JSW Group

ABOUT US

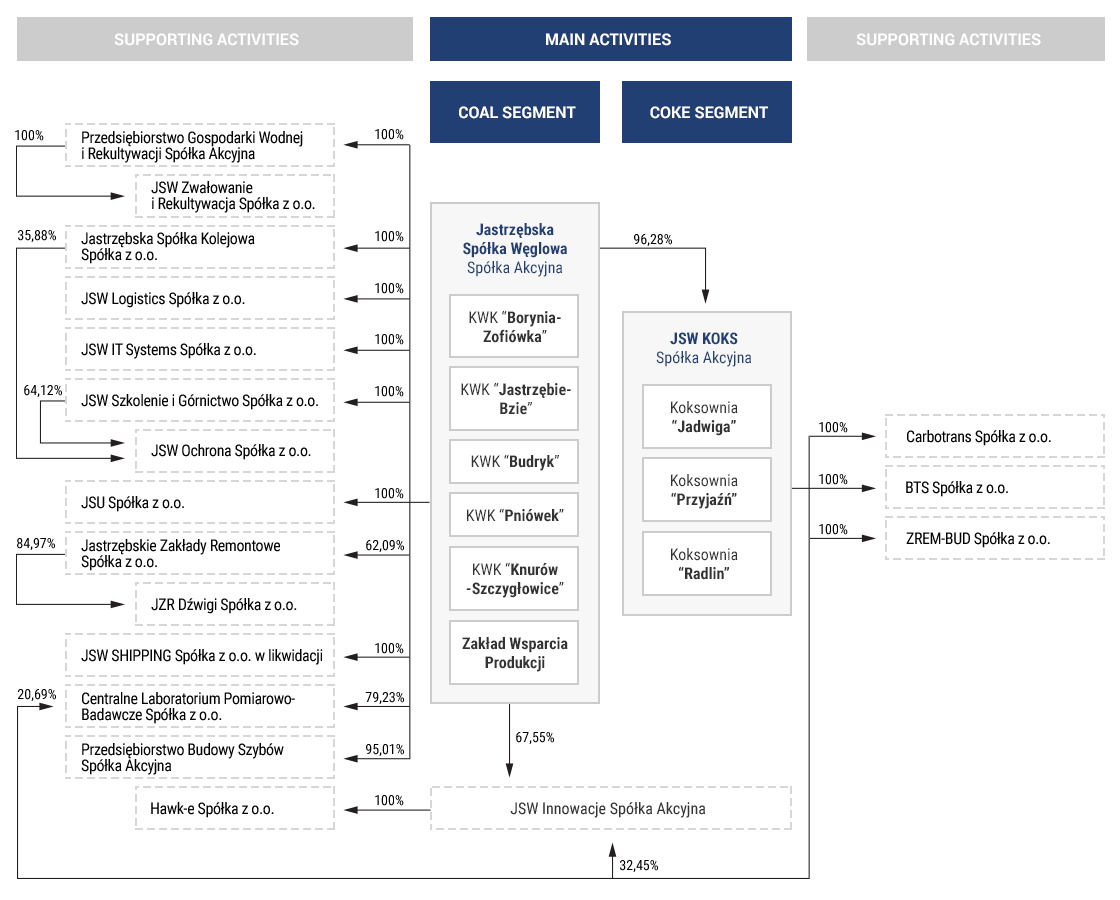

JSW Group is the largest producer of high-quality coking coal in the European Union and one of the major producers of coke for steelmaking. The Group's core business encompasses the production and sale of coking coal as well as the production and sale of coke and coal derivatives. The Group's parent is the WSE-listed Jastrzębska Spółka Węglowa S.A., based in Jastrzębie-Zdrój. JSW S.A. operates in the Upper Silesia region of Poland. Aside from coking coal and coke, JSW Group is an important producer of coal derivatives that are generated in the coking process.

5 hard coal mines

3 coking plants

long mine life-cycle (30-50 years)

1.2 billion in extractable coal resources

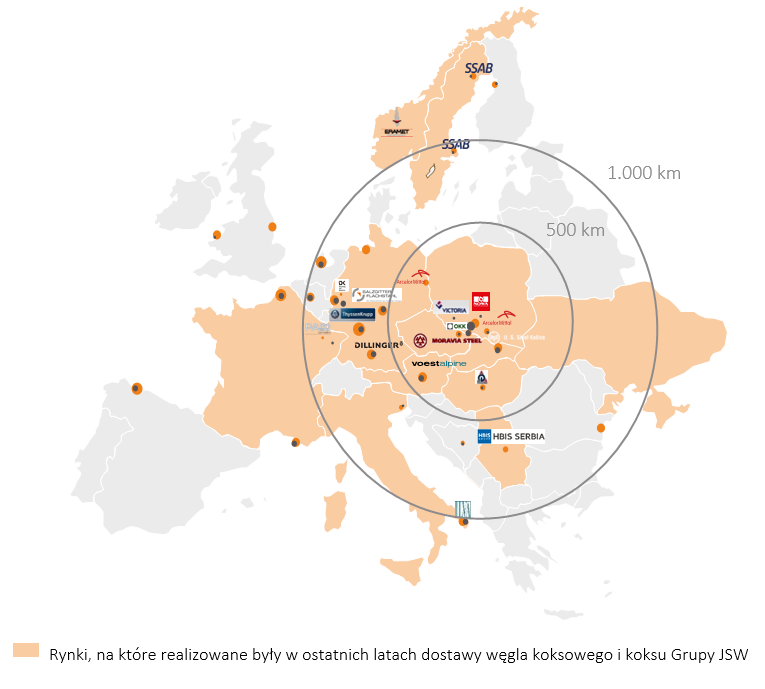

JSW Group is one of the largest employers in Poland. At the end of 2021, it had over 31 000 employees, including more than 23 000 at Jastrzębska Spółka Węglowa. JSW Group delivers coking coal and coke mainly to some of the largest European steelmakers and into more distanced markets in the case of coke. The majority of European steelmakers operating the basic oxygen furnace process using coke are located within 500km.

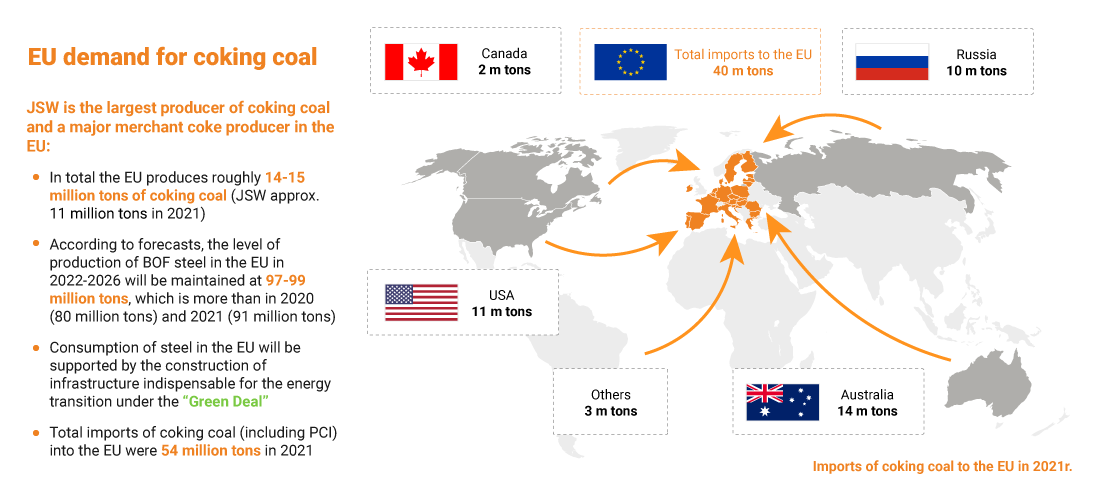

For the European steel industry, it is important to ensure a stable supply of its key raw materials on competitive terms. The lack of own sufficient sources of supply means that the European Union is practically dependent on imports of iron ore and coking coal.

In 2020, the European Commission confirmed the coking coal status as a critical raw material on the list of 30 raw materials for which supply shortages and their effects have greater impact on the economy than shortages of other materials.

At present, only Poland and the Czech Republic among the European Union member states produce coking coal. In 2020, the Czech Republic took the final decision to shut down two of OKD’s four mines, i.e. Darkov and CSA (they were shut down at the end of February 2021) and to shut down the other two mines by the end of 2022. That means that JSW will become the sole significant producer of coking coal in the EU

The Group is an important supplier of high quality coking coal to the domestic and European market. Being the owner of its coking plants, the Group can tap the synergy effects, by delivering coking coal and coke. The Group’s strong position ensues from the resources it holds and its advantageous location in the vicinity of key European steel manufacturers, which are the main offtakers of the Group’s products. After the scaling back of production in Czech mines, JSW became the strategic supplier of coal to the Central European market, and the efforts taken recently focus on continuing to strengthen the Group’s position as a key stable supplier regardless of market conditions.

On a global scale, the Group’s share in hard coal production is insignificant, representing approx. 0.2% of global coal output. The global annual production of coal is over 8 billion tons, of which approx. 1.2 billion tons is coking coal for the needs of cokemaking and the steel industry, which include coking coal and PCI. The remaining coal production is made up of products used primarily for energy generation purposes. The Group’s market share in the global production of coking coal is approx. 0.9%, while in the UE the Group is the largest producer of coking coal, including the position of the leading producer of hard coking coal grades, with a share of roughly 78%.

IMPACT OF THE PANDEMIC ON BUSINESS

The experience gained on running mines in 2020 during the COVID-19 pandemic was used in 2021 and to prepare the plans for 2022. The above measures were taken considering the health and safety of employees in accordance with the Recommendations for companies with the State Treasury’s participation, in which the Minister of State Assets exercises the rights attached to the shares.

A return to restrictions associated with the subsequent waves of COVID-19 may pose a risk to the Group’s operations. Limitation of rail or marine transport may be another risk factor disrupting the Group’s sales activity. Further waves of COVID-19 infections may also result in labor force shortages in individual countries, industries or industrial plants, disrupting their operations and limiting the demand for the Group’s products. The consequences resulting from possible restrictions and associated with a slowdown in industrial activity could therefore again cause perturbations in entire supply chains.

The course of the COVID-19 pandemic in 2021 affected the level of economic and industrial activity across the world but to a substantially less pronounced degree than in 2020, especially starting from Q2 2021 when the pandemic restrictions were downgraded, while the steel industry was additionally treated as a “core” or “sensitive” business - thereby ensuring production continuity in this sector. Much of the steel production capacity was shut down during the most austere restrictions during the outset of the pandemic in 2020. However, as the restrictions were released, the blast furnaces were brought back on line. In 2021 only those blast furnaces in Europe remained off line that had been turned off for renovation or shut down previously for causes other than the COVID-19 pandemic.

JSW’S AND THE GROUP’S COMMERCIAL SITUATION

2021 was a period of rising steel production following the limitations seen in 2020 triggered by the pandemic. In 2021 steel production was on the rise across the world with global growth of 3.7% compared to the previous year. In the EU steel production climbed 15.4%. Despite that, production was still down by roughly 3% versus the pre-pandemic period (2019).

The Group cooperates with business partners under long-term contracts executed chiefly with stable major steel companies. All of the long-term contracts in place continued to function in 2021. Considering the disruptions to supply chains and the shutdown of Czech mines, JSW’s position as a stable local supplier became more prominent. The Group has a stable position on the coke market in Europe and overseas. It is a well-regarded supplier among European steel mills and one of the largest suppliers on the Indian market. Coke offtakers include steel mills that do not have their own coking plants. JSW KOKS’s coking plants are their major suppliers of coke, which augments the Group’s safety in market downturns.

The high demand for raw materials to produce steel, including coking coal and coke and the improvement on the steam coal market enabled the Group to liquidate a major portion of its coal inventories from last year. The pursuit of its trading policy and the noticeable improvement in market conditions contributed to higher coal sales to external customers in 2021 versus 2020, which were up by roughly 7.4% and a high level of coke production and sales.

Group structure at 31 december 2021

*On 23 December 2021 the District Court of Gdańsk-Północ issued a decision that is not legally binding as of 31 December 2021 on deleting JSW SHIPPING from the national court register.

Our assets

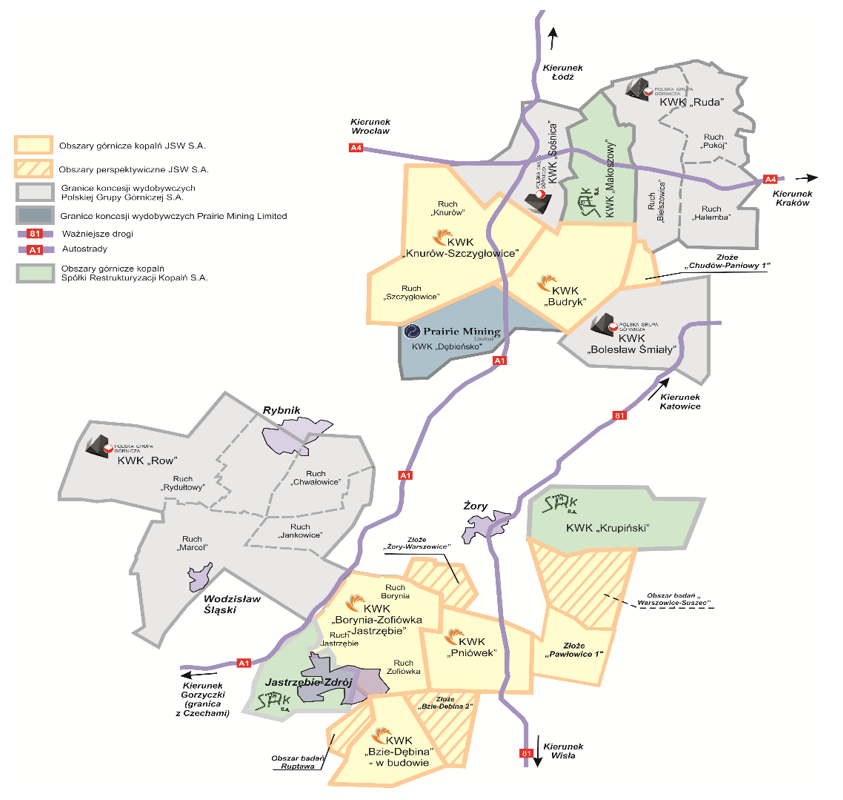

Our mining area is located in the Upper Silesia Coal Basin. The mines hold a total of approx. 7 001,0 billion tonnes in coal resources, including approx. 1 223,6 billion tonnes in extractable resources (based on mine records as at 31 December 2021).

JSW Group mines are developing hard coal deposits within the following townships: Jastrzębie-Zdrój and Żory, and municipalities Świerklany, Mszana, Pawłowice, Gierałtowice, Ornontowice, Pilchowice, and cities: Mikołów, Czerwionka-Leszczyny, Gliwice, Knurów.

Coal resources at JSW mines

JSW Group's mining activities are spread out over five mines. All of them operate within the geographical bounds specified in their concessions, which have specific validity dates, surface areas and depths.

| KOPALNIE GRUPY | RESOURCES (m tons) |

RECOVERABLE RESERVES (m tons) |

FORECAST OF THE MINES’ LIFE OF MINE |

|---|---|---|---|

| BUDRYK | 1 358,1 | 246,5 | 2077 r. |

| PNIÓWEK | 1 530,4 | 303,9 | 2081 r. |

| BORYNA - ZOFIÓWKA | 1 589,7 | 175,9 | Borynia-2051 r. Zofiówka-2051 r. |

| KNURÓW - SZYDŁOWICE | 1 681,2 | 311,3 | Szczygłowice-2078 r. Knurów-2072 r. |

| JASTRZĘBIE-BZIE | 841,6 | 196,0 | 2084 r. |

| TOTAL | 7 001,0 | 1 233,6 | - |

If, due to market conditions, it will not be financially plausible to carry out the investments needed to develop the documented resources fully, the life of mine in the various mines may be truncated.

Concessions

JSW's mines operate on the basis of appropriate concessions and permits. Expanding the resource base as part of concession deposits is an objective at all of the mines.

|

DEPOSIT SUBJECT TO CONCESSION (concessions for extraction of hard coal and methane as an accompanying mineral) |

CONCESSION NO. | DATE OF GRANTING THE CONCESSION |

DATE OF EXPIRY OF THE CONCESSION |

|

|---|---|---|---|---|

| KWK BORYNIA-ZOFIÓWKA | “Borynia” Deposit, “Szeroka I” Mining Area | 7/2009 | 27.10.2009 | 31.12.2025 |

| “Zofiówka” Deposit, “Jastrzębie Górne I” Mining Area | 5/2010 | 14.05.2010 | 31.12.2042 | |

| KWK JSTRZĘBIE - BZIE | “Bzie - Dębina 2 - Zachód” Deposit “Bzie - Dębina 2 - Zachód” Mining Area | 15/2008 | 01.12.2008 | 31.12.2042 |

| “Bzie - Dębina 1 - Zachód” Deposit “Bzie - Dębina 1 - Zachód” Mining Area | 2/2019 | 23.05.2019 | 31.12.2051 | |

| “Jas-Mos 1” Deposit, “Jastrzębie III” Mining Area | 1/2019 | 05.02.2019 | 31.12.2025 | |

| KWK BUDRYK | “Budryk” Deposit, “Ornontowice I” Mining Area | 13/94 | 21.03.1994 | 31.12.2043 |

| “Chudów - Paniowy 1” Deposit “Ornontowice II” Mining Area | 3/2005 | 18.04.2005 | 31.12.2044 | |

| KWK KNURÓW-SZCZYGŁOWICE | “Szczygłowice” Deposit “Szczygłowice” Mining Area | 4/2019 | 30.08.2019 (obowiązuje od 01.01.2020) | 31.12.2040 |

| “Knurów” Deposit “Knurów” Mining Area | 60/94 | 21.04.1994 | 15.04.2044 | |

| KWK PNIÓWEK | “Pniówek” Deposit, “Krzyżowice III” Mining Area | 5/2019 | 08.11.2019 (obwiązuje od 01.01.2020) | 31.12.2051 |

| “Pawłowice 1” Deposit, “Pawłowice 1” Mining Area | 3/2012 | 21.06.2012 | 31.12.2051 | |

|

AREA COVERED BY THE CONCESSION (exploration concessions |

CONCESSION NO. |

DATE OF GRANTING THE CONCESSION |

DATE OF EXPIRY OF THE CONCESSION |

|---|---|---|---|

| “Ruptawa” exploration area (Upper Silesian Coal Basin) | 2/2019/p | 06.02.2019 | 06.02.2022 |

| “Warszowice-Suszec” exploration area (Upper Silesian Coal Basin) | 1/2018/p | 15.01.2018 | 15.01.2023 |

Significant events in 2021

CHANGES TO THE COMPANY’S GOVERNANCE RULES IN 2021

To streamline the Company’s governance, in 2021 the Management Board adopted a number of resolutions pertaining to changes in the organizational structure of the Company’s Management Board Office and its mines. These changes intended to enhance the effectiveness of governance and adapt to the evolving market environment.

The key changes in the Company’s governance in 2021 pertained to the following:

- adopting the JSW Management Board’s Bylaws to adapt them to the amendments made to the Articles of Association and precisely define, among other things, the ability to participate in Management Board meetings by using means of direct remote communication and absolute majority of votes and indicate that the President of the Management Board shall cast the deciding vote in the event of a tie vote.

- updating the Framework Mine Organization Charts and the Rules and Regulations and Organization Chart of the Management Board Office and the Organizational Bylaws of the Production Support Unit to augment the effectiveness of governance and adapt to evolving market and legal conditions,

- giving consent for the gratuitous disposal of an organized part of JSW’s enterprise in the form of a mine operating in the “Jastrzębie-Bzie” Mining Area, which constitutes a designated part of KWK “Jastrzębie-Bzie” to Spółka Restrukturyzacji Kopalń S.A. in Bytom.

- updating JSW’s Organizational Bylaws.

SUPPORTING SOLUTIONS APPLIED AS PART OF THE ANTI-CRISIS SHIELD

During 2021, the Group used the available aid solutions (under the Act of 31 March 2020 amending the act on special solutions associated with preventing, counteracting and combating COVID-19, other contagious diseases and crisis situations they precipitate and certain other acts, introducing solutions aimed at, among other things, supporting undertakings in the crisis caused by the COVID-19 pandemic (“Anti-Crisis Shield”), including mainly:

- Deferral of the payment for social insurance and health insurance, the Labor Fund, Guaranteed Employee Benefit Fund, Bridge Pension Fund and Solidarity Fund contributions – JSW benefited from the deferral of payment of ZUS contributions by 6 months starting from March 2020. As at 31 December 2021, JSW obtained a 6-month deferral of payment of ZUS contributions for January, February, March and April 2021. The total amount of liabilities for social insurance in 2021 whose payment deadline had been deferred was PLN 429.4 million. As at 31 December 2021 all of the deferred contributions had been paid.

- Assistance Program of the Polish Development Fund – in December 2020, JSW and JSW KOKS signed loan agreements (liquidity and preferential loans) under the governmental program entitled “Polish Development Fund’s Financial Shield for Large Companies” for the total amount of PLN 1,198.5 million. The loans were disbursed fully in December 2020. On 31 March 2021, JSW and JSW KOKS, in respect to their preferential loans in the total amount of PLN 198.5 million (JSW: PLN 173.6 million, JSW KOKS: PLN 24.9 million) applied to the Polish Development Fund (“PFR”) to cancel a portion thereof, i.e. up to 75% of the “Actual Covid Loss”. On 23 September 2021, JSW and JSW KOKS received from PFR "Statements on partial release from the debt and the amount of forgiveness of a preferential loan": JSW in the amount of PLN 89.2 million and JSW KOKS in the amount of PLN 18.7 million, effective as of 24 September 2021. On 29 October 2021, JSW KOKS repaid the balance of the preferential loan. Under the annexes, concluded in 2021, to the liquidity and preferential loan agreements concluded by JSW and JSW KOKS, the interest rates and repayment schedules for the principal installments of these loans were changed.

- The Parent Company takes advantage of the support pursuant to Article 32 item 4 of the Act of 19 June 2020 on subsidies to interest on bank loans granted to enterprises affected by the effects of COVID-19 (amending the Corporate Income Tax Act, by adding Article 38 ha) as regards exemption from taxation on revenues from buildings subject to taxation pursuant to Article 24b of the corporate income tax act, whose total amount in the period from 1 January to 31 December 2021 was PLN 180 thousand.

- In accordance with the Regulation issued by the Finance Minister on 25 March 2021 (Journal of Laws Item 571), some subsidiaries have taken advantage of the deferral of the deadline for submitting the statement on the amount of earned income (incurred loss) and payment of tax due by payers of corporate income tax for 2020 until 30 June 2021.

- Pursuant to the Act of 2 March 2020 on special solutions associated with preventing, counteracting and combating COVID-19, other infectious diseases and crisis situations they precipitate (Journal of Laws 2020 Item 374, as amended) the annual fee for perpetual usufruct of land by JSW Innowacje was reduced to PLN 0.1 million

MATERIAL AGREEMENTS AND TRANSACTIONS

SIGNING OF AN AGREEMENT FOR CO-FUNDING IN THE FORM OF A LOAN WITH NATIONAL FUND FOR ENVIRONMENTAL PROTECTION AND WATER MANAGEMENT

On 20 July 2021, JSW signed with NFOŚiGW an agreement for co-funding in the form of a loan up to PLN 24.5 million for the project entitled “Reclamation of land between the Szotkówka river and the Pochwacie spoil heap in Połomia - Stage II”. As at the date of approval of this report the funding has not been disbursed. The loan bears interest at a floating interest rate. The loan will be repaid quarterly, starting from March 2028.

JSW KOKS SIGNING A CO-FUNDING AGREEMENT WITH THE NATIONAL FUND FOR ENVIRONMENTAL PROTECTION FOR THE PROJECT "KRAIC INSTALLATION – CONSTRUCTION OF THE SECOND LINE WITH A ACID ABSORPTION COLUMN AT RADLIN COKING PLANT"

On 1 September 2021, JSW KOKS signed an agreement for co-funding in the form of a loan of up to PLN 80.8 million with the National Fund for Environmental Protection and Water Management in Warsaw. The purpose of the agreement is to co-finance, in the form of a loan, a project under the name: “KRAIC installation – construction of the 2nd line with an acid absorption column at the Radlin Coking Plant”. The project will support deeper purification of coke-oven gas, which will be used to fuel a cogeneration plant under construction at the Radlin Coking Plant to satisfy the plant's own needs, enable feeding heat surpluses to the local market, and sell surplus electricity to the NPS. As of the date of approval of this report, the loan has not been drawn down. The loan bears interest at a floating interest rate. The loan will be amortized quarterly, starting from September 2023.

SIGNING OF AN AGREEMENT FOR CO-FUNDING IN THE FORM OF A LOAN WITH NATIONAL FUND FOR ENVIRONMENTAL PROTECTION AND WATER MANAGEMENT

On 8 November 2021, JSW signed a co-funding agreement with NFOŚiGW in the form of a loan up to PLN 60.0 million. The agreement is to provide co-funding in the form of a loan to a project entitled “Commercial utilization of methane – Knurów Section”. The loan will be paid out in tranches. As at the date of approval of this report the funding has not been disbursed. The loan bears interest at a floating interest rate. The loan will be repaid quarterly, starting from March 2022. The carrying value of the loan as at 31 December 2021 is PLN 57.1 million.

EXECUTION OF AN ANNEX TO THE COKING COAL SUPPLY AGREEMENT WITH VOESTALPINE STAHL GMBH

On 25 November 2021 JSW signed an annex to the coking coal supply agreement with Voestalpine Stahl GmbH with its registered office in Linz, Austria, which became the sole partner in the agreement in place of Voestalpine Rohstoffbeschaffungs GmbH and Importkohle GmbH with its registered office in Linz, Austria. By the power of the executed annex, the term of the long-term agreement of 2017 (executed for a period of 5 years from 1 April 2018 to 31 March 2023) was extended for another 5 years to 31 March 2028. Thereby, following the execution of the annex, the total estimated value of the agreement climbed to PLN 4.9 billion. Under this annex, the current terms and conditions of the agreement have not been modified, which are standard for agreements of this type on the market.

EXECUTION OF AN AGREEMENT ON THE FREE-OF-CHARGE TRANSFER OF A DESIGNATED PART OF THE JASTRZĘBIE III MINE TO SPÓŁKA RESTRUKTURYZACJI KOPALŃ S.A.

On 31 December 2021 an agreement was signed by and between JSW and SRK in Bytom on the free-of-charge transfer of an organized part of the enterprise of JSW in the form of the Jastrzębie III Mining Area of KWK Jastrzębie-Bzie (“OPE”) to SRK. JSW obtained approval for the transaction from the JSW Supervisory Board expressed in its resolution of 1 December 2021 and the JSW Shareholder Meeting expressed in its resolution of 29 December 2021, respectively. The above agreement was signed on the basis of the procedure prescribed by the Act of 7 September 2007 on the Functioning of the Hard Coal Mining Industry. The disposal of the OPE by JSW is an effect of the measures taken to optimize JSW’s operations in connection with the phasing out of mining operations in the Jastrzębie III mining area as well as a headcount reduction with the use of state budget funds prescribed by the aforementioned act, which will contribute to the improved efficiency of JSW’s operations. As a result of the OPE disposal agreement, a total of 2,148 people will be transferred to SRK, including the group of 1,234 employees previously taken over by JSW from other mining companies listed in the social contract for the transformation of the hard coal mining sector. The takeover of these people by JSW and then their transfer to SRK will not generate any employment costs on the part of JSW and will also not result in savings in future periods.

EXECUTION OF A COAL SUPPLY AGREEMENT WITH MORAVIA STEEL

After the day ending the reporting period, i.e. on 17 January 2022, JSW signed a master coal supply agreement with Moravia Steel a.s. with its registered office in Trzyniec, Czech Republic. This agreement was executed for a term of 7 years starting from January 2022 to December 2028. Under the agreement, coal, mainly coking coal, will be supplied to secure the production needs of TŘINECKÉ ŽELEZÁRNY a.s. The estimated value of the agreement is PLN 2.6 billion.