Results and perspectives by segments

Segments

The Group is an active participant of the metallurgical coal – coke – steel supply chain. It focuses on extraction and processing of coal as well as sale of the JSW Group’s products, such as coal, coke and other hydrocarbons. It is therefore the key element of the recommended Group operation model.

The Group is organized and managed in segments by type of products offered and type of production activity. The Management Board of the JSW has identified operating segments based on the financial reporting of the companies comprising the Group. The Group's operations are conducted by the following operating segments:

Coal segment

Comprising hard coal mining and sales13.8 mt

of produced coalPLN 1,357.7 m

on capital expendituresCoke segment

Comprising production and saleof coke and hydrocarbons

3.7 mt

of produced cokePLN 227.3 m

on capital expendituresOther segments

Comprising the other operations of the Group’s entitiesPLN 487.7 m

of sales revenuesPLN 122.2 m

on capital expendituresTable. Segment results

| ITEM | COAL SEGMENT | COKE SEGMENT | OTHER SEGMENTS | |||

|---|---|---|---|---|---|---|

| 2021 | 2020 | 2021 | 2020 | 2021 | 2020 | |

| Sales revenues from external customers | 5,079.8 | 3 554,6 | 5,064.7 | 3 047,0 | 487.7 | 387,8 |

| Adjustment of sales revenues on account of execution of hedging transactions* | - | - | (3.1) | (53.4) | - | - |

| Operating profit/(loss) | 411.9 | (1 760,2) | 1,234.4 | (88,0) | 86.7 | 92,2 |

| Depreciation and amortization | 1,039.4 | 935,0 | 113.7 | 107,7 | 145.6 | 133,9 |

| EBITDA | 1,451.3 | (825,2) | 1,348.1 | 19,7 | 232.3 | 226,1 |

| Adjusted EBITDA** | 1,724.7 | (308,6) | 1,508.2 | - | - | - |

* The item results from a change in the presentation rules applied by the Group as of 1 January 2021 and pertains to reclassification of the effective result in connection with realizing the hedged position from being reported as other comprehensive income to profit or loss.

** EBITDA after excluding the impairment loss of PLN 348.4 million on non-current assets in the coal segment of JSW mines, recognized as a result of tests completed in 2021 and the reversal of the impairment loss of PLN 75.0 million on the assets of KWK Knurów-Szczegółowice (in 2020 the EBITDA of the coal segment was adjusted to reflect the impairment loss of PLN 516.6 million on the assets of KWK Jastrzębie-Bzie recognized as a result of the tests conducted). In turn, in 2021 EBITDA in the coke segment was adjusted to reflect the impairment losses recognized as a result of the conducted tests in the non-current assets of the Radlin Coking Plant and the Jadwiga Coking Plant totaling PLN 420.6 million and the reversed impairment loss of PLN 260.5 million regarding the assets of the Przyjaźń Coking Plant.

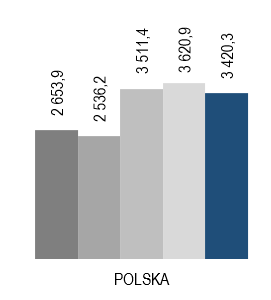

Revenues on the sales of coal to external buyers in 2021 were PLN 5,079.8 million, up 42.9% from 2020. This growth was precipitated by the increase in the volume of coal sales by 0.9 million tons and by commanding a higher average sales price for coking coal, which was up PLN 182.92 / ton. In the reporting period, sales revenues in the coke segment (without taking into account the adjustment of sales revenues on account of executing hedging transactions) totaled PLN 5,064.7 million, signifying growth of 66.2% versus 2020. The increase in revenues from the sales of coke and hydrocarbons was caused primarily by the average sales price of coke increasing by PLN 488.72 per ton, i.e. by 62.8%.

Segment-specific information for reporting purposes

The Group presents information on operating segments in accordance with IFRS 8 "Operating Segments". The Group is organized and managed in segments by type of products offered and type of production activity.

| Coal | Coke | Other segments * | Consolidation adjustments ** | Total | |

|---|---|---|---|---|---|

| FOR THE PERIOD ENDED 31 DECEMBER 2021 | |||||

| Total segment sales revenues | 8 495,1 | 5 061,6 | 1 771,1 | (4 698,7) | 10 629,1 |

| - Revenues on inter-segment sales | 3 415,3 | - | 1 283,4 | (4 698,7) | - |

| - Sales revenues from external customers | 5 079,8 | 5 064,7 | 487,7 | - | 10 632,2 |

| - Adjustment of sales revenues on account of realization of hedging transactions | - | (3,1) | - | - | (3,1) |

| Segment’s gross profit/(loss) on sales | 1 409,1 | 1 571,0 | 160,2 | (545,1) | 2 595,2 |

| Segment's operating profit/(loss) | 411,9 | 1 234,4 | 86,7 | (470,6) | 1 262,4 |

| Depreciation and amortization | (1 039,4) | (113,7) | (145,6) | 78,6 | (1 220,1) |

| OTHER SIGNIFICANT NON-CASH ITEMS: | |||||

| - Recognition of impairment losses for non-financial non-current assets | (348,4) | (420,6) | - | 0,4 | (768,6) |

| - Reversal of impairment losses for non-financial non-current assets following impairment tests | 75,0 | 260,5 | - | - | 335,5 |

| TOTAL SEGMENT ASSETS, INCLUDING: | 9 559,3 | 4 349,0 | 2 168,8 | (2 241,0) | 13 836,1 |

| Increases in non-current assets (other than financial instruments and deferred income tax assets) | 1 653,0 | 102,8 | 145,0 | (34,4) | 1 866,4 |

** The "Consolidation adjustments" column eliminates the effects of intra-segment transactions within the Group

| Coal | Coke | Other segments * | Consolidation adjustments ** | Total | |

|---|---|---|---|---|---|

| FOR THE PERIOD ENDED 31 DECEMBER 2020 (restated data)*** |

|||||

| Total segment sales revenues | 5 577,2 | 2 993,6 | 1 489,6 | (3 124,4) | 6 936,0 |

| - Revenues on inter-segment sales | 2 022,6 | - | 1 101,8 | (3 124,4) | - |

| - Sales revenues from external customers | 3 554,6 | 3 047,0 | 387,8 | - | 6 989,4 |

| - Adjustment of sales revenues on account of realization of hedging transactions | - | (53,4) | - | - | (53,4) |

| Segment’s gross profit/(loss) on sales | (603,2) | 144,3 | 160,4 | (102,8) | (401,3) |

| Operating profit of the segment | (1 760,2) | (88,0) | 92,2 | (24,6) | (1 780,6) |

| Depreciation and amortization | (935,0) | (107,7) | (133,9) | 71,7 | (1 104,9) |

| OTHER SIGNIFICANT NON-CASH ITEMS: | |||||

| - Reversal of impairment losses for non-financial non-current assets | (516,6) | - | - | - | (516,6) |

| TOTAL SEGMENT ASSETS, INCLUDING: | 9 384,9 | 2 458,3 | 2 132,0 | (829,6) | 13 145,6 |

| Increases in non-current assets (other than financial instruments and deferred income tax assets) | 1 684,2 | 127,6 | 235,3 | (77,4) | 1 969,7 |

** The "Consolidation adjustments" column eliminates the effects of intra-segment transactions within the Group

*** Data restated in connection with the change of presentation described in more detail in Note 2.6

Presented below is reconciliation of the results (operating profit/(loss)) generated by the segments with profit/(loss) before tax:

| 2021 | 2020 (restated data) |

|

|---|---|---|

| OPERATING PROFIT/(LOSS) | 1 262,4 | (1 780,6) |

| Financial income | 8,2 | 8,1 |

| Financial costs | (104,0) | (95,2) |

| Share in profits/(losses) of associates | 0,1 | 0,1 |

| PROFIT/(LOSS) BEFORE TAX | 1 166,7 | (1 867,6) |

Segment assets

The amounts of total assets are measured in a manner consistent with the method applied in the consolidated statement of financial position. These assets are allocated by segment's business and by physical location of the asset component.

Group assets are located in Poland.

The reconciliation of segment assets with the Group's total assets is presented below:

| 31.12.2021 | 31.12.2020 | |

|---|---|---|

| SEGMENT ASSETS | 13 836,1 | 13 145,6 |

| Investments in associates | 1,2 | 1,2 |

| Deferred tax assets | 849,9 | 877,0 |

| Investments in the FIZ Asset Portfolio, long-term | 767,5 | 612,0 |

| Other non-current assets | 390,6 | 378,7 |

| Income tax overpaid | 69,2 | 3,4 |

| Financial derivatives | 10,7 | 7,8 |

| Investments in the FIZ Asset Portfolio, short-term | 9,6 | 5,2 |

| Other current financial assets | 27,0 | - |

| TOTAL ASSETS ACCORDING TO THE CONSOLIDATED STATEMENT OF FINANCIAL POSITION | 15 961,8 | 15 030,9 |

Information relating to geographical areas

The geographic breakdown of revenues on sales is depicted by the buyer's country of origin:

| Note | 2021 | 2020 (restated data)* |

|

|---|---|---|---|

| Sales in Poland, of which: | |||

| Coal | 3 389,3 | 2 438,8 | |

| Coke | 792,3 | 381,9 | |

| Other segments | 472,6 | 370,1 | |

| TOTAL SALES IN POLAND | 4 654,2 | 3 190,8 | |

| Sales abroad, including: | |||

| EU member states, of which: | 5 583,6 | 3 365,6 | |

| Coal | 1 690,5 | 1 115,8 | |

| Coke | 3 878,5 | 2 232,6 | |

| Other segments | 14,6 | 17,2 | |

| Non-EU Europe, of which: | 350,8 | 218,9 | |

| Coke | 350,7 | 218,9 | |

| Other segments | 0,1 | - | |

| Other states, of which: | 43,6 | 214,1 | |

| Coke | 43,2 | 213,6 | |

| Other segments | 0,4 | 0,5 | |

| TOTAL SALES ABROAD, including: | 5 978,0 | 3 798,6 | |

| Coal | 1 690,5 | 1 115,8 | |

| Coke | 4 272,4 | 2 665,1 | |

| Other segments | 15,1 | 17,7 | |

| Adjustment of sales revenues on account of realization of hedging transactions | (3,1) | (53,4) | |

| TOTAL SALES REVENUES | 4.1 | 10 629,1 |

6 936,0 |

* Data restated in connection with the change of presentation described in more detail in Note 2.6.

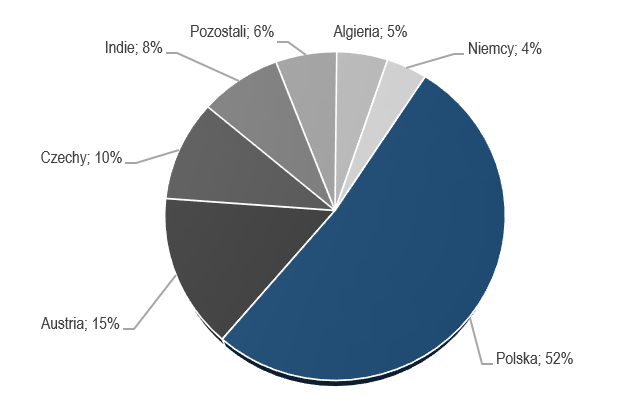

Revenues on sales – geographic breakdown by the country of origin of the counterparty making the purchase:

| 2021 | 2020 (restated data)* |

|

|---|---|---|

| Poland | 4 654,2 | 3 190,8 |

| Austria | 1 579,0 | 907,5 |

| Germany | 1 536,0 | 1 129,9 |

| Czech Republic | 1 187,4 | 688,2 |

| Belgium | 498,7 | 102,3 |

| Romania | 485,8 | 335,6 |

| Switzerland | 206,7 | 132,7 |

| Slovakia | 161,4 | 123,9 |

| Norway | 144,0 | 86,2 |

| Spain | 100,7 | 54,8 |

| Singapore | 43,6 | 214,0 |

| France | 23,6 | 16,0 |

| Holland | 9,2 | - |

| Luxembourg | 1,4 | - |

| Ireland | 0,3 | - |

| Sweden | - | 7,5 |

| Other countries | 0,2 | - |

| Adjustment of sales revenues on account of realization of hedging transactions | (3,1) | (53,4) |

| TOTAL SALES REVENUES | 10 629,1 | 6 936,0 |

Information on key customers

For the period from 1 January to 31 December 2021, revenues on sales to two clients, to each one of them individually, exceeded 10% of the Group's revenues on sales. Revenues on sales to one of them were PLN 2,387.1 million and to the other PLN 1,534.9 million. Revenues on sales to those clients were included in the Coal segment and in the Coke segment.

For the period from 1 January to 31 December 2020, revenues on sales to two clients, to each one of them individually, exceeded 10% of the Group's revenues on sales. Revenues on sales to one of them were PLN 1,463.0 million and to the other PLN 881.9 million. Revenues on sales to those clients were included in the Coal segment and in the Coke segment.

Coal segment

The Group’s mining activity is performed by five hard coal mines. All these mines do their business within the geographical boundaries of their concession areas for which the concession expiry date, the surface area and the depth are specified. The Group’s mines exploit hard coal deposits in the mining areas defined in the concessions, located in townships of Jastrzębie-Zdrój and Żory, rural townships (gmina) of Świerklany, Mszana, Pawłowice, Gierałtowice, Ornontowice, Pilchowice, as well as the towns of Mikołów, Czerwionka-Leszczyny, Gliwice, Knurów, and Pszczyna.

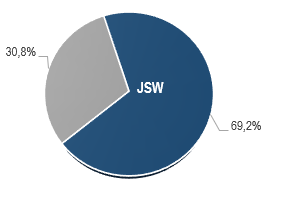

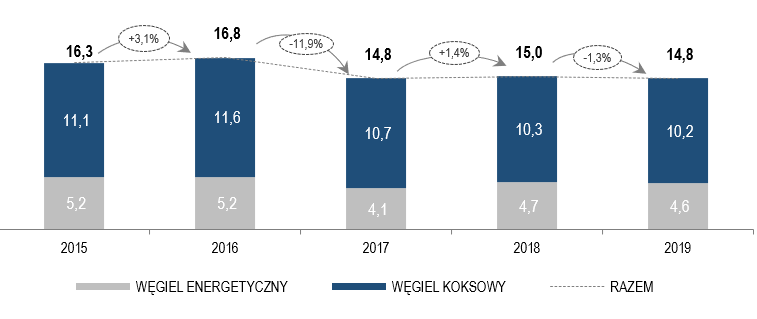

Structure of coal production and sale

The structure of the Group’s coal production is the result of the current geological conditions in mines and rapidly changing market needs, taking into account supply and demand in the domestic and foreign markets. The share of coking coal and steam coal in total net production in 2021 was 80.0% and 20.0%, respectively.

In 2021, a total of 14.9 million tons of coal was sold, of which, on account of the intended use of coal, the share of coking coal sales in the Group’s total deliveries was 77.9% with the remaining 22.1% was steam coal.

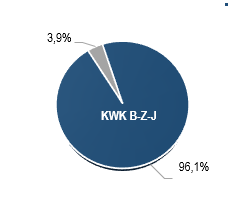

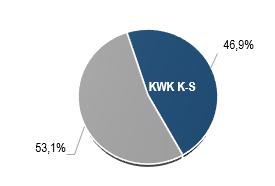

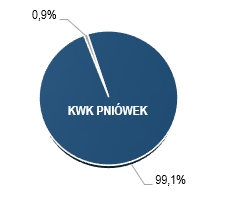

The coal production volume achieved by the Group’s mines in 2021 was 13.8 million tons, i.e. 0.6 million tons less than in 2020. In the period under analysis, the Group’s mines produced and sold mainly hard coking coals, and lesser volumes of coking gas coal. The Borynia-Zofiówka and Pniówek mines produced good quality hard coking coal, with a very good average level of CRI 25-30% and CSR 60-65, mainly for the production of blast furnace coke. The Budryk mine and the Szczygłowice Section of the Knurów-Szczygłowice mine also produce hard coking coal with good quality parameters, i.e. low volatile matter content below 31% and a good average CRI of 30-34% and CSR of 50-55%. In turn, the Knurów Section produced coking gas coal of stable quality parameters with a CRI of 40% and CSR of 45%. The Budryk and Knurów-Szczygłowice mines also produce steam coal used by power plants and co-generation plants to produce electricity and heat.

Chart. Coal production in the Group in 2017-2021 (million tons)

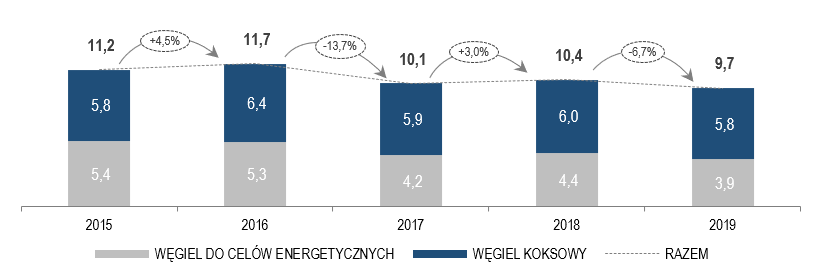

The total sales of coal produced by the Group’s mines, comprising intra-group and external deliveries, were realized at 14.9 million tons, i.e. 0.9 million tons more than in 2020, including coking coal sales growth of 0.8 million tons.

Chart. Coal sales to external offtakers in 2017-2021 (million tons)

In 2021, compared to the previous year, external sales of coking coalincreased by 0.6 million tons, i.e. 9.5%, while internal sales posted growth of 0.2 million tons, i.e. 4.4%. In the period in question, the sales of steam coal to external buyers increased by 0.1 million tons compared to the previous year.

In external sales, the share of coal supplies to domestic customers accounted for 68.4% (volume) and 60.5% (revenue), while sales to the international market represented 31.6% and 39.5%, respectively. For comparison, in 2020 these percentages were as follows: domestic buyers 69.5% (volume) and 64.3% (revenue); foreign buyers 30.5% (volume) and 35.7% (revenue).

In 2021, revenues from sales to external buyers in the coal segment reached PLN 5,079.8 million and were approx. PLN 1,525.2 million, i.e. 42.9% higher than in 2020 as a result of improving market circumstances and higher sales volumes.

Table. Key quality parameters of coal produced by the Group in 2021 (mean values)

| CATEGORY | KWK BORYNIA - ZOFIÓWKA | KWK PNIÓWEK | KWK KNURÓW-SZCZYGŁOWICE | KWK BUDRYK | ||

|---|---|---|---|---|---|---|

| Section Borynia | Section Zofiówka | Secion Knurów | Secion Szczygłowice | |||

| METALLURGICAL (COKING) COAL | ||||||

| Ash content Ad (%) | 6,7 | 7,6 | 6,3 | 8,1 | 7,6 | 7,5 |

| Humidity Wtr (%) | 11,3 | 10,2 | 9,7 | 7,1 | 8,8 | 8,5 |

| Sulfur content Std (%) | 0,68 | 0,55 | 0,54 | 0,68 | 0,42 | 0,54 |

| Volatile matter content (Vdaf (%) | 25,1 | 22,5 | 25,7 | 32,3 | 29,3 | 28,8 |

| Sinterability (RI) | 81 | 74 | 82 | 75 | 81 | 82 |

| Coke strength after reaction CSR (%) | 61 | 62 | 65 | 45 | 55 | 50 |

| CO2 coke reactivity index (CRI %) | 27 | 30 | 24 | 40 | 30 | 34 |

| STEAM COAL | ||||||

| Ash content Ar (%) | - | 20,4 | 14,0 | 23,2 | 20,6 | 25,8 |

| Humidity Wtr (%) | - | 9,5 | 3,7 | 9,2 | 8,9 | 10,7 |

| Sulfur content Str (%) | - | 0,53 | 0,57 | 0,65 | 0,35 | 0,52 |

| Calorific value (Qir MJ/kg) | - | 23,7 | 28,3 | 22,2 | 23,8 | 21,0 |

Table. Achieved production and sales of coal, including intra-Group sales

| ITEM | 2021 | 2020 | 2019 | 2018 | 2017 | GROWTH RATE 2020=100 |

|---|---|---|---|---|---|---|

| Production (million tons) | 13,8 | 14,4 | 14,8 | 15,0 | 14,8 | 95,8 |

| - Metallurgical (coking) coal | 11,0 | 11,1 | 10,2 | 10,3 | 10,7 | 99,1 |

| - Steam coal | 2,8 | 3,3 | 4,6 | 4,7 | 4,1 | 84,8 |

| Total volume of JSW’s sales (million tons)(1) | 14,9 | 14,0 | 13,8 | 14,8 | 14,6 | 106,4 |

| - Metallurgical (coking) coal | 11,6 | 10,8 | 9,9 | 10,4 | 10,4 | 107,4 |

| - Steam coal | 3,3 | 3,2 | 3,9 | 4,4 | 4,2 | 103,1 |

| Intra-group sales (million tons)(1) | 4,7 | 4,5 | 4,1 | 4,4 | 4,5 | 104,4 |

| - Metallurgical (coking) coal | 4,7 | 4,5 | 4,1 | 4,4 | 4,5 | 104,4 |

| - Steam coal | - | - | - (2) | - (2) | - | - |

| Sales volume to external customers (million tons)(1) | 10,2 | 9,5 | 9,7 | 10,4 | 10,1 | 107,4 |

| - Metallurgical (coking) coal | 6,9 | 6,3 | 5,8 | 6,0 | 5,9 | 109,5 |

| - Steam coal | 3,3 | 3,2 | 3,9 | 4,4 | 4,2 | 103,1 |

| Revenues from coal sales (PLN million)(3) | 8 495,1 | 5 577,2 | 7 688,0 | 8 296,6 | 7 929,2 | 152,3 |

| Revenues from inter-segment coal sales revenues (PLN million) | 3 415,3 | 2 022,6 | 2 916,9 | 3 212,0 | 3 003,3 | 168,9 |

| Revenues from coal sales to external customers (PLN million) | 5 079,8 | 3 554,6 | 4 771,1 | 5 084,6 | 4 925,9 | 142,9 |

(2) because of the low volume, there is no impact on the figures expressed in million tons,

(3) this value takes into account the Group’s additional revenues in 2021, 2020, 2019, 2018 and 2017, respectively: PLN 274.5 million, PLN 85.3 million, PLN 315.9 million, PLN 225.2 million and PLN 245.0 million from the sale of coal produced outside the Group

Coke segment

Coke production and sale

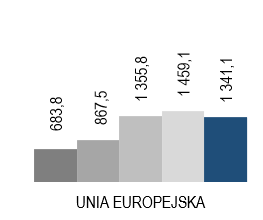

The quantity of coke production in the Group in 2021, compared to 2020, increased by 0.4 million tons, i.e. 12.1%, while sales remained at a comparable level. Sales revenues in the coke segment, comprising coke and hydrocarbons, were PLN 5,064.7 million in the period under analysis, and were up PLN 2,017.7 million, i.e. 66.2% higher than in 2020. The increase in the sales revenues from coke and hydrocarbons was attributable to commanding higher sales prices for these products (the average coke sales price obtained in 2021 was PLN 1,266.47 per ton, which is a 62.8% increase over 2020.

Poland is one of the main suppliers of coke in the EU market. Since the coke market is globalized, coke from Poland competes with supplies of this commodity not only from Europe but also from all other parts of the world, including China, Russia and Colombia. The prices of blast furnace coke in the European market stood on average in 2021 at USD 460.0 per ton on a CFR Nothern Europe Port basis, representing an increase of 92.6% compared to USD 238.8 per ton on CFR Nothern Europe Port basis in 2020. Chinese coke prices shot up 64.3% to an average price of 480.6 USD/t.

2021 was a period when standard coke flows were revisited on the global market. China returned to its role of a net exporter; in 2021 the export of coke from China is estimated to be 6.1 million tons, or a substantially higher level than in 2020 (3.5 million tons). In 2021 coke imports to China stood at 1.3 million tons, down 55% compared to the previous year.

Globally, coke production in 2021 versus the previous year moved up 4% to 718 million tons. In China it was roughly 478 million tons, which accounts for approx. 67% of global coke production, and accordingly China noted a 2% increase compared to the previous year. The rebound of steel production triggered a resurgence in coke demand in European countries, which were traditionally its largest importer. Coke consumption in Europe climbed 10% in 2021 versus the previous year to approximately 46 million tons. Coke production in this period also moved up 10% to approximately 44 million tons.

It is estimated (according to CRU) that the global coke trade in 2021 was 31 million tons, which represents an increase of 18% compared to the previous year.

The prices of the coke sold by the Group are set at the turn of each quarter; to reflect the market terms of negotiations it is optimal to compare the prices commanded in a given quarter with the average prices in the previous quarter.Considering the prices affecting JSW’s prices in a given year (the average price in Q4 of last year - Q3 of the current year), the growth in the average reference price for coke in 2021 versus 2020 was +48% (blast furnace coke on the European market: USD 244 in 2020; USD 362 in 2021).

Table. Realized coke production and sales together with revenues from sale of coke and hydrocarbons

| ITEM | 2021 | 2020 | 2019 | 2018 | 2017 | GROWTH RATE 2020=100 |

|---|---|---|---|---|---|---|

| Production (million tons)(1) | 3,7 | 3,3 | 3,2 | 3,6 | 3,5 | 112,1 |

| Coke sales volume (million tons) | 3,6 | 3,6 | 2,9 | 3,5 | 3,5 | 100,0 |

| Sales revenues (PLN million)(2) | 5 064,7 | 3 047,0 | 3 545,0 | 4 451,5 | 3 688,1 | 166,2 |

| Adjustment of sales revenues on account of execution of hedging transactions (PLN million)(3) | (3,1) | (53,4) | - | - | - | 5,8 |

(2) revenues from sales of coke and hydrocarbons.

(3) the item results from a change in the presentation rules applied by the Group as of 1 January 2021 pertaining to reclassification of the effective result in connection with execution of the hedged position from other comprehensive income to profit or loss.

Other segments

The Group is also engaged in limited auxiliary activities that are immaterial from the standpoint of the Group’s operations and financial standing. In 2021 sales revenues in other segments was PLN 487.7 million, or 4.6% of the Group’s sales revenues, and were up 25.8% above the amounts generated in 2020

The Group's other activity includes various types of support activities, including in the areas of innovations, IT, logistics, repair and maintenance services, laboratory and insurance services.

The Group includes:

Centralne Laboratorium Pomiarowo-Badawcze Sp. z o.o. – Technical research services, chemical and physiochemical analyses of minerals, and solid, liquid and gaseous materials and products.

JSW IT SYSTEMS Sp. z o.o. - Computer hardware consulting, programming and data processing services.

JSW Innowacje S.A. - The Group’s research and development activity, feasibility studies and oversight over execution of projects and implementations.

Jastrzębskie Zakłady Remontowe Sp. z o.o. - Service activity pertaining to renovation, maintenance and upkeep of machinery and equipment Production of machinery for mining, quarrying and construction as well as generation, transmission, distribution of, and trading in, electricity.

![]()

Przedsiębiorstwo Budowy Szybów S.A. - Specialized mining services: designing and execution of vertical and horizontal mine workings and tunnels, construction services, architectural and engineering services, lease of machinery and equipment as well as assembly, repairs and upkeep of machinery for the mining, quarrying and construction industries.

Jastrzębska Spółka Kolejowa Sp. z o.o. - Provision of railway lines, maintenance of railway infrastructure structures and equipment, construction and repair of railway tracks and facilities.

JSW Logistics Sp. z o.o. - Rendering services concerning rail siding services, coal and coke transportation, organizing the carriage of cargo and technical maintenance and repair of rail cars.

Przedsiębiorstwo Gospodarki Wodnej i Rekultywacji S.A. - Provision of water and sewage-related services and discharge of salt water, supply of industrial water, reclamation activity and production of salt.

Jastrzębska Spółka Ubezpieczeniowa Sp. z o.o. - Insurance intermediation and insurance administration pertaining to insurance claims handling, tourist and hotel activity.

JSW Szkolenie i Górnictwo Sp. .z o.o. - Mining support activity and operating the shower rooms in JSW’s mines.

Sales prices

Coal market

The Group sets coal prices based on published price indexes, taking into account differences in quality between the Group’s coal grades compared to index coal grades and the bonus it derives from its geographical location.

Coal selling prices (PLN/ton)

| ITEM | 2021 | 2020 | 2019 | 2018 | 2017 | GROWTH RATE 2020=100 |

|---|---|---|---|---|---|---|

| Average sales prices of coal produced by JSW (PLN/t) | ||||||

| Metallurgical (coking) coal | 619,68 | 436,76 | 634,84 | 658,67 | 656,70 | 141,9 |

| Steam coal | 224,85 | 249,36 | 275,79 | 249,40 | 206,71 | 90,2 |

| TOTAL(1) | 491,59 | 373,78 | 490,99 | 486,32 | 471,10 | 131,5 |

Coke market

Average coke sales prices

| ITEM | 2021 | 2020 | 2019 | 2018 | 2017 | GROWTH RATE 2020=100 |

|---|---|---|---|---|---|---|

| Coke (PLN/t)(1) | 1 266,47 | 777,75 | 1 112,88 | 1 139,90 | 972,96 | 162,8 |

More information here.

Revenue

The Group’s product mix referring to the production of hard and semi-soft coking coal grads, steam coal and coke is aligned to dynamically evolving market needs reflecting the supply and demand on local and foreign markets. The Polish market is the main market for the coal produced by the Group.

The European market is the main market for the sale of coke produced by the Group. Having regard for market conditions and market diversification, the overseas markets, especially the Indian market were significant sales markets. Coke sold from Poland to overseas markets successfully competes against Chinese, Russian, Ukrainian or Colombian coke. Hydrocarbon products have regular buyers on the European market. Surplus coke oven gas is sold to consumers directly by coke plants.

Revenues from sales of coal, coke and hydrocarbons, by geographical area and type of end customers

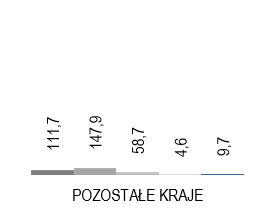

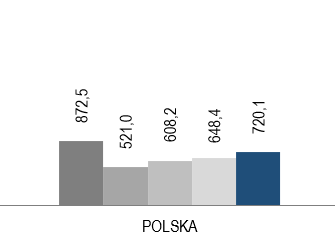

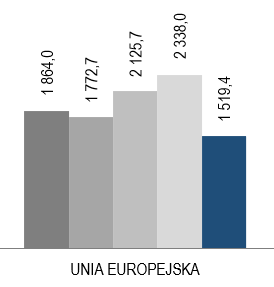

Charts. Coal sales revenues (PLN million)

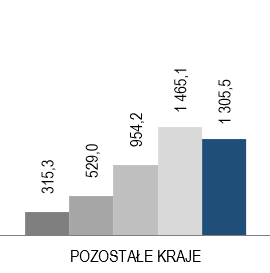

Charts. Sales revenues from coke and hydrocarbons (PLN million)

Chart. Revenue mix by country of destination as of 31 December 2021

Investments

PLN 1,588.6 million of the total capital expenditures incurred in 2021 of PLN 1,707.2 million was spent on property, plant and equipment, PLN 110.1 million was spent on right-of-use assets, PLN 8.4 million was spent on intangible assets and PLN 0.1 million was spent on investment property.

Of the total expenditures incurred in 2020 of PLN 1,896.0 million, PLN 1,633.1 million was spent on property, plant and equipment, PLN 247.8 million on right-of-use assets, and PLN 15.1 million on intangible assets.

| ITEM | 2021 | 2020 | 2019* | 2018 | 2017 | GROWTH RATE 2020=100 |

|---|---|---|---|---|---|---|

| COAL SEGMENT | ||||||

| Expenditures on property, plant and equipment (without expensable mining pits), investment property and intangible assets | 619,0 | 753,1 | 1 235,7 | 864,4 | 394,9 | 82,2 |

| Expenditures on expensable mining pits | 651,1 | 604,1 | 531,8 | 541,4 | 459,1 | 107,8 |

| Expenditures re. the right-of-use assets | 87,6 | 195,1 | 283,2 | n/a | n/a | 44,9 |

| TOTAL | 1 357,7 | 1 552,3 | 2 050,7 | 1 405,8 | 854,0 | 87,5 |

| COKE SEGMENT | ||||||

| Expenditures on property, plant and equipment and intangible assets | 226,7 | 127,2 | 115,0 | 50,1 | 45,3 | 178,2 |

| Expenditures re. the right-of-use assets | 0,6 | 0,4 | - | n/a | n/a | 150,0 |

| TOTAL | 227,3 | 127,6 | 115,0 | 50,1 | 45,3 | 178,1 |

| OTHER SEGMENTS | ||||||

| Expenditures on property, plant and equipment and intangible assets | 100,3 | 163,8 | 150,5 | 212,7 | 123,4 | 61,2 |

| Expenditures re. the right-of-use assets | 21,9 | 52,3 | 83,5 | n/a | n/a | 41,9 |

| TOTAL | 122,2 | 216,1 | 234,0 | 212,7 | 123,4 | 56,5 |

| TOTAL SEGMENTS | ||||||

| Expenditures on property, plant and equipment (without expensable mining pits), investment property and intangible assets | 946,0 | 1 044,1 | 1 501,2 | 1 127,2 | 563,6 | 90,6 |

| Expenditures on expensable mining pits | 651,1 | 604,1 | 531,8 | 541,4 | 459,1 | 107,8 |

| Expenditures re. the right-of-use assets | 110,1 | 247,8 | 366,7 | n/a | n/a | 44,4 |

| TOTAL** | 1 707,2 | 1 896,0 | 2 399,7 | 1 668,6 | 1 022,7 | 90,0 |

| TOTAL (AFTER CONSOLIDATION ADJUSTMENTS) | 1 668,4 | 1 832,0 | 2 329,0 | 1 639,1 | 1 013,7 | 91,1 |

** Value of capital expenditures before consolidation adjustments (in 2021: PLN (-)38.8 million, in 2020: PLN (-)64.0 million, in 2019: PLN (-)70.7 million, in 2018: PLN (-)29.5 million, in 2017: PLN 9.0 million).

Investments in property, plant and equipment in JSW

In 2021, the Parent Company incurred capital expenditures on property, plant and equipment of PLN 1,357.7 million. They were down 12.5% compared to the same period of 2020. PLN 1,269.4 million of the capital expenditures incurred in the period under analysis was spent on property, plant and equipment, PLN 0.6 million was spent on intangible assets and PLN 0.1 million was spent on investment property, while PLN 87.6 million was spent on right-of-use assets. In 2021, capital expenditures were financed from own funds. Moreover, the Parent Company acquired external financing.

Key investment projects carried out by JSW

| ITEM |

CAPITAL EXPENDITURES for the period of 12 months ended 31 December 2020 |

DESCRIPTION OF THE INVESTMENT |

|---|---|---|

| CONSTRUCTION OF LEVEL 1120 IN THE BORYNIA SECTION OF THE KWK BORYNIA-ZOFIÓWKA COAL MINE | 19,4 |

Works to build level 1120 in the Borynia Section of KWK Borynia-Zofiówka mine were continued. Recoverable reserves planned to be opened from level 1120 m are estimated at 40 million tons. The deposits contain mainly type 35 (hard) coking coal. The project is slated for execution in two stages: Stage 1 until 2024, assuming the opening of seams 502/1 and 504/1 and the deepening of shaft II; and Stage 2 in 2022-2029, assuming the opening of areas B and C at level 1120. The extraction of resources using the deepened shaft II is anticipated to commence in 2025. |

| OPENING AND INDUSTRIAL UTILIZATION OF RESOURCES WITHIN THE AREA OF THE DEPOSITS: “BZIE-DĘBINA 2-ZACHÓD” AND “BZIE-DĘBINA 1-ZACHÓD” IN KWK JASTRZĘBIE-BZIE MINE | 81,7 |

The Parent Company continued the opening and utilization of new deposits started in 2005: “Bzie-Dębina 2-Zachód” and “Bzie-Dębina 1-Zachód” from level 1110 m. The recoverable coal reserves are estimated to be 181 million tons down to level 1300 m. The deposits contain mainly type 35 (hard) coking coal. In 2021 expenditures were continued in connection with the tunneling and equipping of underground mining pits. |

| CONSTRUCTION OF LEVEL 1080 IN THE ZOFIÓWKA SECTION OF THE BORYNIA-ZOFIÓWKA COAL MINE | 40,9 |

The parent company continued the execution of the investment project to build level 1080 in the Zofiówka Section to provide access to and exploit resources of the “Zofiówka” deposit below the 900 level. The estimated amount of recoverable reserves between levels 900-1080 is 42 million tons. In 2021 works were continued on the tunneling process of underground mining pits. |

|

CONSTRUCTION OF A NEW LEVEL IN THE BUDRYK MINE AND MODERNIZATION OF COAL PREPARATION PLANTS |

0,5 |

The Parent Company continued the construction of the 1290 m mining level started in 2007. The total amount of recoverable coal reserves available from level 1290m of the “Budryk” deposit is estimated to be 166 million tons to the depth of 1400m. The construction of the new 1290m level together with the modernization of the Coal Preparation Plant will ultimately enable the start of the production of type 35 (hard) coal, increase the production of coking coal to approx. 65% and increase total coal production. |

|

CONSTRUCTION OF A NEW LEVEL IN THE BUDRYK MINE AND MODERNIZATION OF COAL PREPARATION PLANTS |

5,1 |

The execution of some investment tasks, i.e. the modernization of the coal preparation plant in 2016-2022 is handled by JZR with the participation of external financing using FRP funds. As at the end of December 2021, approx. 99.0% of the total budget specified in Business Plan 1 for the investment project associated with the modernization of the Coal Preparation Plant at KWK Budryk was completed. In the analyzed period of 2021, capital expenditures of PLN 5.1 million were incurred in connection with the execution of investments. |

|

COMMERCIAL METHANE USAGE AT KWK BUDRYK AND KWK KNURÓW-SZCZYGŁOWICE |

82,2 |

The Parent Company is implementing investments involving the extension of infrastructure enabling JSW to generate electricity and heat by using methane obtained in mines in the methane drainage process. The implementation of this project will facilitate utilization of methane from the KWK Budryk Mine and the KWK Knurów-Szczygłowice Mine, as well as enable generation of energy, to be used primarily by the mines. The surplus energy will be used by JSW’s other units, and may be traded seasonally. The investment project envisages the building of gas engines and construction of the technical, i.e. gas and energy, infrastructure in KWK Budryk and KWK Knurów-Szczygłowice. In 2021, the investment project incurred capital expenditures of PLN 59.3 million (KWK Budryk) and PLN 22.9 million (KWK Knurów-Szczygłowice). |

|

CONSTRUCTION OF LEVEL 1050 IN THE KNURÓW-SZCZYGŁOWICE MINE, KNURÓW SECTION |

8,5 |

The Parent Company conducted works aimed at tapping into the resources available on level 850-1050 in the Knurów Section. The project is executed with a view to gaining access to deposits of high quality type 34 coking coal. The total quantum of documented recoverable coal reserves available on level 850-1050 in the Knurów Section is 86 million tons. In 2021, works were conducted in connection with the tunneling process of mining pits on level 1050. |

|

CONSTRUCTION OF LEVEL 1050 IN THE KNURÓW-SZCZYGŁOWICE MINE, SZCZYGŁOWICE SECTION |

11,6 |

The Parent Company conducted works aimed at tapping into the resources available on level 850-1050 in the Szczygłowice Section. The project is executed with a view to gaining access to deposits of type 35 coking coal. The total quantum of documented recoverable coal reserves available on level 850-1050 in the Szczygłowice deposit is estimated to be 64 million tons. In 2021, work continued in connection with the tunneling process of underground mining pits. |

|

EXTENSION OF THE PNIÓWEK MINE |

111,4 |

The Parent Company continued the investment project launched in 2017 in KWK Pniówek related to expansion of the mining level of 1,000 m together with deepening shafts IV and III. The project is performed to secure effective exploitation and an access to reserves of type 35 coal in the south-west part of the “Pniówek” deposit, which are planned to be exploited after 2022. The total quantum of recoverable coal reserves available from level 1000 in KWK Pniówek is estimated at approximately 57 million tons. In 2021, works were conducted to tunnel the underground mining pits and deepen shafts III and IV. |

| RAZEM | 361,3 |

The modernization of the Coal Preparation Plants to increase coking coal production and to launch the production of type 35 coking coal, as well as other investment activities to increase net coal production in the Knurów-Szczygłowice mine.

The Group executed a capital expenditure project to modernize the coal preparation plants and other capital expenditure activities to launch production of type 35 (hard) coal, increase the share of coking coal in total output and increase the net coal production level. The investment project will increase the share of coking coal (type 34 and 35) produced to the target of 80% in the mine’s production mix, start the production of type 35 (hard) coking coal and increase the total production output. JZR implements a part of the capital expenditure tasks, i.e. the modernization of Coal Preparation Plants in 2016-2021 and other tasks, aimed at increasing the net coal production. On 31 May 2021, a final acceptance protocol was signed, which confirmed the completion of the full range of works in accordance with the material scope of the agreement and the material and financial schedule, completed with a trial run and positive technological tests confirming the assumed parameters. In connection with the execution of the investment project in 2021, expenditures of PLN 7.6 million were incurred, reaching 107.6% of the execution of the budget specified in Business Plan 1 for the project executed in KWK Knurów-Szczygłowice.

Financial support contract JZR

On 30 September 2016, an agreement was concluded between the State Treasury and JZR to provide non-state aid support, effected in three tranches, in the total amount of up to PLN 290.0 million, in the form of a cash contribution in exchange for shares in JZR’s increased share capital, subscribed for by the State Treasury. Proceeds from the support were designated for the modernization of the coal preparation plants of KWK Budryk and KWK Knurów-Szczygłowice.

Since the contract for modernization of the Coal Preparation Plant in KWK Budryk was terminated by the General Contractor, since the deadlines contemplated for the completion of all of the work has elapsed and since the budgets posited in the project’s business plan have been overun, in Q3 2021 JZR submitted a request to ARP for the purpose of obtaining the third tranche of support funds to conclude annex 2 to the Agreement to extend support that is not public aid, revise the Investment Project schedule, update the business plan of the project to reflect the revised scope of the Investment Project, change the detailed scope of the Investment Project to be implemented under the provisions of the Investment Cooperation Agreement and, in parallel, it asked the Ministry of State Assets to give its opinion on the proposed changes above.

As part of the arrangements under discussion, JZR also prepared a revision of the Business Plan for the Investment Project and retained an independent expert to draft a Private Investor Test to confirm that the transaction of contributing the third tranche of support fund will be done on an arm’s length basis. JZR is also taking efforts to secure the third tranche of aid funds totaling PLN 20.0 million. In December 2021 JZR received APR’s positive recommendation to enter into Annex 2. Analytical work is ongoing in the Ministry of Development and Technology.

Other capital expenditures of the Group

Capital expenditures in other Group companies in 2021 totaled PLN 349.5 million (including expenditures associated with right-of-use assets of PLN 22.5 million). The expenditures on property, plant and equipment, investment property and intangible assets amounted to PLN 327.0 million and were 12.4% higher than in the corresponding period of 2020. The capital expenditures in the coke segment and other segments in 2021 accounted for 20.5% of the Group’s total expenditures. Investments in property, plant and equipment incurred by the companies were allocated for execution of key investment projects and tasks securing their on-going operating activities.

| ITEM |

CAPITAL EXPENDITURES for the period of 12 months ended 31 December 2020 |

KEY INVESTMENT PROJECTS CARRIED OUT BY OTHER GROUP COMPANIES |

|---|---|---|

|

MODERNIZATION OF COKE OVEN BATTERIES IN PRZYJAŹŃ COKING PLANT |

67,2 |

The Przyjaźń Coking Plant belonging to JSW KOKS pursues an investment program which included commissioning in 2011 of the modernized oven battery no. 1, and a plan to modernize more coke oven batteries in the future. On 15 September 2011, the company signed an agreement with BP Koksoprojekt Sp. z o.o. from Zabrze, selected in a tender procedure to perform formal, legal and design work for the purpose of modernization of coke oven batteries no. 3 and 4, and execution designs for modernization of coking battery no. 4. The preparation stage of the execution designs for modernization of battery no. 4. was completed in 2014. On 14 March 2018, the JSW Management Board adopted a resolution to approve Execution Documents to implement in 2018-2021 an investment project entitled “Modernization of Coke Oven Battery no. 4 at the Przyjaźń Coking Plant”. In 2019, a tender procedure was conducted to select the General Contractor for the Investment (GRI). The contractor for this task recommended by the Tender Commission is Shandong Province Metallurgical Engineering Co., Ltd. Since the amount of the offer substantially exceeded the budget posited by JSW KOKS, the Management Board of JSW KOKS decided on 31 March 2020 to cancel the tender proceeding and commenced efforts to work out a different approach to conducting this task. In accordance with the adopted method of implementation of the investment project (the so-called in-house approach), the whole project was divided into stages. The selection of contractors for the execution of each stage was based on applicable tender procedures. On 30 July 2021, an agreement was signed with ZARMEN Sp. z o.o. as the contractor for the main task, with the completion date falling on 19 February 2024. On 13 December 2021 an agreement to co-fund the investment was executed with the Voivodship Fund For Environmental Protection and Water Management in Katowice. Support was provided in the form of a preferential loan of PLN 70.0 million disbursed under the regional program for co-funding investments to protect the atmosphere. |

|

CONSTRUCTION OF A POWER UNIT AT THE RADLIN COKING PLANT |

61,9 |

This project, executed by JSW KOKS, is designed to use coke oven gas to generate electricity and heat for own needs and for sale. A part of the project is the construction of a power unit fired with own coke oven gas, of a thermal capacity of 104 MW, with an extraction condensing turbine of a capacity of 28 MWe and a heat-generating segment of a capacity of 37 MWt, which will supply electricity, steam and heat to the Radlin coking plant, as well as heat to the nearby KWK ROW, Marcel Section and the town of Radlin inhabitants. On 14 March 2018, the JSW Management Board adopted a resolution approving the Execution Documents which plan the execution in 2018-2020 of an investment project entitled “Construction of a Power Unit at the Radlin Coking Plant.” On 12 June 2019, an agreement was signed with RAFAKO S.A., setting the investment project completion date for 12 November 2021. Two annexes to the existing agreement were concluded. They did not change the contractual completion date. However, the investment project will not be completed within the original deadline, and mediation between RAFAKO S.A. and JSW KOKS has been initiated before the Court of Arbitration at the General Counsel to the Republic of Poland. In addition, JSW KOKS undertook the work initiated by the signing of a letter of intent between Polimex Mostostal S.A., Nowe Jaworzno Grupa TAURON Sp. z o.o. ("NJGT") and Fundusz Inwestycji Polskich Przedsiębiorstw Fundusz Inwestycyjny Zamknięty Aktywów Niepublicznych of 6 October 2021 ("Letter of Intent") – the accession took place on the basis of Annex No. 1 to the said Letter of Intent which entered into force on 9 November 2021. During the mediation procedure on 15 December 2021 the parties entered into a tenative agreement on the approach to mediation, and after the last day of the reporting period, i.e. on 13 January 2022 annex 3 to the Main Contract was executed. Due to the delay in the design work and the performance of construction work by RAFAKO S.A., the anticipated timing for the completion of all of the work and commissioning the new combined heat and power plant in the Radlin Coking Plant should be in the latter half of 2023. |

| TOTAL | 129,1 |

Suppliers

The Group is obligated to comply with provisions of the Act of 11 September 2019 - Public Procurement Law. As at the final day of the reporting period, the Group was obligated to hold public tenders for procurement orders for goods and services valued in excess of EUR 431 thousand, following the procedures prescribed by the law.

The most commonly applied procedure is an open tender procedure. Bids may be submitted by all potential suppliers satisfying the awarding party’s requirements specified in the tender procedure. The prices set during such a procedure remain valid for the duration of the contract. For procurements with a value under the threshold for application of the Public Procurement Law, the Group selects suppliers based on its own internal bylaws, mostly in the form of electronic auctions or requests for proposals.

Suppliers in the coal segment

The biggest suppliers in the segment in 2021 were the following firms:

Suppliers in the coke segment

The Group’s biggest suppliers for coking activities are primarily the following companies:

In the Management Board’s opinion, its relations with suppliers do not make the Group dependent on any one supplier in a way that could have an adverse impact on the Group’s activity.