Market and competitive environment

JSW Group is the European Union's largest producer of high-quality coking coal and a major producer of coke. The type and range of the Group's activities and products are largely sensitive to changes on the intertwined coal, coke and steel markets.

Coal market:

- global:

The coking coal market is global as demand for coking coal and coke largely depends on the condition of the steel industry, which uses these commodities in blast furnaces to produce pig iron - over 70% of steel is produced in blast-furnace technology. Coking coal is usually processed into coke at large steel-makers’ own coking plants and at non-integrated (commercial) coking plants.

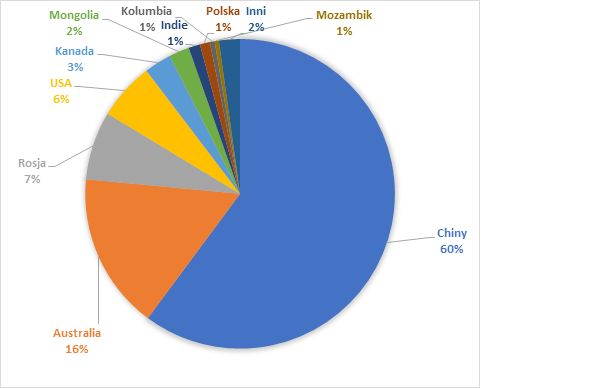

Global coking coal production (1029 mt/year) is highly concentrated in several countries. The largest producers of coking coal remain China (~605 mt/year) and Australia (~170 mt/year), which together have a market share of more than 75%. The largest exporters of coking coal include:

Tabele.Coking coal producers in 2020

| BHP Group | Teck Resources | Anglo American | Grupa JSW |

|

|---|---|---|---|---|

| Coking coal production | 40 mt | 21,1 mt | 17 mt | 11,1 mt |

| EBITDA | 0,1 mld USD | 2,5 mld USD | 9,9 mld USD | -638 mld PLN |

| Workforce | ~ 80 000 | ~ 10 100 | ~ 63 000 | ~ 30 600 |

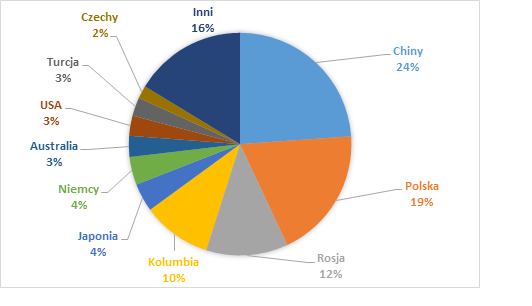

Chart. Largest producers of coking coal in 2020 [mt, estimated values]

China, the world's largest producer of coking coal, is also a major importer of this raw material. All of its production ends up on the domestic market. Australia - the second largest producer of coking coal, behind China - exports nearly 100% of its production.

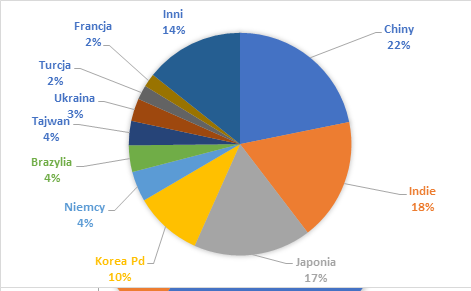

Global demand for coking coal is highly dependent on one customer - China, whereas its global supply depends on the main supplier - Australia, which together with other major exporters - USA, Canada and Russia - account for over 90% of global coal supplies. The total volume of trade in coking coal in 2020 reached approx. 294 mt (Resources and Energy Quarterly, Department of Industry, Innovation and Science, Australian Government, December 2020).

The flows of coking coal in global markets in 2020 were influenced by the Covid-19 pandemic and China's decision to informally ban coking coal imports from Australia.

The level of global coking coal imports - aside from the supply-demand relationship between China and Australia - is also driven by one-off events such as adverse weather conditions, logistics or geological problems. These events are temporary and lead to alternative sources of import being activated. The Covid-19 pandemic and its effects on the steel, coke and coal markets had a material impact on demand, supply and commercial relations in 2020.

Chart. Largest importers of coking coal in 2020 [mt, estimated values]

- european:

Guaranteed stable deliveries of key raw materials at competitive prices are important to the European steel industry. A lack of sufficient own sources of supply means that the European Union is almost entirely dependent on the import of both iron ore and coking coal. On 3 September, the European Commission published the EU's list of Critical Raw Materials, i.e. raw materials that are of strategic significance to the functioning and economic development of the European Union. Their shortages may have grave economic effects for the entire economy. The economic significance and risk associated with supply security are taken into account in evaluating the risk of shortages. The EC reviews the Critical Raw Materials List every three years. From the viewpoint of the Polish economy, the most important information was that coking coal remains on the list as a strategic raw material for European steelmaking.

Currently in the EU coking coal is generally produced only in Poland and the Czech Republic, which means that the European Union has historically had and continues to have a structural deficit of coking coal. Demand from the steel industry exceeds the mining capacities in EU countries by approx. 35-40 mt, depending on the level of steel output in the blast furnace process. The deficit of coking coal on the EU market is mainly made up by imports from Australia, USA, Canada, Russia and in recent years Mozambique and Colombia.

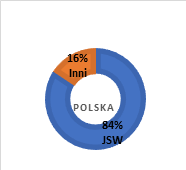

In the European Union, aside from JSW (with an output of approx. 11 mt in 2020), coking coal is also mined by the Czech-based OKD (1 mt of coal mined in 2020), which is systematically shutting down its mines. That company will cease mining activities at the end of 2022 at the latest.

In 2019, Great Britain announced the launch of construction on a new mine - West Cumbria Mining (WCM). The British mine is expected to eventually produce approx. 3.5 mt of metallurgical coal per year, but the project is delayed due to the Covid-19 pandemic as well as environmental activists' protests against the construction of a new mine in Great Britain.

As leading producer of coking coal in the European Union, JSW, while benefiting from a geographic advantage, is subject to general trends on the global market. Market volatility and the impact of global price mechanisms mean that currently transactions on the coking coal market are conducted on the basis of price indexes published for coals from Australia and USA.

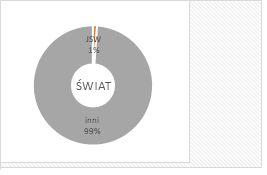

Chart. JSW's share in coking coal production in Poland, EU and globally in 2020 [mt, %]

- domestic:

JSW is the only domestic producer of hard coking coal and a major producer of semi-soft coking coal. The other domestic producers mainly produce thermal coal, while semi-soft coking coal is mined only by PGG in small quantities (1.2 mt in 2020).

Coal companies in Poland usually produce coal for electricity and heat generation purposes. The largest domestic coal companies, aside from Jastrzębska Spółka Węglowa S.A., are: Polska Grupa Górnicza S.A. and Lubelski Węgiel „Bogdanka” S.A.

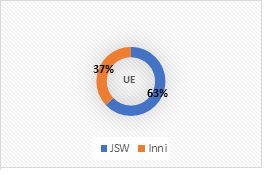

JSW Group is a major supplier of high-quality coking coal on the domestic and European market. The remaining portion of the coal produced by JSW is thermal coal, which is sold to domestic industrial power plants. JSW Group, not a major producer of thermal coal, is seen by customers in the domestic energy generation segment as a supplementary supplier.

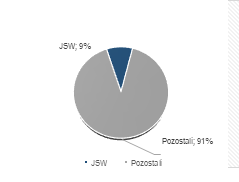

Chart. JSW's share in production of thermal coal in Poland in 2020 [mt, %]

The price of thermal coal in Poland is largely driven by the situation on the domestic market and competition between domestic producers. The thermal coal market in Poland is largely dependent on the domestic economic situation, weather conditions, energy policy (prices of electricity, use of biomass, lignite-based electricity generation, share of subsidised renewable energy). Thermal coal prices to a limited extent follow the global trends in price indexes for spot transactions. While indexes set trends, the situation on the domestic market and competition between domestic producers are of key significance. Market prices for thermal coal are determined by the Polish Steam Coal Market Index (PSCMI). This is a group of price indicators for benchmark thermal coal for produced domestically and sold on the domestic energy market (PSCMI 1 index) or the domestic heating market (PSCMI 2 index). These indicators are based on monthly ex-post data and reflect the sales price for hard coal (ex-works), with quality parameters optimised to customer needs.

Coke market:

- global:

The iron and steel industry is the largest and crucial customer for coke, where it is mainly used to produce pig iron in a blast-furnace process, while finer types are used to produce agglomerates from iron ore that are then used in the production of ferro-alloys. Foundries that use high-quality foundry coke are also in this customer group.

The other types of coke are used for smelting non-ferrous metals (zinc, lead and copper), in the lime industry, chemicals industry (mainly to produce carbide), soda industry (production of glass), food sector (sugar refineries, dryers) and in the communal sector (heating coke).

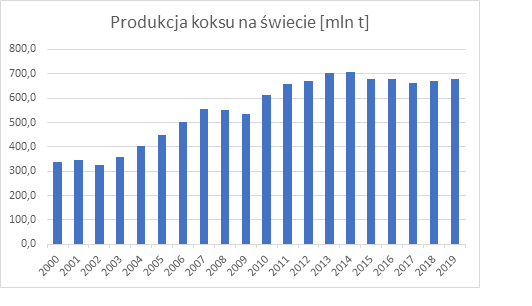

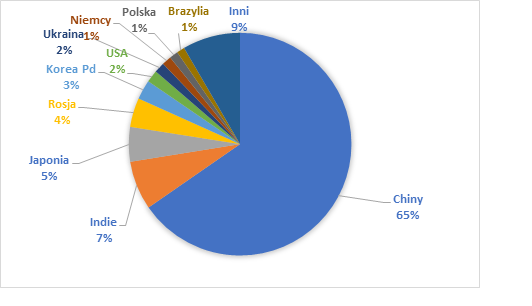

Just as in the case of coking coal, the coke market is global. Coke production is increasing and demand for coke mainly depends on the level of steel production in blast-furnace processes and changes in the technological processes for steel production. Coke production is mainly concentrated in Asian countries, which account for over 80% of global coke output.

The total global trade of coke is estimated at approx. 27-30 mt, with the EU accounting for approx. 9-11 mt. Largest coke exporters in 2020: Poland (5.4 mt), China (3.5 mt) and Colombia (3.4 mt). These three countries accounted for close to 50% of the global coke trade volume.

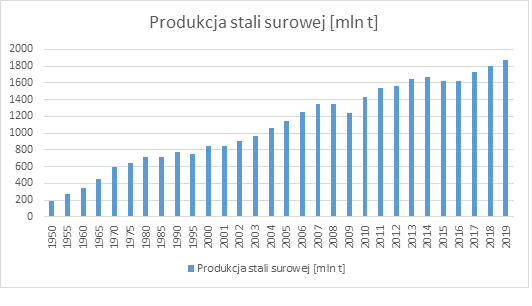

Chart. Global coke production [mt]

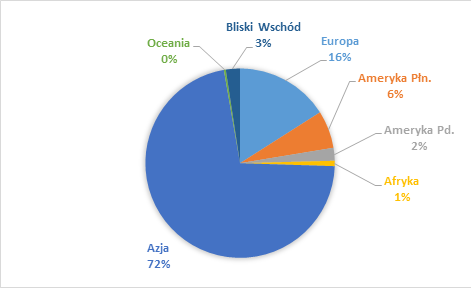

Chart. Largest producers of coke in 2020 [mt, %]

Chart. Largest exporters of coke in 2020 [mt, %]

- european:

European Union member states account for merely 5-7% of coke consumption, consuming approx. 40 mt (approx. 34 mt in 2020 due to the pandemic). The EU's share in the consumption of imported coke is approx. 9-11 mt, which is approx. 1/3 of the global consumption of imported coke.

The European Union predominantly features coking plants integrated with steel works, which meets their needs using internally produced coke in the first place. At JSW Group, coking plants are independent, meaning that the entire coke output is for sale. Several independent coking plants are also located in Hungary, Czech Republic and Bosnia. JSW Group's advantage over other coke producers lies in the availability of the raw material - JSW's coking plants use coking coal from JSW's own mines. Despite the fact that most of the European steelworks have their own integrated coking plants, they still require imports to a certain degree. On average, European steelworks meet 95% of their demand through their integrated coking plants. When reducing steel production, external supplies are cut first, which is why when steel output at integrated steelworks is weakened, it affects predominately independent coking plants supplying coke to these steelworks.

Coke consumption structure globally and in the EU is similar: approx. 80% of coke is used for producing pig iron in large-furnace processes and the other 20% outside of large furnaces. A vast majority of coke is producing in coking plants owned by steel-makers. This production is for the internal purposes of steel works owned by these steel-makers. Only a small volume (slightly over 4% of total production volume) is internationally traded.

- domestic:

Domestic coke production reached 7.6 mt in 2020, of which 3.3 mt was produced at JSW's coking plants. JSW accounts for 44% of the overall domestic output. The other coke producers in Poland are: ArcelorMittal Poland Koksownia Częstochowa Nowa Sp. z o.o, WZK Victoria S.A. and Carbo-Koks Sp. z o.o. JSW and ArcelorMittal Poland are the dominant producers of blast-furnace coke in Poland.

Exports of Polish coke reached 6.3 mt in 2020, up by 3%. However, exports to European countries declined by 12% from 2019, while exports to the rest of the world grew by 66%. India imported nearly 1 mt from Poland and was by far the largest non-European market in 2020. The considerable growth in exports to non-European countries, including to Asia, resulted from the specific pandemic situation and turmoil on the European market, coupled with strong demand from Asia. In the coming years, the market should revert to typical patterns, i.e. exporting coke from Poland mainly to the European market, with supplementary exports to overseas markets.

Steel market:

- global:

The steel market is dominated by global steel-makers and steel production is largely concentrated in Asian countries. China remains the largest producer of steel.

Steel production is still dominated by oxygen-blown converter technology using coke. It accounts for over 70% of the global steel production structure. Steel production in electric arc furnaces accounts for approx. 28% of crude steel output, while production in open hearth furnaces has a small and declining share.

Chart. Crude steel production [mln t]

Steel demand, output and prices determine the market conditions for coking coal producers, setting demand for coking coal and realisable prices for this raw material.

Chart. Steel production by geographic region in 2020 [mt,%]

Global coke production reached 1.864 billion tonnes in 2020 and was less than 1% lower than in 2019. The leading producer - with an annual steel output of more than 1 billion tonnes - is China, which upped its production in 2020 by 5% y/y. Output also grew in Vietnam, Iran, Egypt, Turkey and Russia. Steel production in USA declined by 17%, while in the EU it decreased by 12%.

Tabela.Largest producers of steel in 2020, by country

| [mln t] | |

|---|---|

| China | 1053,0 |

| India | 99,6 |

| Japan | 83,2 |

| Russia | 73,4 |

| USA | 72,7 |

Tabela.Largest producers of steel - companies (2020)

| [year] | |

|---|---|

| China Baowu Group | ~ 115 mln t |

| ArcelorMittal | ~ 72 mln t |

- european:

The oxygen-blown converter process also dominates in the European Union (59%) but steel production in electric arc furnaces has a larger share (41%) than the global average.

Demand for steel in the EU is driven by investments: in construction (approx. 35% of steel consumption), automotive (18%) and machinery (approx. 14%). The pipeline industry also plays an important role in the steel consumption structure (with a 13% share), along with the metal product sector (14% of global steel consumption).

Guaranteed stable deliveries of key raw materials at competitive prices are important to the European steel industry. Lack of sufficient own sources of supply means that the European Union is highly dependent on the import of both iron ore and coking coal.

- domestic:

In 2020, the Polish economy consumed approx. 12.9 mt of steel products, i.e. 6% less than in the previous year. Despite the on-going pandemic, forecasts for 2021 are optimistic and the market is expected to rebound. Production capacities in Polish steelmaking were also permanently reduced to approx. 10.6 mt annually as a result of a decision taken by the largest domestic producer - ArcelorMittal Poland - to shut down the pig iron portion of its steelworks in Kraków. One converter and seven electric steel mills, five flat product rolling mills, twelve long product rolling mills and pipe and section mills currently operate in Polish steel plants.

According to World Steel Association data, Poland produced 7.9 mt of crude steel in 2020, i.e. 12% less than in 2019 (9 mt). The sole producer of crude steel in the blast furnace process, i.e. using coke and thus also coking coal, is ArcelorMittal Poland in its steel plant in Dąbrowa Górnicza.