Key financial and operating data in the JSW Group

In 2020 the Group suffered noticeable negative effects of the pandemic situation caused by the COVID-19 virus in all areas of its operations. The limitations related to the restrictions caused by the appearance of COVID-19 contributed to losing production and sales volumes, and what is significant - they contributed to significantly lower Group revenue and a deterioration in its profitability indicators.

Considering that the type and scope of the Group’s operations is highly sensitive to changes in the interconnected coal, coke and steel markets, the unstable economic situation due to the COVID-19 pandemic had a significant impact on the financial performance of JSW and the Group.

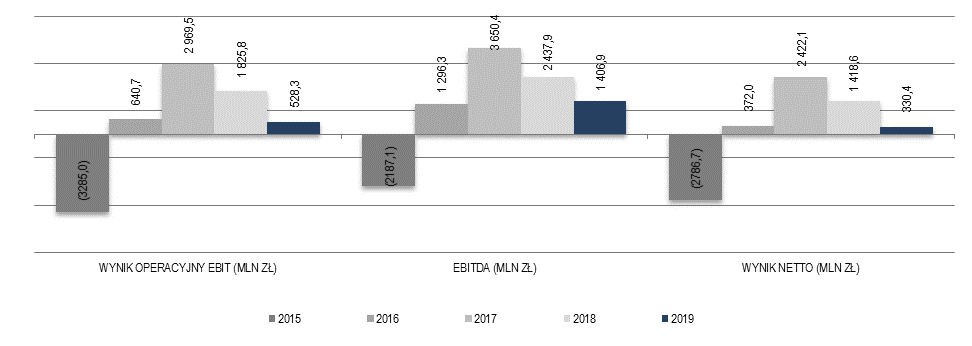

The Group closed 2020 with a loss of PLN 1,537.4 million, achieved sales revenues of PLN 6,989.4 million, and Group EBITDA was PLN (638.4) million. In 2020, the Group produced 14.4 million tons of coal, excavated 73.1 km of corridor roadways, and produced 3.3 million tons of coke.

Table. Economic and financial highlights for the JSW Group

| ITEM | JEDN. | 2020 | 2019 | 2018 | 2017 | 2016 | GROWTH RATE 2019=100 |

|---|---|---|---|---|---|---|---|

| CONSOLIDATED STATEMENT OF FINANCIAL POSITION | |||||||

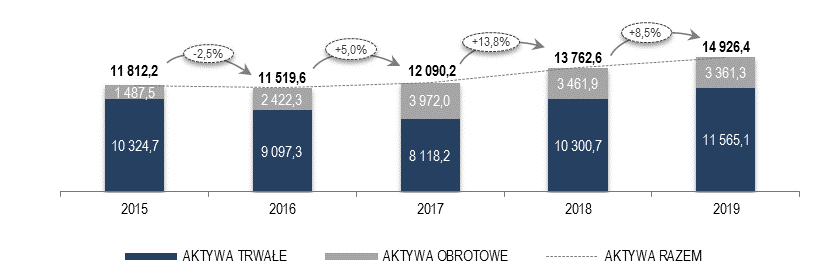

| Balance sheet total | PLN million | 15 030,9 | 14 926,4 | 13 762,6 | 12 090,2 | 11 519,6 | 100,7 |

| Non-current assets | PLN million | 11638,5 | 11 565,1 | 10 300,7 | 8 118,2 | 9 097,3 | 100,6 |

| Current assets | PLN million | 3 392,4 | 3 361,3 | 3 461,9 | 3 972,0 | 2 422,3 | 100,9 |

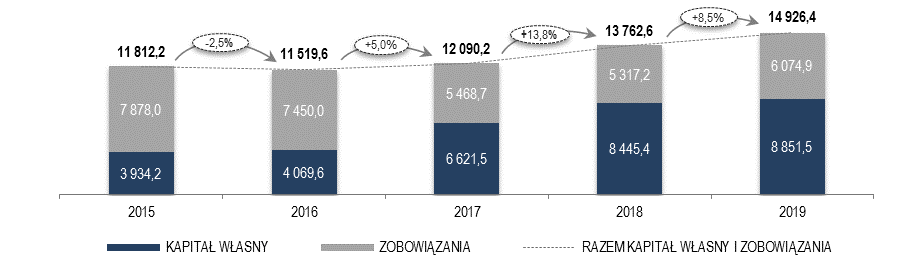

| Equity | PLN million | 7 317,1 | 8 851,5 | 8 445,4 | 6 621,5 | 4 069,6 | 82,7 |

| Liabilities | PLN million | 7 713,8 | 6 074,9 | 5 317,2 | 5 468,7 | 7 450,0 | 127,0 |

| CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME | |||||||

| Sales revenues | PLN million | 6 989,4 | 8 671,8 | 9 809,5 | 8 877,2 | 6 731,3 | 80,6 |

| Gross profit (loss) on sales | PLN million | (347,9) | 1 603,6 | 2 871,1 | 3 238,9 | 1 229,7 | - |

| Operating profit/(loss) | PLN million | (1 743,3) | 905,6 | 2 254,1 | 3 116,5 | 226,6 | - |

| EBITDA | PLN million | (638,4) | 1 939,5 | 3 020,1 | 3 941,2 | 1 065,4 | - |

| EBITDA margin | % | (9,1) | 22,4 | 30,8 | 44,4 | 15,8 | - |

| Profit/(loss) before tax | PLN million | (1 867,6) | 828,0 | 2 192,5 | 3 123,6 | 19,6 | - |

| Net profit/(loss) | PLN million | (1 537,4) | 649,6 | 1 760,8 | 2 543,3 | 4,4 | - |

| Total comprehensive income | PLN million | (1 534,3) | 636,7 | 1 718,4 | 2 552,0 | 16,2 | - |

| CONSOLIDATED STATEMENT OF CASH FLOWS | |||||||

| Net cash flow on operating activity | PLN million | 354,7 | 1 140,3 | 2 818,4 | 2 870,7 | 896,5 | 31,1 |

| Net cash flow on investing activity | PLN million | (549,3) | (2 260,5) | (1 581,7) | (2 170,3) | (354,4) | 24,3 |

| Net cash flow on financing activity | PLN million | 1 441,2 | (180,3) | (755,8) | (699,8) | 277,7 | - |

| Net movement in cash and cash equivalents | PLN million | 1 246,6 | (1 300,5) | 480,9 | 0,6 | 819,8 | - |

| FINANCIAL RATIOS | |||||||

| Dividend per share | PLN/share | - | 1,71 | - | - | - | - |

| Current liquidity | 1,03 | 1,05 | 1,03 | 1,67 | 1,14 | 98,1 | |

| Quick liquidity | 0,76 | 0,70 | 0,84 | 1,46 | 0,98 | 108,6 | |

| Net return on sales | % | (22,0) | 7,5 | 17,9 | 28,6 | 0,1 | - |

| Return on Assets (ROA) | % | (10,2) | 4,4 | 12,8 | 21,0 | 0,0 | - |

| Return on Equity (ROE) | % | (21,0) | 7,3 | 20,8 | 38,4 | 0,1 | - |

| Total debt ratio | 0,51 | 0,41 | 0,39 | 0,45 | 0,65 | 124,4 | |

| Debt to equity ratio | 1,05 | 0,69 | 0,63 | 0,83 | 1,83 | 152,2 | |

| Fixed capital to non-current assets ratio | 0,90 | 0,91 | 0,91 | 1,0 | 0,70 | 98,9 | |

| PRODUCTION DATA | |||||||

| Coal production | million tons | 14,4 | 14,8 | 15,0 | 14,8 | 16,8 | 97,3 |

| Metallurgical (coking) coal production | million tons | 11,1 | 10,2 | 10,3 | 10,7 | 11,6 | 108,8 |

| Steam coal production | million tons | 3,3 | 4,6 | 4,7 | 4,1 | 5,2 | 71,7 |

| Coke production | million tons | 3,3 | 3,2 | 3,6 | 3,5 | 4,1 | 103,1 |

| Mining cash cost | PLN/ton | 407,37 | 426,00 | 396,46 | 312,54 | 251,38 | 95,6 |

| Cash conversion cost | PLN/ton | 178,37 | 191,78 | 161,68 | 149,82 | 133,52 | 93,0 |

| OTHER DATA | |||||||

| Stock price at the end of the period | PLN/share | 25,95 | 21,38 | 67,26 | 96,27 | 66,90 | 121,4 |

| Headcount at the end of the period | persons | 30 593 | 30 629 | 28 268 | 26 465 | 27 366 | 99,9 |

| Average headcount during the year | persons | 30 674 | 29 440 | 27 207 | 26 563 | 30 765 | 104,2 |

| Investments in property, plant and equipment | PLN million | 1 832,0 | 2 329,0 | 1 639,1 | 1 013,7 | 911,3 | 78,7 |

| Depreciation and amortization | PLN million | 1 104,9 | 1 033,9 | 766,0 | 824,7 | 838,8 | 106,9 |

Impact of the pandemic on the financial standing and valuation of assets and liabilities

Costs incurred

In 2020 the Group incurred significant labor costs related to employees contracting COVID-19, their quarantine, the execution of preventive measures involving the need of phasing in “downtime” and costs related to handling and organizing the overall process to ensure that the pandemic’s repercussions are as least onerous as possible. In connection with the preventive measures taken, the Group incurred costs associated with, among others, the purchase of tents, non-contact thermometers, biological suits, medical masks, gloves, disinfectants and disinfection equipment. Moreover, the Group supported state institutions in combating the SARS-CoV-2 pandemic, making financial and in-kind donations in the amount of PLN 3.3 million.

The total costs incurred for combating the COVID-19 pandemic in the Group were PLN 93.2 million, of which PLN 90.3 was recognized in other costs, PLN 2.2 million in cost of products, materials and goods sold and the remaining part was charged to selling and distribution expenses and administrative expenses.

Revenues earned

In 2020, in connection with the COVID-19 pandemic, the Group took advantage of the aid solutions offered by the State under the Anti-Crisis Shield, including mainly the co-funding of employee salaries from the Guaranteed Employee Benefits Fund for the maximum period of 3 months in the amount of PLN 182.5 million (the amount was fully captured in the financial result in 2020 and presented in other revenues – Note 4.3. of the Consolidated financial statements of the JSW Group for the financial year ended 31 December 2020). The Group also received financial support from the Polish Development Fund (PFR) under the Financial Shield for Large Companies in the form of a preferential and liquidity loan, which is described in greater detail in Note 6.1. of the consolidated financial statements of the JSW Group for the financial year ended 31 December 2020. On account of the preferential interest rate on PFR loans, JSW achieved revenue of PLN 27.4 million, which is the difference between the fair value of the loans and the amount received (the amount recognized in other revenues – Note 4.3. of the aforementioned consolidated financial statements). The PFR’s financial aid was granted to cover the losses suffered in 2020 in connection with the COVID-19 pandemic and therefore the above revenue on account of the preferential interest rate was fully captured in the 2020 financial result.

Total revenues associated with the COVID-19 pandemic, which were received by the Group under the Anti-Crisis Shield and captured in other revenues amount to PLN 210.3 million.

Impairment of non-current assets

Information on the completed impairment tests is presented in Note 7.5. of the Consolidated financial statements of the JSW Group for the financial year ended 31 December 2020.

Impact of the SARS-CoV-2 virus pandemic on the assessment of expected credit losses

The level of impairment losses recognized in 2020 on trade receivables was affected by the deterioration of ratings of some business partners and recognition of the impact of the SARS-CoV-2 coronavirus pandemic on the credit quality of clients.

To take into account the impact of the SARS-CoV-2 coronavirus on the credit quality of the customers from the coal and coke trade receivables group, JSW has adjusted the probability of default on the basis of external ratings through including an additional bonus for the risk associated with the economic situation and forecasts for the future. The effect of including the impact of the coronavirus on the amount of the impairment allowance recognized as at 31 December 2020 for coal and coke trade receivables was PLN 1.1 million.

The impairment allowance recognized for coal and coke trade receivables in the amount of PLN 15.3 million (Note 7.11 of the Consolidated financial statements of the JSW Group for the financial year ended 31 December 2020) was additionally affected by a significant downgrading of the rating of one of the business partners (in the group of business partners whose share of sales revenues was above 2.5%), which resulted in an increase of the impairment allowance by PLN 11.2 million.

The Group is currently analyzing the impact of the COVID-19 pandemic on the market situation and signals that may indicate a deteriorating financial standing of the business partners caused by the pandemic and, if necessary, will continue to update the estimates adopted to calculate the expected credit losses in next reporting periods.

The foregoing assessment was made in accordance with the Group’s best knowledge as at the date of preparing the Consolidated financial statements of the JSW Group for the financial year ended 31 December 2020. The actual scale of the future effects of the SARS-CoV-2 coronavirus pandemic and their impact on the activity and the financial and operational standing and prospects of the Group is currently unknown and impossible to estimate and depends on factors which are beyond the Group’s control and are subject to dynamic changes.

Liquidity position

The COVID-19 pandemic caused a temporary reduction of production, which has direct impact on the Group’s current activity, including the level of earned revenues and incurred costs, and, as a result, the Group’s financial liquidity and debt level. Accordingly, the Group is taking efforts to mitigate the impact of the pandemic on the Group’s liquidity, by taking advantage of the solutions available on the market to support working capital management and is applying for the public financial aid available on the market and funding available as part of the anti-crisis shield (more in Note 9.5. Risk management of the Consolidated financial statements of the JSW Group for the financial year ended 31 December 2020).

Because of the entry into force, on 1 April 2020, of the Act of 31 March 2020 on amending the act on special solutions associated with preventing, counteracting and combating COVID-19, other contagious diseases and crisis situations they precipitate and certain other acts, introducing solutions aimed at, among other things, supporting undertakings in the crisis caused by the COVID-19 pandemic (“Anti-Crisis Shield”), the Group has taken advantage of support solutions, which are described in more detail in Note 2.3.3. Consolidated financial statements of the JSW Group for the financial year ended 31 December 2020.

Asset situation

Drivers of non-current assets (up PLN 73.4 million)

As at 31 December 2020, the biggest non-current assets line item was property, plant and equipment (77.3%). Its value increased in 2020 by PLN 323.3 million, i.e. 3.7%. In the period under analysis the Group incurred expenditures on property, plant and equipment of PLN 1,633.1 million with depreciation of PLN 901.2 million. At the same time, in the analyzed period of 2020, JSW recognized an impairment loss for the non-current assets in KWK Jastrzębie-Bzie in the amount of PLN 516.6 million, which is described in more detail in Note 7.5. Consolidated financial statements of the JSW Group for the financial year ended 31 December 2020.

In addition, as at 31 December 2020, an increase in deferred tax assets was recorded in non-current assets by PLN 352.0 million, or 67.0%, including PLN 354.6 million in JSW, chiefly due to increased tax loss (increase in the assets by PLN 285.3 million), increase in unpaid salaries together with ZUS contributions in the part payable by the taxpayer (increase in assets by PLN 37.2 million) and increase in provisions for liabilities – (increase in assets by PLN 25.8 million).

At the same time, there was a decrease in non-current assets, in the Investments line item in the FIZ asset portfolio by PLN 562.0 million, i.e. 47.9%, in connection with the decisions made by JSW’s Management Board in 2020 – series A and B Investment Certificates with the total value of PLN 1,398.8 million were redeemed.

Factors changing current asset (up PLN 31.1 million)

Compared to 31 December 2019, as at the last day of the reporting period, the overall level of current assets increased by PLN 31.1 million, or 0.9%, driven mainly by an increase of cash and cash equivalents by PLN 1,247.0 million in connection with funding from the Polish Development Fund under the Governmental Program PFR Financial Shield for Large Corporates received by JSW and JSW KOKS in December 2020 to counteract the negative effects of the COVID-19 pandemic in the following amounts: JSW: PLN 1,173.6 million, JSW KOKS: PLN 24.9 million.

Simultaneously, in the period under analysis, there was a decrease by PLN 700.0 million in non-current assets under Investments in the FIZ Asset Portfolio in connection with redemption of Investment Certificates held by JSW in 2020.

In addition, as at the last day of the reporting period, a PLN 250.5 million, or 22.2%, there was a drop in inventories, primarily finished products by PLN 214.4 million (lower coke inventories in the Group by 302.7 thousand tons) and materials by PLN 38.9 million.

In addition, the balance of assets on account of overpaid income tax fell by PLN 159.4 million, or 97.9%, and other current financial assets dropped by PLN 85.6 million, or 94.3%.

Sources of covering assets

Equity change drivers (decrease by PLN 1,534.4 million)

A decrease in total equity by 17.3% as at the end of the reporting period is associated primarily with a decrease in retained earnings by PLN 1,565.0 million, or 24.7%, relative to 31 December 2019, which resulted directly from the recognized net loss attributable to shareholders of JSW of PLN 1,546.0 million.

Liability change factors (increase by PLN 1,638.9 million)

On 31 December 2020, liabilities constituted 51.3% of total equity and liabilities, which was 10.6 percentage points more than on 31 December 2019. In the period under analysis, the an increase of non-current liabilities by PLN 1,552.7 million, i.e. by 60.2% was recorded relative to the balance as at 31 December 2019, mainly as a result of an increase in liabilities under loans and borrowings by PLN 1,353.0 million, among others in connection with JSW and JSW KOKS taking advantage of the financial support program for entrepreneurs to combat effects of COVID-19 under the governmental program entitled “The Polish Development Fund’s Financial Shield for Large Companies” and obtaining cash in the form of liquidity loan and preferential loan (a total of PLN 941.7 million in the long-term part). In addition, the growth in liabilities for loans and borrowings resulted from the origination in 2020 of the remaining portion of the revolving facility for PLN 260.0 million and the term facility for PLN 158.7 million in accordance with the finance agreements executed in 2019, which is presented in more detail in Note 6.1. of the consolidated financial statements of the JSW Group for the financial year ended 31 December 2020.

As at 31 December 2020, compared to 31 December 2019, also long-term provisions increased by PLN 143.2 million, or 16.5% (mainly due to higher provisions for mine closures in JSW by PLN 101.9 million) and employee benefit liabilities increased by PLN 54.2 million, i.e. by 6.5%.

In the period under analysis, current liabilities increased by PLN 86.2 million, or 2.5%, in relation to the balance as at 31 December 2019, mainly as a result of an increase in liabilities under loans and borrowings by PLN 295.7 million, or 1,146.0%, primarily in connection with the funding received from the Polish Development Fund in the form of a preferential loan and a liquidity loan (in the amount of PLN 256.8 million in the short-term part) earmarked for financing current activity, including working capital. In addition, as at the end of the reporting period, in the consolidated statement of financial position, in a separate line item, the Group presented FIZ liabilities in the amount of PLN 121.3 million, PLN 91.5 million of which were liabilities under the Fund’s buy-back obligations in Sell-Buy-Back (SBB) transactions described in more detail in Note 7.7. of the consolidated financial statements of the JSW Group for the financial year ended 31 December 2020. Also lease liabilities increased by PLN 20.3 million, or 9.8%, in comparison with the previous year.

At the same time, in current liabilities, trade and other liabilities declined in 2020 by PLN 358.5 million, or 12.9%, mainly due to a decrease in investment liabilities by PLN 428.1 million, or 63.0%, and trade liabilities by PLN 216.9 million, or 19.4%, with a simultaneous increase in liabilities for social security and other taxes by PLN 294.1 million, or 58.0%.

Sales revenue

In 2020, sales revenues totaled PLN 6,989.4 million and were PLN 1,682.4 million, or 19.4%, lower than in 2019, mainly due to lower revenues on coal sales by PLN 1,216.5 million, i.e. 25.5%, and lower revenues on coke sales by PLN 426.4 million, i.e. 13.1%. The lower coal and coke sales revenues result primarily from the lower actual average sales prices: metallurgical (coking) coal down by PLN 198.08/t, i.e. by 31.2%, steam coal down by PLN 26.43/t, i.e. by 9.6%, and coke down by PLN 335.13/t, i.e. by 30.1%. In addition, revenues on sales of hydrocarbons were lower by PLN 71.6 million, or 25.1%, primarily due to the average sales price of tar by PLN 38.7 million lower, and BTX, which was PLN 24.8 million lower, which resulted from the lower sales prices of both of these products.

In 2020, the Group recorded a gross loss on sales in the amount of PLN 347.9 million, compared to a profit of PLN 1,603.6 million recorded in 2019.

The result before tax for 2020 amounted to PLN (1,867.6) million. After including income tax of PLN 330.2 million, the net result for 2020 was PLN (1,537.4) million and was up PLN 2,187.0 million from the result generated in 2019. In 2020, following the recognition, in other comprehensive income , of the valuation of hedges (change of value) of PLN 27.2 million with income tax of PLN (5.1) million, and actuarial losses of PLN (23.4) million with income tax of PLN 4.4 million, total comprehensive income totaled PLN (1,534.3) million. Basic and diluted loss per share attributable to shareholders of JSW was PLN (13.17) (in 2019, profit of 5.36 PLN per share).

Cash flow from operating activities

The positive net cash flows on operating activity generated by the Group in 2020 in the amount of PLN 354.7 million did not cover the capital expenditures incurred by the Group, including in particular the expenditures for the purchase of property, plant and equipment in the amount of PLN 2,055.5 million. The decrease in the cash flows on operating activity was driven primarily by the loss before tax in the amount of PLN 1,867.6 million (chiefly due to the decline in the coal and coke market, combined with major fluctuations of the prices of these products). In addition, the Group can feel the effects of the introduced restrictions related to the pandemic, which destabilized the market, impairing economic growth and industrial production. Other factors affecting the cash flow on operating activity are presented in Note 8.1. of the consolidated financial statements of the JSW Group for the financial year ended 31 December 2020.

Cash flow on investing activity

In 2020, cash used in investing activities was PLN 549.3 million and was PLN 1,711.2 million lower than in 2019.Such a big difference is attributable mainly to the proceeds obtained by JSW from redemption of the investment certificates in the amount of PLN 1,398.8 million. In addition, the Group received cash in connection with termination of a bank term deposit by JZR in the amount of PLN 90.0 million. The main capital expenditures item in 2020 is the purchase of property, plant and equipment in the amount of PLN 2,055.5 million.

Cash flow on financing activity

In 2020, net cash flow on financing activity was PLN 1,441.2 million compared to PLN (180.3) million of cash flows in 2019. Their level in the period under analysis takes into account, among others, received loans and borrowings and subsidies in the amount of PLN 1,735.7 million, mainly in connection with the financing received from the PFR.

As a result of the above-described events, the balance of cash and cash equivalents as at 31 December 2020 was PLN 1,597.3 million, while the net change in cash and cash equivalents was PLN 1,246.6 million.

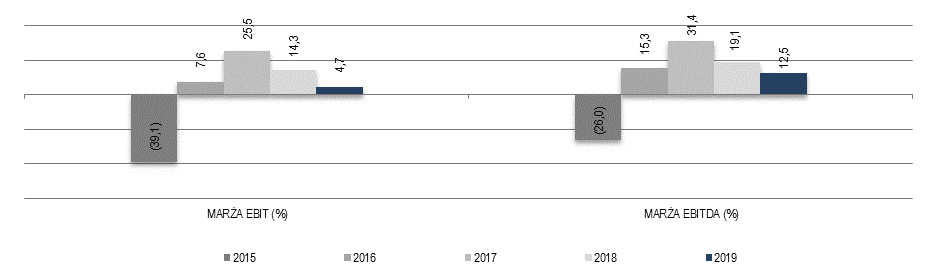

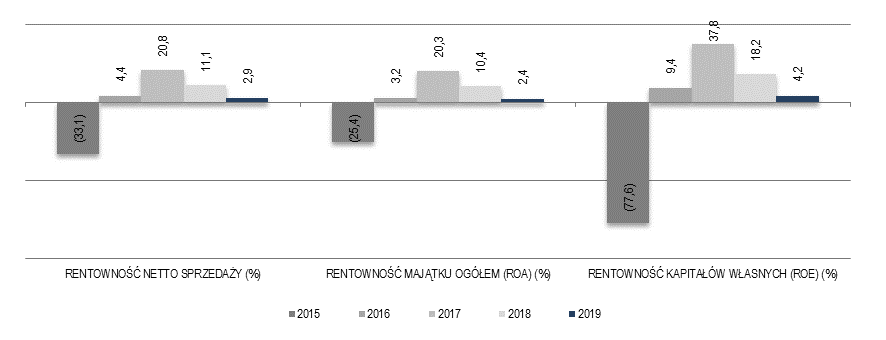

Selected financial ratios

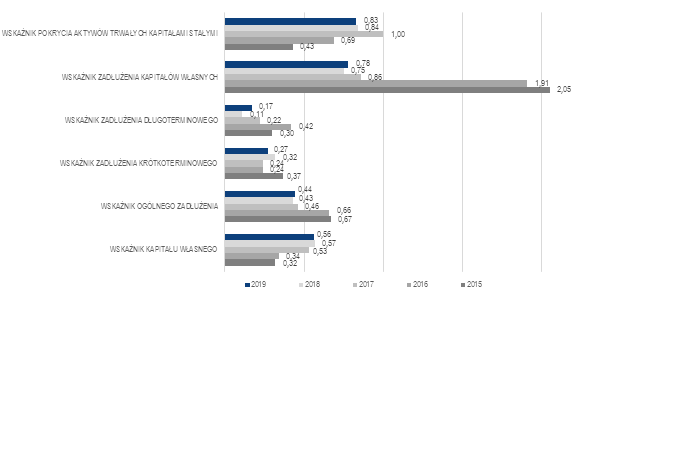

Debt and funding mix

As at the end of the reporting period, the share of liabilities in financing the Group’s activity, measured by the total debt ratio increased to 0.51 compared to 0.41 as at the end of 2019 showing a growth in the share of liabilities in the Group’s financing structure. As at the end of 2020, the Group had a debt arising from loans and borrowings in the amount of PLN 2,007.8 million. The long-term debt ratio grew from 0.17 to 0.28 mainly as a result of the increase in non-current liabilities by PLN 1,552.7 million, i.e. 60.2%, including mainly liabilities for loans and borrowings of PLN 1,353.0 million and liabilities of provisions of PLN 143.2 million. The increase of liabilities in financing the Group’s activity also caused an increase in the debt to equity ratio from 0.69 to 1.05 at the end of the reporting period.

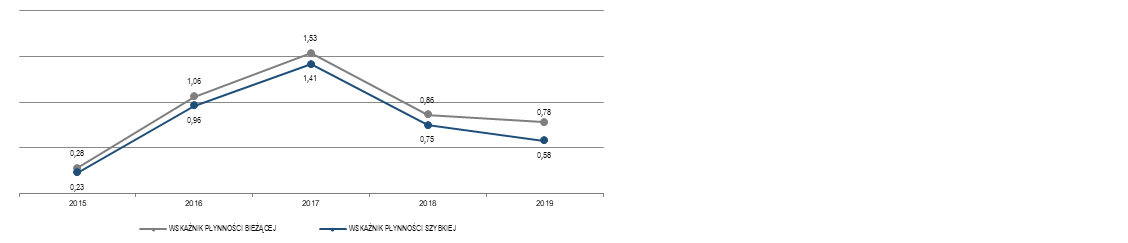

Liquidity

In the period from 1 January to 31 December 2020, current and quick liquidity ratios stood at 1.03 and 0.76, respectively. The financial resources management process and the aid solutions utilized by the Group under the Anti-Crisis Shield through deferral of the payment dates of some of its civil-law liabilities are described in detail in Section 1.5.3. and Section 7.1.4. of this report.

Profitability

Analysis of the profitability ratios points to a decrease in profitability compared to 31 December 2019, attributable to sales revenues being down PLN 1,682.4 caused primarily by the actual average sales prices of coal being down PLN 117.21 million, i.e. 23.9%, and of coke by PLN 335.13 million, i.e. by 30.1%.

Liquidity

In the period from 1 January to 31 December 2020, the return on assets (ROA) and return on equity (ROE) ratios decreased as compared to corresponding period of 2018 being (10.2) and (21.0), respectively, which is the outcome of the net loss generated in 2020 of PLN 1,537.4 million.

Mining cash cost

Mining cash cost in 2020 stood at PLN 5,860.1 million, i.e. it was PLN 428.5 million (6.8%) lower than in 2019. The decrease in mining cash cost was caused primarily by the following factors:

- the lower costs of employee benefits by PLN 235.5 million (7.1%),

- lower costs of external services by PLN 138.6 million (8.4%), despite an increase in the costs of mining damage removal services (by PLN 56.7 million), chiefly as a result of a change in provisions for related future liabilities on account of mining damage,

- lower costs of consumption of materials and energy by PLN 51.0 million (4.5%),

- lower other costs by nature by PLN 20.9 million (29.9%), mainly due to change of the provisions for court proceedings.

In addition, the costs of taxes and fees went up PLN 17.5 million (14.2%), with the bulk being the increase in real estate tax of PLN 12.4 million.

On a per-unit basis the mining cash cost in 2020 was PLN 407.37 per ton, i.e. PLN 18.63 per ton (4.4%) less than in 2019, influenced by the 6.8% decrease of expenditures for coal production and 0.4 mt decrease in net coal production.

Cash conversion cost

In 2020, the cash conversion cost was PLN 593.4 million, down by PLN 14.5 million, or 2.4%, as compared to 2019. This change was driven mainly by:

- a decrease in the costs of consumption of materials net of coal feedstock of PLN 13.1 million, or 20.7%,

- costs of external services without the coal feedstock transport costs down PLN 11.8 million, or 6.1%,

- selling and distribution expenses minus depreciation and amortization attributable to selling and distribution expenses down PLN 4.4 million, or 14.0%,

- a decrease in energy consumption costs of PLN 2.1 million, or 5.3%,

- personnel costs being up by PLN 18.0 million, or 8.0%,

- administrative expenses less depreciation and amortization up PLN 2.7 million, or 3.9%,

- increase in the costs of taxes and fees by PLN 2.4 million, or 7.6%,

- other costs up PLN 0.4 million, or 33.3%,

As a result of the above events, on a per-unit basis, cash conversion cost for 2020 reached PLN 178.37 per ton and was PLN 13.41 per ton, 7.0%, lower relative to 2019.

Employment

As at 31 December 2020, the Group had 30,593 employees while as at 31 December 2019 the headcount was 30,629. At the end of 2020, JSW had 21,973 employees and in 2019 it employed 22,433 persons. In 2020, JSW optimized the headcount as a result of temporary suspension of new recruitments to supplement natural employee departures. The Group’s average headcount in 2020 was 30,674 employees. It was up 1,234 employees compared to the same period of the previous year. The average headcount in JSW in 2020 was 22,302 persons. It was 264 persons higher than in the previous year.