ECONOMIC AND FINANCIAL FIGURES OF JSW

| ITEM | UNIT | 2021 | 2020 | 2019 | 2018 | 2017 | GROWTH RATE 2020=100 |

|---|---|---|---|---|---|---|---|

| STATEMENT OF FINANCIAL POSITION | |||||||

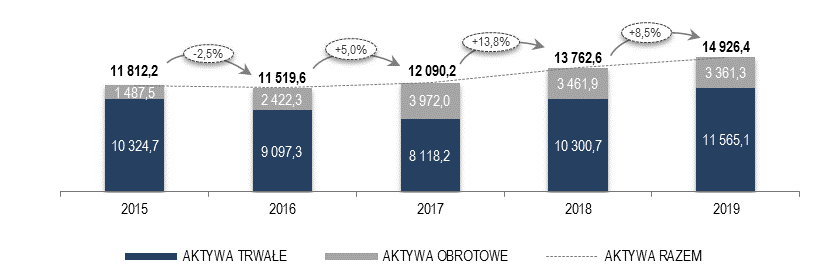

| Non-current assets | PLN million | 12 070,2 | 11638,5 | 11 565,1 | 10 300,7 | 8 118,2 | 103,7 |

| Current assets | PLN million | 3 891,6 | 3 392,4 | 3 361,3 | 3 461,9 | 3 972,0 | 114,7 |

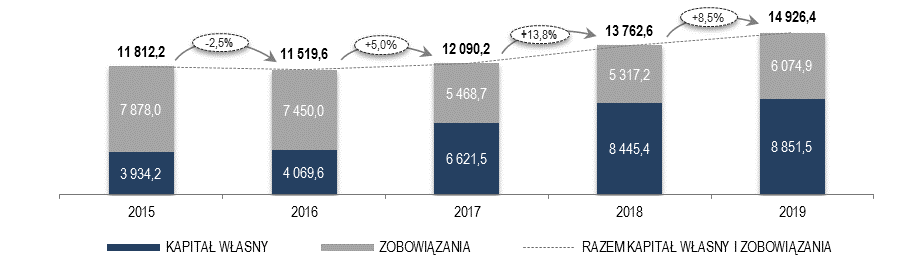

| Equity | PLN million | 8 297,8 | 7 317,1 | 8 851,5 | 8 445,4 | 6 621,5 | 113,4 |

| Liabilities | PLN million | 7 664,0 | 7 713,8 | 6 074,9 | 5 317,2 | 5 468,7 | 99,4 |

| STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME | |||||||

| Sales revenues | PLN million | 10 629,1 | 6 936,0 | 8 671,8 | 9 809,5 | 8 877,2 | 153,2 |

| Gross profit (loss) on sales | PLN million | 2 595,2 | (401,3) | 1 603,6 | 2 871,1 | 3 238,9 | - |

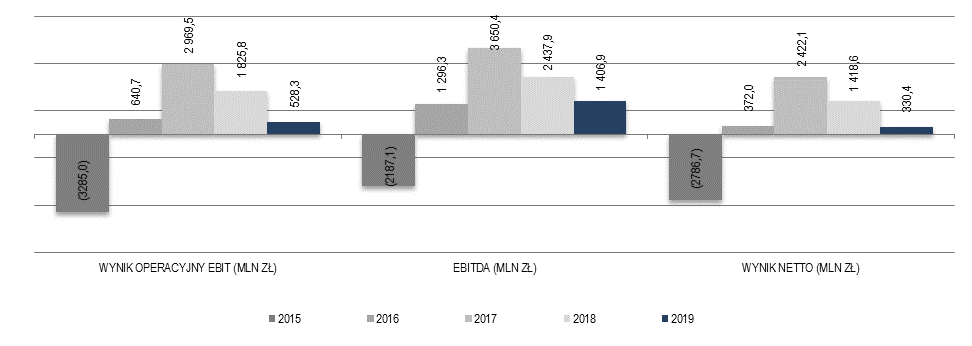

| Operating profit/(loss) | PLN million | 1 262,4 | (1 780,6) | 905,6 | 2 254,1 | 3 116,5 | - |

| EBITDA | PLN million | 2 482,5 | (675,7) | 1 939,5 | 3 020,1 | 3 941,2 | - |

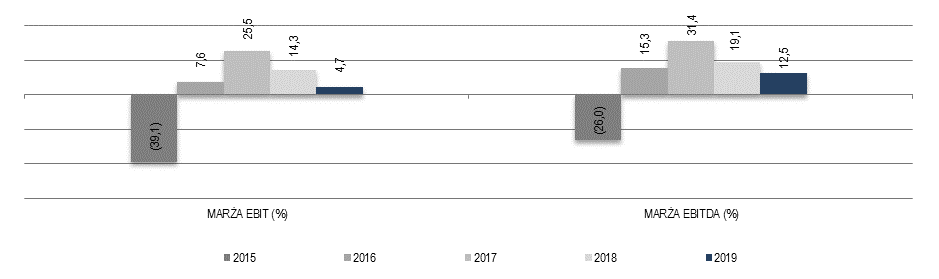

| EBITDA margin | % | 23,4 | (9,7) | 22,4 | 30,8 | 44,4 | - |

| Profit/(loss) before tax | PLN million | 1 166,7 | (1 867,6) | 828,0 | 2 192,5 | 3 123,6 | - |

| Net profit/(loss) | PLN million | 952,6 | (1 537,4) | 649,6 | 1 760,8 | 2 543,3 | - |

| Total comprehensive income | PLN million | 980,8 | (1 534,3) | 636,7 | 1 718,4 | 2 552,0 | - |

| STATEMENT OF CASH FLOWS | |||||||

| Net cash flow on operating activity | PLN million | 1 661,2 | 354,7 | 1 140,3 | 2 818,4 | 2 870,7 | 468,3 |

| Net cash flow on investing activity | PLN million | (1 620,2) | (549,3) | (2 260,5) | (1 581,7) | (2 170,3) | - |

| Net cash flow on financing activity | PLN million | (338,1) | 1 441,2 | (180,3) | (755,8) | (699,8) | - |

| Net movement in cash and cash equivalents | PLN million | (297,1) | 1 246,6 | (1 300,5) | 480,9 | 0,6 | - |

| FINANCIAL RATIOS | |||||||

| Dividend per share | PLN/share | - | - | 1,71 | - | - | - |

| Current liquidity | 1,08 | 1,03 | 1,05 | 1,03 | 1,67 | 104,9 | |

| Quick liquidity | 0,90 | 0,76 | 0,70 | 0,84 | 1,46 | 118,4 | |

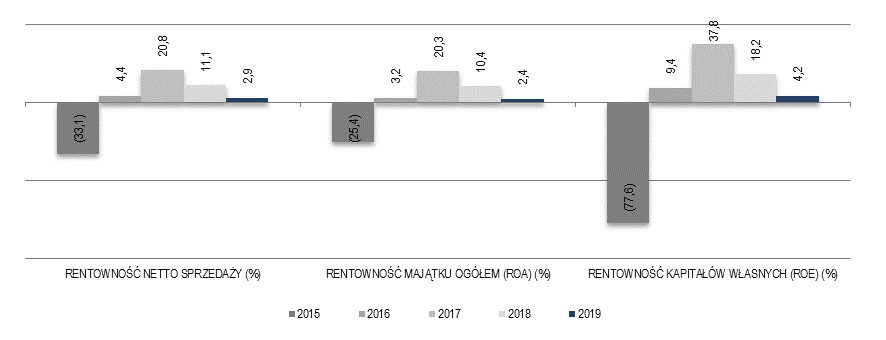

| Net return on sales | % | 9,0 | (22,2) | 7,5 | 17,9 | 28,6 | - |

| Return on Assets (ROA) | % | 6,0 | (10,2) | 4,4 | 12,8 | 21,0 | - |

| Return on Equity (ROE) | % | 11,5 | (21,0) | 7,3 | 20,8 | 38,4 | - |

| Total debt ratio | 0,48 | 0,51 | 0,41 | 0,39 | 0,45 | 94,1 | |

| Debt to equity ratio | 0,92 | 1,05 | 0,69 | 0,63 | 0,83 | 87,6 | |

| Fixed capital to non-current assets ratio | 0,90 | 0,90 | 0,91 | 0,91 | 1,0 | 100,0 | |

| PRODUCTION DATA | |||||||

| Coal production | million tons | 13,8 | 14,4 | 14,8 | 15,0 | 14,8 | 95,8 |

| Coking coal production | million tons | 11,0 | 11,1 | 10,2 | 10,3 | 10,7 | 99,1 |

| Steam coal production | million tons | 2,8 | 3,3 | 4,6 | 4,7 | 4,1 | 84,8 |

| Mining cash cost | PLN/ton | 447,12 | 407,37 | 426,00 | 396,46 | 312,54 | 109,8 |

| Cash conversion cost | PLN/ton | 173,10 | 178,37 | 191,78 | 161,68 | 149,82 | 97,1 |

| OTHER DATA | |||||||

| Stock price at the end of the period | PLN/share | 34,87 | 25,95 | 21,38 | 67,26 | 96,27 | 134,4 |

| Headcount at the end of the period | persons | 31 916 | 30 593 | 30 629 | 28 268 | 26 465 | 104,3 |

| Average headcount during the year | persons | 30 560 | 30 674 | 29 440 | 27 207 | 26 563 | 99,6 |

| Investments in property, plant and equipment | PLN million | 1 746,0 | 1 832,0 | 2 329,0 | 1 639,1 | 1 013,7 | 95,3 |

| Depreciation and amortization | PLN million | 1 220,1 | 1 104,9 | 1 033,9 | 766,0 | 824,7 | 110,4 |

IMPACT OF THE PANDEMIC ON THE FINANCIAL STANDING AND VALUATION OF ASSETS AND LIABILITIES

Costs incurred

In 2021 the Group incurred labor costs related to employees contracting COVID-19, their quarantine, the execution of preventive measures and costs related to handling and organizing the overall process to ensure that the pandemic’s repercussions were felt to the least degree possible. The total costs incurred for combating the pandemic in the Group in 2021 were PLN 28.2 million, of which PLN 26.6 was recognized in other costs, PLN 1.2 million in cost of products, materials and goods sold and the remaining part was charged to selling and distribution expenses and administrative expenses (in 2020: PLN 93.2 million).

Revenues earned

Under the preferential loans obtained from the Polish Development Fund ("PFR"), on 23 September 2021, JSW and JSW KOKS received declarations from the PFR on partial forgiveness of the preferential loans: JSW in the amount of PLN 89.2 million and JSW KOKS in the amount of PLN 18.7 million (for details see Note 6.1. of the Consolidated financial statements of the Jastrzębska Spółka Węglowa S.A. Group for the financial year ended 31 December 2021). The loans were forgiven effective as of 24 September 2021. The total amount of the forgiven loans of PLN 107.9 million was recognized in other revenues.

As a result of changes in the repayment schedules of the principal installments and interest on the liquidity loan and the preferential loan from PFR, and the changes to market interest rates, the Parent Company generated revenue of PLN 38.7 million by virtue of the preferential interest rate applied to these loans in 2021, which is the difference between the fair value of the loans and the amount received (PLN 27.4 million in 2020) - the amount recognized in other revenues.

Impairment of non-current assets

As at 31 December 2021, the Group analyzed the signs of impairment of the carrying amount of assets under IAS 36 Impairment of Assets, in order to verify whether any further impairment of assets may have occurred. The conducted tests identified the need to set up an impairment loss for non-current assets in the coal segment for a total amount of PLN 348.4 million and in the coke segment of PLN 420.6 million and to reverse an impairment loss in the coal segment of PLN 75.0 million and in the coke segment of PLN 260.5 million. The impairment loss recognized as at 31 December 2021 is presented in other expenses in the total amount of PLN 768.6 million (establishment of an impairment loss) and in other income in the total amount of PLN 335.5 million (reversal of impairment losses) in the consolidated statement of profit or loss and other comprehensive income. The details are presented in Note 7.5. of the Consolidated financial statements of the Jastrzębska Spółka Węglowa S.A. Group for the financial year ended 31 December 2021.

Impact of the SARS-CoV-2 virus pandemic on the assessment of expected credit losses

The level of impairment losses recognized in 2021 on trade receivables was affected by the improvement of ratings of some business partners and recognition of the impact of the SARS-CoV-2 coronavirus pandemic on the credit quality of clients. The Group adjusted the probability of default on the basis of external ratings through including an additional premium for the risk associated with the current economic situation and forecasts. The effect of including the impact of the SARS-CoV-2 coronavirus pandemic on the impairment loss recognized as at 31 December 2021 for coal and coke trade receivables was PLN 3.4 million (PLN 1.1 million as at 31 December 2020).

Liquidity position

The Group continues its efforts to mitigate the impact of the pandemic on its liquidity by taking advantage of the solutions available on the market to support working capital management (more in Note 9.5. of the Consolidated financial statements of the Jastrzębska Spółka Węglowa S.A. Group for the financial year ended 31 December 2021).

Factors changing non-current assets (up PLN 431.7 million)

As at 31 December 2021, the biggest non-current assets line item was property, plant and equipment (77.7%). Its value increased in 2021 by PLN 387.8 million, i.e. 4.3%. In 2021, the Group incurred expenditures on property, plant and equipment in the amount of PLN 1,588.6 million, with depreciation of PLN 1,023.0 million. In 2021, as a result of asset impairment tests performed, JSW and JSW KOKS recognized a total impairment loss of PLN 433.1 million with respect to non-current assets (recognition of a loss of PLN 768.6 million and reversal of a loss of PLN 335.5 million), of which PLN 410.8 million related to property, plant and equipment.

In addition, as at 31 December 2021, a PLN 155.5 million, or 25.4%, increase was recorded in non-current assets in the Investments in the FIZ asset portfolio line item resulting from, among others, the settlement, at the end of 2020, of the Sell Buy Back (SBB) transaction which is presented by the Fund as an asset and liability and conclusion of a new SBB transaction as at the end of September 2021 (at the same time the Fund’s net asset value as at 31 December 2021 is PLN 507.7 million, which means an increase compared to 31 December 2020 by PLN 17.0 million).

At the same time, a decrease by PLN 107.0 million, or 17.9% was recorded in non-current assets in the right-of-use asset line item compared to 2020, including PLN 136.8 million, or 23.0% in the Parent Company (chiefly due to an increase in marginal interest rates in H2 2021 and execution of a lower number of agreements on right-of-use assets).

Factors changing current assets (up PLN 499.2 million)

An increase in the total amount of current assets was primarily caused by an increase in the trade and other receivables item by PLN 924.4 million, or 102.9%, mainly as a result of growth of trade receivables being up PLN 936.6 million, or 142.1%, which was mostly driven by the higher sales revenues achieved by the Group in December 2021. In addition, as at 31 December 2021, a higher balance of assets was recorded on account of overpaid income tax by PLN 65.8 million, which results from PLN 60.6 million higher value of assets on account of overpaid tax in JSW KOKS compared to 2020.

In addition, in connection with the transfer, as of 1 January 2022, to Spółka Restrukturyzacji Kopalń S.A. of the designated part of the “Jastrzębie III” Mining Area in KWK Jastrzębie-Bzie, as at 31 December 2021 the Group disclosed assets in accordance with IFRS 5 non-current assets (group for disposal) held for sale in the amount of PLN 27.0 million.

At the same time, a decline by PLN 297.5 million or 18.6% was recorded in 2021 in current assets under cash and cash equivalents, which is connected with financing the Group’s ongoing activity and an investment program from its own funds). Also inventories dropped by PLN 227.8 million, or 25.9% (a decrease of the inventories of the Group’s coal by 1,279.9 thousand tons).

Sources of covering assets

Drivers of change in equity (up by PLN 980.7 million)

The 13.4% increase in total equity is primarily associated with an increase in retained earnings by PLN 950.1 million, or 20.0% as compared to 31 December 2020, which directly resulted from the recognized net profit of PLN 903.7 million attributable to shareholders of the Parent Company.

Drivers of change in liabilities (down by PLN 49.8 million)

A decrease in non-current liabilities of PLN 318.7 million, or 7.7% was posted in the period under analysis versus 31 December 2020, mainly due to loans and borrowings dropping by PLN 329.1 million, or 19.5%, resulting from the reclassification of part of these liabilities to current liabilities, as well as due to partial forgiveness of the preferential loans from PFR (in the long-term portion in the total amount of PLN 80.7 million) and from repayment of loans and borrowings. Moreover, employee benefit liabilities rose by PLN 143.3 million, or 16.2%, and lease liabilities by PLN 105.4 million, or 25.9%.

At the same time, in 2021, non-current liabilities for provisions rose by PLN 261.5 million, or 25.9% (mainly due to higher provisions for mine closures of PLN 273.1 million).

The level of current liabilities grew by PLN 268.9 million, or 7.5%, compared to the level as at 31 December 2020, mainly as a result of the increase in FIZ liabilities by PLN 138.5, or 114.2%, including mainly liabilities on the Fund’s sell-buy-back transactions – an increase by PLN 145.8 million. Furthermore, an increase in the level of loans and borrowings by PLN 137.5 million, or 42.8%, caused mainly by the reclassification of part of the non-current loans and borrowings, despite the forgiveness of the preferential loans from PFR (PLN 27.2 million in total in the short-term part).

In connection with the transfer, as of 1 January 2022, to Spółka Restrukturyzacji Kopalń S.A. of the designated part of the “Jastrzębie III” Mining Area in KWK Jastrzębie-Bzie, as at 31 December 2021, the Group disclosed liabilities connected with assets held for sale in the amount of PLN 65.8 million, including employee benefit liabilities: PLN 25.3 million and provisions: PLN 40.5 million. The increase by PLN 48.2 million was also noted in the financial derivatives line item as a result of implementation of transactions by the Parent Company hedging against the change in coking coal prices.

Sales revenue in 2021 amounted to PLN 10,629.1 million and were higher by PLN 3,693.1 million, i.e. by 53.2%, than in 2020, mainly due to coke sales revenues higher by PLN 1,740.4 million, i.e. by 61.4% (without taking into account adjustments to sales revenues on account of execution of hedging transactions), coal sales revenues higher by PLN 1,525.2 million, i.e. by 42.9%, hydrocarbons sales revenues higher by PLN 277.3 million i.e. by 129.5% and sales revenues on other activity higher by PLN 99.9 million i.e. by 25.8%. The higher revenues result primarily from the higher average sales prices of coke by PLN 488.72 per ton, i.e. by 62.8%, and the coal sales volume higher by 0.9 million tons and the average coking coal price higher by PLN 182.92 per ton, i.e. by 41.9%. On the other hand, higher revenues from sales of hydrocarbons resulted mainly from the higher average sales price of BTX by 138.4% and tar by 72.7%.

Cost of products, materials and goods sold incurred in 2021 increased by PLN 696.6 million, or 9.5%, compared to 2020, in connection with an increase in costs by nature by PLN 586.6 million, i.e. by 6.4%, which was mainly driven by a rise in consumption of materials and energy by PLN 339.4 million and in employee benefits by PLN 201.4 million.

In 2021, the Group achieved a gross profit on sales in the amount of PLN 2,595.2 million, compared to a loss of PLN 401.3 million incurred in 2020.

Selling and distribution expenses that consist mostly of the costs of shipping of the Group’s main products in 2021 totaled PLN 277.6 million, down PLN 10.9 million, i.e. 3.8%, as compared to the costs incurred in 2020.

Administrative expenses comprising, among others, costs associated with management and administrative functions in the period under analysis totaled PLN 684.8 million and were PLN 12.9 million, i.e. 1.8%, lower than the costs incurred in the previous year.

Other revenues in 2021 were PLN 590.3 million and were higher by PLN 276.2 million, or 87.9% versus 2020, mainly in connection with the reversal of impairment losses on non-current assets of PLN 335.5 million as a result of impairment tests (of which PLN 75.0 million refers to reversal of impairment loss on the property of KWK Knurów-Szczygłowice and PLN 260.5 million to reversal of impairment loss on the property of the Przyjaźń Coking Plant). Furthermore, other revenues in 2021 include the effect of partial amortization of the preferential loans from PFR in the amount of PLN 107.9 million (for JSW: PLN 89.2 million, for JSW KOKS: PLN 18.7 million). Other revenues in 2020 included subsidies to employee salaries from the Guaranteed Employee Benefit Fund received in connection with the decline of turnover as a result of COVID-19 in the amount of PLN 182.5 million.

Other costs amounted to PLN 882.0 million in 2021 and were PLN 174.3 million, i.e. 24.6%, higher than in 2020. The increase in other costs in 2021 was driven mainly by recognizing the impairment loss for the carrying amount of non-current assets in the amount of PLN 768.6 million, as a result of impairment tests (including impairment loss on the value of assets of JSW mines in the amount of PLN 348.4 million and impairment loss on the value of assets of JSW KOKS in the amount of PLN 420.6 million). In the comparison period, the Group recognized an impairment loss for the carrying amount of non-current assets of KWK Jastrzębie-Bzie in the amount of PLN 516.6 million as well as the costs incurred in connection with the COVID-19 pandemic in the amount of PLN 90.3 million (in 2021: PLN 26.6 million).

Other net gains/(losses) in 2021 amounted to PLN (78.7) million, compared to the gain of PLN 0.5 million in 2020, signifying a decline of PLN 78.2 million. The change was mainly driven by the loss incurred in 2021 on financial derivatives higher by PLN 52.4 million as compared to 2020, resulting primarily from measurement of commodity swap transactions hedging the risk of coking coal price (in 2021, JSW implemented transactions hedging coking coal price risk in the amount of 189 thousand tons, which accounted for approx. 4% of the exposure). As at 31 December 2021, the open position in commodity swaps amounted to 179 thousand tons. Increasing coking coal prices favorable to JSW in 2021 had a negative impact on the derivative transactions concluded earlier, generating a negative result on settlement in the amount of PLN (8.1) million and a negative fair value measurement of active transactions as at 31 December 2021 in the amount of PLN (39.7) million. In case of the unsecured part of exposure, the Parent Company benefited from the increase in coking coal prices. In addition, a loss up by PLN 20.3 million on disposal of property, plant and equipment was recorded. Also, in 2021, the FX gain was PLN 7.8 million lower. Simultaneously, in the period in question, profits were recorded from fair value measurement and realization of the FIZ asset portfolio in the amount of PLN 5.8 million (2020: PLN 9.8 million). As a result of the aforementioned events, the Group recorded an operating profit in the amount of PLN 1,262.4 million, compared to a loss of PLN 1,780.6 million recorded in 2020.

Financial income in 2021 amounted to PLN 8.2 million and was PLN 0.1 million higher than financial income generated in 2020. Financial costs were PLN 104.0 million and were PLN 8.8 million, or 9.2%, higher than those incurred in 2020, mainly due to an increase in the costs of interest and commissions on loans and borrowings by PLN 25.0 million, with a simultaneous decrease in interest associated with settlement of the discount on account of long-term provisions by PLN 9.4 million and a decrease in interest on leasing by PLN 5.1 million.

As a result of the aforementioned factors, the result before tax for 2021 amounted to PLN 1,166.7 million. After including income tax of PLN (214.1) million, the net profit for 2021 was PLN 952.6 million and was up PLN 2,490.0 million from the net profit generated in 2020. In 2021, following the recognition, in other comprehensive income, of the valuation of hedges (change of value) of PLN (23.3) million with income tax of PLN 4.4 million, and actuarial gains of PLN 58.1 million with income tax of PLN (11.0) million, total comprehensive income totaled PLN 980.8 million. Basic and diluted profit per share attributable to shareholders of the Parent Company was PLN 7.70 (in 2020, loss of 13.17 PLN per share).

Cash flow from operating activities

The positive net cash flow on operating activity generated by the Group in 2021 in the amount of PLN 1,661.2 million were primarily affected by profit before tax in the amount of PLN 1,166.7 million, depreciation and amortization of PLN 1,220.1 million, and change in inventories of PLN 227.6 million, despite the recognition of a PLN (904.0) million change in trade and other receivables, and income tax paid in the amount of PLN (281.5) million and the partial forgiveness of the preferential loans from PFR of PLN (107.9) million. Other factors affecting the cash flow on operating activity are presented in Note 8.1. of the Consolidated financial statements of the Jastrzębska Spółka Węglowa S.A. Group for the financial year ended 31 December 2021.

Cash flow on investing activity

Cash used in investing activities in 2021 was PLN 1,620.2 million and was PLN 1,070.9 million higher compared to 2020. The difference results from recognition, in the comparison period, of redemption of investment certificates of PLN 1,398.8 million as well as recognition of cash in connection with termination of a bank term deposit by JZR in the amount of PLN 90.0 million. The main capital expenditures item is the purchase of property, plant and equipment in the amount of PLN 1,596.2 million, down PLN 459.3 million compared to 2020.

Cash flow on financing activity

In 2021, net cash flow on financing activity amounted to PLN (338.1) million compared to PLN 1,441.2 million of cash flows in 2020, which resulted from recognition in the previous year of proceeds from loans and borrowings and subsidies (mainly in connection with received PFR loans) in the amount of PLN 1,735.7 million (in 2021: PLN 119.6 million).

As a result of the above-described events, the balance of cash and cash equivalents as at 31 December 2021 was PLN 1,299.8 million, while the net change in cash and cash equivalents was PLN (297.1) million.

Selected financial ratios

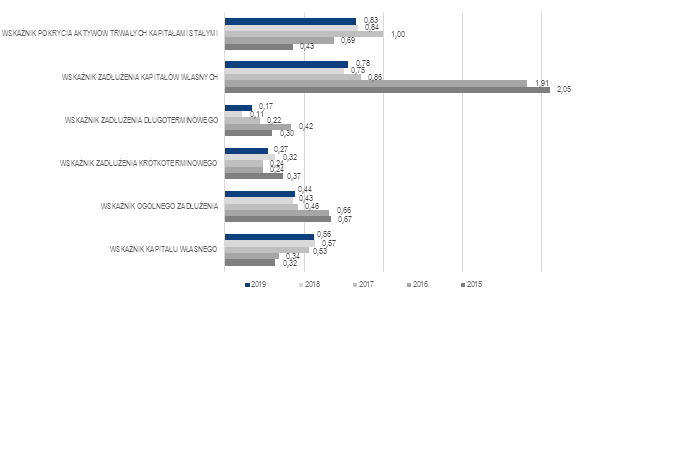

Debt and funding mix

As at the end of the reporting period, the share of liabilities in financing the Group’s activity, measured by the total debt ratio, decreased and was 0.48 compared to 0.51 as at the end of 2020. As at 31 December 2021, the Group had a debt arising from loans and borrowings in the amount of PLN 1,816.2 million. The long-term debt ratio fell down to 0.24, compared to 0.28 as at 31 December 2020, mainly as a result of the decrease in non-current liabilities by PLN 318.7, or 7.7%, including mainly loans and borrowings of PLN 329.1 million and employee benefit liabilities of PLN 143.3 million, in spite of an increase in non-current liabilities for provisions by 261.5 million. On the other hand, the equity ratio rose to 0.51 from 0.48 due to equity higher by PLN 980.7 million, as a result of an increase in retained earnings by PLN 950.1 million.

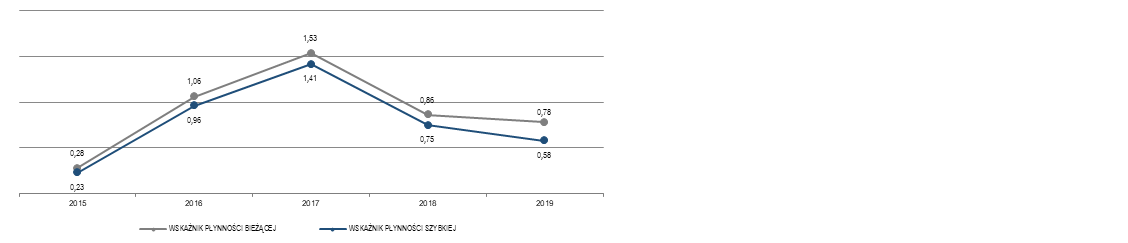

Liquidity

In 2021, current liquidity ratio was 1.08, increasing against 2020 by 4.9%, while quick liquidity ratio was 0.90 (growth by 18.4%, from 0.76 at the end of 2020). The above results from an increase in current assets by PLN 499.2 million, i.e. by 14.7%, including primarily trade and other receivables by PLN 924.4 million (mainly in connection with high sales revenues in December 2021) and with a concurrent decrease in cash and cash equivalents by PLN 297.5 million (mainly as a result of financing current activities and the investment program with own funds) and a decrease in inventories by PLN 227.8 million. The liquidity ratio is significantly affected by a lower growth rate of current liabilities, excluding provisions, as compared to the growth rate of current assets.

Profitability

Analysis of the profitability ratios points to an increase in profitability compared to the previous year, attributable to sales revenues being up PLN 3,693.1 million caused primarily by the higher average sales prices of the Group’s products, i.e. coal up by PLN 117.81 million, or 31.5%, and coke by PLN 488.72 million, or 62.8%.

The return on assets (ROA) and return on equity (ROE) ratios increased as compared to 2020, being 6.0 and 11.5, respectively, which is the outcome of the net profit generated in 2021 of PLN 952.6 million.

Mining cash cost

Mining cash cost (“MCC”) is a ratio used by the Group for management purposes. The methodology of calculation and presentation of coal mining cash cost reflects the cost from the point of view of cash consumption regardless of the period in which it was incurred. The Parent Company calculates the mining cash cost by subtracting costs not directly associated with the production of coal and costs not permanently affecting the financial flows from all costs incurred in the period.

The mining cash cost for 2021 was PLN 6,149.8 million, which is PLN 289.7 million (4.9%) higher than in 2020. The increase in mining cash cost was caused primarily by the following factors:

- higher costs of consumption of materials and energy by PLN 188.5 million (17.5%), of which the consumption of materials increased by PLN 123.5 million and energy consumption by PLN 65.0 million. The increase in costs of energy consumption was related to an increase in the unit price of electricity, which was affected by the price of CO2 emission allowances and the introduction of a capacity fee on energy collected the external grid from 1 January 2021, and an increase in energy costs was impacted by the higher amount of cooling energy used for climate hazard prevention and the higher unit price of heat and cooling as a result of the increase in the price of electricity in the competitive market. The increase in the costs of consumption of materials, in turn, was mainly due to higher consumption of materials used in the prevention of caving hazard, transport by overhead and floor railroads, transport of the mined coal using belt conveyors and fire prevention,

- higher costs of employee benefits by PLN 177.0 million (5.8%), resulting primarily from the 3.4% increase in base salary as of 1 July 2021 and the implementation, as of 1 September 2021, of new base salary rates which were 1.6% higher than the existing ones as a result of the Memorandum of Agreement executed on 13 September 2021 by and between the JSW Management Board and the Representative Trade Union Organizations, as well as disbursement of additional cash bonus. Salary for work on Saturdays, Sundays and holidays also increased. In 2020, the labor costs associated with COVID-19 (among others the labor costs associated with employees falling ill with COVID-19, being on quarantine or preventive measures involving the necessity to introduce the so-called downtime) in the amount of PLN 77.1 million were excluded from the mining cash cost. In 2021 these excluded costs amounted to PLN 24.3 million.

- other costs by nature up PLN 7.6 million (15.5%), mainly on account of an increase in the cost of non-life insurance, in connection with the update of the value of the underground property subject to insurance,

- costs of taxes and charges up PLN 5.6 million (4.0%), with the bulk being the real estate tax on account of the increase in fixed assets subject to taxation with the real estate tax and increase of the real estate rates for municipalities,

On a per-unit basis the mining cash cost in 2021 was PLN 447.12 per ton, i.e. PLN 39.75 per ton (9.8%) more than in the corresponding period of 2020, influenced by the 4.9% increase of expenditures for coal production and 0.6 mt decrease in net coal production.

Cash conversion cost

The cash conversion cost (“CCC”) is a measure used by the Group’s coke plants and calculated as the sum of costs by nature incurred by the coking plants, net of the cost of coal feedstock (including the cost of transporting the feedstock), the cost of purchasing electricity to be resold and selling and distribution expenses net of depreciation attributable to selling and distribution expenses. Unit cash conversion cost is calculated as the value of this measure divided by the coke production volume designated for sale. As of 1 January 2020 the definition of the coke cash conversion cost changed by extending the list of exclusions to include the cost of purchasing electricity to be resold.

In 2021, the cash conversion cost of coke was PLN 633.3 million, i.e. increased by PLN 39.9 million or 6.7% as compared to 2020. This change was driven mainly by:

- the costs of external services without the coal feedstock transport costs up PLN 16.7 million, or 9.3%, driven mainly by the cost of renovation services being up PLN 13.6 million and costs of other services (mostly laboratory services) being up PLN 5.2 million, combined with the costs of transportation services being down PLN 2.2 million (lower costs of coke storage and unloading),

- the costs of consumption of materials net of coal feedstock up by PLN 15.6 million, or 31.0%, which is caused primarily by higher consumption of materials for overhauls by PLN 10.7 million, materials for production by PLN 2.9 million, and increase in consumption of nitrogen and other materials by PLN 0.7 million,

- the costs of energy consumption up by PLN 8.0 million, or 21.3%, resulting primarily from higher costs of steam consumption by PLN 5.0 million and higher costs of electricity consumption by PLN 3.1 million,

- the costs of employee benefits down by PLN 5.5 million, or 2.3%, as a result of the decrease in employee benefit liabilities by PLN 22.2 million and a concurrent increase of costs associated with, among other things, payment by JSW KOKS of a one-off bonus charged to the payroll fund in the amount of PLN 2.8 million in June 2021 and PLN 5.6 million in November 2021, execution of salary adjustments which increased the costs of social security and other benefits by PLN 3.0 million,

- selling and distribution expenses minus depreciation and amortization attributable to selling and distribution expenses down PLN 3.5 million, or 12.9%, mainly due to costs of transportation services being down PLN 2.8 million and the personnel costs being down PLN 0.3 million.

As a result of the above events, on a per-unit basis, Cash Conversion Cost for 2021 reached PLN 173.10 per ton and was PLN 5.27 per ton, 3.0% lower relative to 2020.

Employment

As at 31 December 2021, the Group had 31,916 employees while as at 31 December 2020 the headcount was 30,593. At the end of 2021 JSW had 23,119 employees versus 21,973 employees in 2020. The Group’s average headcount in 2021 was 30,560 employees, which was down by 114 employees compared to 2020. The average headcount in the Parent Company in 2021 was 22,103 persons. It was 199 persons below the previous year.

In 2021 the JSW Management Board decided to transfer free of charge a portion of JSW’s enterprise in the form of the “Jastrzębie III” Mining Area in KWK “Jastrzębie-Bzie” to Spółka Restrukturyzacji Kopalń S.A. As a result of the signed agreement, under the procedure contemplated by Article 8a of the Act of 7 September 2007 on the Functioning of the Hard Coal Mining Industry, as amended, the Parent Company transferred 2,148 employees (including 1,234 employees of PGG) to SRK as of 1 January 2022. On the transfer date, these people were employees of KWK Jastrzębie–Bzie.