Results and perspectives by segments

Segments

The Group is an active participant of the metallurgical coal – coke – steel supply chain. It focuses on extraction and processing of coal as well as sale of the JSW Group’s products, such as coal, coke and other hydrocarbons. It is therefore the key element of the recommended Group operation model.

The Group is organized and managed in segments by type of products offered and type of production activity. The Management Board of the JSW has identified operating segments based on the financial reporting of the companies comprising the Group. The Group's operations are conducted by the following operating segments:

Coal segment

hard coal mining and sales

14,4 million tons

coal production1 552,3 PLN million

capital expendituresCoke segment

production and sale of coke and hydrocarbons3,3 million tons

coke production127,6 PLN million

capital expendituresOther segments

activity of other Group entities, among others activities in specialized mining services, innovation, IT, logistics, repair and upkeep services, laboratory and insurance services387,8 PLN million

sales revenues216,1 PLN million

capital expendituresTable. Segment results

| ITEM | COAL SEGMENT | COKE SEGMENT | OTHER SEGMENTS | |||

|---|---|---|---|---|---|---|

| 2020 | 2019 | 2020 | 2019 | 2020 | 2019 | |

| Sales revenues from external customers | 3 554,6 | 4 771,1 | 3 047,0 | 3 545,0 | 387,8 | 355,7 |

| Operating profit/(loss) | (1 760,2) | 478,1 | (50,7) | 259,5 | 92,2 | 93,2 |

| Depreciation and amortization | 935,0 | 878,6 | 107,7 | 103,4 | 133,9 | 108,9 |

| EBITDA | (825,2) | 1 356,7 | 57,0 | 362,9 | 226,1 | 202,1 |

| Adjusted EBITDA* | (308,6) | - | - | 173,1 | - | - |

*EBITDA after excluding the impairment loss on non-current assets of KWK Jastrzębie-Bzie, recognized as a result of completed tests in 2020 in the amount of PLN 516.6 million. In turn, in the Coke Segment in 2019, EBITDA was adjusted for the dissolution of an impairment loss on the assets of the Radlin Coking Plant in the amount of PLN 189.8 million.

In 2020, revenues on coal sales to external buyers were PLN 3,554.6 million, down 25.5% compared to 2019. In the reporting period, revenues on sales of coke totaled PLN 3,047.0 million, down 14.0% compared to 2019. The decline in sales revenues was driven primarily by the slump in average sales prices: metallurgical (coking) coal down by PLN 198.08/t, steam coal down by PLN 26.43/t and coke down by PLN 335.13/t.

In the reporting period under analysis, the share of revenues held by the top five external buyers in the Coal segment was 73.0% of revenues in this segment (73.8% in the corresponding period of 2019). Other buyers, whose unit share did not exceed 10.0% of revenues, generated the remaining 27.0% of total revenues of the coal segment. The share of revenues held by the top five buyers in the Coke segment was 62.8% of revenues in this segment (69.6% in the period from 1 January to 31 December 2019). Other buyers, whose individual share did not exceed 10.0% of revenues, generated the remaining 37.2% of total revenues in the coke segment.

Segment-specific information for reporting purposes

The Group presents information on operating segments in accordance with IFRS 8 "Operating Segments". The Group is organized and managed in segments by type of products offered and type of production activity.

| Coal | Coke | Other segments * | Consolidation adjustments ** | Total | |

|---|---|---|---|---|---|

| FOR THE PERIOD ENDED 31 DECEMBER 2020 | |||||

| Total segment sales revenues | 5 577,2 | 3 047,0 | 1 489,6 | (3 124,4) | 6 989,4 |

| - Revenues on inter-segment sales | 2 022,6 | - | 1 101,8 | (3 124,4) | - |

| - Sales revenues from external customers | 3 554,6 | 3 047,0 | 387,8 | - | 6 989,4 |

| Segment’s gross profit/(loss) on sales | (603,2) | 197,7 | 160,4 | (102,8) | (347,9) |

| Segment's operating profit/(loss) | (1 760,2) | (50,7) | 92,2 | (24,6) | (1 743,3) |

| Depreciation and amortization | (935,0) | (107,7) | (133,9) | 71,7 | (1 104,9) |

| OTHER SIGNIFICANT NON-CASH ITEMS: | |||||

| - Recognition of impairment losses for non-financial non-current assets | (516,6) | - | - | - | (516,6) |

| TOTAL SEGMENT ASSETS, INCLUDING: | 9 384,9 | 2 458,3 | 2 132,0 | (829,6) | 13 145,6 |

| Increases in non-current assets (other than financial instruments and deferred income tax assets) | 1 684,2 | 127,6 | 235,3 | (77,4) | 1 969,7 |

**The "Consolidation adjustments" column eliminates the effects of intra-segment transactions within the Group

| Coal | Coke | Other segments * | Consolidation adjustments ** | Total | |

|---|---|---|---|---|---|

| FOR THE PERIOD ENDED 31 DECEMBER 2019 | |||||

| Total segment sales revenues | 7 688,0 | 3 545,0 | 1 294,0 | (3 855,2) | 8 671,8 |

| - Revenues on inter-segment sales | 2 916,9 | - | 938,3 | (3 855,2) | - |

| - Sales revenues from external customers | 4 771,1 | 3 545,0 | 355,7 | - | 8 671,8 |

| Segment’s gross profit/(loss) on sales | 1 177,2 | 285,4 | 172,6 | (31,6) | 1 603,6 |

| Operating profit of the segment | 478,1 | 259,5 | 93,2 | 74,8 | 905,6 |

| Depreciation and amortization | (878,6) | (103,4) | (108,9) | 57,0 | (1 033,9) |

| OTHER SIGNIFICANT NON-CASH ITEMS: | |||||

| - Reversal of impairment losses for non-financial non-current assets | 5,6 | 189,8 | - | - | 195,4 |

| TOTAL SEGMENT ASSETS, INCLUDING: | 8 280,7 | 2 343,9 | 1 955,9 | (744,5) | 11 836,0 |

| Increases in non-current assets (other than financial instruments and deferred income tax assets) | 2 424,1 | 107,5 | 528,7 | (318,1) | 2 742,2 |

**The "Consolidation adjustments" column eliminates the effects of intra-segment transactions within the Group

Presented below is reconciliation of the results (operating profit/(loss)) generated by the segments with pre-tax profit/(loss)

| 2020 | 2019 | |

|---|---|---|

| OPERATING PROFIT/(LOSS) | (1 743,3) | 905,6 |

| Financial income | 8,1 | 26,5 |

| Financial costs | (132,5) | (104,4) |

| Share in profits/(losses) of associates | 0,1 | 0,3 |

| PROFIT/(LOSS) BEFORE TAX | (1 867,6) | 828,0 |

Segment assets

The amounts of total assets are measured in a manner consistent with the method applied in the consolidated statement of financial position. These assets are allocated by segment's business and by physical location of the asset component.

Group assets are located in Poland.

The reconciliation of segment assets with the Group's total assets is presented below:

| 31.12.2020 | 31.12.2019 | |

|---|---|---|

| SEGMENT ASSETS | 13 145,6 | 11 836,0 |

| Investments in associates | 1,2 | 1,2 |

| Deferred tax assets | 877,0 | 525,0 |

| Investments in the FIZ Asset Portfolio, long-term | 612,0 | 1 174,0 |

| Other non-current assets | 378,7 | 376,1 |

| Income tax overpaid | 3,4 | 162,8 |

| Financial derivatives | 7,8 | 60,5 |

| Investments in the FIZ Asset Portfolio, short-term | - | 700,0 |

| Other current financial assets | 5,2 | 90,8 |

| TOTAL ASSETS ACCORDING TO THE CONSOLIDATED STATEMENT OF FINANCIAL POSITION | 15 030,9 | 14 926,4 |

Information relating to geographical areas

The geographic breakdown of revenues on sales is depicted by the buyer's country of origin:

| Note | 2020 | 2019 | |

|---|---|---|---|

| Sales in Poland, of which: | |||

| Coal | 2 438,8 | 3 509,2 | |

| Coke | 381,9 | 720,0 | |

| Other segments | 370,1 | 354,7 | |

| TOTAL SALES IN POLAND | 3 190,8 | 4 583,9 | |

| Sales abroad, including: | |||

| EU member states, of which: | 3 365,6 | 3 486,9 | |

| Coal | 1 115,8 | 1 261,9 | |

| Coke | 2 232,6 | 2 224,5 | |

| Other segments | 17,2 | 0,5 | |

| Non-EU Europe, of which: | 218,9 | 601,0 | |

| Coke | 218,9 | 600,5 | |

| Other segments | - | 0,5 | |

| Other states, of which: | 214,1 | - | |

| Coke | 213,6 | - | |

| Other segments | 0,5 | - | |

| TOTAL SALES ABROAD, including: | 3 798,6 | 4 087,9 | |

| Coal | 1 115,8 | 1 261,9 | |

| Coke | 2 665,1 | 2 825,0 | |

| Other segments | 17,7 | 1,0 | |

| TOTAL SALES REVENUES | 4.1 | 6 989,4 | 8 671,8 |

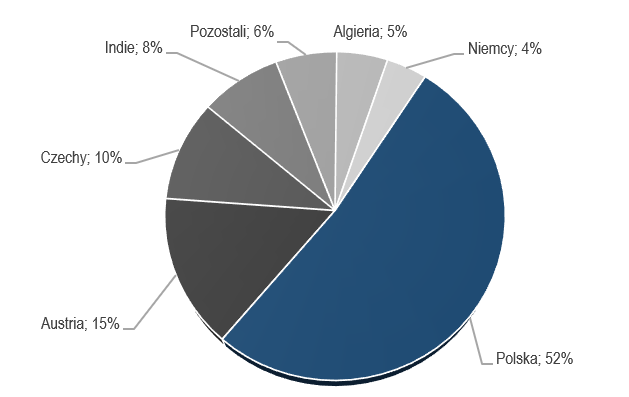

Revenues on sales – geographic breakdown by the country of origin of the counterparty making the purchase:

| 2020 | 2019 | |

|---|---|---|

| Poland | 3 190,8 | 4 583,9 |

| Germany | 1 129,9 | 1 006,6 |

| Austria | 907,5 | 1 308,6 |

| Czech Republic | 688,2 | 769,1 |

| Romania | 335,6 | 18,9 |

| Singapore | 214,0 | - |

| Switzerland | 132,7 | 471,1 |

| Slovakia | 123,9 | 118,1 |

| Belgium | 102,3 | 98,8 |

| Norway | 86,2 | 129,9 |

| Spain | 54,8 | 74,3 |

| France | 16,0 | 21,1 |

| Sweden | 7,5 | 9,7 |

| Luxembourg | - | 60,2 |

| Other countries | - | 1,5 |

| TOTAL SALES REVENUES | 6 989,4 | 8 671,8 |

Information on key customers

For the period from 1 January to 31 December 2020, revenues on sales to two clients, to each one of them individually, exceeded 10% of the Group's revenues on sales. Revenues on sales to one of them were PLN 1,463.0 million and to the other PLN 881.9 million. Revenues on sales to those clients were included in the Coal segment and in the Coke segment.

For the period from 1 January to 31 December 2019, revenues on sales to two clients, to each one of them individually, exceeded 10% of the Group's revenues on sales. Revenues on sales to one of them were PLN 2,502.6 million and to the other PLN 1,288.1 million. Revenues on sales to those clients were included in the Coal segment and in the Coke segment.

Coal segment

The Group’s mining activity is performed by five hard coal mines. All these mines do their business within the geographical boundaries of their concession areas for which the concession expiry date, the surface area and the depth are specified. The Group’s mines exploit hard coal deposits in the mining areas defined in the concessions, located in townships of Jastrzębie-Zdrój and Żory, rural townships (gmina) of Świerklany, Mszana, Pawłowice, Gierałtowice, Ornontowice, Pilchowice, as well as the towns of Mikołów, Czerwionka-Leszczyny, Gliwice, Knurów, and Pszczyna.

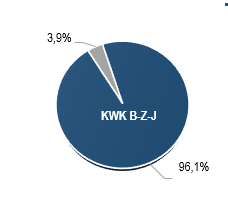

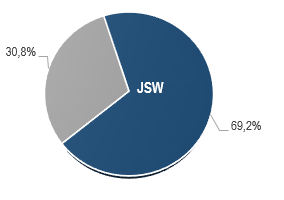

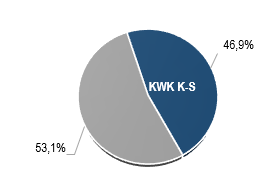

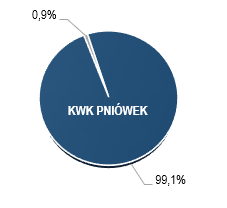

Structure of coal production and sale

The structure of the Group’s coal production is the result of the current geological conditions in mines and rapidly changing market needs, taking into account supply and demand in the domestic and foreign markets. The share of metallurgical (coking) coal and steam coal in total net coal production in 2020 was 76.9% and 23.1%, respectively.

The preventive change in the organization of work and the high absenteeism had an impact on the coal production level. In addition, from 9 to 28 June 2020, the usual coal mining production cycle in the “Knurów-Szczygłowice” and “Budryk” mines was suspended. The above measures were taken in the interest of the employees’ health and safety, in connection with the recommendations of the Silesian Voivode, the Silesian State Voivodeship Sanitary Inspector and the Minister of State Assets.

JSW’s coal production in 2020 was presented compared to the forecasts in the technical and economic plan:

| I | II | III | IV | V | VI | VII | VIII | IX | X | XI | XII |

YEAR 2020 |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Increase/(decrease) in production compared to business plan forecasts (in 000s tons) |

136,6 | 136,7 | (110,1) | (325,3) | (378,8) | (342,5) | 0,9 | (41,6) | (70,0) | (60,3) | 4,6 | (104,3) | (1 154,1) |

Compared to the forecasts in the 2020 business plan (PTE), the annual production of coal in JSW was 1,154.1 thousand tons lower, while the most significant deviation from the plan was in the months when JSW was affected by the pandemic the most, i.e. in March, April, May and June 2020. Up until the outbreak of the pandemic, the production was higher than planned.

JSW has been performing its commercial contracts for the supply of coal to external buyers and to own coking plants on an ongoing basis. Coke sales were also carried out in accordance with the agreed schedules.

In 2020, a total of 14.0 million tons of coal was sold, of which, in terms of the intended use of coal, the share of metallurgical (coking) coal sales in the Group’s total deliveries was 77.1%, with the remaining 22.9% made up of steam coal, with a calorific value consistent with the customers’ requirements.

In the period under analysis, the Group’s mines produced and sold mainly hard coking coals, and lesser volumes of coking gas coal. The Borynia-Zofiówka (the Borynia-Zofiówka Section) and Pniówek mines produced good quality hard coking coal, mainly for the production of blast furnace coke. The Budryk mine and Knurów-Szczygłowice mine - the Szczygłowice Section, thanks to modified coal properties, has also started production of hard coking coal of good quality parameters, i.e. the low volatile matter content of less than 31% and good mean CRI above 30% and CSR above 50%. On the other hand, the Knurów Section produced coking gas coal of stable quality parameters. The Budryk and Knurów-Szczygłowice mines also produce steam coal used by power plants and co-generation plants to produce electricity and heat.

Table. Key quality parameters of coal produced by the Group in 2020 (mean values)

| CATEGORY | KWK BORYNIA - ZOFIÓWKA | KWK PNIÓWEK | KWK KNURÓW-SZCZYGŁOWICE | KWK BUDRYK | |||||

|---|---|---|---|---|---|---|---|---|---|

| Section Borynia | Section Zofiówka | Secion Knurów | Secion Szczygłowice | ||||||

| METALLURGICAL (COKING) COAL | |||||||||

| Ash content Ad (%) | 7,0 | 6,7 | 6,3 | 6,6 | 7,5 | 7,3 | |||

| Humidity Wtr (%) | 3,7 | 10,0 | 9,5 | 6,8 | 7,6 | 7,3 | |||

| Sulfur content Std (%) | 0,67 | 0,45 | 0,58 | 0,58 | 0,40 | 0,57 | |||

| Volatile matter content (Vdaf (%) | 24,2 | 21,3 | 25,7 | 31,6 | 28,8 | 29,5 | |||

| Sinterability (RI) | 80 | 72 | 82 | 77 | 79 | 83 | |||

| Coke strength after reaction CSR (%) | 65,6 | 52,8 | 64,3 | 43,8 | 53,9 | 51,2 | |||

| CO2 coke reactivity index (CRI %) | 24,1 | 38,2 | 24,2 | 41,2 | 32,8 | 35,2 | |||

| STEAM COAL | |||||||||

| Ash content Ar (%) | - | 32,2 | 12,6 | 22,7 | 21,6 | 25,8 | |||

| Humidity Wtr (%) | - | 13,9 | 3,3 | 9,3 | 9,4 | 9,2 | |||

| Sulfur content Str (%) | - | 0,39 | 0,64 | 0,61 | 0,39 | 0,55 | |||

| Calorific value (Qir MJ/kg) | - | 17,3 | 29,1 | 22,5 | 23,1 | 21,6 | |||

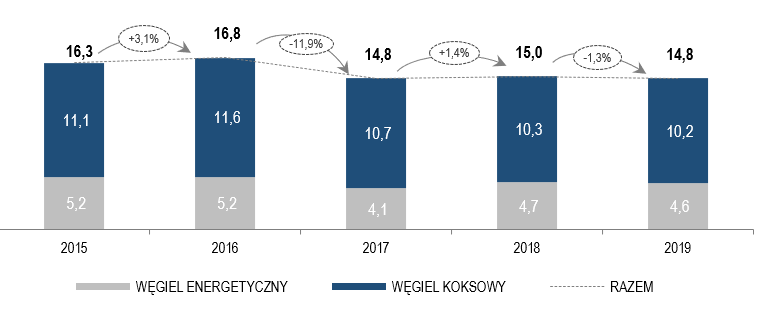

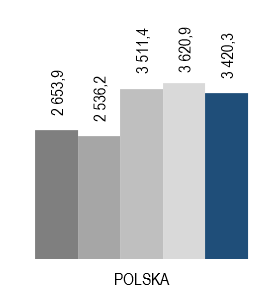

Chart. Coal production in the Group in 2016-2020 (million tons)

The total sales of coal produced by the Group’s mines, comprising intra-group and external deliveries, were realized at 14.0 million tons, i.e. 0.2 million tons more than in 2019. Despite the difficult situation in the coke and steel markets, as well as in the commercial power plant generation sector, steam coal sales fell by 0.7 million tons. On the other hand, metallurgical (coking) coal sales went up by 0.9 million tons.

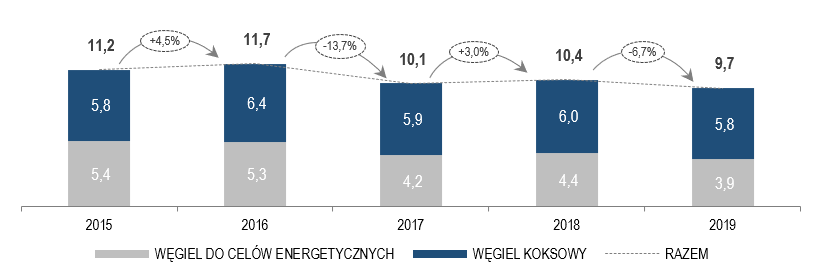

Chart. Coal sales to external offtakers in 2016-2020 (million tons)

The sales of metallurgical (coking) coal intensified as a result of the gradual increase in steel production in Europe, which translated into higher demand for coke and metallurgical (coking) coal, and of activities undertaken by our salesforce. In 2020, compared to the previous year, external sales of these products increased by 0.5 million tons, i.e. 8.6%, and internal sales increased by 0.4 million tons, i.e. 9.8%. In the period in question, the sales of steam coal to external buyers dropped by 0.7 million tons compared to the previous year, due to lower purchases of steam coal by domestic commercial power plants resulting from lower than planned electricity generation.

External coal deliveries to domestic customers were 69.5% (by volume) and 64.3% (by revenue) and to international customers - 30.5% and 35.7%, respectively. For comparison, in 2019 these percentages were as follows: domestic buyers 78.7% (by volume) and 71.7% (by revenue); foreign buyers 21.3% (by volume) and 28.3% (by revenue).

In 2020, revenues from sales to external buyers in the coal segment reached PLN 3,554.6 million and were approx. PLN 1,216.5 million, i.e. 25.5%, lower than in 2019 as a result of unfavorable market situation. In 2020, the average coal sales price PLN 373.78 per ton and was 23.9% lower than in 2019. Prices of metallurgical (coking) coal fell by 31.2%, and steam coal prices fell by 9.6%.

Table. Achieved production and sales of coal, including intra-Group sales

| ITEM | 2020 | 2019 | 2018 | 2017 | 2016 | GROWTH RATE 2019=100 |

|---|---|---|---|---|---|---|

| Production (million tons) | 14,4 | 14,8 | 15,0 | 14,8 | 16,8 | 97,3 |

| - Metallurgical (coking) coal | 11,1 | 10,2 | 10,3 | 10,7 | 11,6 | 108,8 |

| - Steam coal | 3,3 | 4,6 | 4,7 | 4,1 | 5,2 | 71,7 |

| Total volume of JSW’s sales (million tons)(1) | 14,0 | 13,8 | 14,8 | 14,6 | 17,2 | 101,4 |

| - Metallurgical (coking) coal | 10,8 | 9,9 | 10,4 | 10,4 | 11,8 | 109,1 |

| - Steam coal | 3,2 | 3,9 | 4,4 | 4,2 | 5,4 | 82,1 |

| Intra-group sales (million tons)(1) | 4,5 | 4,1 | 4,4 | 4,5 | 5,5 | 109,8 |

| - Metallurgical (coking) coal | 4,5 | 4,1 | 4,4 | 4,5 | 5,4 | 109,8 |

| - Steam coal | - | - (2) | - (2) | - | 0,1 | - |

| Sales volume to external customers (million tons)(1) | 9,5 | 9,7 | 10,4 | 10,1 | 11,7 | 97,9 |

| - Metallurgical (coking) coal | 6,3 | 5,8 | 6,0 | 5,9 | 6,4 | 108,6 |

| - Steam coal | 3,2 | 3,9 | 4,4 | 4,2 | 5,3 | 82,1 |

| Revenues from coal sales (PLN million)(3) | 5 577,2 | 7 688,0 | 8 296,6 | 7 929,2 | 5 846,2 | 72,5 |

| Revenues from inter-segment coal sales revenues (PLN million) | 2 022,6 | 2 916,9 | 3 212,0 | 3 003,3 | 2 294,6 | 69,3 |

| Revenues from coal sales to external customers (PLN million) | 3 554,6 | 4 771,1 | 5 084,6 | 4 925,9 | 3 551,6 | 74,5 |

(2) because of the low volume, there is no impact on the figures expressed in million tons,

(3) this value takes into account the Group’s additional revenues in 2020, 2019, 2018, 2017 and 2016 of, respectively: 85.3 million, PLN 315.9 million, PLN 225.2 million, PLN 245.0 million and PLN 99.0 million, from the sale of coal produced outside the Group

Coke segment

Production and sale of coke

The Group believes that the impact of COVID-19 on the coke segment should not be long term. After a short drop in Q2 2020, in H2 2020 the production capacity utilization and sales volumes showed a steady upward trend. The ratio of coke to coal prices, both the one achieved in 2020 and forecast for 2021, stays at a level favorable for the Group. According to the current knowledge, the projected ratios of coke to coal prices point to the capacity to achieve positive financial results in 2021.

The impact of the restrictions associated with the COVID-19 pandemic on the Group is decreasing and in Q4 2020 the situation improved compared to the prior periods in 2020. The efforts made by the sales services and the noticeable improvement of demand from the business partners brought an increase in coal sales to external customers by approximately 8.0% vs. Q3 2020, while coke sales fell by 4.6%. In Q4 the production of coke rose 9.1% while the slight decrease in sales resulted from much lower coke inventories available in Q4 2020.

Coke continued to be dispatched to overseas markets and the demand on the European market grew noticeably.

Sales of JSW products were conducted mainly on the basis of long-term contracts, in which recovery to full contractual amounts is taking place.

The production of coke by the Group in the period from 1 January to 31 December 2020, as compared to the corresponding period of 2019, was 0.1 million tons, i.e. 3.1%, higher, whereas sales were up by 24.1%. In the period under analysis, sales revenues in the coke segment, comprising coke and hydrocarbons, were PLN 3,047.0 million, and were PLN 498.0 million, i.e. 14%, lower than in the corresponding period of 2019. The decrease in revenues from the sales of coke and hydrocarbons was caused by the lower sales prices commanded for these products.

Table. Realized coke production and sales together with revenues from sale of coke and hydrocarbons

| ITEM | 2020 | 2019 | 2018 | 2017 | 2016 | GROWTH RATE 2019=100 |

|---|---|---|---|---|---|---|

| Production (million tons)(1) | 3,3 | 3,2 | 3,6 | 3,5 | 4,1 | 103,1 |

| Coke sales volume (million tons) | 3,6 | 2,9 | 3,5 | 3,5 | 4,1 | 124,1 |

| Sales revenues (PLN million)(2) | 3 047,0 | 3 545,0 | 4 451,5 | 3 688,1 | 2 822,7 | 86,0 |

(2) revenues from sales of coke and hydrocarbons.

Other segments

The Group is also engaged in limited auxiliary activities that are immaterial from the standpoint of the Group’s operations and financial standing. In 2020, sales revenues in other segments amounted to PLN 387.8 million, or 5.5% of the Group’s sales revenues, and were 9.0% higher than in 2019.

The Group's other activity includes various types of support activities, including in the areas of innovations, IT, logistics, repair and maintenance services, laboratory and insurance services.

The Group includes:

Centralne Laboratorium Pomiarowo-Badawcze Sp. z o.o. – Technical research services, chemical and physiochemical analyses of minerals, and solid, liquid and gaseous materials and products.

JSW IT SYSTEMS Sp. z o.o. - Computer hardware consulting, programming and data processing services.

JSW Innowacje S.A. - The Group’s research and development activity, feasibility studies and oversight over execution of projects and implementations.

Jastrzębskie Zakłady Remontowe Sp. z o.o. - Service activity pertaining to renovation, maintenance and upkeep of machinery and equipment Production of machinery for mining, quarrying and construction as well as generation, transmission, distribution of, and trading in, electricity.

![]()

Przedsiębiorstwo Budowy Szybów S.A. - Specialized mining services: designing and execution of vertical and horizontal mine workings and tunnels, construction services, architectural and engineering services, lease of machinery and equipment as well as assembly, repairs and upkeep of machinery for the mining, quarrying and construction industries.

Jastrzębska Spółka Kolejowa Sp. z o.o. - Provision of railway lines, maintenance of railway infrastructure structures and equipment, construction and repair of railway tracks and facilities.

JSW Logistics Sp. z o.o. - Rendering services concerning rail siding services, coal and coke transportation, organizing the carriage of cargo and technical maintenance and repair of rail cars.

Przedsiębiorstwo Gospodarki Wodnej i Rekultywacji S.A. - Provision of water and sewage-related services and discharge of salt water, supply of industrial water, reclamation activity and production of salt.

Jastrzębska Spółka Ubezpieczeniowa Sp. z o.o. - Insurance intermediation and insurance administration pertaining to insurance claims handling, tourist and hotel activity.

JSW Szkolenie i Górnictwo Sp. .z o.o. - Mining support activity and operating the shower rooms in JSW’s mines.

Sales prices

Coal market

The Group sets coal prices based on published price indexes, taking into account differences in quality between the Group’s coal grades compared to index coal grades and the bonus it derives from its geographical location.

Coal selling prices (PLN/ton)

| ITEM | 2020 | 2019 | 2018 | 2017 | 2016 | GROWTH RATE 2019=100 |

|---|---|---|---|---|---|---|

| Average sales prices of coal produced by JSW (PLN/t) | ||||||

| Metallurgical (coking) coal | 436,76 | 634,84 | 658,67 | 656,70 | 397,35 | 68,8 |

| Steam coal | 249,36 | 275,79 | 249,40 | 206,71 | 187,44 | 90,4 |

| TOTAL(1) | 373,78 | 490,99 | 486,32 | 471,10 | 302,07 | 76,1 |

Coke market

Average coke sales prices

| ITEM | 2020 | 2019 | 2018 | 2017 | 2016 | GROWTH RATE 2019=100 |

|---|---|---|---|---|---|---|

| Coke (PLN/t)(1) | 777,75 | 1 112,88 | 1 139,90 | 972,96 | 621,83 | 69,9 |

More information here.

Revenue

The Group’s product structure, both with regard to the production of hard metallurgical (coking) coals and semi-soft coking coals, steam coal and coke, is adapted flexibly to the dynamically changing market needs and in response of the supply and demand in the domestic and foreign markets. The Polish market is the main market for the coal produced by the Group.

The European market is the main market for the sale of coke produced by the Group. Because of the market conditions and market diversification, a significant outlet for coke was also overseas, mainly in the Indian market. Coke sold from Poland to overseas markets successfully competes against Chinese, Russian, Ukrainian or Colombian coke. Hydrocarbon products have regular buyers on the European market. Surplus coke oven gas is sold to consumers directly by coke plants.

Revenues from sales of coal, coke and hydrocarbons, by geographical area and type of end customers

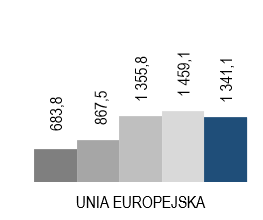

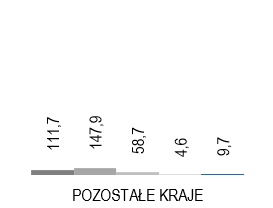

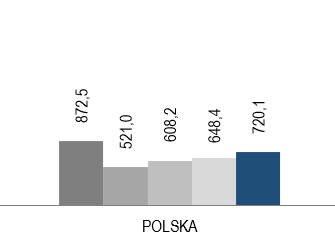

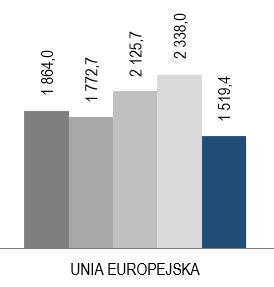

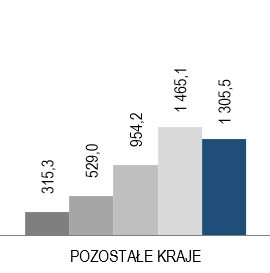

Charts. Coal sales revenues (PLN million)

Charts. Sales revenues from coke and hydrocarbons (PLN million)

Chart. Group's revenue mix by country of destination as of 31 December 2020

Investments

The progress of investment projects carried out in 2020 resulted primarily from the general limitations driven by the impact of the pandemic on the operation of cooperating companies and their ability to provide services and materials. In 2020 the progress of investment projects was lower than planned for 2020 in the business plan.

Of the total expenditures incurred in 2020 of PLN 1,896.0 million, PLN 1,633.1 million was spent on property, plant and equipment, PLN 247.8 million on right-of-use assets, and PLN 15.1 million on intangible assets.

| ITEM | 2020 | 2019* | 2018 | 2017 | 2016 | GROWTH RATE 2019=100 |

|---|---|---|---|---|---|---|

| COAL SEGMENT | ||||||

| Expenditures on property, plant and equipment (without expensable mining pits), investment property and intangible assets | 753,1 | 1 235,7 | 864,4 | 394,9 | 311,0 | 60,9 |

| Expenditures on expensable mining pits | 604,1 | 531,8 | 541,4 | 459,1 | 380,2 | 113,6 |

| Expenditures re. the right-of-use assets | 195,1 | 283,2 | n/a | n/a | n/a | 68,9 |

| TOTAL | 1 552,3 | 2 050,7 | 1 405,8 | 854,0 | 691,2 | 75,7 |

| COKE SEGMENT | ||||||

| Expenditures on property, plant and equipment and intangible assets | 127,2 | 115,0 | 50,1 | 45,3 | 71,4 | 110,6 |

| Expenditures re. the right-of-use assets | 0,4 | - | n/a | n/a | n/a | - |

| TOTAL | 127,6 | 115,0 | 50,1 | 45,3 | 71,4 | 111,0 |

| OTHER SEGMENTS | ||||||

| Expenditures on property, plant and equipment and intangible assets | 163,8 | 150,5 | 212,7 | 123,4 | 250,6 | 108,8 |

| Expenditures re. the right-of-use assets | 52,3 | 83,5 | n/a | n/a | n/a | 62,6 |

| TOTAL | 216,1 | 234,0 | 212,7 | 123,4 | 250,6 | 92,4 |

| TOTAL SEGMENTS | ||||||

| Expenditures on property, plant and equipment (without expensable mining pits), investment property and intangible assets | 1 044,1 | 1 501,2 | 1 127,2 | 563,6 | 633,0 | 69,6 |

| Expenditures on expensable mining pits | 604,1 | 531,8 | 541,4 | 459,1 | 380,2 | 113,6 |

| Expenditures re. the right-of-use assets | 247,8 | 366,7 | n/a | n/a | n/a | 67,6 |

| TOTAL** | 1 896,0 | 2 399,7 | 1 668,6 | 1 022,7 | 1 013,2 | 79,0 |

| TOTAL (AFTER CONSOLIDATION ADJUSTMENTS) | 1 832,0 | 2 329,0 | 1 639,1 | 1 013,7 | 911,3 | 78,7 |

** Value of expenditures before the consolidation adjustments (in 2020: PLN (-)64.0 million, in 2019: PLN (-)70.7 million, in 2018: PLN (-)29.5 million, in 2017: PLN (-)9.0 million, in 2016: PLN 101.9 million).

Investments in property, plant and equipment in JSW

In 2020, JSW incurred capital expenditures on property, plant and equipment in the amount of PLN 1,552.3 million, i.e. 24.3% less than in the same period of 2019. Of the total capital expenditures in the period under analysis: PLN 1,354.8 million was spent on property, plant and equipment, PLN 2.4 million was spent on intangible assets and PLN 195.1 was spent on right-of-use assets. In 2020, capital expenditures were financed from own funds. Moreover, JSW acquired external financing.

The capital expenditures incurred by JSW for property, plant and equipment in 2020 were earmarked for the performance of key tasks (vertical and horizontal development of the mines) and other tasks, including upkeep of the current production capacity.

Key investment projects carried out by JSW

| ITEM |

CAPITAL EXPENDITURES for the period of 12 months ended 31 December 2020 |

DESCRIPTION OF THE INVESTMENT |

|---|---|---|

| CONSTRUCTION OF LEVEL 1120 IN THE BORYNIA SECTION OF THE KWK BORYNIA-ZOFIÓWKA COAL MINE | 12,1 |

Works to build level 1120 in the Borynia Section of KWK Borynia-Zofiówka mine were continued. The recoverable coal reserves planned to be opened from level 1120 m are estimated at 40 million tons. The deposits contain mainly type 35 (hard) metallurgical (coking) coal. As planned, the project will be executed in two stages: Stage 1 until 2024, assuming the opening of seams 502/1 and 504/1 and the deepening of shaft II; and Stage 2 in 2022-2029, assuming the opening of areas B and C at level 1120. Exploitation of resources based on the deepened shaft II should commence in 2025. |

| OPENING AND INDUSTRIAL UTILIZATION OF RESOURCES WITHIN THE AREA OF THE DEPOSITS: “BZIE-DĘBINA 2-ZACHÓD” AND “BZIE-DĘBINA 1-ZACHÓD” IN KWK JASTRZĘBIE-BZIE MINE | 79,8 |

In 2020, JSW continued the opening and utilization of new deposits started in 2005: “Bzie-Dębina 2-Zachód” and “Bzie-Dębina 1-Zachód” from level 1110 m. The recoverable coal reserves are estimated at 174 million tons, down to level 1300 m. The deposits contain mainly type 35 (hard) metallurgical (coking) coal. In 2020, works were continued in connection with the tunneling process of underground mining pits. The commencement of exploitation of resources in area A of the “Bzie-Dębina 2-Zachód” deposit is planned in 2021. |

| CONSTRUCTION OF LEVEL 1080 IN THE ZOFIÓWKA SECTION OF THE BORYNIA-ZOFIÓWKA COAL MINE | 31,3 |

JSW continued the execution of the investment project to build level 1080 in the Zofiówka Section, to provide access to and exploit resources of the “Zofiówka” deposit below the 900 level. The estimated amount of recoverable coal reserves between levels 900-1080 is 43 million tons. In 2020, works were continued on deepening of the IIz shaft to the level of 1,080 and the tunneling process of underground mining pits. |

|

CONSTRUCTION OF A NEW LEVEL IN THE BUDRYK MINE AND MODERNIZATION OF COAL PREPARATION PLANTS |

1,7 |

JSW continued the development of level 1290 m started in 2007. The total amount of recoverable coal reserves available from level 1290m of the “Budryk” deposit is estimated at 168 million tons to the depth of 1400m. The construction of the new 1290m level together with modernization of the Coal Preparation Plant will enable the start of the production of type 35 (hard) coal, increase the production of metallurgical (coking) coal in the mine’s production mix to approx. 65% and increase the total coal production. |

|

CONSTRUCTION OF A NEW LEVEL IN THE BUDRYK MINE AND MODERNIZATION OF COAL PREPARATION PLANTS |

4,3 |

The execution of some investment tasks, i.e. the modernization of the coal preparation plant in 2016-2022, is handled by JZR with external financing using FRP funds. In 2020, approx. 95.5% of the total budget specified in Business Plan 1 for the investment project associated with the modernization of the Coal Preparation Plant at KWK Budryk was completed. |

|

COMMERCIAL METHANE USAGE AT KWK BUDRYK AND KWK KNURÓW-SZCZYGŁOWICE |

95,8 |

JSW is implementing investments involving the extension of infrastructure enabling JSW to generate electrical energy and thermal energy by using methane derived from mines in the methane drainage process. The implementation of this project will facilitate utilization of methane from the KWK Budryk Mine and the KWK Knurów-Szczygłowice Mine, as well as enable generation of energy, to be used primarily by the mines. The surplus energy will be used by JSW’s other units, and may be traded seasonally. The investment project envisages the building of gas engines with a total capacity of 48 MWe, including: 20 MWe in the KWK Budryk mine and 28 MWe in the KWK Knurów-Szczygłowice mine. In 2020, the investment project incurred capital expenditures of PLN 2.2 million (KWK Budryk) PLN 93.6 million (KWK Knurów-Szczygłowice). |

|

CONSTRUCTION OF LEVEL 1050 IN THE KNURÓW-SZCZYGŁOWICE MINE, KNURÓW SECTION |

13,5 |

JSW conducted works aimed at tapping into the resources available on level 850-1050 in the Knurów Section. The project is executed with a view to gaining access to deposits of high quality type 34 metallurgical (coking) coal. The total quantum of documented recoverable coal reserves available on level 850-1050 in the Knurów Section is 86 million tons. In 2020, works were conducted in connection with the tunneling process of mining pits on level 1050. |

|

CONSTRUCTION OF LEVEL 1050 IN THE KNURÓW-SZCZYGŁOWICE MINE, SZCZYGŁOWICE SECTION |

5,2 |

The JSW conducted works aimed at tapping into the resources available on level 850-1050 in the Szczygłowice Section. The project is executed with a view to gaining access to deposits of type 35 metallurgical (coking) coal. The total quantum of documented recoverable coal reserves available on level 850-1050 in the Szczygłowice deposit is estimated at 64 million tons. In 2020, works were continued in connection with the tunneling process of underground mining pits. |

|

EXTENSION OF THE PNIÓWEK MINE |

32,4 |

The company continued the mining work on opening and developing the new ”Pawłowice 1” deposit started in 2007. The total amount of recoverable coal reserves in this deposit is estimated at 132 mt down to the level of 1,300m. The deposit contains mainly type 35 (hard) metallurgical (coking) coal. In 2020, works were conducted in connection with the tunneling process of mining pits. |

|

EXTENSION OF THE PNIÓWEK MINE |

95,6 |

Moreover, the JSW continued the investment project launched in 2017 in the Pniówek mine related to expansion of the mining level at 1,000m, together with deepening of shafts IV and III. The project is performed to secure effective exploitation and an access to reserves of type 35 coal in the south-west part of the “Pniówek” deposit, which are planned to be exploited after 2022. The total quantum of recoverable coal reserves available from level 1000 in KWK Pniówek is estimated at approximately 58 million tons. In 2020, works were conducted to tunnel the underground mining pits and deepen shafts III and IV. |

| RAZEM | 371,7 |

The modernization of the Coal Preparation Plants to increase metallurgical (coking) coal production and to launch the production of type 35 metallurgical (coking) coal, as well as other investment activities to increase net coal production in the Knurów-Szczygłowice mine.

The Group executes a capital expenditure project to modernize the coal preparation plants and other capital expenditure activities to launch production of type 35 (hard) coal, increase the share of metallurgical (coking) coal in total output and increase the net coal production level. The investment project will increase the share of metallurgical (coking) coal (type 34 and 35) produced to the target of 80% in the mine’s production mix, start the production of type 35 (hard) metallurgical (coking) coal and increase the total production output. JZR implements a part of the capital expenditure tasks, i.e. the modernization of Coal Preparation Plants in 2016-2021 and other tasks, aimed at increasing the net coal production. In 2020, the investment project incurred expenditure of PLN 30.2 million. By the end of December 2020, approx. 104.7% of the budget specified in Business Plan 1 for the investment project executed in KWK Knurów-Szczygłowice was performed.

Financial support contract JZR

On 30 September 2016, an agreement was concluded between the State Treasury and JZR to provide non-state aid support, effected in three tranches, in the total amount of up to PLN 290.0 million, in the form of a cash contribution in exchange for shares in JZR’s increased share capital, subscribed for by the State Treasury. Proceeds from the support were designated for the modernization of the coal preparation plants of KWK Budryk and KWK Knurów-Szczygłowice.

In 2018, JZR started preliminary talks with the Ministry of Entrepreneurship and Technology and the Industrial Development Agency on an early repayment to the State Treasury of the non-state aid support funds. In 2019, analytical work was conducted as regards the continuation of the State Treasury’s capital involvement in JZR. On 2 April 2019, a decision was made to suspend this work. Accordingly, on 10 April 2019, JZR informed the Ministry of Energy and the Ministry of Entrepreneurship and Technology about the discontinuation of activities aimed at repaying the support funds. As a result of the arrangements made in December 2019, JZR requested the Industrial Development Agency to conclude Annex no. 2 to the support agreement, to reflect the updated Investment Business Plan under the verified capital expenditure budget and investment project schedule (the completion date of the investment project was postponed from 2019 to 2020). As at the preparation date of this report, the work on concluding the annex is still underway. JZR has also undertaken actions to receive the third tranche of Support, in the amount of PLN 20.0 million. The financing is contingent upon the requirement of the preparation of the updated Investment Project Business Plan, Private Investor Test to confirm the arm’s length basis of the transaction, and consequently conclusion of an annex to the Support Agreement.

Other capital expenditures of the Group

Capital expenditures in other Group companies in the period from 1 January to 31 December 2020 totaled PLN 343.7 million (including expenditures associated with right-of-use assets, of PLN 52.7 million). The expenditures on property, plant and equipment, investment property and intangible assets amounted to PLN 291.0 million and were 9.6% higher than in 2019. The capital expenditures in the coke segment and other segments in 2020 accounted for 18.1% of the Group’s total expenditures. Investments in property, plant and equipment incurred by the companies were allocated for execution of key investment projects and tasks securing their on-going operating activities.

| ITEM |

CAPITAL EXPENDITURES for the period of 12 months ended 31 December 2020 |

KEY INVESTMENT PROJECTS CARRIED OUT BY OTHER GROUP COMPANIES |

|---|---|---|

|

MODERNIZATION OF COKE OVEN BATTERIES IN PRZYJAŹŃ COKING PLANT |

1,6 |

The Przyjaźń Coking Plant (JSW KOKS) pursues an investment program which included commissioning in 2011 of the modernized oven battery no. 1, and a plan to modernize more coke oven batteries in the future. On 15 September 2011, the company signed an agreement with BP Koksoprojekt Sp. z o.o. from Zabrze, selected in a tender procedure to perform formal, legal and design work for the purpose of modernization of coke oven batteries no. 3 and 4, and execution designs for modernization of coking battery no. 4. The preparation stage of the execution designs for modernization of battery no. 4. was completed in 2014. On 14 March 2018, the JSW Management Board adopted a resolution to approve Execution Documents to implement in 2018-2021 the Investment Project entitled “Modernization of Coke Oven Battery no. 4 at the Przyjaźń Coking Plant”. In 2019, a tender procedure was conducted to select the General Contractor for the Investment (GRI). The contractor for this task recommended by the Tender Commission is Shandong Province Metallurgical Engineering Co., Ltd. Since the amount of the offer substantially exceeded the budget posited by JSW KOKS, and the validity of the submitted offer along with the extension of the security deposit guarantee expired on 31 March 2020, the Management Board of JSW KOKS decided on 31 March 2020 to cancel the tender proceeding and commenced efforts to work out a different approach to conducting this task. |

|

CONSTRUCTION OF A POWER UNIT AT THE RADLIN COKING PLANT |

58,9 |

This project, executed by JSW KOKS, is designed to use coke oven gas to generate electricity and heat for own needs and for sale. A part of the project is the construction of a power unit fired with own coke oven gas, of a thermal capacity of 104 MW, with an extraction condensing turbine of a capacity of 28 MWe and a heat-generating segment of a capacity of 37 MWt, which will supply electricity, steam and heat to the Radlin coking plant, as well as heat to the nearby KWK ROW, Marcel Section and the town of Radlin inhabitants. On 14 March 2018, the JSW Management Board adopted a resolution approving the Execution Documents which plan the execution in 2018-2020 of an investment project entitled “Construction of a Power Unit at the Radlin Coking Plant.” On 12 June 2019, an agreement was signed with RAFAKO S.A., setting the investment project completion date for 12 November 2021. Annex no. 2 to the Support Agreement, changing the completion date to Q1 2022, was executed on 15 October 2020. |

| TOTAL | 60,5 |

Suppliers

The Group is obligated to comply with provisions of the Act of 11 September 2019 - Public Procurement Law. As at the balance sheet date, the Group was obligated to hold public tenders for procurement orders for goods and services valued in excess of EUR 428 thousand, following the procedures prescribed by the law.

The most commonly applied procedure is an open tender procedure. Bids may be submitted by all potential suppliers satisfying the awarding party’s requirements specified in the tender procedure. The prices set during such a procedure remain valid for the duration of the contract. For procurements with a value of less than the threshold for application of the Public Procurement Law, the Group selects suppliers based on its own internal bylaws, mostly in the form of electronic auctions or requests for proposals in the OFFERTY (Offers) system. The ongoing supplies of materials for the mines are performed by the Production Support Unit.

Suppliers in the coal segment

The following companies were biggest suppliers in the coal segment in 2020:

Suppliers in the coke segment

The Group’s biggest suppliers for coking activities are primarily the following companies:

In the Management Board’s opinion, its relations with suppliers do not make the Group dependent on any one supplier in a way that could have an adverse impact on the Group’s activity.