Management Board Report on the activity of the JSW S.A. for 2012

1.1. Organization of the Company

1.2. Changes in basic management principles in the Company and its Capital Group

1.3. Organizational or capital ties

1.4.1. The Company’s capital and ownership structure

1.4.2. Prices of JSW S.A. shares in the capital market

1.4.3. Reduction of share capital

1.4.4. Dividends

1.4.5. The number and nominal value of the Company’s shares and shares in the Company’s related parties held by persons discharging executive and supervisory functions

1.4.6. Agreements pertaining to potential changes in the shareholding structure

1.4.7. Information on employee share plan control system

1.4.8. Purchase of treasury stock

1.5. Level of remuneration for persons discharging executive and supervisory functions in JSW S.A.

1.6. Agreements concluded with managers providing for compensation in the event of their resignation or dismissal from the occupied position

1.7. Principles of preparation of the annual financial statements the Management Board’s activity report

2.1. Description of the industry and competition

2.2. Key products, goods and services

2.3. Sales markets

2.4. Material contracts

2.5.1. Capital expenditures in 2012

2.5.2. Capital investments in 2012

3. Financial and property standing of Jastrzębska Spółka Węglowa S.A

3.1. Discussion of economic and financial figures

3.1.1. Assets

3.1.2. Financing of assets

3.1.3. Description of the structure of assets and liabilities from the standpoint of JSW S.A.’s liquidity

3.1.4. Material off-balance sheet items

3.1.5. Statement of comprehensive income

3.2. Information about the Company’s current and expected financial standing

3.2.1. Financial resources management

3.2.2. Debt and the Company’s financing structure

3.2.3. Liquidity

3.2.4. Profitability

3.2.5. Inventories

3.2.6. Mining cash cost

3.3. Proceeds from securities issues

3.4. Evaluation of factors and unusual events affecting the result

3.5. Transactions with related entities

3.6. Information on executed and terminated loan agreements

3.7. Information on granted loans and sureties and received sureties and guarantees

3.8. Differences between the financial results captured in the annual report and the previously published forecasts of results for 2012

3.9. Financial instruments

4.1. Risk factors and threats

4.1.1. Factors related to the Company’s business and market environment

4.1.2. Risk factors associated with the legal environment

4.2. Material factors relating to the Company’s development

4.2.1. Description of events significant for the Company’s development

4.3. More important achievements in research and development

4.4. Issues related to the natural environment

4.5. Headcount and compensation

4.6. Relations with trade unions

4.7. Information about the audit firm auditing the financial statements

4.8. Disputes – material court, administrative and arbitration proceedings

4.8.1. Court Proceedings

4.8.2. Administrative proceedings

4.8.3. Arbitration proceedings

4.9. Other events materially affecting the Company’s operations

5. Representation on the application of Corporate Governance principles

5.1. Identification of the set of corporate governance rules being applied

5.2. Identification of corporate governance rules not applied

5.3. Description of the primary attributes of the internal control and risk management systems in reference to preparing financial statements and consolidated financial statements

5.4. Shareholders holding significant blocks of shares

5.5. Holders of securities giving special rights of control

5.6. Restrictions regarding the exercise of voting rights

5.7. Restrictions on the transfer of ownership title to securities

5.8. Principles of appointment and dismissal of management and supervisory team and their powers

5.9. Description of the rules for amending the Company’s Articles of Association

5.10. Manner of operation of the Shareholder Meeting, its basic powers and a description of shareholder’s rights and how they are exercised

5.11. Composition of management and supervisory bodies, changes in composition and description of operation of the bodies and their committees

5.12. Information policy and communication with the capital market

1.1. Organization of the Company

Jastrzębska Spółka Węglowa S.A. (“Company”; “JSW S.A.”) was incorporated on 1 April 1993. On 17 December 2001 JSW S.A. was registered under number KRS 0000072093 in the National Court Register kept by the District Court in Gliwice, 10th Corporate Division of the National Court Register. The Company was assigned the following REGON statistical number: 271747631. The Company has its registered office in Jastrzębie-Zdrój, Aleja Jana Pawła II 4. The Company’s duration is unlimited. The Company's shares are publicly traded.

The Company’s core line of business is black coal mining and the sale of coke and coal derivatives. The Company’s detailed line of business is presented in § 4 of the Company’s Articles of Association available at www.jsw.pl. According to the Warsaw Stock Exchange classification, JSW S.A. has been categorized into the raw materials sector.

The Company is the parent company in the JSW S.A. Capital Group (“Group”, “Capital Group”) consisting of JSW S.A. and its subsidiaries located in Poland. The companies comprising the Group are classified into the distinct operating segments. The Group prepares consolidated financial statements for the financial year ended 31 December 2012.

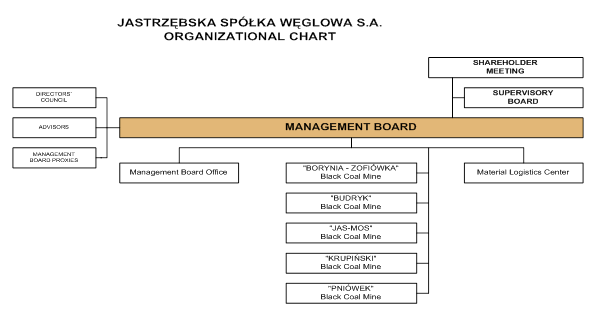

The Company’s organizational structure

JSW S.A.’s organizational structure as at 31 December 2012 is presented in the chart constituting an attachment to JSW S.A.’s Organizational Bylaws:

The Company is a multi-operation enterprise, operating in 2012 and as at the date of this report in the Republic of Poland. In 2012 the Company’s enterprise comprised:

- 5 black coal mines, i.e. Borynia-Zofiówka, Budryk, Jas-Mos, Krupiński, Pniówek,

- Material Logistics Center,

- Management Board Office.

With effect from 1 January 2013, as part of the implementation of the Mine Development Strategy in JSW S.A. for 2010-2030, the Company merged the Borynia-Zofiówka mine with the Jas-Mos mine into the three-section Borynia-Zofiówka-Jastrzębie mine.

Accordingly, as at the date of this report, the Company’s enterprise comprises:

- 4 black coal mines, i.e. Borynia-Zofiówka-Jastrzębie, Budryk, Krupiński, Pniówek,

- Material Logistics Center,

- Management Board Office.

The Company’s mines conduct operations pursuant to pertinent licenses granted to the Company.

The Company’s Management Board, continuing its efforts aimed at harmonizing the organizational structures of the Company’s mines, with a view to ensuring their compliance with existing geological and mining regulations, adopted the standardized Bylaws and Organizational Charts of JSW S.A.’s Mines and made appropriate changes in the Company's mines. These changes came into force as of 1 January 2013.

The internal organization of the Company’s Entities is defined in separate Organizational Bylaws and Organizational Charts adopted by the Management Board.

The organizational structure of the Company’s Entities and the Management Board Office supports efficient operation of the Company and its Entities, and the changes introduced are aimed at the constant improvement of the Company and its performance.

1.2. Changes in basic management principles in the Company and its Capital Group

Basic management principles in the Company

Pursuant to the Articles of Association of Jastrzębska Spółka Węglowa S.A., the Company’s governing bodies are:

- the Management Board,

- the Supervisory Board,

- the Shareholder Meeting.

The powers of the Company’s governing bodies follow from the provisions of the Commercial Company Code and the Articles of Association of JSW S.A. The powers of the Company’s individual governing bodies are defined in:

- of the Management Board, in the Management Board Bylaws,

- of the Supervisory Board, in the Supervisory Board Bylaws,

- of the Shareholder Meeting, in the Shareholder Meeting Bylaws.

The Company’s Management Board consists of three to six members. The number of members in the JSW S.A. Management Board of the 7th term of office (lasting 3 years and ending on the date of the Ordinary Shareholder Meeting approving the financial statements for the financial year 2012) was set in the Shareholder Meeting Resolution of 26 April 2010 at five members. As at 31 December 2012 and as at the date of this report, the JSW S.A. Management Board is composed of:

- Jarosław Zagórowski – President of the Management Board,

- Grzegorz Czornik – Vice-President for Sales,

- Andrzej Tor – Vice-President for Technical Matters,

- Robert Kozłowski – Vice-President for Financial Matters,

- Artur Wojtków – Vice-President for Employment and Social Policy (elected by employees).

CVs of members of the JSW S.A. Management Board are available on the Company’s website.

The Management Board determines the strategic directions, defines goals and tasks, manages the Company directly through resolutions and decisions, and indirectly through Entity Directors, Department Directors and Proxies.

The Directors Council, composed of Directors of the Company’s Entities and other invited persons, is an opinion-making and advisory body to the Management Board.

The President of the Management Board exercises supervision over the Company’s overall operations and makes decisions not reserved for the powers of the Company’s governing bodies. The President of the Management Board also exercises direct supervision over reporting Departments, Teams and Proxies.

Vice-Presidents exercise supervision over the Company’s operations in their respective areas of activity and make decisions not reserved for the powers of the Company’s governing bodies. The Vice-Presidents of the Management Board exercise direct supervision over reporting Departments. Furthermore, the Vice-President for Financial Matters also exercises supervision over the Management Board Representative for Computerization of JSW S.A. and the Vice-President for Technical Matters also exercises substantive supervision over the Health and Safety at Work Team.

The division of powers between the distinct members of the Management Board ensures effective operation of the Company, and the Organizational Bylaws of JSW S.A., the Organizational Bylaws of the Management Board Office and the Organizational Bylaws of the Company’s Mines adopted by the Management Board ensure the effective performance of tasks assigned by the Management Board.

Pursuant to the Articles of Association of JSW S.A., the Supervisory Board consists of at least 9 members appointed by the Shareholder Meeting. On 27 February 2012, the Shareholder Meeting set the number of Supervisory Board members of the 8th term of office (lasting 3 years) at 12. As at 31 December 2012, the composition of the Supervisory Board was as follows:

- Józef Myrczek – Chairman,

- Antoni Malinowski – Deputy Chairman,

- Eugeniusz Baron – Secretary,

- Stanisław Kluza – Member,

- Robert Kudelski – Member,

- Tomasz Kusio – Member,

- Alojzy Nowak – Member,

- Andrzej Palarczyk – Member,

- Łukasz Rozdeiczer-Kryszkowski – Member,

- Adam Rybaniec – Member,

- Adam Wałach – Member.

On 19 February 2013, the Minister of Economy, pursuant to § 15 sec. 12 and 13 of the Company’s Articles of Association, appointed Mr. Andrzej Karbownik to the Supervisory Board of the 8th term of office.

The powers and authority of the Supervisory Board have been described in Item 5.8 of this report.

CVs of members of the JSW S.A. Supervisory Board are available on the Company’s website.

Changes to the management principles in the Company

Changes in the organizational structure of the JSW S.A. Management Board Office

To improve management in the Company, in 2012 the Management Board adopted a number of resolutions pertaining to changes in the organizational structure of the Company’s Management Board Office. These changes were aimed at updating the range of performed tasks and improving the efficiency of operations.

The JSW S.A. Management Board made the following decisions pertaining to changes in the organizational structure, effective in 2012:

- establishing the position of the Management Board Representative for Operational Integration of Coking Plants within the JSW Capital Group, and the Management Board Representative for Spatial Planning in Mining Areas,

- establishing the Coke and Coal Derivatives Sales Strategy Department and the Team for Monitoring Investments of the JSW Group’s Subsidiaries,

- adding provisions regarding the Risk Management System,

- transferring the subordination of the Investor Relations Team from the Strategic Development Department to the Controlling Department,

- transferring the subordination of the Organization and Investor Relations Team (in Warsaw) under the President of the JSW S.A. Management Board,

- changing the current position of Department Director, Chief Accountant of JSW S.A. into Chief Accountant of JSW S.A.,

- establishing, in place of the Organization and Investor Relations Team (in Warsaw), the Organization and Investor Relations Department (in Warsaw),

- transferring the subordination of the organizational unit Management Board Representative for Computerization of JSW S.A. previously assigned to the President of the Management Board to the Vice-President for Financial Matters.

In addition, in 2012, the JSW S.A. Management Board made the decisions pertaining to changes in the organizational structure effective as of 1 January 2013:

- establishing the Internal Audit Team and the Audit Team in place of the previously existing Internal Control and Audit Department, and assigning its subordination to the President of the JSW S.A. Management Board,

- dissolving the organizational unit of the Management Board Representative for Spatial Planning in Mining Areas and establishing the organizational units of the Management Board Representative for Cooperation with Local Authorities and the Management Board Representative for Risk Management.

On 22 January 2013, the JSW S.A. Management Board decided to establish the Legal Department.

The above changes in the organizational structure of the JSW S.A. Management Board Office were aimed at improving the efficiency of operation of the Office and adapting to the changing market situation.

Changes in the organizational structure of the JSW S.A. mines

Since 1 January 2013, the Company’s Entities have been operating within the framework of a new, uniform organizational structure adopted by Management Board decision of 11 December 2012, on the basis of which detailed Organizational Bylaws and Charts of the Company’s Entities were prepared.

In addition, the JSW S.A. Management Board made the following decisions pertaining to changes in the organizational structure of the Company’s Entities in 2012:

On 27 December 2011, the JSW S.A. Management Board made a decision to change the structure of the Borynia-Zofiówka and the Pniówek mines, effective as of 1 January 2012, involving, among others:

- in the Borynia-Zofiówka mine, Borynia Section, establishing a Drilling Unit and the Drilling Senior Foreman position,

- in the Pniówek mine, establishing the Shaft Mining Work Unit.

The above changes in the organizational structure of the Pniówek mine and Borynia-Zofiówka mine, Borynia Section, were aimed at improving the operations of the mines.

On 22 May 2012, the JSW S.A. Management Board made a decision to change the structure of the Pniówek mine, involving, among others:

- dissolving the Division of Mining Works Related to Reinforcements, Liquidations and Underground Transportation,

- establishing the Division Mining Works Related to Reinforcements and Liquidations and the Underground Transportation Division.

On 12 June 2012, the JSW S.A. Management Board made a decision to adopt the draft Organizational Bylaws and the Organizational Chart of JSW S.A.’s merging mines, i.e. the Borynia-Zofiówka and the Jas-Mos mines, and the adoption of the name “Borynia-Zofiówka-Jastrzębie mine”.

On 7 August 2012, the JSW S.A. Management Board made a decision to establish in JSW S.A., as of 1 January 2013, the Borynia-Zofiówka-Jastrzębie mine created as a result of the merger of the Borynia-Zofiówka and the Jas-Months mines.

On 12 September 2012, the JSW S.A. Management Board made a decision to change the structure of the Jas-Mos mine, involving, among others:

- dissolving the Division of Mining Works Related to Reinforcements, Liquidations and Underground Transportation,

- establishing the Division Mining Works Related to Reinforcements and Liquidations and the Underground Transportation Division.

On 26 February 2013, the JSW S.A. Supervisory Board issued a positive opinion on the JSW S.A. Organizational Bylaws adopted by the Company's Management Board on 22 January 2013.

Basic management principles in the Capital Group and their changes

On 8 May 2012, the Jastrzębska Spółka Węglowa S.A. Management Board adopted the document entitled “Principles of Corporate Governance in the Jastrzębska Spółka Węglowa S.A. Capital Group” (“Principles”). The development and implementation of the Principles was based on the provisions of the Capital Group Code providing for, in Article 21, the introduction of uniform procedures and standards of conduct in the JSW S.A. Capital Group. In the Principles, changes in the legal status were taken into account and new solutions were proposed. As a result of the implementation of appropriate regulations in the area of supervision over subsidiaries, standardization was introduced in such areas as the recruitment procedures and the selection of members of the subsidiaries’ corporate bodies.

As at 31 December 2012 and as at the date of this report, the Group was composed of:

- Jastrzębska Spółka Węglowa S.A. with its registered offices in Jastrzębie-Zdrój,

- Koksownia Przyjaźń Sp. z o.o. (“Koksownia Przyjaźń”) with its registered offices in Dąbrowa Górnicza,

- Baza Transportu Samochodowego Sp. z o.o. with its registered offices in Dąbrowa Górnicza,

- Zakład Remontów Mechanicznych Sp. z o.o. with its registered offices in Dąbrowa Górnicza,

- Zakład Przewozów i Spedycji SPEDKOKS Sp. z o.o. with its registered offices in Dąbrowa Górnicza,

- Kombinat Koksochemiczny Zabrze S.A. (“KK Zabrze”) with its registered offices in Zabrze,

- Przedsiębiorstwo Produkcyjno-Handlowo-Usługowe REM-BUD Sp. z o.o. with its registered offices in Zabrze,

- Zakład Transportu Samochodowego, Sprzętu Budowlanego i Usług Serwisowych CARBOTRANS Sp. z o.o. with its registered offices in Zabrze,

- Wałbrzyskie Zakłady Koksownicze Victoria S.A. (“WZK Victoria”) with its registered offices in Wałbrzych,

- Zakład Usług Energetycznych epeKoks Sp. z o.o. with its registered offices in Wałbrzych,

- Spółka Energetyczna Jastrzębie S.A. (“SEJ”) with its registered offices in Jastrzębie-Zdrój,

- SEJ-Serwis Sp. z o.o. with its registered offices in Jastrzębie-Zdrój,

- Przedsiębiorstwo Energetyki Cieplnej S.A. (“PEC”) with its registered offices in Jastrzębie-Zdrój,

- Polski Koks S.A. with its registered offices in Katowice,

- Przedsiębiorstwo Gospodarki Wodnej i Rekultywacji S.A. (“PGWiR”) with its registered offices in Jastrzębie-Zdrój,

- Jastrzębskie Zakłady Remontowe Sp. z o.o. (“JZR”) with its registered offices in Jastrzębie-Zdrój,

- JZR Dźwigi Sp. z o.o. with its registered offices in Jastrzębie-Zdrój,

- Centralne Laboratorium Pomiarowo-Badawcze Sp. z o.o. with its registered offices in Jastrzębie-Zdrój,

- Jastrzębska Spółka Kolejowa Sp. z o.o. with its registered offices in Jastrzębie-Zdrój,

- Advicom Sp. z o.o. with its registered offices in Jastrzębie-Zdrój,

- Jastrzębska Spółka Ubezpieczeniowa Sp. z o.o. with its registered offices in Jastrzębie-Zdrój.

Pursuant to the JSW S.A. Management Board decision of 14 December 2011 regarding the introduction of a personal union in certain subsidiaries of the Group involving joint management, with effect from 1 January 2012 the President of the Koksownia Przyjaźń Management Board was also appointed to the position of President of the KK Zabrze Management Board.

Koksownia Przyjaźń Sp. z o.o. was transformed into a joint stock company pursuant to the decision of the District Court in Katowice, 8th Corporate Division of the National Court Register, of 2 January 2013 on entering the changes in the National Court Register.

1.3. Organizational or capital ties

As at the date of the Management Board Report on the activity of the JSW S.A. for 2012, JSW S.A. held, directly or indirectly, shares in the following subsidiaries:

Key investments pertaining to acquisition of shares

In 2012, the following changes occurred in the Group’s structure:

- The Group continued the process of incorporation of companies through Jastrzębska Spółka Ubezpieczeniowa Sp. z o.o. taking over Jastrzębska Agencja Turystyczna Sp. z o.o. As a result of the merger of the companies, the share capital of Jastrzębska Spółka Ubezpieczeniowa Sp. z o.o. was increased by PLN 537,500.00 through the issue of 1,075 shares with a par value of PLN 500.00 each, which was registered on 1 March 2012.

- Increase in the share capital of JZR by PLN 378,500.00, i.e. by 757 new shares with a par value of PLN 500.00 each, which were subscribed for by JSW S.A. The shares were covered with an in-kind contribution in the form of JSW S.A.’s assets of the market value of PLN 378,191.00 and a cash contribution in the amount of PLN 309.00. The above changes in the company’s capital were registered on 13 April 2012.

- Increase in the share capital of SEJ by PLN 3,421,600.00, i.e. by 34,216 new shares with a par value of PLN 100.00 each, which were subscribed for by JSW S.A. The shares were covered with an in-kind contribution in the form of JSW S.A.’s assets of the market value of PLN 3,421,510.00 and an additional cash contribution in the amount of PLN 90.00. The above changes in the company’s capital were registered on 13 April 2012.

- Acquisition of 10 shares in Koksownia Przyjaźń by JSW S.A. for PLN 10,321.80 on 26 April 2012. After the transaction the Parent Company holds 1,626,417 shares with 97.78% votes at the Shareholder Meeting of Koksownia Przyjaźń.

Following the transformation of Koksownia Przyjaźń into a joint stock company, which occurred pursuant to the decision of the District Court in Katowice, 8th Corporate Commercial Division of the National Court Register, on 2 January 2013, JSW S.A. holds 81,320,850 shares in Koksownia Przyjaźń representing a 97.78% stake in the company’s share capital. - Increase of the share capital of Advicom Sp. z o.o. by PLN 10,012,500.00, i.e. by 20,025 new shares with a par value of PLN 500.00 each. The new shares will be allotted to the shareholders in proportion to the stakes currently held. JSW S.A. is entitled to 15,031 new shares worth PLN 7,515,500.00. The stake expressed as a percentage has not changed. This change in the capital of the above company was funded with the reserve capital and was registered on 18 June 2012.

1.4.1. The Company’s capital and ownership structure

As at the last date of the reporting period and at the date of this report, the Company’s share capital was PLN 587,057,980.00 and was divided into 117,411,596 ordinary shares with a par value of PLN 5.00 each, as follows:

- 99,524,020 series A shares,

- 9,325,580 series B shares,

- 2,157,886 series C shares,

- 6,404,110 series D shares.

Registered shares which will be dematerialized pursuant to the Act on Trading in Financial Instruments of 29 July 2005 will be transformed into bearer shares upon such dematerialization. The total number of votes linked to all the shares issued by JSW S.A. is 117,411,596 votes at the JSW S.A. Shareholder Meeting.

As at 31 December 2012 and at the date of the Management Board Report on the activity of the JSW S.A. for 2012 (1), the shareholding structure of JSW S.A. was as follows:

| Number of shares | Number of votes at the Shareholder Meeting | Percentage of share capital | Percentage of the total number of votes at the Shareholder Meeting | |

|---|---|---|---|---|

| State Treasury of the Republic of Poland(2) | 64,775,542 | 64,775,542 | 55.16% | 55.16% |

| Other shareholders(3) | 50,478,168 | 50,478,168 | 43.00% | 43.00% |

| Other shareholders(4) | 2,157,886 | 2,157,886 | 1.84% | 1.84% |

| Total | 117,411,596 | 117,411,596 | 100.00% | 100.00% |

(1) The Company does not hold an itemized breakdown of the shareholder structure as at 31 December 2012 or at the date of the Management Board Report on the activity of the JSW S.A. for 2012 due to the pending process of the Company’s eligible employees acquiring shares free of charge from the State Treasury by the power of the Act on Commercialization and Privatization of 30 August 1996. The information included in the foregoing table was transmitted in Current Report no. 40/2012 on 30 November 2012 prepared on the basis of the notification submitted by the State Treasury.

(2) The State Treasury, including Employee Shares. The shares of eligible employees or their successors until their transfer remain the property of the State Treasury. 1. Starting on 10 October 2011, JSW S.A. began to dispose, free of charge, 14,928,603 registered series A shares with a par value of PLN 5.00 each to eligible employees. 2. In connection with the contribution of KK Zabrze shares to JSW S.A., the shares of persons entitled to a gratuitous purchase of KK Zabrze shares allowing them to exercise their right to a gratuitous purchase of JSW S.A. shares instead of KK Zabrze shares. Starting on 23 April 2012, JSW S.A. began to dispose, free of charge, 1,130,137 series D shares with a par value of PLN 5.00 each to eligible employees.

(3) Institutional and individual investors, including employees of JSW S.A., KK Zabrze and their heirs, who have taken advantage of their entitlement to acquire Employee Shares free of charge, pursuant to the Act on Commercialization and Privatization of 30 August 1996.

(4) Series C employee shares offered in a private subscription to an investment company which offered to dispose of the taken-up series C shares to the employees referred to in sec. 5 of Resolution no. 3 of the Company’s Shareholder Meeting of 12 May 2011, Rep. A no. 3173/2011. On 17 April 2012, the JSW S.A. Shareholder Meeting adopted a resolution to retire 1,796,324 series C shares (Current Report no. 25/2012). Information about the adjustment of the number of series C shares is presented in Item 1.4.3 of the Management Board Report on the activity of the JSW S.A. for 2012.

The Company has not received any information about the percentage thresholds of the total number of votes being exceeded as prescribed by art. 69 section 1 of the Act on Public Offerings and the Conditions for Admitting Financial Instruments to an Organized Trading System and on Public Companies.

As at the date of submission of this report, according to the notices received from shareholders holding directly or indirectly through subsidiaries at least 5% of the total number of votes at the JSW S.A. Shareholder Meeting (Current Report No. 40/2012 of 30 November 2012), the ownership structure of JSW S.A. was as follows:

1.4.2. Prices of JSW S.A. shares in the capital market

In 2012, the average annual price per JSW S.A. share was PLN 93.59 and the difference between the listing at the beginning and end of 2012 was +7.94%. By comparison, the WIG20 index increased by 17.72% and the WIG-Surowce (WIG-Raw Materials) index increased by 70.50% in the same period.

In 2012, the lowest closing price per JSW S.A. share was PLN 82.80 and the highest closing price per JSW S.A. share was PLN 110.60. The value of JSW S.A. shares as at the end of 2012 was PLN 92.40. The average daily trading volume in 2012 was 145,235 shares.

The prices of JSW S.A. shares as well as the WIG20 and WIG-Surowce indexes in 2012 and the RESPECT index since the date of inclusion of JSW S.A. in its composition are presented in the following graph:

1.4.3. Reduction of share capital

On 17 April 2012, the Shareholder Meeting adopted a resolution to retire 1,796,324 series C shares, a resolution to authorize the JSW S.A. Management Board to acquire treasury shares of JSW S.A. free of charge for the purpose of retirement and a resolution to reduce the share capital by PLN 8,981,620, i.e. from PLN 596,039,600 to PLN 587,057,980 and create other reserve capital (Current Report no. 25/2012). On 30 April 2012, JSW S.A. received the decision of the District Court in Gliwice, 10th Business Division of the National Court Register, dated 26 April 2012 on the registration of a share capital decrease in JSW S.A. in connection with the retirement of 1,796,324 series C shares corresponding to 1,796,324 shares in the JSW S.A. Shareholder Meeting (Current Report no. 29/2012).

The consequences of the anticipated decrease in the number of shares granted to the employees (retirements of series C shares) caused a reduction of costs of the employee share ownership program which was captured in the ledgers as at 30 June 2011 in the amount of PLN 243.9 million. The adjustment of costs was carried out in the ledgers in 2011. At the same time the Company made proper adjustment of the surplus of the share issue value over their par value on account of the employee share ownership plan by the amount of PLN 234.9 million, and retained profits by the amount of PLN 9.0 million.

The amount of the share capital after registration of the retirement is PLN 596,039,600 and is divided into 119,207,920 shares with a par value of PLN 5.00 each. The total number of votes linked to all the shares issued by JSW S.A. after the registration of the change in the value of share capital (retirement of shares) is 117,411,596 votes at the JSW S.A. Shareholder Meeting. The shares were retired following the voluntary retirement procedure, without any remuneration. The purpose of the share capital decrease is to transfer the amount corresponding to the share capital decrease forming the sum of the par value of the shares being retired to a separate other reserve capital account, which may be used only to cover losses.

1.4.4. Dividends

In accordance with the recommendation presented in the JSW S.A. issue prospectus (p. 59), in 2013 the Management Board will propose to the JSW S.A. Shareholder Meeting the payment of a dividend of at least 30% of the consolidated net profit for 2012. The Company's dividend policy takes into account the Group’s development plans, in particular its investment plans aimed at ensuring stable development of the Group and generating profit from ongoing operations, and depends on current activity results, cash flows, financial standing and capital requirements, general economic conditions as well as legal, tax, regulatory and contractual restrictions pertaining to dividend payments and on other factors which the Management Board considers important, and is subject to changes aimed at adapting it to the above factors. The Company’s dividend payments also depend on the approach of the State Treasury who is the shareholder with the decisive vote.

On 31 May 2012, the Ordinary Shareholder Meeting of JSW S.A. adopted a resolution on the distribution of net profit for the financial year 2011. The net profit earned by JSW S.A. in 2011 in the amount of PLN 2,082,532,648.47, reduced by the obligatory payment from the profit for the period from 1 January 2011 to 31 July 2011 charged from wholly-owned State Treasury companies pursuant to the Act of 1 December 1995 on Profit Distributions by Companies Wholly Owned by the State Treasury (Journal of Laws No. 154 Item 792, as amended) in the amount of PLN 126,978,067.20 million, and therefore the distributable net profit of PLN 1,955,554,581.27 was distributed as follows:

- the amount of PLN 631,674,386.48 was earmarked for dividends. This means that the dividend per share was PLN 5.38. The date of acquisition of the right to the dividend was set at 6 July 2012 and the dividend was paid on 24 July 2012. The dividend received by the State Treasury was PLN 349.6 million,

- the amount of PLN 130,000,000.00 was earmarked for distribution to JSW S.A.’s employees and to cover related charges. The profit bonus for employees was paid out on 22 June 2012,

- the amount of PLN 1,193,880,194.79 was earmarked for additional reserve capital to finance the investment program of JSW S.A.

As a result of 2011 profit distributions from subsidiaries, the Company received dividends in the total amount of PLN 54.1 million.

The dividend per share ratio is presented in Note 32 of the “Financial statements of Jastrzębska Spółka Węglowa S.A. for the financial year ended 31 December 2012”.

1.4.5. The number and nominal value of the Company’s shares and shares in the Company’s related parties held by persons discharging executive and supervisory functions

The holding of JSW S.A.’s shares with the nominal value of PLN 5.00 each by persons discharging executive and supervisory functions is as follows:

| Number of shares as at 31 December 2012 | Number of shares as at the date of submission of this report | |

|---|---|---|

| Management Board | ||

| Jarosław Zagórowski | 210 | 210 |

| Grzegorz Czornik | 378 | 378 |

| Robert Kozłowski | - | - |

| Andrzej Tor | 211 | 211 |

| Artur Wojtków | 367 | 367 |

| Supervisory Board | ||

| Józef Myrczek | - | - |

| Antoni Malinowski | - | - |

| Eugeniusz Baron | 382 | 382 |

| Andrzej Karbownik* | - | - |

| Stanisław Kluza | - | - |

| Robert Kudelski | 256 | 256 |

| Tomasz Kusio | - | - |

| Alojzy Nowak | - | - |

| Andrzej Palarczyk | 591 | 591 |

| Łukasz Rozdeiczer-Kryszkowski | - | - |

| Adam Rybaniec | - | - |

| Adam Wałach | 532 | 532 |

* On 19 February 2013, Mr. Andrzej Karbownik was appointed to the JSW S.A. Supervisory Board of the 8th term of office.

The persons discharging executive and supervisory functions in the Company do not hold any shares in JSW S.A.’s subsidiaries.

1.4.6. Agreements pertaining to potential changes in the shareholding structure

The Company’s Management Board does not have information about agreements which may result in the future in changes to the proportions of shares held by the existing shareholders.

1.4.7. Information on employee share plan control system

Series A and C shares

Since JSW S.A. was incorporated as a result of transformation of state-owned enterprises into a joint-stock company, pursuant to the provisions of the Act on Commercialization and Privatization, eligible employees and their heirs are entitled to gratuitous receipt of 15% shares of JSW S.A. from the State Treasury. Starting on 10 October 2011, JSW S.A. began to dispose, free of charge, to eligible employees, series A shares.

At the same time, employees employed as at the date of the first listing of JSW S.A. shares who did not acquire the aforementioned entitlement, acquired the right to receive free of charge additionally issued 3,954,210 series C shares.

The actions taken in 2011 and the process of disposing of the shares to employees eligible and ineligible to receive the (series A and C) shares was described in detail in the annual report for 2011 – the JSW S.A. Management Board activity report for the financial year ended 31 December 2011, Item 1.4.5.

On 27 February 2012, the JSW S.A. Management Board adopted a resolution to determine the number of shares for each group of ineligible employees, divided by period of employment (Current Report no. 14/2012). Pursuant to the above resolution, the number of the JSW S.A.’s series C shares designated to be allocated to employees of the Capital Group eligible to acquire them free of charge was determined to be 2,157,886 series C shares out of 3,954,210 issued shares. Then, in its resolution of 27 February 2012, the JSW S.A. Supervisory Board gave consent to divide series C shares in the manner defined in the resolution of the JSW S.A. Management Board in the matter of determining the number of shares for each group of ineligible employees divided by period of employment.

Considering the above, the JSW S.A. Management Board recommended retirement of the surplus of 1,796,324 series C shares. On 17 April 2012, the Extraordinary Shareholder Meeting adopted a resolution to retire the surplus shares. On 26 April 2012, the reduction of the JSW S.A. share capital associated with the retirement of series C shares was registered. Series C shares have been allocated since 1 March 2012. By 20 April 2012, series A and C shares were allocated in JSW S.A. plants. After this date agreements on gratuitous disposal of series A and C shares are concluded in the branches of the Dom Maklerski PKO BP brokerage house.

Series D shares

In connection with the contribution of KK Zabrze shares to JSW S.A., the State Treasury Minister, acting pursuant to Article 38 d section 1 of the Act on Commercialization and Privatization, issued an offer addressed to entitled to a gratuitous purchase of KK Zabrze shares allowing them to exercise their right to a gratuitous purchase of shares by purchasing JSW S.A. shares instead of KK Zabrze shares. On 23 April 2012, the gratuitous sale of shares commenced, to eligible employees of KK Zabrze who submitted their declarations that their right to a gratuitous purchase of KK Zabrze shares may be exercised by a purchase of 1,130,137 registered series D shares of JSW S.A. with a par value of PLN 5.00 each.

KK Zabrze shares were exchanged into JSW S.A. shares based on the following parity: 1 JSW S.A. share = 0.876 KK Zabrze shares. This parity was determined by an auditor in the opinion on the fair value of the non-cash contribution made by the State Treasury – the State Treasury Minister to JSW S.A. in the form of shares of KK Zabrze, which was commissioned by the Management Board of JSW S.A.

By 31 December 2012, the following shares were sold:

- 14,149,045 shares out of 14,928,603 series A shares earmarked for eligible employees. 779,558 shares were still available.

- 2,120,048 shares out of 2,157,886 series C shares earmarked for ineligible employees. 37,838 shares were not sold.

- 853,944 shares out of 1,130,137 series D shares earmarked for eligible employees. 276,193 shares were not sold.

The process of gratuitous sale of series A and C shares will continue until 8 October 2012, while series D shares will be sold gratuitously until 21 March 2014.

The shares received may not be sold for a period of 2 years (or 3 years for Management Board members), starting from 7 July 2011, regardless of the date when the eligible persons actually received the shares ("lock-up"). During that period, the shares will be held in custody of the Dom Maklerski PKO BP S.A. brokerage house.

1.4.8. Purchase of treasury stock

In 2012, Jastrzębska Spółka Węglowa S.A. did not purchase any treasury stock.

1.5. Level of remuneration for persons discharging executive and supervisory functions in JSW S.A.

The total amount of the remuneration, understood as the amount of remuneration, bonuses and benefits received in cash, in kind or in any other form, paid out to persons discharging executive and supervisory functions for 2012 and for the comparative period is presented in the following tables. The JSW S.A. Management Board forms key management personnel.

Remuneration of the Management Board in 2012 (PLN)

| Period in office in 2012 | Management services* | Annual bonus** | Benefits, income from other sources | Income earned in subsidiaries | Total | |

|---|---|---|---|---|---|---|

| Jarosław Zagórowski | 1 Jan-31 Dec | 960, 000.00 | 480,000.00 | - | - | 1,440,000.00 |

| Andrzej Tor | 1 Jan-31 Dec | 840,000.00 | 420,000.00 | - | - | 1,260,000.00 |

| Grzegorz Czornik | 1 Jan-31 Dec | 840,000.00 | 420,000.00 | - | - | 1,260,000.00 |

| Marek Wadowski | 1 Jan-16 Jan | 36,129.03 | - | - | - | 36,129.03 |

| Artur Wojtków | 1 Jan-31 Dec | 840,000.00 | 420,000.00 | - | - | 1,260,000.00 |

| Robert Kozłowski | 1 Apr-31 Dec | 630,000.00 | 315,000.00 | - | - | 945,000.00 |

| Total | 4 ,146,129.03 | 2,055,000.00 | - | - | 6,201,129.03 |

* This item includes only remuneration based on management contracts.

** This item includes the annual bonus due for 2012 in the maximum amount permitted by the contract. The bonus is payable at the request of the President of the Management Board, depending on the degree of achievement of KPIs, and is subject to approval by the Supervisory Board.

Remuneration of the Management Board in 2011 (PLN)

| Period in office in 2011 | Remuneration, management services* | Annual bonus** | Benefits, income from other sources | Income earned in subsidiaries | Total | |

|---|---|---|---|---|---|---|

| Jarosław Zagórowski | 1 Jan-31 Dec | 308,002.28 | 302,182.44 | 81,146.97 | 41,454.96 | 732,786.65 |

| Andrzej Tor | 1 Jan-31 Dec | 286,602.21 | 269,073.33 | 117,826.91 | 41,454.96 | 714,957.41 |

| Grzegorz Czornik | 1 Jan-31 Dec | 286,602.21 | 269,073.33 | 49,700.25 | 44,909.54 | 650,285.33 |

| Marek Wadowski | 1 Jan-31 Dec | 286,602.21 | 269,073.33 | 56,265.88 | 41,154.52 | 653,095.94 |

| Artur Wojtków | 1 Jan-31 Dec | 286,383.36 | 269,073.33 | 45,457.34 | 37,309.44 | 638,223.47 |

| Total | 1,454,192.27 | 1,378,475.76 | 350,397.35 | 206,283.42 | 3,389,348.80 |

* This item includes only remuneration based on employment agreements and management contracts.

** This item includes the annual bonus paid for 2010 and the annual bonus due for 2011.

Remuneration of the Supervisory Board in 2012 (PLN)

| Period in office in 2012 | Remuneration | Other income | Total | |

|---|---|---|---|---|

| Józef Myrczek | 1 Jan-31 Dec | 41,454.96 | - | 41,454.96 |

| Eugeniusz Baron | 1 Jan-31 Dec | 41,454.96 | - | 41,454.96 |

| Tomasz Kusio | 1 Jan-31 Dec | 41,454.96 | - | 41,454.96 |

| Miłosz Karpiński | 1 Jan-10 Jul | 21,841.86 | - | 21,841.86 |

| Antoni Malinowski | 1 Jan-31 Dec | 41,454.96 | - | 41,454.96 |

| Adam Wałach | 1 Jan-31 Dec | 41,454.96 | - | 41,454.96 |

| Janusz Tomica | 1 Jan-31 May | 17,272.90 | - | 17,272.90 |

| Zbigniew Kamieński | 1 Jan-27 Mar | 9,917.99 | - | 9,917.99 |

| Marek Adamusiński | 1 Jan-31 May | 17,272.90 | - | 17,272.90 |

| Adam Zbigniew Rybaniec | 1 Jan-31 Dec | 41,454.96 | - | 41,454.96 |

| Mariusz Warych | 1 Jan-31 May | 17,272.90 | - | 17,272.90 |

| Alojzy Zbigniew Nowak | 1 Jan-31 Dec | 41,454.96 | - | 41,454.96 |

| Stanisław Kluza | 27 Mar-31 Dec | 31,648.41 | - | 31,648.41 |

| Andrzej Palarczyk | 31 May-31 Dec | 24,293.50 | - | 24,293.50 |

| Robert Kudelski | 31 May-31 Dec | 24,293.50 | - | 24,293.50 |

| Łukasz Rozdeiczer-Kryszkowski | 31 May-31 Dec | 24,293.50 | - | 24,293.50 |

| Total | 478,292.18 | - | 478,292.18 |

Remuneration of the Supervisory Board in 2011 (PLN)

| Period in office in 2011 | Remuneration | Other income | Total | |

|---|---|---|---|---|

| Józef Myrczek | 1 Jan-31 Dec | 41 454,96 | - | 41 454,96 |

| Eugeniusz Baron | 1 Jan-31 Dec | 41 454,96 | - | 41 454,96 |

| Tomasz Kusio | 1 Jan-31 Dec | 41 454,96 | - | 41 454,96 |

| Miłosz Karpiński | 1 Jan-31 Dec | 41 454,96 | - | 41 454,96 |

| Antoni Malinowski | 1 Jan-31 Dec | 41 454,96 | - | 41 454,96 |

| Adam Wałach | 1 Jan-31 Dec | 41 454,96 | - | 41 454,96 |

| Janusz Tomica | 1 Jan-31 Dec | 41 454,96 | - | 41 454,96 |

| Zbigniew Kamieński | 1 Jan-31 Dec | 41 454,96 | - | 41 454,96 |

| Marek Adamusiński | 1 Jan-31 Dec | 41 454,96 | - | 41 454,96 |

| Adam Zbigniew Rybaniec | 1 Jan-31 Dec | 41 454,96 | - | 41 454,96 |

| Mariusz Warych | 4 Oct-31 Dec | 10 029,43 | - | 10 029,43 |

| Alojzy Zbigniew Nowak | 6 Oct-31 Dec | 9 806,55 | - | 9 806,55 |

| Total | 434 385,58 | - | 434 385,58 |

In 2012, no loans were granted to any members of the JSW S.A. Management or Supervisory Boards.

In 2012, the Nomination and Remuneration Committee was established. Its tasks include supervision over the implementation of the remuneration system for the Management Board, monitoring and periodic review of the remuneration system for JSW S.A.’s executive personnel and, if necessary, formulation of recommendations for the Supervisory Board. The tasks of the Nomination and Remuneration Committee are described in Item 5.11 of this report.

1.6. Agreements concluded with managers providing for compensation in the event of their resignation or dismissal from the occupied position

Agreements concluded with managers providing for compensation in the event of their resignation or dismissal from the occupied position without an important reason or in the event that their dismissal resulted from a merger with the Company through an acquisition.

Still in force in 2012 were the Management Contracts (“Contracts”) and Non-Competition Agreements entered into in 2011 with members of the JSW S.A. Management Board pursuant to the decision of the JSW S.A. Supervisory Board of 18 November 2011. On 1 March 2012, the Supervisory Board appointed Mr. Robert Kozłowski to the position of Vice-President of the JSW S.A. Management Board for Financial Matters for the 7th term of office and signed with him a Management Contract and a Non-Competition Agreement under the same terms and conditions as those binding the other Management Board members.

In accordance with the provisions of the Management Contracts, if a Contract is terminated by JSW S.A. for reasons other than a gross breach of the provisions of the Contract by the JSW S.A. Management Board member, expiration of the Contract as a result of expiration and non-renewal of the Management Board member’s mandate or termination of the Contract by the Management Board member for reasons attributable to JSW S.A., the Management Board member is entitled to a severance pay in the amount of 3 times the fixed monthly salary. If the dismissal of the Management Board member or the non-appointment of the Management Board member for the next term of office is unrelated to the Benchmark (correlation of the changing JSW S.A. share price with the value of the WIG-20 index) for which in the reasonable opinion of JSW S.A. the relevant Management Board member is responsible or co-responsible with other Management Board members, in the event of termination of the Contract due to expiration and non-renewal of his/her mandate, the Management Board member is entitled to a severance pay in the amount of 3 times the fixed monthly salary.

In addition, pursuant to the Non-Competition Agreement, in the period of 12 months from the termination of the Management Contract, the Manager receives compensation in the total amount constituting the equivalent of 100% of the fixed salary paid to him/her in the period of 12 calendar months preceding the termination of the Management Contract. If the termination or non-extension of the Management Contract takes place in connection with the Benchmark for which in the reasonable opinion of JSW S.A. the Manager is responsible or co-responsible with other Management Board members, the Manager will receive compensation in the total amount constituting the equivalent of 25% of the fixed salary paid to him/her in the period of 12 calendar months preceding the termination of the Management Contract. In both situations, the Manager’s entitlement to compensation will be contingent on his/her refraining from the conduct of any business competitive to that of JSW S.A. Such compensation will be paid to the Manager in monthly installments.

In 2012, no compensation was paid under any non-competition agreement.

1.7. Principles of preparation of the annual financial statements the Management Board’s activity report

The financial statements for the financial year ended 31 December 2012 are prepared in accordance with International Financial Reporting Standards (“IFRS”) as approved by the European Union. The financial statements are prepared according to the principle of historical cost, with the exception of financial derivatives carried at fair value. The adopted accounting principles were employed using the principle of continuity in all of the presented financial years. The accounting (policy) principles applied to prepare the financial statements were presented in Note 2 to the Financial Statements of Jastrzębska Spółka Węglowa S.A. for the financial year ended 31 December 2012.

The financial statements are consistent with the requirements of the provisions of law and regulations of capital market institutions pertaining to the scope of activity reports, in particular:

- Regulation issued by the Finance Minister on 19 February 2009 on the Current and Periodic Information Transmitted by Securities Issuers and the Conditions for Recognizing the Information Required by the Regulations of a Non-Member State as Equivalent, as amended.

- Accounting Act of 29 September 1994.

- Act of 15 September 2000 entitled the Commercial Companies Code.

- Regulations of Giełda Papierów Wartościowych w Warszawie S.A. (Warsaw Stock Exchange) and the relevant resolutions adopted by the Management Board.

The Management Board’s report on the activity of Jastrzębska Spółka Węglowa S.A. for the financial year ended 31 December 2012 has been prepared in accordance with the principle of internal consistency of the document and compliance with the Financial Statements of Jastrzębska Spółka Węglowa S.A. for the financial year ended 31 December 2012, and covers the reporting period from 1 January to 31 December 2012 and the comparative period from 1 January to 31 December 2011.

2.1. Description of the industry and competition

JSW S.A.’s core line of business comprises:

- production and sale of coking coal (hard and semi-soft) and steam coal,

- sale of coke and coal derivatives produced by the Capital Group’s coking plants.

In 2012, the Company was the only domestic producer of type 35 (hard) coking coal and a major producer of type 34 (semi-soft) coal. In Poland, type 34 coking coal is also produced by Kompania Węglowa S.A. The share of JSW S.A. in the domestic production of type 35 coking coal and type 34 coal is 66% and 14%, respectively1. The Company’s share in the domestic production of steam coal is approximately 6%1. For many years, the largest producer and consumer of coal has been China (more than 3.5 billion tons). The world’s largest coal producers ranked below China are the United States, India, Australia, Indonesia, Russia and South Africa. In Europe, major producers of coal other than Poland are the Czech Republic, Germany, Ukraine and Russia. The total production of coal does not cover the demand of European customers, hence the need, especially in Western countries, to import the required coal. The deficit of coal in the European Union in 2011 was approximately 180 million tons2, including approximately 40 million tons of coking coal. This creates an opportunity for JSW S.A. to place its coal within a profitable geographic rent area.

In the area of production of hard coking coal, thanks to its balance sheet and operating resources and significant capital expenditure commitment, the Company has a strong foundation to maintain its leading position in the European coking coal market. The Company has approximately 0.5 billion tons of operable coal resources, including significant quantities of high-quality coking coal with a low ash and sulfur content and very good coking parameters, enabling the Company to direct its offer to the coking and power industries both at home and abroad.

Another major product of JSW S.A., after hard coking coal, is coke produced by the Group’s coking plants from an appropriately composed mix of coking coals. The Group’s share in the domestic production of coke is approximately 45%, which puts it in second place in the Polish coke market after ArcelorMittal Poland. The main market for the sale of coke produced by the Group is the European market. However, in light of the recent market conditions (the economic slowdown, a low rate of growth of steel production in Europe, high inventories of coke and a reduced coke production capacity utilization rate), the Company’s customer base was expanded to include overseas customers. Accordingly, part of the coke produced in the Group’s coking plants has been exported to India and Brazil.

The diversity of coal and coking products offered by JSW S.A. enables the Company to sell its merchandise to a number of industries (coke production, metallurgy, electricity and heat production, insulation materials, etc.). This allows the Company to operate at many levels and flexibly manage its trading policy, adjusting it to the current market conditions.

2.2. Key products, goods and services

JSW S.A.’s coal mining activity is performed by five coal mines. The Borynia-Zofiówka3 and Pniówek mines produce good quality coking coal mainly for the production of blast furnace coke. The Jas-Mos1 mine produces coking coal with very low phosphorus content and low volatile matter content, used successfully in the production of foundry coke. The Budryk and Krupiński Mines currently produce primarily steam coal used by power plants to generate electricity. However, it should be emphasized that the production structure of the commercial coal in the mines, both with regard to hard and semi-soft coking coals and steam coal, is adapted flexibly to the dynamically changing market needs and in consideration of the supply and demand in the local and foreign markets.

In order to enable comprehensive management of the distribution of coke and coal derivatives produced by the Group’s coking plants (Koksownia Przyjaźń, KK Zabrze and WZK Victoria), in 2012 the sale of these products was commenced by Polski Koks S.A. (a subsidiary of the Group) acting for and on behalf of JSW S.A. The product structure of Koksownia Przyjaźń and KK Zabrze is dominated by blast furnace coke and WZK Victoria specializes in the production of foundry coke. The takeover by JSW S.A. of the coke and coal derivatives sales process allows the Company to organize its product sales and enables it to conduct an optimal policy of pricing its coal and coking products.

Coal

In 2012, the quality parameters of individual shipments of commercial coal, in particular type 35 (hard) coal from the Borynia-Zofiówka, Pniówek mines and the Jas-Mos mine (with low volatile matter coal – LVM) and type 34 (semi-soft) from the Budryk and Krupiński mines and steam coal produced in the Borynia-Zofiówka, Budryk and Krupiński mines fitted within the limits set forth in the commercial agreements.

The table below presents the main characteristics of the coal produced by JSW S.A.’s mines in 2012.

| Coking coal | Steam coal | |||

|---|---|---|---|---|

| type 35 (hard) |

type 35 (LVM) (hard) |

type 34 (semi-soft) |

||

| Mine | Borynia-Zofiówka Pniówek |

Jas-Mos | Budryk Krupiński |

Borynia-Zofiówka Budryk Krupiński |

| Purpose | coke production | coke production | coke production | electricity and heat production |

| Ash content Ad / Ar (%) | 6.6 – 7.2 | 5.9 – 6.7 | 5.4 – 7.8 | 17.8 – 27.8 |

| Humidity Wtr (%) | 8.3 – 9.8 | 8.6 – 8.9 | 5.7 – 7.5 | 8.2 – 14.6 |

| Sulfur content S<td / Str (%) | 0.45 – 0.68 | 0.39 – 0.48 | 0.63 – 0.84 | 0.43 – 0.98 |

| Volatile matter content Vdaf (%) | 22.2 – 26.9 | 19.7 – 20.5 | 33.0 – 38.5 | – |

| Calorific value Qir (MJ/kg) | 29.1 – 29.7 | 29.9 – 30.2 | 28.7 – 30.5 | 19.9 – 23.3 |

| Coke strength after reaction CSR (%) | 51.2 – 68.8 | 29.6 – 48.3 | 21.6 – 39.4 | – |

| CO2 coke reactivity index CRI (%) | 21.2 – 38.7 | 45.3 – 54.9 | 40.3 – 55.8 | – |

The coal production volume in 2012 was at the level of 13.5 million tons, i.e. 0.9 million tons more than in 2011 and 0.2 million tons more than planned for 2012. The total sales of coal produced by JSW S.A., comprising intra-group and external deliveries, were realized at 12.7 million tons, i.e. 0.3 million tons more than in 2011.

In 2012, compared to the same period of the previous year, sales of coking coal increased by 0.5 million tons. However, supplies of steam coal in 2012 decreased by 0.2 million tons compared to 2011. It is noteworthy that the share of sales of the best quality type 35 (hard) coal that attracts the highest prices in the Company's total deliveries keeps increasing (2010: 55.9%, 2011: 57.8%, 2012: 60.4%). In the sales of coking coal, type 35 coal accounted for 83.6% (2011: 83.2%). The remaining 16.4% of the sales was type 34 (semi-soft) coal.

The following table presents the actual coal production and sales figures, including intra-group sales.

| 2012 | 2011 | Growth rate | |

|---|---|---|---|

| Production (in millions of tons) | 13.5 | 12.6 | 107.1% |

| - Coking coal (in millions of tons)(1) | 9.5 | 8.8 | 108.0% |

| - Steam coal (in millions of tons) | 4 | 3.8 | 105.3% |

| Total volume of JSW S.A.’s sales (in millions of tons)(2) | 12.7 | 12.4 | 102.4% |

| - Coking coal (in millions of tons) | 9.1 | 8.6 | 105.8% |

| - Steam coal (in millions of tons) | 3.6 | 3.8 | 94.7% |

| Volume of intra-group sales (in millions of tons)(2) | 4.5 | 4 | 112.5% |

| - Coking coal (in millions of tons) | 4.2 | 3.7 | 113.5% |

| - Steam coal (in millions of tons) | 0.3 | 0.3 | 100.0% |

| Revenues on sales of coal (in PLN millions)(3) | 6,736.7 | 7,849.6 | 85.8% |

(1) The share of hard coal in the total coal production in 2012 and 2011 was 57.5% and 58.2%, respectively.

(2) The volume of sales of coal produced by JSW S.A. which does not include the coal produced by other entities in the amount of 64.4 thousand tons in 2012 and 66.7 thousand tons in 2011.

(3) The figure presented does not include the Company’s revenues on sales of coal produced by other entities in 2012 and 2011 in the amount of PLN 26.6 million and PLN 29.6 million, respectively.

In 2012, revenues on sales of coal produced by JSW S.A. reached PLN 6,736.7 million and were lower by PLN 1,112.9 million (14.2%) than those generated in the same period of the previous year, which is a consequence of the ongoing economic slowdown and a decrease in the prices of coking coal in the markets. The table below presents the prices obtained for the sale of coal produced by JSW S.A.

| 2012 | 2011 | Growth rate | |

|---|---|---|---|

| Coking coal (PLN/t) | 615.45 | 791.19 | 77.8% |

| Steam coal (PLN/t) | 313.9 | 265.86 | 118.1% |

| Total (PLN/t)(1) | 531.58 | 631.03 | 84.2% |

(1) The prices pertain to deliveries of coal produced by JSW S.A. and include transportation costs amounting to, on average, PLN 11.07 per ton in 2012 and PLN 5.61 per ton in 2011.

Coke

In the coke production area in 2012, the sale of coke and coal derivatives under a new trading procedure was launched. In accordance with the provisions of the new procedure, JSW S.A. sold 1.8 million tons of coke. Revenues on sales of coke and coal derivatives during the period under analysis reached PLN 1,873.6 million. The average obtained selling price of coke was PLN 938.00 per ton (FCA basis). The table below presents the actual volume of sales, the average selling price of coke and revenues on sales of coke and coal derivatives.

| 2012 | 2011(3) | Growth rate | |

|---|---|---|---|

| External sales volume (in millions of tons)(1) | 1.8 | - | - |

| Revenues on sales to external buyers (in PLN millions)(2) | 1,873.6 | - | - |

| Average selling price (PLN/t)(4) | 938 | - | - |

(1) Volume of sales of the coke produced by the Group.

(2) Revenues on sales of coke and coal derivatives produced by the Group and sold by JSW S.A.

(3) JSW S.A. did not participate in sales of coke.

(4) FCA price.

2.3. Sales markets

2012 was a year of economic slowdown which had a significant impact on the coal, coke and steel markets. This slowdown once again demonstrated the existing risk of market cyclicality affecting the Company. Recent years have proved increasingly shorter periods of the duration of market cycles. The most recent serious global economic crisis occurred in 2009 with a different duration and intensity in various regions of the world. The domestic and international coal and coke markets are subject to a number of factors remaining beyond the Company’s control. In 2012, and in particular in the second half of the year, the international metallurgical market was very difficult. In the coking coal – coke – steel supply chain, lower demand for steel translated into a decrease in prices and revenues on sales of coke and coking coal. This was particularly noticeable in the European market as crude steel production in the European Union in Q3 2012 was over 10% lower than in Q2 2012, and 2% lower in Q4 2012 than in Q3 2012. In H2 2012, the world’s crude steel production capacity utilization rate kept declining (July: 79.4%, September: 77.7%, December: 73.2%). In Europe, almost a third of all blast furnaces installed were shut down. Coke prices in the European market kept declining steadily. For instance, in November 2012 the price of blast furnace coke in the European market averaged USD 270 per ton based on CFR Northern Europe and was USD 135 per ton (33%) lower than in November 2011. The situation in the coking coal market was similar. In Q4 2012, the benchmark price of coking coal decreased by USD 115 per ton (40%) compared to Q4 2011. A similar situation was observed in the coking coal spot market where the price in November 2012 was USD 102 per ton lower than in November 2011. At the end of year, the downward trend in spot prices stopped, which favorably affected the mood for 2013 forecasts.

Despite this unfavorable market environment, the Company achieved its sales objectives in terms of volume, having realized 99.6% of the planned sales of coal. In 2012, not only did JSW S.A. manage to maintain the volume of deliveries to its existing customers, but also established cooperation with new trading partners.

The following table presents a comparison of the volume of coal supplies broken down by geographical area and type of end user:

| 2012 | 2011 | Growth rate | |

|---|---|---|---|

| Total coal sales (in millions of tons), including: | 12.7 | 12.4 | 102.4% |

| Coking coal (in millions of tons) | 9.1 | 8.6 | 105.8% |

| - Poland | 7.7 | 7.4 | 104.1% |

| - European Union | 1.1 | 1.2 | 91.7% |

| - Other countries | 0.3 | - | - |

| Steam coal (in millions of tons)(1) | 3.6 | 3.8 | 94.7% |

| - Poland | 3.4 | 3.6 | 94.4% |

| - European Union | 0.2 | 0.2 | 100.0% |

(1) The volume of sales of coal does not include the coal produced by other entities in the amount of 64.4 thousand tons in 2012 and 66.7 thousand tons in 2011.

The Company’s major customers include JSW S.A.’s affiliate Koksownia Przyjaźń and ArcelorMittal Group entities for which revenues on sales of coal accounted for 27.8% and 32.1% (2011: 33.3% and 30.2%) of JSW S.A.’s total revenues on sales of coal, respectively. Other customers, whose individual shares did not exceed 10.0% of JSW S.A.’s revenues, generated the remaining 40.1% (2011: 36.5%) of the Company’s total revenues on sales of coal.

In 2012, JSW S.A.’s coke sales structure broken down by geographic area was as follows(1):

| Volume of coke (in millions of tons) |

Share | Revenues(2) (PLN million) |

Share | |

|---|---|---|---|---|

| Total coke sales (in millions of tons), including: | 1.8 | 100.0% | 1,873.6 | 100.0% |

| - Poland | 0.4 | 22.2% | 375.7 | 20.1% |

| - European Union | 1.3 | 72.2% | 1,442.7 | 77.0% |

| - Others | 0.1 | 5.6% | 55.2 | 2.9% |

(1) No reference to 2011 – the Company’s trading activity was based on a different organizational chart.

(2) Revenues on sales of coke and coal derivatives produced by the Group’s coking plants and sold by JSW S.A.

The share of revenues on sales of coke to 5 main customers was 68.1% of total revenues in this segment. Other buyers whose unit share did not exceed 10.0% of revenues, generated the remaining 31.9% of total revenues of the coke segment.

2.4. Material contracts

In 2012, annual contracts for delivery of coking coal with all existing buyers were concluded, thus continuing the cooperation from the year before. The contracts define primarily such elements as the volume of deliveries, price, quality, delivery conditions and payment terms, payment security method, and provisions on contractual penalties for failure to perform the contract. Just like the year before, the prices were agreed through negotiations on the basis of the so-called coal benchmark, for quarterly periods. In respect of steam coal, JSW S.A. entered into a new contract with EDF Paliwa Sp. z o.o., thus maintaining the existing cooperation (a detailed description is provided later in this section).

Presented below is information about contracts of material importance for the Company’s activity, as disclosed in the current reports, i.e. contracts and revenues where the Company or its subsidiary is a party and whose value is at least 10.0% of the Company's equity. These contracts regulated the sale of products of JSW S.A. or its subsidiaries:

- In Current Report no. 13/2012 of 22 February 2012, the Company’s Management Board informed that the total estimate value of the contracts until the end of their term, concluded between the Capital Group companies and the ArcelorMittal Poland S.A. Capital Group in the period from the publication of Current Report no. 28/2011 (i.e. 20 September 2011) to 22 February 2012, reached PLN 2,330 million. The contract with the highest value is the contract signed on 22 February 2012 between JSW S.A. and ArcelorMittal Poland S.A. seated in Dąbrowa Górnicza for deliveries of coking coal.

Material terms and conditions of the Contract: the pricing terms are agreed upon on a quarterly basis. The Contract is valid from 1 January 2012 to 31 December 2012. The settlement currency is PLN. The estimate net value of the Contract till the end of its term is PLN 1,800 million. The contract comprises mutual provisions on sanctions in the event of failure to perform the contractual obligations by any of the parties in the amount of 10.0% of the gross value of goods that have not been delivered/collected. In the event either party suffers a loss in excess of the amount of liquidated damages, it may pursue additional compensation. The other terms of the Contract do not differ from those commonly used in this type of contract. - In Current Report no. 37/2012 of 10 July 2012, the Company’s Management Board announced that the total value of revenues and the estimated value of contracts, for the period ending on their expiration date, entered into by and between the Capital Group companies and the companies of the voestalpine AG Capital Group (voestalpine Rohstoffbeschaffungs GmbH with its registered office in Linz, Importkohle GmbH with its registered office in Vienna, voestalpine Stahl Donawitz GmbH & Co KG with its registered office in Leoben-Donawitz and voestalpine Stahl GmbH with its registered office in Linz) during the preceding 12 months had reached the net amount of PLN 3,297 million. The highest-value contract is the contract for the deliveries of blast furnace coke with an estimated net value until the end of its term of PLN 1,287 million signed on 19 January 2006 by and between Jastrzębska Spółka Węglowa S.A. (appearing in the Contract as the Seller), KK Zabrze with its registered office in Zabrze (appearing in the Contract as the Coke Producer), Polski Koks S.A. with its registered office in Katowice (appearing in the Contract as the party exercising the rights and fulfilling the obligations of the Seller) – both of which are subsidiaries of JSW S.A. – and voestalpine Rohstoffbeschaffungs GmbH with its registered office in Linz and Importkohle GmbH with its registered office in Vienna acting for and on behalf of voestalpine Stahl Donawitz GmbH & Co KG with its registered office in Leoben-Donawitz and voestalpine Stahl GmbH with its registered office in Linz (appearing in the Contract as the Buyers).

Material terms and conditions of the Contract: the Contract is in force from 1 April 2005 to 31 March 2016. The prices in the Contract are agreed upon on a quarterly basis per metric ton. The prices for the deliveries are agreed upon before the start of each new period of deliveries and are specified in a separate annex based on the Contract.

The Contract does not contain any provisions regarding liquidated damages except for the customary clauses on the settlement of quality in the form of price reductions used in standard contracts for the deliveries of coke. The other terms of the Contract do not differ from those commonly used in this type of contract. - In Current Report no. 41/2012 of 27 December 2012, the Company’s Management Board announced that the total value of the contract entered into on 27 December 2012 by and between JSW S.A. and EDF Paliwa Sp. z o.o. with its registered office in Kraków and sales revenues during the most recent 12 months reached the total net value of approximately PLN 944.0 million. Of the largest value is the contract for the sale of steam coal signed on 27 December 2012 by and between Jastrzębska Spółka Węglowa S.A. (referred to in the Contract as the Seller) and EDF Paliwa Sp. z o.o. with its registered office in Kraków (referred to in the Contract as the Buyer). The term of the Contract is from 1 January 2013 to 31 December 2015, but may be extended thereafter. The prices are to be agreed upon separately for each year. The estimated net value of the Contract until the end of its term is approximately PLN 700.0 million.

- The Contract contains mutual provisions on sanctions in the event of failure to perform the contractual obligations by any of the parties in the amount of 20% of the gross value of goods that have not been delivered/collected, calculated according to the most recent contractual prices. If the parties to the Contract suffer a loss exceeding the payable contractual penalty, they can pursue supplementary compensation. The other terms of the Contract do not differ from those commonly used in this type of contract.

2.5.1. Capital expenditures in 2012

In 2012, Jastrzębska Spółka Węglowa S.A. incurred expenditures on non-current assets in the amount of PLN 1,467.6 million, up by 13.4% from the year before. The following table presents the structure of capital expenditures in 2012 and in the comparative period:

| 2012 | 2011 | Growth rate | |

|---|---|---|---|

| Capital expenditure construction activity | 487.3 | 429.2 | 113.5% |

| Purchases of finished capital assets | 493.1 | 576.3 | 85.6% |

| Expenditures on expensable mining pits | 487.2 | 288.6 | 168.8% |

| Total | 1,467.6 | 1,294.1 | 113.4% |

From the total expenditures incurred in 2012 in the amount of PLN 1,467.6 million, PLN 1,455.9 million was incurred for property, plant and equipment, PLN 7.6 million for investment property and PLN 4.1 million for intangible assets. The capital expenditures in 2012 were financed from own funds. In the upcoming years, the Company does not plan to change significantly the structure of capital expenditure financing.

The capital expenditures incurred by the Company on property, plant and equipment in 2012 were earmarked for the following tasks:

- development tasks (for vertical and horizontal expansion of mines),

- to ensure current production capacity.

The amounts of expenditures incurred for property, plant and equipment in 2012 and in the comparable period, according to the above breakdown, are as follows:

| 2012 | 2011 | Growth rate | |

|---|---|---|---|

| Capital expenditures on development tasks | 317.5 | 277.7 | 114.3% |

| Capital expenditures to ensure current production capacity | 662.9 | 727.8 | 91.1% |

| Expenditures on expensable mining pits | 487.2 | 288.6 | 168.8% |

| Total | 1,467.6 | 1,294.1 | 113.4% |

As for development investments, in 2012 Jastrzębska Spółka Węglowa S.A. executed the following projects pertaining to vertical expansions of mines and horizontal expansion:

Construction of a new level in the existing Budryk mine

The Company continued construction of the 1290m mining level. This will make it possible to open resources of Type 35 (hard) coking coal in the mine’s deposits. The total amount of the operable resources at level 1290m is estimated at 157.8 million tons. The investment project was started in 2007 and will be completed in 2019. The remaining capital expenditures scheduled for project execution associated with construction of level 1290m to 2019 (end of construction) are estimated at PLN 713.9 million.

Development of the Pniówek mine

The Company continued its work on opening and developing the new “Pawłowice 1” deposit started in 2007. The total amount of operable resources in this deposit is estimated at 54.2 million tons up to level 1140m. After their extraction, resources up to the level 1300m are planned to be opened. The deposit contains mainly type 35 (hard) coking coal. The remaining capital expenditures scheduled for project execution associated with opening and development of the “Pawłowice 1” deposit till 2045 are estimated at PLN 2,626.2 million.

In addition, in the Pniówek mine, the Company continued the construction of the 1000m mining level. The total size of the operable resources at level 1000m is estimated at 54.2 million tons. The remaining capital expenditures scheduled for project execution associated with construction of level 1000m and maintenance of extraction at this level to 2016 (end of construction) are estimated at PLN 168.6 million.

Development of the Borynia-Zofiówka mine, Zofiówka Section

The Company continued the opening and utilizing of new resources started in 2005: “Bzie-Dębina 1-Zachód” and “Bzie-Dębina 2-Zachód” from level 1110m. Operable resources planned to be opened from level 1110m amount to 98.6 million tons. After their extraction, resources up to the level 1300m are planned to be opened. The deposits contain mainly type 35 (hard) coking coal. The remaining capital expenditures scheduled for project execution associated with opening and developing “Bzie-Dębina 1-Zachód” and “Bzie-Dębina 2-Zachód” deposits till 2042 are estimated at PLN 3,037.5 million.

In addition, in the Zofiówka Section, the Company continued the development of the 1080m mining level started in 2006. The total size of the operable resources at level 1080m is estimated at 47.0 million tons. The deposits at this level contain mainly type 35 (hard) coking coal. The remaining capital expenditures scheduled for project execution associated with construction of extraction level 1080m to 2020 (end of construction) are estimated at PLN 657.1 million.

Development of the Krupiński mine

In 2010, the Company started to open the “Żory-Suszec” deposit and sections “E” and “Zgoń” in the Krupiński mine. The total amount of potential operable resources is estimated at 27.3 million tons of coking coal. The remaining capital expenditures scheduled for project execution associated with opening of the “Żory-Suszec” deposit and section “E” and “Zgoń” till 2018 (end of construction) are estimated at PLN 389.8 million.

Development of the Borynia-Zofiówka mine, Borynia Section

As part of its formal and legal activities (execution of a contract for a fee-based use of geological information and receipt of a decision approving the geological documentation of the “Żory-Warszowice” coal deposit) aimed at the provision and utilization of the “Żory-Warszowice” deposit, in 2012 the Company incurred capital expenditures of PLN 2.9 million. The total amount of potential operable resources is estimated at 31.5 million tons. The capital expenditures scheduled for project execution associated with opening and development of the “Żory-Warszowice” deposit are estimated at PLN 575.0 million.

The expenditures incurred in 2012 for property, plant and equipment earmarked for execution of JSW S.A.’s aforementioned key projects are presented in the table below:

| 2012 | 2011 | Growth rate | |

|---|---|---|---|

| Vertical development of the mines | |||

| Budryk Mine Construction of level 1290m |

62.6 | 36.2 | 172.9% |

| Pniówek Mine Construction of level 1000m |

95.7 | 80.5 | 118.9% |

| Borynia-Zofiówka Mine, Zofiówka Section Construction of level 1080m |

35.3 | 25.6 | 137.9% |

| Total | 193.6 | 142.3 | 136.1% |

| Horizontal development and development of potential new mining areas | |||

| Borynia-Zofiówka Mine, Zofiówka Section Opening and industrial utilization of the “Bzie-Dębina 2-Zachód” and “Bzie-Dębina 1-Zachód” coking coal deposits |

61.9 | 71.9 | 86.1% |

| Pniówek Mine Opening and industrial utilization of the new “Pawłowice-1” coking coal deposit |

15.8 | 19.8 | 79.8% |

| Krupiński Mine Opening seams in sections “E” and “Zgoń” and reserves of part of the “Żory-Suszec” deposit |

43.3 | 43.7 | 99.1% |

| Borynia-Zofiówka Mine, Borynia Section Utilization of the "Żory-Warszowice” deposit |

2.9 | - | - |

| Total | 123.9 | 135.4 | 91.5% |

| Total capital expenditures on development tasks | 317.5 | 277.7 | 114.3% |

Furthermore, as part of expenditures incurred to ensure the current production capacity, works were performed on the construction of infrastructure for the technical and organizational integration of the Borynia-Zofiówka and Jas-Mos mines.

2.5.2. Capital investments in 2012