JSW Group

ABOUT US

JSW Group is the largest producer of high-quality coking coal in the European Union and one of the major producers of coke for steelmaking. The Group's core business encompasses the production and sale of coking coal as well as the production and sale of coke and coal derivatives. The Group's parent is the WSE-listed Jastrzębska Spółka Węglowa S.A., based in Jastrzębie-Zdrój. JSW S.A. operates in the Upper Silesia region of Poland. Aside from coking coal and coke, JSW Group is an important producer of coal derivatives that are generated in the coking process.

5 hard coal mines

3 coking plants

long mine life-cycle (30-50 years)

1.2 billion in extractable coal resources

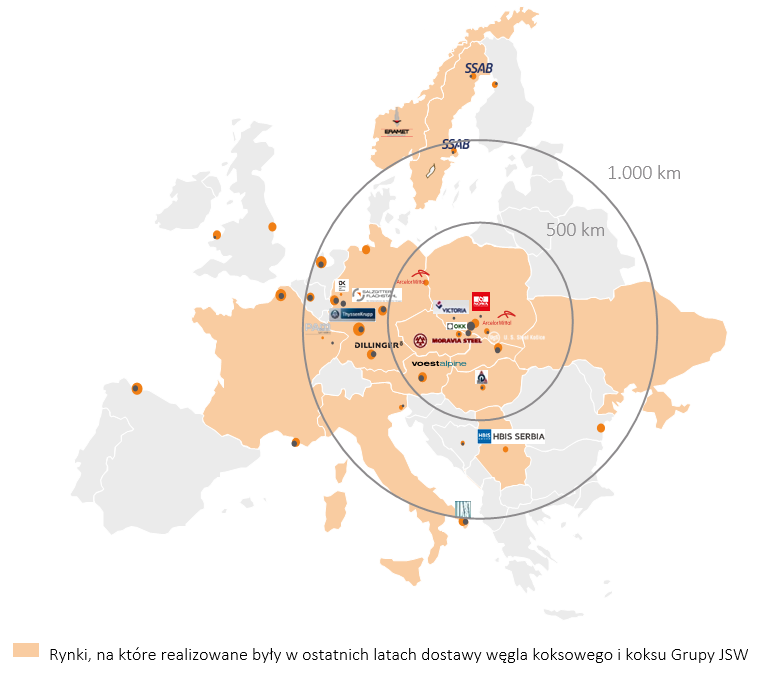

JSW Group is one of the largest employers in Poland. At the end of 2020, it had over 30 000 employees, including more than 21 000 at Jastrzębska Spółka Węglowa. JSW Group delivers coking coal and coke mainly to some of the largest European steelmakers and into more distanced markets in the case of coke. The majority of European steelmakers operating the basic oxygen furnace process using coke are located within 500km.

Group structure at 31 december 2020

Our assets

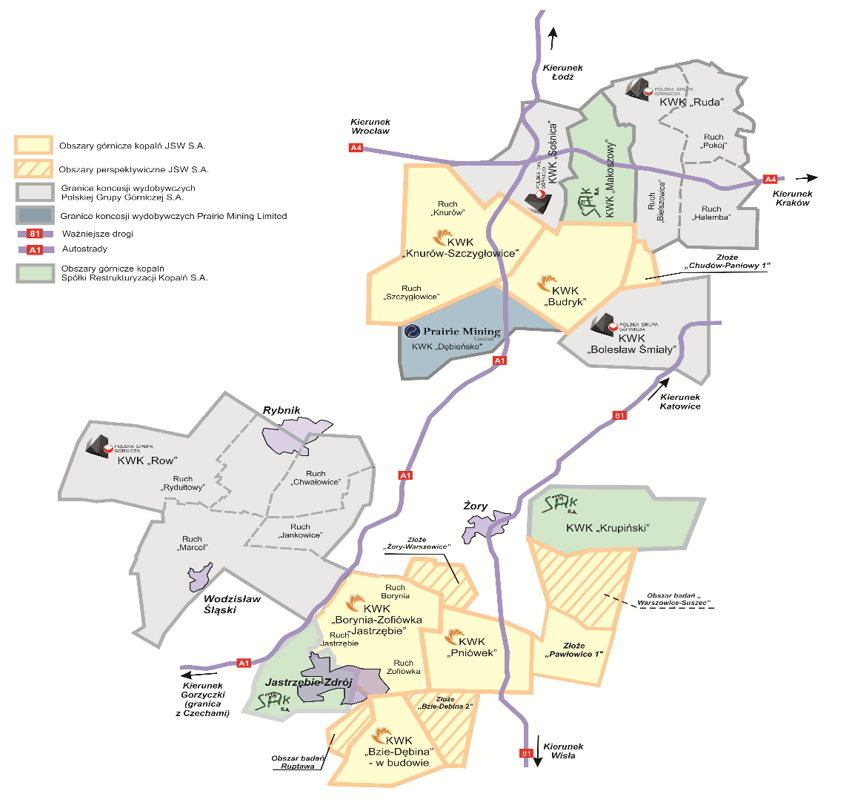

Our mining area is located in the Upper Silesia Coal Basin. The mines hold a total of approx. 7.073,3 billion tonnes in coal resources, including approx. 1.223,4 billion tonnes in extractable resources (based on mine records as at 31 December 2020).

JSW Group mines are developing hard coal deposits within the following townships: Jastrzębie-Zdrój and Żory, and municipalities Świerklany, Mszana, Pawłowice, Gierałtowice, Ornontowice, Pilchowice, and cities: Mikołów, Czerwionka-Leszczyny, Gliwice, Knurów.

Coal resources at JSW mines

| KOPALNIE GRUPY | RESOURCES (m tons) |

RECOVERABLE RESERVES (m tons) |

FORECAST OF THE MINES’ LIFE OF MINE |

|---|---|---|---|

| BUDRYK | 1 360,8 | 248,0 | 2077 r. |

| PNIÓWEK | 1 547,5 | 304,2 | 2071 r. |

| BORYNA - ZOFIÓWKA | 1 595,6 | 178,2 | Borynia-2051 r. Zofiówka-2051 r. |

| KNURÓW - SZYDŁOWICE | 1 724,7 | 313,4 | Szczygłowice-2078 r. Knurów-2072 r. |

| JASTRZĘBIE-BZIE | 844,7 | 189,6 | 2084 r. |

| TOTAL | 7 073,3 | 1 233,4 | - |

In January 2020, the Management Board decided to separate Ruch Jastrzębie from KWK Borynia-Zofiówka-Jastrzębie and move it into KWK Bzie-Dębina under construction, which was the re-named as KWK Jastrzębie-Bzie, and to change the name KWK Borynia-Zofiówka-Jastrzębie to KWK Borynia-Zofiówka.

Concessions

JSW's mines operate on the basis of appropriate concessions and permits. Expanding the resource base as part of concession deposits is an objective at all of the mines.

|

DEPOSIT SUBJECT TO CONCESSION (concessions for extraction of hard coal and methane as an accompanying mineral) |

CONCESSION NO. | DATE OF GRANTING THE CONCESSION |

DATE OF EXPIRY OF THE CONCESSION |

|

|---|---|---|---|---|

| KWK BORYNIA-ZOFIÓWKA | “Borynia” Deposit, “Szeroka I” Mining Area | 7/2009 | 27.10.2009 | 31.12.2025 |

| “Zofiówka” Deposit, “Jastrzębie Górne I” Mining Area | 5/2010 | 14.05.2010 | 31.12.2042 | |

| KWK JSTRZĘBIE - BZIE | “Bzie - Dębina 2 - Zachód” Deposit “Bzie - Dębina 2 - Zachód” Mining Area | 15/2008 | 01.12.2008 | 31.12.2042 |

| “Bzie - Dębina 1 - Zachód” Deposit “Bzie - Dębina 1 - Zachód” Mining Area | 2/2019 | 23.05.2019 | 31.12.2051 | |

| “Jas-Mos 1” Deposit, “Jastrzębie III” Mining Area | 1/2019 | 05.02.2019 | 31.12.2025 | |

| KWK BUDRYK | “Budryk” Deposit, “Ornontowice I” Mining Area | 13/94 | 21.03.1994 | 31.12.2043 |

| “Chudów - Paniowy 1” Deposit “Ornontowice II” Mining Area | 3/2005 | 18.04.2005 | 31.12.2044 | |

| KWK KNURÓW-SZCZYGŁOWICE | “Szczygłowice” Deposit “Szczygłowice” Mining Area | 4/2019 | 30.08.2019 (obowiązuje od 01.01.2020) | 31.12.2040 |

| “Knurów” Deposit “Knurów” Mining Area | 60/94 | 21.04.1994 | 15.04.2044 | |

| KWK PNIÓWEK | “Pniówek” Deposit, “Krzyżowice III” Mining Area | 5/2019 | 08.11.2019 (obwiązuje od 01.01.2020) | 31.12.2051 |

| “Pawłowice 1” Deposit, “Pawłowice 1” Mining Area | 3/2012 | 21.06.2012 | 31.12.2051 | |

|

AREA COVERED BY THE CONCESSION (exploration concessions |

CONCESSION NO. |

DATE OF GRANTING THE CONCESSION |

DATE OF EXPIRY OF THE CONCESSION |

|---|---|---|---|

| “Ruptawa” exploration area (Upper Silesian Coal Basin) | 2/2019/p | 06.02.2019 | 06.02.2022 |

| “Warszowice-Suszec” exploration area (Upper Silesian Coal Basin) | 1/2018/p | 15.01.2018 | 15.01.2023 |

| Rejowiec exploration area (Lubelskie Coal Basin) | 7/2019 | 19.09.2019 | 19.09.2023 |

Significant events in 2020

Changes to the management principles in the company in 2020

To improve management in the Company, in 2020 the Management Board adopted a number of resolutions pertaining to changes in the organizational structure of the Company’s Management Board Office and plants. These changes were aimed at improving the efficiency of operation and at adjusting to the changing market conditions.

The key changes in the Company’s organization in 2020:

- amendments to JSW S.A. Management Board Bylaws,

- the name of the Division of the Vice-President of the Management Board for Technical Matters was changed to the Division of the Vice-President of the Management Board for Technical and Operational Matters,

- change of the position of Mr. Artur Dyczko in the Company Management Board by entrusting him with serving in the capacity of Vice-President of the Management Board for Technical and Operational Matters for the 10th term of office starting from 20 January 2020,

- change of the name of the Division of the Vice-President of the Management Board for Strategy and Development to the Division of the Vice-President of the Management Board for Development,

- update of the Framework Mine Organization Charts and the Rules and Regulations and Organization Chart of the Management Board Office and the Production Support Unit, to the extent necessary to adapt them to the changing legal regulations and market conditions,

- change in the organizational structure of KWK Borynia-Zofiówka-Jastrzębie consisting in spinning off the Jastrzębie Section and subordinating it to KWK Bzie-Dębina under development, which was named KWK Jastrzębie-Bzie,

Supporting solutions applied as part of the anti-crisis shield

Because of the entry into force, on 1 April 2020, of the Act of 31 March 2020 on amending the act on special solutions associated with preventing, counteracting and combating COVID-19, other contagious diseases and crisis situations they precipitate and certain other acts, introducing solutions aimed at, among other things, supporting undertakings in the crisis caused by the COVID-19 pandemic (“Anti-Crisis Shield”), the Group has taken advantage of support solutions, including:

- Deferral of the payment deadline for the fee for perpetual usufruct of land from 31 March 2020 till 30 June 2020: on 29 June 2020, JSW paid the liability in the amount of PLN 3.0 million. Group companies also took advantage of this aid solution.

- Property tax – On 15 April 2020, JSW applied to the Town Office in Jastrzębie-Zdrój, Pawłowice Municipal Office, Town Office in Knurów, for deferring the payment dates of property tax installments whose statutory deadlines fall in April, May and June 2020, until 30 September 2020. In accordance with the issued resolutions, the Pawłowice Municipal Office in the total amount of PLN 2.1 million (installments for May and June 2020) and the Jastrzębie-Zdrój Town Office in the total amount of PLN 5.5 million (installments for April, May and June 2020) extended the payment deadlines till 30 September 2020. For the Knurów Town Office, deferral of the payment dates of property tax installments in the total amount of PLN 2.9 million (installments for April, May and June 2020) till 30 September 2020, in accordance with JSW’s application. The payment of the property tax installments in the amount of PLN 10.5 million was made on 30 September 2020. More information at Management Board Report of Activity

- Personal income tax advance – JSW paid the tax for May 2020 in the amount of PLN 14.4 million on 21 December 2020. In addition, the parent company paid the tax liability for March 2020 in the amount of PLN 13.9 million and for April 2020 in the amount of PLN 25.8 million on 1 June 2020. Companies from the Group also took advantage of this supporting solution.

- Social insurance and health insurance, Labor Fund, Guaranteed Employee Benefit Fund, Bridge Pension Fund and Solidarity Fund contributions – JSW paid the deferred contributions for March 2020 in the amount of PLN 70.3 million on 15 October 2020, the contributions for April 2020 in the amount of PLN 124.4 million on 16 November 2020, and the contributions for May 2020 in the amount of PLN 59.4 million on 15 December 2020. After the final date of the reporting period the contributions for July 2020 in the amount of PLN 58.4 million on 15 February 2021 and for August 2020 in the amount of PLN 49.4 million on 15 March 2021. More information at Management Board Report of Activity

- Assistance Program of the Polish Development Fund (“PFR”) – on 15 July 2020 JSW submitted an official application to PFR under the Financial Shield for Large Companies for financial support in connection with combating the effects of the COVID-19 pandemic. In December 2020 JSW signed a liquidity loan agreement for PLN 1.0 billion and a preferential loan agreement for PLN 173.6 million with PFR. The loans were disbursed fully in December 2020. The loans may be used only to finance the current activity, including working capital.On 31 July 2020 JSW KOKS also submitted an application to PFR for financial support. On 23 December 2020 a preferential loan agreement was signed under the governmental program entitled “The Polish Development Fund’s Financial Shield for Large Companies” for PLN 24.9 million. The loan amount was disbursed on 30 December 2020.

- The Parent Company takes advantage of the support pursuant to Article 32 item 4 of the Act of 19 June 2020 on subsidies to interest on bank loans granted to enterprises affected by the effects of COVID–19 as regards exemption from the tax on revenues from buildings subject to taxation pursuant to Article 24b of the corporate income tax, set for the period from 1 June to 31 December 2020 in the total amount of PLN 0.1 million. Companies from the Group, such as JSW KOKS, JZR, PBSz and Carbotrans, also took advantage of this aid solution.

- The Group obtained co-funding to employee salaries from the Guaranteed Employee Benefit Fund in the amount of PLN 182.5 million.

On 30 July 2020, JSW submitted an application to the Voivodeship Labor Office in Katowice for co-funding of employee salaries from the Guaranteed Employee Benefit Fund (FGŚP) for the maximum period of 3 months in the amount of PLN 166.9 million. The application was accepted by the Voivodeship Labor Office on 4 August 2020. In August 2020, JSW’s bank account was credited with the first tranche in the amount of PLN 55.6 million and in September 2020 with the remaining PLN 111.3 million. On 30 October 2020 JSW settled the received support and repaid the amount of PLN 6.5 million. The total amount of the support received is PLN 160.4 million.

On 29 July 2020, JSW KOKS submitted an application to the Voivodeship Labor Office in Katowice for subsidy to employee salaries from the Guaranteed Employee Benefit Fund for the period of 1 month in the amount of PLN 5.7 million, and on 7 August 2020 the same application for a subsidy for the period of 2 months in the amount of PLN 11.5 million. The Voivodeship Labor Office in Katowice transferred funds to the bank account of JSW KOKS in August and September 2020 totaling PLN 17.1 million. In August and October 2020, after making the settlement JSW KOKS repaid financing totaling PLN 0.3 million. The total amount of the received support is PLN 16.8 million.

Also JSW SiG took advantage of the subsidy to employee salaries from the Guaranteed Employee Benefit Fund obtaining a subsidy in the amount of PLN 5.0 million and JSU obtained a subsidy in the amount of PLN 0.3 million. - All JSU’s recreation facilities acceded to the program under the name “Polish Tourist Voucher” under which, as at 31 December 2020, the amount of the tourist vouchers used by customers totaled PLN 0.1 million.

- In accordance with the Regulation issued by the Finance Minister on 27 March 2020, some subsidiaries have taken advantage of the deferral of the deadline for submitting the statement on the amount of earned income (incurred loss) and payment of tax due by payers of corporate income tax for 2019 until 31 May 2020.

- Invoking the provisions of Article 31 of the Act of 2 March 2020 on special solutions associated with preventing, counteracting and combating COVID-19, other infectious diseases and crisis situations they precipitate, Group companies took advantage of the possibility of deferral of submission of the TPR declarations (transfer pricing documentation) to 31 December 2020. The declarations were sent by the required deadline.

Material agreements and transactions

TERMINATION OF A FINANCE CONTRACT WITH THE EUROPEAN INVESTMENT BANK

On 15 October 2020 the JSW Management Board adopted a resolution to terminate, by mutual consent of the parties, the finance contract entered into on 9 April 2019 by and between JSW, a JSW subsidiary, i.e. JSW KOKS and the European Investment Bank (“EIB”) with its registered office in Luxembourg. This financing was granted in the form of a term facility in the amount of PLN 58.5 million for execution of strategic investments by JSW and JSW KOKS. As at 31 December 2020, neither JSW nor JSW KOKS has any debt under this facility.

SIGNING AN AGREEMENT WITH THE POLISH DEVELOPMENT FUND FOR A LIQUIDITY LOAN TO BE GRANTED TO JSW UNDER THE GOVERNMENT PROGRAM ENTITLED THE PFR FINANCIAL SHIELD FOR LARGE COMPANIES

On 9 December 2020, a tri-partite agreement was signed between JSW, Polski Fundusz Rozwoju S.A. (“PFR”) and JZR as one of the guarantors of the loan. The agreement pertains to extending a liquidity loan to JSW of PLN 1.0 billion under the governmental program entitled The Polish Development Fund’s Financial Shield for Large Companies. According to the collateral requirements, JZR and JSW KOKS extended a surety to secure the timely performance by JSW of the obligations arising out of the extended financing.

SIGNING OF AN INTERCREDITOR AGREEMENT BETWEEN JSW, POLSKI FUNDUSZ ROZWOJU AND THE COMPANY’S EXISTING FINANCIAL CREDITORS THAT ARE PARTIES TO THE AGREEMENT OF 9 APRIL 2019

On 15 December 2020 an intercreditor agreement was entered into by and between JSW, Polski Fundusz Rozwoju S.A. and the Company’s financial creditors that are parties to the agreement of 9 April 2019, of which JSW reported in Current Report No. 29/2019.

The signed Agreement constitutes the fulfillment of the primary condition precedent for PFR’s disbursement of a PLN 1.0 billion liquidity loan granted to JSW under the agreement of 9 December 2020 between JSW and the Polish Development Fund to extend a liquidity loan to JSW under the governmental program PFR’s Financial Shield for Large Companies described above. The signing of the agreement constitutes the fulfillment of the primary condition precedent for the disbursement of funds under the preferential loan for the amount of PLN 173.6 million.

SIGNING OF A PREFERENTIAL LOAN AGREEMENT BETWEEN JSW AND POLSKI FUNDUSZ ROZWOJU S.A. UNDER THE GOVERNMENT PROGRAM ENTITLED THE PFR FINANCIAL SHIELD FOR LARGE COMPANIES

On 23 December 2020, a loan agreement was signed between JSW, Polski Fundusz Rozwoju S.A. and JZR and JSW KOKS as guarantors of the extended loan. The agreement pertains to granting a preferential loan to JSW in the amount of PLN 173.6 million under the government program entitled The Polish Development Fund’s Financial Shield for Large Companies. The deadline for repayment of the liabilities under the loan is 30 September 2024. Its more important resolutions pertain to the following: for the term of the support, JSW’s Management Board will not recommend to the Shareholder Meeting to resolve to distribute dividends, interim dividends or any other remuneration, including remuneration on account of a share redemption or some other amount on or in respect of its share capital; there is no possibility, without PFR’s prior consent, to take actions resulting in: change of the legal form, demerger or merger, combination, consolidation or restructuring.

The loan agreement contains standard restrictions regarding incurring additional financial debt, establishing collateral, disposing of assets and acquiring companies, interests, shares or rights in partnerships, other interest-based entities or enterprise or parts thereof, and no possibility of establishing any companies without PFR’s prior consent, subject to the possibility of performing any actions in this respect described in the loan agreement, including specific intragroup transactions.